Table of Contents

- Quick Glance: Multi-Cap vs Flexi-Cap Funds

- Features of Multi-Cap Funds

- Who Should Consider Investing in Multi-Cap Mutual Funds?

- Features of Flexi-Cap Funds

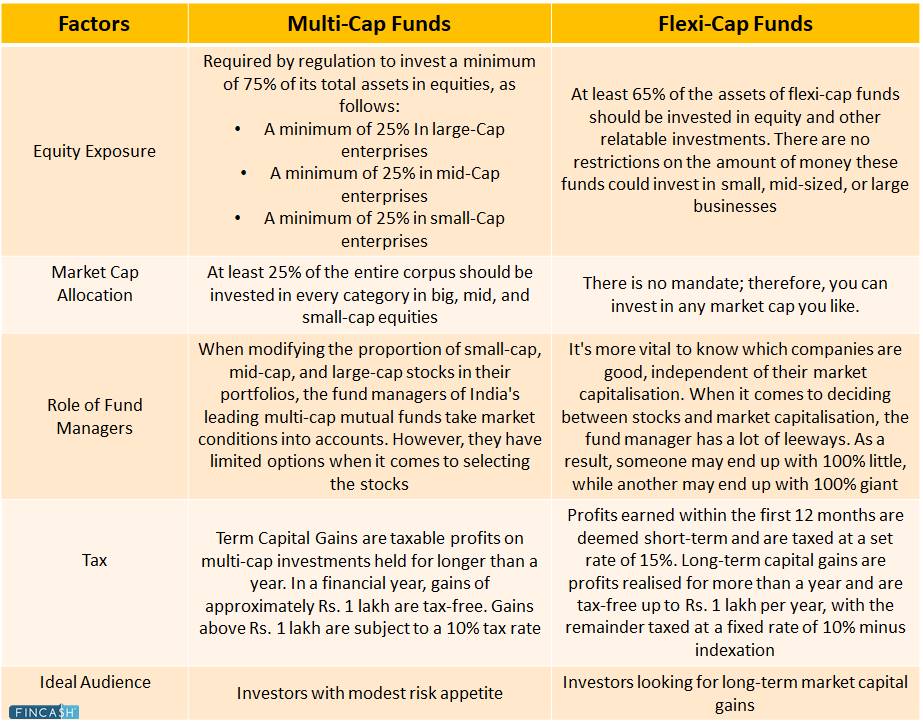

- Flexi-Cap vs Multi-Cap Funds: SEBI's Mandate

- What makes Multi-Cap Fund Different from Flexi-Cap Fund?

- Flexi-Cap Fund vs Multi-Cap: The Classic Confusion Between Them

- Flexi-Cap Fund vs Multi-Cap Fund: Which One to Choose?

- Tips for Choosing Multi-Cap and Flexi-Cap Funds

- Conclusion

Multi-Cap vs Flexi-Cap: What will Suit you Better?

Equity-oriented Mutual Funds could be valuable to your Portfolio if you want to create wealth over time. They can help you beat Inflation and reach your goals if you are willing to take some risk and receive Market-linked returns.

Mutual Funds (MF) are a fantastic avenue to consider when Investing in equities, especially for individuals without much knowledge or time to spend researching which stocks to buy. There are several subcategories of mutual funds within the equity category.

Multi-Cap and Flexi-Cap Funds are two of them. While both types of funds invest in firms with various market capitalisations, how they do it varies. Here is a more detailed guide on flexi-cap funds vs multi-cap funds and which one to choose.

Quick Glance: Multi-Cap vs Flexi-Cap Funds

As the name implies, the key goal of a multi-cap fund is to hold a diversified portfolio of large, small-cap, and mid-cap companies. On the contrary, the flexi-cap fund is a dynamic equities open-ended fund. It invests in firms with a wide Range of market capitalisations.

Let’s find out more about them through a differentiating table:

Features of Multi-Cap Funds

Here are some key features of multi-cap funds:

- Regardless of market conditions, a multi-cap fund must maintain its equity allocation

- With multi-cap funds, you get to experience the best of both worlds: large-cap stability and mid-cap and small-cap high-return potential

- The fund manager does not have a lot of flexibility in shifting allocation to a specific market capitalisation sector in this. However, if the large-cap portfolio is healthy, it can provide some stability

- The majority of multi-cap funds' equity portfolios are skewed toward large-cap corporations, with the remainder invested in mid-cap and small-cap enterprises

Who Should Consider Investing in Multi-Cap Mutual Funds?

