Table of Contents

Income Approach

What is the Income Approach?

The Income approach is a method of valuation used especially in Real Estate appraisals. These appraisals are calculated by dividing the capitalisation rate by net operating income into rental payments. These calculations are used by investors for valuing properties based on profitability.

This method also analyses the expected economic benefits that investors anticipate from investment in real estate. The method discounts the expected cash flow of properties in their present value. For this, the capitalization of property is used. Note that the Capitalization Rate represents the risk of investment and is calculated based on a property’s Interest before Depreciation, Interest, and Taxes.

The current interest rate on property mortgages, equity investment in property and risk Factor will be considered as well.

Talk to our investment specialist

Example of Income Approach

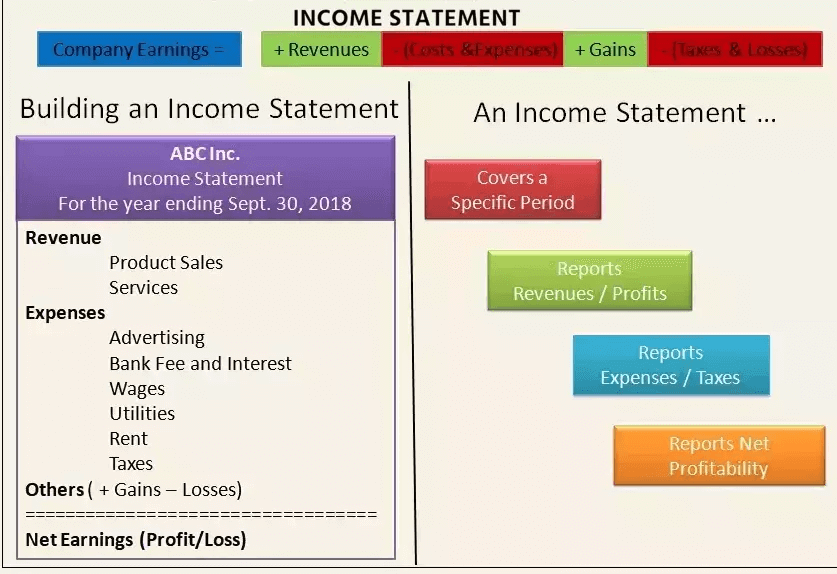

Jaydeep wants to invest in real estate and approaches an investment advisor. The investment advisor has to calculate the capitalisation rate of the real estate investment by using the income approach valuation method to determine the property's present value.

The investment advisor then uses the income statement of the specified property and calculates the interest before depreciation, interest and taxes at Rs. 2 lakhs.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.