Table of Contents

Small-Cap vs Flexi-Cap: Which One to Choose?

Before you decide to invest in equity Mutual Funds, it's important to know about the company's Market capitalisation. Market capitalisation, in basic words, is the valuation of a firm that is traded on a stock exchange. It's a crucial Factor that can help investors figure out how much money they'll make from a certain stock and how much risk they'll take.

Based on their market capitalisation, mutual funds are divided into large-, mid-, small-, and multi-cap categories. In this article, you'll learn about what small-cap vs flexi-cap funds are, along with factors influencing investment decisions.

Small-Cap Mutual Fund

Small cap funds are Equity Funds whose Portfolio is mostly made up of equities and equity-linked instruments issued by firms listed after the top 250 in terms of market capitalisation. The Underlying firms of small-cap companies have a market capitalisation of between Rs. 10 crores and Rs. 500 crores.

These businesses have a lot of potential for expansion due to their small size. As a result, small-cap businesses have the potential to outperform mid- and Large cap funds in terms of returns. However, these funds have a higher level of risk, and at times, they can be quite volatile.

Features of Small-Cap Funds

The following are the key characteristics of small-cap funds:

- Small-cap funds put their money into small size companies such as start-ups or small-revenue businesses in the early phases of development fall under this category

- These funds are often volatile. This is due to the fact that small-cap companies are not financially sound

- Small-cap mutual funds invest in firms that have a great potential for future growth

- These funds are high-risk investments. They can produce tremendous returns for investors that are searching for rapid growth and are willing to take on a lot of risks

- During a bull market phase, small-cap mutual funds beat mid and large-cap mutual funds

- Small-cap funds perform less efficient than mid and large-cap funds during a Bear Market phase

Talk to our investment specialist

Why Pick Small-Cap Mutual Funds?

Small-cap funds invest in firms that are likely to grow in value over time. As a result, if you invest in these firms, you can anticipate your money to rise dramatically over time. You must keep a check on how your fund's performance is and the reputation of your fund management; these elements will help you decide whether or not to invest in the fund.

Investors who have a high-risk appetite or are willing to take high risks can consider Investing in this category. However, it's advisable to keep some small-cap funds in your portfolio. When putting together a stock portfolio, it's critical to have a benchmark to evaluate your results against. An investor can correctly measure the success of his portfolio by comparing it to a benchmark.

Top 10 Best Small Cap Funds to Invest in 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹173.528

↑ 0.81 ₹63,007 20 2 -1.5 29 37.2 26.1 L&T Emerging Businesses Fund Growth ₹83.9103

↑ 0.18 ₹16,061 22.8 -2.1 -2.9 25.7 34.6 28.5 Franklin India Smaller Companies Fund Growth ₹176.97

↑ 0.76 ₹13,545 20.4 1.7 -3.4 28.9 34.1 23.2 HDFC Small Cap Fund Growth ₹142.057

↑ 0.59 ₹34,032 23 4.1 3.8 28 33.7 20.4 Kotak Small Cap Fund Growth ₹268.724

↑ 0.95 ₹17,329 19.4 -0.9 -1.7 21.1 32.2 25.5 ICICI Prudential Smallcap Fund Growth ₹88.99

↑ 0.11 ₹8,254 19.4 4.9 -1.2 21.3 31.9 15.6 DSP BlackRock Small Cap Fund Growth ₹202.204

↑ 1.13 ₹16,305 25 2.8 5.8 24.8 31.9 25.6 Sundaram Small Cap Fund Growth ₹263.6

↑ 1.28 ₹3,311 21.4 3.6 4.6 25.6 31.7 19.1 IDBI Small Cap Fund Growth ₹30.7767

↑ 0.13 ₹576 15 -7.9 -5.7 23.6 31.6 40 SBI Small Cap Fund Growth ₹175.967

↑ 0.77 ₹34,028 15.9 1.6 -2.5 21 28.3 24.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Jul 25 100 Crore & Sorted on 5 Year CAGR Returns.

What is a Flexi-Cap Mutual Fund?