Investors who are modest risk-takers and don't wish to spend much time researching a single fund in the market could consider multi-cap schemes for long-term wealth creation. These funds can outperform Large cap funds but not small-cap or mid cap funds.

Thus, the multi-cap funds are appropriate for individuals who are willing to take on more risk in exchange for larger profits. You'll need to have a longer investment horizon of a minimum of 5-7 years due to the higher mid-cap and small-cap components.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Motilal Oswal Multicap 35 Fund Growth ₹57.0416

↓ -0.36 ₹12,267 1.3 -5.4 14.4 21.2 22.9 45.7 Mirae Asset India Equity Fund Growth ₹106.786

↓ -1.24 ₹37,778 3.6 -0.9 8.4 12 20.7 12.7 Kotak Standard Multicap Fund Growth ₹79.005

↓ -1.22 ₹49,130 3.9 -0.5 6.7 15.7 22.6 16.5 BNP Paribas Multi Cap Fund Growth ₹73.5154

↓ -0.01 ₹588 -4.6 -2.6 19.3 17.3 13.6 IDFC Focused Equity Fund Growth ₹81.249

↓ -1.25 ₹1,685 -1.3 -3.3 11 16.1 22 30.3 Aditya Birla Sun Life Equity Fund Growth ₹1,690.55

↓ -19.68 ₹21,668 3.6 -2.2 9.2 15.5 24 18.5 Principal Multi Cap Growth Fund Growth ₹353.321

↓ -4.64 ₹2,615 0.7 -4.1 6.9 15 25.8 19.5 SBI Magnum Multicap Fund Growth ₹104.585

↓ -0.21 ₹21,035 0.9 -3 5.3 11.7 21.7 14.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 25 Apr 25

Features of Flexi-Cap Funds

Here are some key features of flexi-cap funds:

- There is no minimum investment threshold for large-, mid, and Small cap funds, unlike multi-cap funds

- In flexi-cap funds, the exposure can be modified dynamically

- By chasing both value and growth, a flexi-cap fund gives its fund management more freedom to investigate investing possibilities across large-, mid-, and small-cap firms

Flexi-Cap vs Multi-Cap Funds: SEBI's Mandate

Previously, fund managers were allowed to distribute the scheme's money according to their preferences, and fund managers and investors preferred higher exposure to large-cap equities. However, given the present mandate, fund managers must invest in a wide range of market cap stocks.

Following this directive, the Securities and Exchange Board of India (SEBI) permitted funds to be introduced into a new category known as Flex-cap funds. This fund type has the freedom to invest in a certain section of the stock market.

Following SEBI's pronouncement, many Mutual Fund Houses, particularly those with high Assets Under Management (AUM), shifted their existing multi-cap funds to the flexi-cap category. SEBI does not put any restrictions on flexi-cap funds as long as they maintain a minimum of 65% equity investment at all times.

Talk to our investment specialist

What makes Multi-Cap Fund Different from Flexi-Cap Fund?

Multi-cap funds must adhere to the 25-25-25 rule, which mandates that they invest 25% in large-cap firms, 25% in mid-cap companies, and 25% in small-cap companies, with minimum investment needs across market cap categories.

To provide AMCs greater flexibility, SEBI proposed a new category called "Flexi-Cap Fund." This fund will be structured as a dynamic equities fund with no restrictions or biases in terms of market capitalisation.

Under the new category, these funds continue investing in the flexi-cap fund, which gives the entire fund flexibility while investing across market cap categories.

Flexi-Cap Fund vs Multi-Cap: The Classic Confusion Between Them

Since the SEBI mandate, there has been immense uncertainty between the two. Multi-cap and flexi-cap funds have always had a similar investment objective as they allow for investment in stocks having varying market capitalisations.

A multi-cap fund provides excellent diversification with the equity's Asset Class. But stock choice can be difficult, particularly in the small-cap category, and the exposure can be costly during a market downturn.

On the other hand, flexi-cap funds are required to invest at least 65% of their assets in stocks, with no market-cap exposure restrictions. This gives fund managers unlimited flexibility in aligning their portfolios with their favourite segment based on market movements.

However, if the fund management is unable to predict market developments accurately, there could be a significant downside risk.

Flexi-Cap Fund vs Multi-Cap Fund: Which One to Choose?

Each of these categories is meant to work in a particular way depending on the market stage. Here is a brief on how these funds might fare during bull and Bear Market cycles.

