Flexi-Cap vs Large-Cap: Which is Better?

The moment you reach your twenties, concepts like savings, investments and returns begin hovering. You reach a pinnacle where you might already possess basic financial planning and investment knowledge, but it's never enough.

Mutual Funds, among other things, are one of the greatest investment alternatives for those who want to start Investing early. By doing so, you can save money, avoid paying Taxes and expand your wealth.

However, considering that there are hundreds of options available out there, selecting a mutual fund to invest in is quite a strenuous task. Out of all the options, you may hear about flexi-cap and Large cap funds often. What are they? And, should you invest in them? Let's find out the answers with a comprehensive comparison between flexi-cap vs large-cap funds.

What is a Flexi-Cap Mutual Fund?

According to the Securities and Exchange Board of India (SEBI), a flexi-cap fund is an open-ended, dynamic equity scheme. It is a mutual fund that isn't limited to investing in companies with a predetermined Market capitalisation.

The scheme's basic investment in equity and equity-related securities accounts for 65% of its total assets. For each flexi-cap plan, the Asset Management Company (AMC) has the discretion to select a suitable benchmark. The prospectus for the fund will be shown in the flexi-cap mutual fund structure.

Furthermore, as far as Regulation 18(15A) of the SEBI (Mutual Funds) Regulations, 1996 is concerned, SEBI has allowed fund companies to convert the present scheme into a flexi-cap scheme, subject to compliance with the requirement for a change in essential features of the scheme.

A flexi-cap fund helps investors diversify their Portfolio by investing in firms with varying market capitalisations, such as large-, mid- and small-cap, reducing risk and Volatility. They are also known as diversified equities funds or multi-cap funds.

Features of Flexi-Cap Funds

Here are some of the salient features of flexi-cap funds:

- They invest in a wide Range of capitalisations rather than focusing on a specific sector

- It gives both security and growth to the portfolio because of its flexibility, which allows them to switch between Capital market groups and equities

- They can even swap from one sector to the next if one of the Capital Markets isn't functioning well. This provides investing options as well as diversification opportunities

- Flexi-cap funds invest more than 65% of their assets in stocks and similar products

- They put their money into firms with strong business strategies, financial statements, and track records. Similarly, if a few stocks are underperforming, they can easily quit

- Flexi-cap funds, unlike multi-cap funds, have no restrictions on the percentage of assets they must hold in any capitalisation sector and are in a better position to provide a risk-return adjustment

Talk to our investment specialist

Benefits of Investing in Flexi-Cap Funds

These funds are a suitable choice for investors looking to participate in the whole market cycle, ranging from medium to long term. Here are key benefits helping you to know why you should invest in flexi-cap funds:

- Flexi-cap funds are meant to identify growth possibilities in a rising market while also reducing the downside risk in a collapsing market

- These are well-diversified equities strategies with a "go-anywhere" attitude

- They aim to take advantage of investment possibilities across the board

- Flexi-cap funds give fund managers the freedom to invest throughout the market capitalisation spectrum

- The risk and return components are well balanced because of the diverse portfolio

- They have the ability to capitalise on opportunities throughout the market spectrum, regardless of market capitalisation, Industry, or style

What is a Large-Cap Mutual Fund?

Also known as blue-chip stocks, large-cap mutual funds are a type of equity mutual fund that invests primarily in the stock and equity-linked securities of firms under 100 companies in market capitalisation. These are noted for their consistency and stability. However, during bullish market trends, big firms can be outpaced by small and mid-cap firms.

Companies in this category are acknowledged to have a good reputation in the market. With the finest large-cap funds, you can be certain that you're investing in firms with a proven track record of outperforming their peers over a time period ranging from medium to long term.

When compared to small-cap and mid cap funds, these have a lower risk profile, making them ideal for risk-averse investors.

Features of Large-Cap Funds

Some of the key features of large-cap funds are as follow:

- Large-cap funds, sometimes known as blue-chip funds, are essentially Equity Funds that invest primarily in stocks. They concentrate on stocks of blue-chip businesses, among other types of equities

- These funds are a safer investment in equity funds than mid-cap or Small cap funds because of their stability and liquidity

- Investors with a ten-year investment horizon and a desire for long-term financial appreciation may benefit from large-cap funds

- Rapid fluctuations in the stock prices of large-cap companies are uncommon due to the continual trading of blue-chip stocks. As a result, blue-chip funds provide consistent returns

- Blue-chip stocks are easy to trade, even in tough times, due to their reputation, quality, and dependability. The frequent selling and buying of equities result in quick cash flow, making blue-chip funds very liquid

Benefits of Investing in Large-Cap Mutual Funds

For those new to mutual funds, large-cap funds are a good place to start as they are the companies considered financially sound. The investors are generally safe because 80% of the funds' assets are invested in large-cap companies.