Mutual funds that invest in equities and equity-related securities across all market capitalisations are known as flexi-cap funds. These funds are year-round investments that provide a safe way to invest in the stock market.

The product's dynamic nature and well-balanced risk-return profile make it a good fit for your core investment portfolio. The use of a longer investing horizon might assist in smoothing out the fluctuations in the market. Systematic investing for the long term via the Systematic Investment plan (SIP) method is suggested to create a consistent exposure to the fund category.

Features of Flexi-Cap Funds

Flexi-cap funds are given this name because they are versatile and can switch from one capitalisation to another. Here are the key characteristics of this fund:

- Flexi-cap funds invest at least 65% of their assets in stocks and associated products

- They invest in a wide Range of capitalisations rather than focusing on a specific sector

- The fund managers split the fund's assets into several capitalisations, which helps to limit risk by reducing the Volatility of a single Capital market. This also diversifies the portfolio because the fund managers invest in equities based on their growth prospects rather than the company's size

- As market capitalisation isn't a significant constraint, fund managers can shift from one category to the next based on market movements

- They provide a two-fold benefit by allowing you to invest in equities that seem good investment options while also allowing you to withdraw funds quickly if they do not perform as expected

Why Invest in Flexi-Cap Funds?

The flexibility of this fund is the primary reason for someone to invest in it. The fund manager can adjust the portfolio when market values and macroeconomic conditions change. If the fund manager feels that wider markets are better positioned than large-caps, he can change the portfolio allocation to mid and small-caps to benefit from the upswing in these sectors. This increased interest of investors in flexi-cap funds. Investors with a moderate to high-risk tolerance and minimum of a 5-year investment horizon can go with this fund.

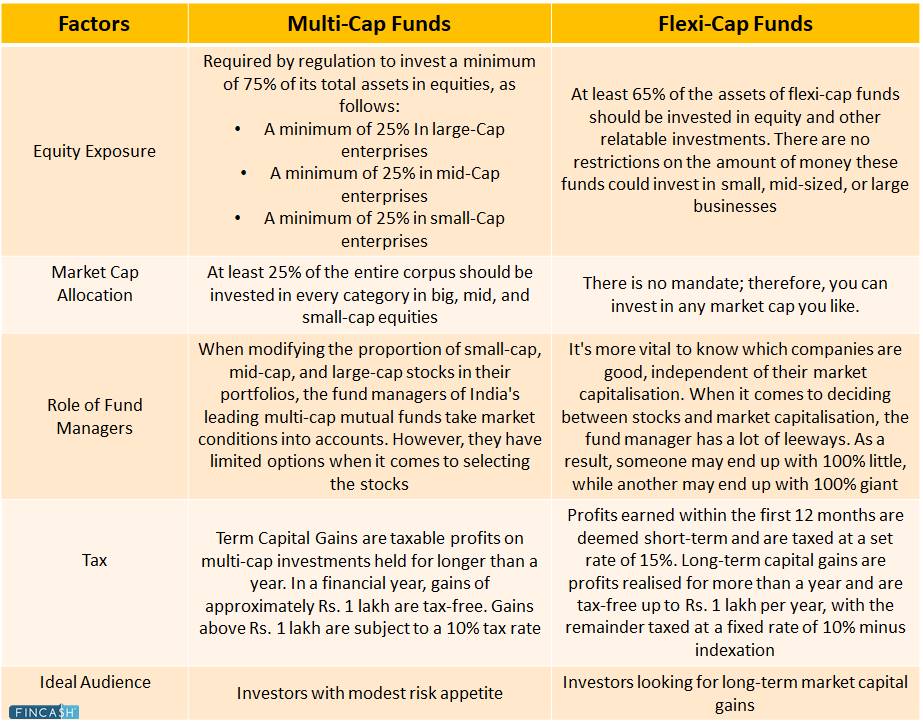

Flexi-Cap Funds Vs Small-Cap Funds

It's not an easy task to choose between flexi-cap and small-cap funds. However, the investment horizon is the most significant factor in deciding. If market fluctuations make you troublesome, then a flexi-cap fund could be the best option. If you have a longer time horizon of roughly 10-15 years and can forget about the stock markets after investing in them, you can invest in small-cap funds.