The Bull Phase

When the markets are rising and the favourable macroeconomic outlook, it is said to be in the bull phase. This is when mid-cap and small-cap equities climb quickly and offer exceptional gains. There is a lot of liquidity, and these businesses don't have a lot of restrictions.

Multi-cap funds will do well in a Rally during this phase because they are required to invest 25% in mid-cap and 25% in small-cap funds. In the case of flexi-cap funds, however, the allocation is at the discretion of the fund management, as there is no requirement for a minimum 50% exposure in mid and small-cap funds. Multi-cap funds typically outperform flexi-cap funds during bull markets.

The Bear Phase

A bear phase occurs when the market is in a downward spiral; mid-cap and small-cap equities are most likely to suffer during this time. These stocks or companies may encounter extreme Volatility and liquidity constraints during this period, making it difficult to exit positions.

Flexi-cap funds can minimise their exposure to small and mid-cap funds during this phase since they have the option to allocate across market capitalisation. This could protect the fund against a steep decline. However, even during a bear market, multi-cap funds would be required to invest a minimum of 25% of their assets in mid-and small-cap equities, which might reduce the fund's returns. Flexi-cap funds typically outperform multi-cap funds during downturn markets.

Flexi-cap funds can lower their mid-cap or small-cap company exposure to zero during a bad market. On the other hand, multi-cap funds may be well-positioned during a bull market because they include a minimum of 25% exposure to mid-and small-cap stocks.

Flexi-cap funds may outperform multi-cap funds during a bear market, whereas, during a bull market, multi-cap funds may outperform flexi-cap funds. As a result, multi-cap funds are better suited to investors with a high-risk appetite and a longer horizon for an investment of more than five years.

The flexi-cap is a good option for investors who want to diversify their exposure across market capitalisation. Before deciding between the two, investors should consider their current portfolio market-cap allocation, risk profile, investment horizon, and investment purpose.

Tips for Choosing Multi-Cap and Flexi-Cap Funds

Here are some factors that you must consider while deciding on the best choice between multi-cap and flexi-cap funds:

The Risk Factor

Multi-cap funds are riskier than flexi-cap funds since they must invest at least 50% of their assets in small and mid-cap sectors. On the other hand, flexi-cap funds can shift a considerable part of assets to large-cap funds if the small and mid-cap segments are underperforming. To some extent, this could mitigate the downside.

Diversification

Multi-cap funds have an advantage over flexi-cap funds in that they do not have to time their entry and exit in the Mid and Small Cap categories. Multi-cap funds will profit from a quick spike in mid and small-cap companies since they must stick to their mandate allocation.

Flexi-cap will be able to shift between large, mid, and small-cap stocks with greater ease, and they will strive to produce Alpha from both stock and market cap selection. Multicap will have a more stringent mandate, with a greater emphasis on a stock selection with a pre-determined cap. Multi-caps outperform flexi-cap in terms of mandate stability.

Record of Achievement

Even though flexi-cap is a newly established category, it is essentially the same as a multi-cap fund from the past, with the same flexibility. As a result, this category has a lot of vintage and performance history.

Multi-cap funds, on the other hand, are only a few years old and have yet to demonstrate their worth. Multi-cap funds delivered 55.85% during one year on November 22, 2021, while flexi-cap funds delivered 44.63%.

Given that multi-cap funds have a set allocation of 50% to small- and mid-caps, it will be interesting to examine how they perform during different market cycles.

Choosing Appropriateness

The multi-cap category allows fund managers to show off their stock-picking abilities while also having the ability to generate alpha. Multi-cap funds are suitable for investors that prefer a set allocation as their optimal exposure across capitalisation and have a high-risk appetite.

For the fund's initiatives to produce rewards, these investors would also need a longer investment horizon. Because there is no set minimum allocation across market capitalisation in the flexi-cap category, the fund manager's conviction and ability to judge the appropriate allocation is crucial.

When a market sector becomes unattractive, flexi-cap managers might move the allocation to another market segment that has performed better recently. Flexi-cap funds are a good option for investors who want to diversify their exposure across market capitalisation.

Conclusion

Both of these subcategories of equities are appropriate for investors with a 5-year investment horizon and the ability to tolerate considerable risk in the pursuit of wealth. Whatever form of mutual fund you choose, be sure it fits your risk profile, investment objectives, Financial goals, and time frame for achieving those goals.

Finally, if the scheme chosen meets your needs, you can invest through a Systematic Investment plan (SIP). When equities markets are predicted to be volatile, SIPs limit risk with their built-in rupee-cost averaging feature and compound your wealth over time, allowing you to achieve your financial objectives.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.