Table of Contents

Market Cap to GDP Ratio

What is Market Cap to GDP Ratio?

The Market cap to GDP ratio refers to the measure of the total value of all stocks traded publicly in a nation and divided by the nation's Gross Domestic Product (GDP). The market cap to GDP ratio is also known as the Buffet indicator. It is used as a way of checking whether the country's stock market is undervalued or overvalued in comparison to a historical average. It is also a form of price valuation multiple for an entire nation.

Warren Buffet once said that the buffet indicator is probably the best single measure of where valuation stands at any given moment. One of the reasons he said this because it's a simple way of viewing the value of all stocks on an aggregate level and then comparing that value to the country's total output which is the GDP. This is closely related to price-to-sales-ratio. It is a high level of valuation.

Important Points about Market Cap to GDP Ratio

If you wish to interpret the market cap to GDP ratio, understand that in valuation the Price/Sales or EV/Sales are used as a metric measure of valuation. In order to properly understand a company's valuation other elements also have to be taken into consideration like margins and growth. This falls in line with the interpretation of the buffer indicator which makes complete sense since it is about the same ratio. However, this is for an entire nation and not just for one company.

Limitations of Buffet Indicator

Now you know that the indicator is a great high-level metric, however, a price/sale ratio is also fairly crude. This is because it doesn't take into consideration business profitability, but only the top-line revenue figure, which can be misleading.

Moreover, the ratio has been trending higher over a long period of time because of which money to invest and what the fair average ratio should be is the question. Many believe that the average is over 100%, which indicates a market is overvalued, there are others who believe the new normal is closer to 100%.

Lastly, the ratio is impacted by the trends in Initial Public Offerings (IPO). It is also impacted by the percentage of companies that are traded publicly. If everything is equal and there was a large rise in the percentage of companies that are public vs private, the market cap to GDP ratio would rise even though nothing has changed from the perspective of valuation.

Formula of Market Cap to GDP

Market Cap to GDP Ratio = Value of all public stocks in a nation ÷ the GDP of the nation × 100

Talk to our investment specialist

Market Cap to GDP ratio by Country

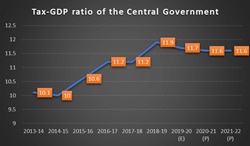

The current total market cap to GDP ratio of India for mid-December 2020 is 72.35%. The expected future annual return is 8%.

For other countries it is mentioned below:

| Country | GDP ($Trillion) | Total Market/GDP Ratio (%) | Historical Min. (%) | Historical Max. (%) | Years of Data |

|---|---|---|---|---|---|

| USA | 21.16 | 183.7 | 32.7 | 183.7 | 50 |

| China | 14.63 | 68.14 | 0.23 | 153.32 | 30 |

| Japan | 5.4 | 179.03 | 54.38 | 361 | 36 |

| Germany | 4.2 | 46.36 | 12.14 | 57.84 | 30 |

| France | 2.94 | 88.8 | 52.5 | 183.03 | 30 |

| UK | 2.95 | 99.68 | 47 | 201 | 48 |

| India | 2.84 | 75.81 | 39.97 | 158.2 | 23 |

| Italy | 2.16 | 14.74 | 9.36 | 43.28 | 20 |

| Canada | 1.8 | 126.34 | 76.29 | 185.04 | 30 |

| Korea | 1.75 | 88.47 | 33.39 | 126.1 | 23 |

| Spain | 1.52 | 58.56 | 46.35 | 228.84 | 27 |

| Australia | 1.5 | 113.07 | 86.56 | 220.28 | 28 |

| Russia | 1.49 | 51.33 | 14.35 | 115.34 | 23 |

| Brazil | 1.42 | 63.32 | 25.72 | 106.49 | 23 |

| Mexico | 1.23 | 26.34 | 11.17 | 44.78 | 29 |

| Indonesia | 1.14 | 33.07 | 17.34 | 145.05 | 30 |

| Netherlands | 0.98 | 107.6 | 46.95 | 230.21 | 28 |

| Switzerland | 0.8 | 293.49 | 77.48 | 397.77 | 30 |

| Sweden | 0.6 | 169.83 | 27.53 | 192.09 | 30 |

| Belgium | 0.56 | 77.18 | 46.04 | 148.83 | 29 |

| Turkey | 0.55 | 23.5 | 15.1 | 128.97 | 28 |

| Hong Kong | 0.38 | 1016.63 | 571.84 | 2363.31 | 30 |

| Singapore | 0.38 | 90.63 | 76.89 | 418 | 33 |

The data is as on December 16, 2020.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.