The way a large-cap fund's portfolio is created using the remaining 20% of the corpus, on the other hand, has a considerable influence on its performance. Here is why you can pick large-cap mutual funds:

- These funds provide investors with greater short-term returns and contribute to long-term wealth-building while paying out dividends regularly

- Large-cap funds have the potential to withstand market downturns

- They provide consistent and low-risk returns

- Large-cap funds might be beneficial to investors with a low-risk tolerance

Best Performing Large Cap Funds 2025

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 500 9.2 12.5 15.4 21.9 12.6 Nippon India Large Cap Fund Growth ₹92.7289

↑ 0.14 ₹50,876 100 0 3.7 10.2 19.1 17.7 9.2 ICICI Prudential Bluechip Fund Growth ₹113.88

↑ 0.04 ₹78,502 100 1 4.6 10.8 18.3 16 11.3 Invesco India Largecap Fund Growth ₹69.92

↓ -0.23 ₹1,718 100 -1.1 3 8.4 17.7 14.4 5.5 DSP TOP 100 Equity Growth ₹477.768

↑ 0.98 ₹7,285 500 0.1 3 7 17.6 13.3 8.4 Bandhan Large Cap Fund Growth ₹78.896

↑ 0.01 ₹2,051 100 -0.3 4 9.8 17.5 13.1 8.2 BNP Paribas Large Cap Fund Growth ₹224.392

↑ 1.38 ₹2,702 300 1.2 3.8 7.9 16.2 13.2 4.4 HDFC Top 100 Fund Growth ₹1,169.98

↑ 2.36 ₹40,604 300 1.7 4.5 8.1 16 14.7 7.9 Aditya Birla Sun Life Frontline Equity Fund Growth ₹537.01

↑ 1.33 ₹31,386 100 0 3.4 9.3 15.7 13.5 9.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23 Research Highlights & Commentary of 9 Funds showcased

Commentary IDBI India Top 100 Equity Fund Nippon India Large Cap Fund ICICI Prudential Bluechip Fund Invesco India Largecap Fund DSP TOP 100 Equity Bandhan Large Cap Fund BNP Paribas Large Cap Fund HDFC Top 100 Fund Aditya Birla Sun Life Frontline Equity Fund Point 1 Bottom quartile AUM (₹655 Cr). Top quartile AUM (₹50,876 Cr). Highest AUM (₹78,502 Cr). Bottom quartile AUM (₹1,718 Cr). Lower mid AUM (₹7,285 Cr). Bottom quartile AUM (₹2,051 Cr). Lower mid AUM (₹2,702 Cr). Upper mid AUM (₹40,604 Cr). Upper mid AUM (₹31,386 Cr). Point 2 Established history (13+ yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (16+ yrs). Established history (22+ yrs). Established history (19+ yrs). Established history (21+ yrs). Oldest track record among peers (29 yrs). Established history (23+ yrs). Point 3 Rating: 3★ (upper mid). Top rated. Rating: 4★ (top quartile). Rating: 3★ (lower mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 4★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 12.61% (bottom quartile). 5Y return: 17.75% (top quartile). 5Y return: 15.99% (top quartile). 5Y return: 14.38% (upper mid). 5Y return: 13.32% (lower mid). 5Y return: 13.06% (bottom quartile). 5Y return: 13.18% (bottom quartile). 5Y return: 14.71% (upper mid). 5Y return: 13.52% (lower mid). Point 6 3Y return: 21.88% (top quartile). 3Y return: 19.10% (top quartile). 3Y return: 18.26% (upper mid). 3Y return: 17.69% (upper mid). 3Y return: 17.61% (lower mid). 3Y return: 17.49% (lower mid). 3Y return: 16.16% (bottom quartile). 3Y return: 15.96% (bottom quartile). 3Y return: 15.74% (bottom quartile). Point 7 1Y return: 15.39% (top quartile). 1Y return: 10.23% (upper mid). 1Y return: 10.78% (top quartile). 1Y return: 8.39% (lower mid). 1Y return: 6.96% (bottom quartile). 1Y return: 9.79% (upper mid). 1Y return: 7.90% (bottom quartile). 1Y return: 8.13% (bottom quartile). 1Y return: 9.34% (lower mid). Point 8 Alpha: 2.11 (top quartile). Alpha: -0.94 (upper mid). Alpha: 1.30 (top quartile). Alpha: -5.05 (bottom quartile). Alpha: -1.17 (lower mid). Alpha: -2.13 (bottom quartile). Alpha: -5.54 (bottom quartile). Alpha: -1.63 (lower mid). Alpha: -0.70 (upper mid). Point 9 Sharpe: 1.09 (top quartile). Sharpe: 0.29 (upper mid). Sharpe: 0.48 (top quartile). Sharpe: 0.04 (bottom quartile). Sharpe: 0.26 (lower mid). Sharpe: 0.21 (bottom quartile). Sharpe: -0.06 (bottom quartile). Sharpe: 0.21 (lower mid). Sharpe: 0.31 (upper mid). Point 10 Information ratio: 0.14 (bottom quartile). Information ratio: 1.37 (top quartile). Information ratio: 1.26 (top quartile). Information ratio: 0.67 (lower mid). Information ratio: 0.74 (upper mid). Information ratio: 0.72 (upper mid). Information ratio: 0.47 (bottom quartile). Information ratio: 0.54 (bottom quartile). Information ratio: 0.58 (lower mid). IDBI India Top 100 Equity Fund

Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

Invesco India Largecap Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

BNP Paribas Large Cap Fund

HDFC Top 100 Fund

Aditya Birla Sun Life Frontline Equity Fund

Large Cap funds having AUM/Net Assets above 500 Crore and managing funds for 5 or more years. Sorted on Last 3 Year Return.

