Table of Contents

Net Income

What is Net Income?

Net Income is the profit your business earns after expenses and allowable deductions. It represents the amount of money remaining after all operating expenses, Taxes, interest, and preferred stock dividends have been deducted from a company's total revenue.

The total revenue in an Accounting period subtracting (minus) all expenses during the same period. Net income is your actual Take-Home Pay after all adjustments.

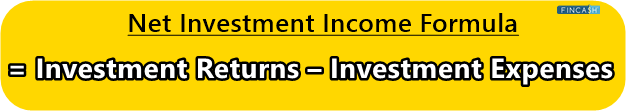

Net Income Formula

The formula for net income is as follows:

Total Revenue - Total Expenses = Net Income

Net Income Calculation

Net income is found on the last line of the income statement, which is why it's often referred to as the bottom line. Let's look at a hypothetical income statement for Company XYZ:

| Inclusive | Costs (INR) |

|---|---|

| Total Revenue | 10,00,000 |

| Costs of Goods Sold | 5,00,000 |

| Gross Profit | 5,00,000 |

| Operating Expenses | 2,00,000 |

| Rent | 70,000 |

| Utilities | 50,000 |

| Depreciation | 50,000 |

| Total Operating Cost | 3,70,000 |

| Interest Expenses | 50,000 |

| Taxes | 50,000 |

| Net Income | 30,000 |

By using the formula we can see that:

Net Income= 10,00,000 - 5,00,000 - 3,70,000 - 50,000 - 50,000 = INR 30,000

Why is Net Income Important?

Net income is important because it indicates how much money a company is making after all of its costs have been accounted for. It is a key measure of a company's Financial Performance and is often used to determine the value of a company.

Net income is important for a number of reasons. For one, it can help investors and analysts determine the financial health of a company. If a company has a high net income, it may be seen as more financially stable and potentially more attractive to investors. Net income is also an important Factor in calculating a company's Earnings Per Share, which is used to evaluate the company's stock price. In addition, net income is used by businesses to make decisions about how to allocate resources and invest in the future. For example, a company with a high net income may choose to invest in new equipment or expand its operations, while a company with a low net income may need to focus on cost-cutting measures in order to improve its profitability.

Overall, net income is an important financial metric that helps investors, analysts, and businesses understand the financial performance and health of a company.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.