Table of Contents

What does Home Insurance Cover?

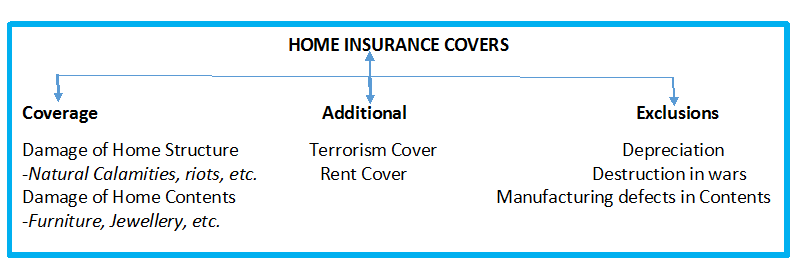

The concept of Home insurance is simple. It covers damage to the structure of your house due to perils such as fire, lightning, earthquake, flood, landslides, etc. Also, home insurance covers damage to the contents of your house which includes robbery, burglary, etc. So, basically, it can cover all the important factors that can cause damage or loss to our house.

Some companies allow you to cover either the structure of the house or the contents, while others allow you to cover both. But, when you buy home insurance, you should ensure that you get the right kind of coverage required for your property.

Home Insurance Coverage- Building & Contents

- Fire and lightening

- Explosion of gas and domestic appliances

- Earthquakes, floods, cyclones, landslides, hurricane, tornado, subsidence, riots, etc.

- Covers loss of household contents and expenses caused due to housebreaking, robbery, theft, etc.

- Jewellery and precious stones

- Covers any injuries or damages to third parties

- Furniture, fittings, furnishings, false ceilings, flooring or any modifications

- Utensils, Clothes and valued articles

- Television, VCR/VCD, home theatre

- Air-condition, fridge, personal computer, washing machine, flour mill, etc.

- Baggage

- Insurance against Personal Accident

- Protection for domestic servants against injury or accidental death under the Workmen's Compensation Act.

Talk to our investment specialist

Home Insurance Covers: Exclusions

- Depreciation

- Destruction caused in public/civic wars

- Willful destruction of property

- Manufacturing defects in home contents

Home Insurance Covers: Additional

There can be extra add-on covers such as-

1. Terrorism cover

Damage caused to the structure and contents of your house through acts of terrorism.

2. Rent cover

This cover provides expenses towards rent (for alternative accommodation). The amount can be capped through a sub-limit.

However, there can be many more add-on home insurance covers, depending on the insurance firm.

How to Choose Best Home Insurance Covers?

There are several reasons that can lead to loss or damage to your property or household goods. But, you should make a smart decision over various home insurance covers as this affects the premium as well as the safety of your house. So, as a first step, you should thoroughly examine your house, its quality of construction and its location. For example, if your house is located in the hilly region, then it is more prone to landslides, etc. On the other hand, if you own a house in old constructed building then it can adversely effect during earthquakes, etc.

Conclusion

So, while buying a home insurance, make sure you weigh your property and the extent of coverage you might be needing. If you are living in a rented apartment, then buying vast covers will involve extra costs. Therefore, understand your property well, and study the overall home insurance covers before opting for one!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.