Apart from this, small-caps have provided higher returns than large-caps, but they are also more volatile, whereas flexi-caps would also provide strong returns, though not as high as large-caps, they would be less volatile because of their more diverse nature.

| Basis | Flexi-Cap | Small-Cap |

|---|---|---|

| Meaning | Mutual funds that invest in equities and equity-related securities across all market capitalisations | Small-cap funds are equity-oriented mutual funds that must invest at least 80% of their assets in small-cap businesses' shares and equity-related securities |

| Market Capitalisation | No mandate; can invest freely across the market caps | Less than 5000 crores |

| Flexibility to Fund Manager | High | Less |

| Ideal for | Investors with a moderate-high risk appetite who seek consistent returns and better risk-adjusted returns | Investors with a high-risk appetite who seek higher returns |

| Risk Appetite | Comparatively lower than small-cap funds | High |

| Example | SBI Flexi-Cap Funds, Aditya Birla Sun Life Flexi-Cap Fund and so on | IDFC Emerging Businesses Fund, Axis Small-Cap Fund, SBI Small-Cap Fund and so on |

Key Factors Consider While Investing in Small-Cap Funds and Flexi-Cap Funds

Market capitalisation is a key factor when it comes to selecting firms to invest in through Mutual Fund Houses. Not only does market capitalisation represent the size of a firm, but it also shows other factors that investors consider, such as the company's track record, growth potential, and risk. Check on the list of factors to be considered before:

Potential Returns

Small-cap mutual funds have a high return potential and might be an excellent addition to your portfolio. By taking a high degree of risk, you can ensure that these funds function as those buffers in your portfolio that give excellent value if things work out in the market for them. Flexi-cap funds invest in a variety of market capitalisations and sectors. It guarantees a steady stream of money at predetermined periods.

Expense Ratio

The expense ratio is an annual fee assessed by asset management businesses to their clients. Fund houses impose this fee to defray the costs of running a mutual fund system. Investors who can locate funds with the lowest expense ratio that invest in small-cap funds are likely to earn better returns. Same way, examine the expense ratios of the top flexi-cap funds before making your decision.

Investment Horizon

Small-cap funds are for moderate investors who desire to grow money over a long period of time. These strategies work best with a five- to the seven-year investment horizon. Investors in small-cap funds might choose between short-term and long-term strategies. However, investing in small-caps for the long term is encouraged to give those firms time to expand and improve in value.

Past Performance

Looking at the prior outcomes of a fund will help you figure out if the mutual fund plan has been consistent. You must analyse the fund's performance throughout several market cycles, both bullish and negative. You can proceed with a fund if it has been consistent in all market circumstances and times.

Fund Manager's Performance

When investing in a fund, it's crucial to look at the fund manager's track record. Every buy-and-sell decision is made after extensive research and analysis in flexi-cap or small-cap funds. As a result, the fund manager's ability to manage the plan influences its performance

Taxation

The number of Capital Gains taxed when redeeming small-cap or flexi-cap equity funds depend on how long the money was invested, which is referred to as the holding period. Short Term Capital Gains (STCG) are capital gains from the Redemption that have a holding duration of less than one year and are taxed at 15%. Long Term Capital Gains (LTCG) are defined as profits earned after more than one year, and when they exceed one lakh, they are taxed at a rate of 10% on the excess.

Risks

You must examine your alternatives and the possibility of good returns from various low-volatility strategies. There is no denying that small-cap funds are comparatively riskier than flexi-cap funds, but some can manage risk better than their competitors.

The Bottom Line

Depending on your investment goals, you can pick which funds to include in your portfolio. On the one hand, flexi-caps tend to give more flexibility and steady payouts, whereas small-caps offer more risk and return. However, it's advisable to pick both types of funds in your portfolio to have exposure to both market segments.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.