Managed Futures

What is Managed Futures?

When the equity Market in the States seems dull and unprofitable, investors and day-traders look for other investment options for a smooth and regular cashflow. Investors look for different assets and commodities to diversify their investment Portfolio and make the best of their investment. Many people opt for hedge fund as well as managed futures for the best returns.

The question is ‘what exactly are the managed funds’? How you could use them to diversify your investment portfolio? Let’s understand the Managed Futures meaning and the reasons to consider for your next investment.

Understanding Managed Futures and CTAs

Managed futures can be defined as a group of experienced and qualified money managers that are in this Industry for as long as 30 years. Basically, it is a group of commodity trading advisors and specialists. Now, these trading advisors are supposed to sign up for the CTFC or Commodity Futures Trading Commission in order to qualify for being presented as the money managers for investors.

The FBI conducts a proper background check on these money managers to ensure they operate legally. Furthermore, they have to submit the financial statements annually to the NFA. The popularity of CTA has grown in the past few years. In fact, it has a history of Offering great returns to investors. The popularity of managed futures is expected to grow in the coming years, especially if the equity market in the US underperforms.

Talk to our investment specialist

Benefits of Investing in Managed Futures

The main advantage of Investing in the managed futures is the returns it offers. First of all, it can help diversify your portfolio and mitigate investment risks. Experts believe that combining your asset investment with these alternative asset classes can be a wise decision. Note that managed futures are considered alternative investment options. They are inversely related to the stocks and Bonds. For instance, these alternative assets have the potential to recover the damages that the stock market is highly likely to experience due to the inflationary pressure.

To put in simple terms, if the increasing Inflation has a negative impact on the bonds and equity, then this alternative Asset Class tends to perform the best during such market conditions. As they are inversely correlated, traditional and alternative investment opportunities can be the best way to manage your risk. You can rest assured that if the stock market doesn’t perform well, the managed futures will help compensate for the loss.

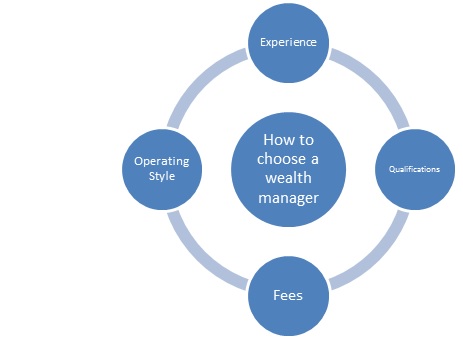

It is important to run a background check on the money manager (whether you choose a group or an individual) before making an investment. You can request the disclosure documents to get a clear picture of the investment, returns, risk, and other aspects. This document also contains information about the total fee the CTA will charge for managing your funds. Make sure you go over these documents to know the trading plan of the CTA, risk-adjusted return, and annualized rate of return, drawdowns, and fees.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.