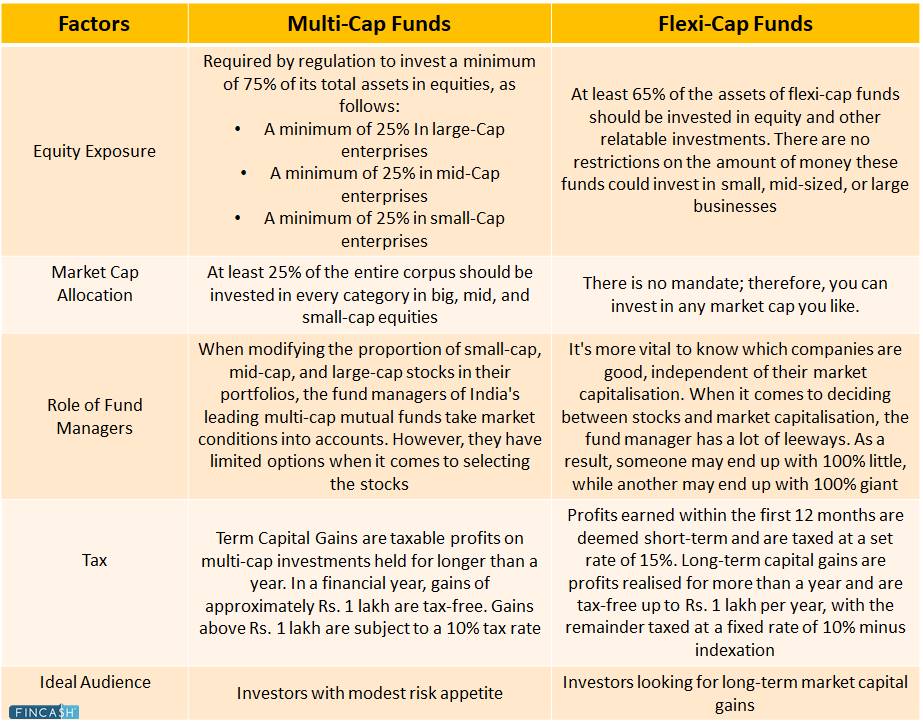

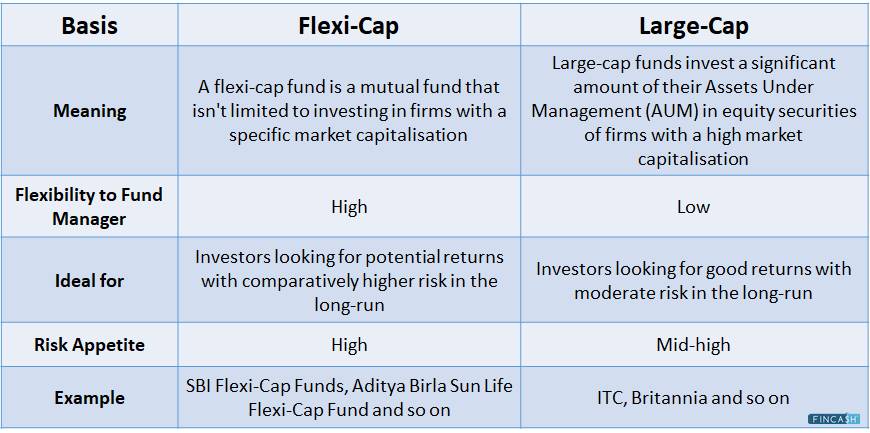

Difference Between Flexi-Cap and Large-Cap

There has been a lot of confusion between the two. The aim of large-cap and flexi-cap funds has always been the same: to invest in equities with various market capitalisations. Here is the key difference between them:

Flexi Cap Vs Large Cap: Which one is Best Suited for you?

Flexi-cap funds are best suited for investors who want to diversify their core equity portfolio holdings by investing in high-quality firms with the potential to produce long-term Economic Value. Also, if you are looking for a fund that takes a systematic approach to portfolio management, you must invest in flexi-cap funds.

It is ideal for investors with a moderate risk tolerance who wish to invest for 3 to 7 years in order to achieve their long-term financial objectives. On the other hand, large-cap funds are ideal for investors who wish to invest for at least 2 to 4 years and expect a high return. However, investors must be prepared for the risk of moderate losses in their assets.

Key Pointers to Consider While Investing in Large-Cap or Flexi-Cap Funds

Flexi-cap and large-cap mutual funds contribute by providing consistent returns. However, it's better to know everything before investing in these funds as investors. Listed down factors are to be considered while investing in any of these funds:

Past Performance

The greatest approach to analysing the success of any asset or investment is to look at its history. These two mutual funds are the same way. It's crucial to see if the funds' returns have been constant over time. If yes, you can continue with your decision. However, make sure you don't centralise your decision only on this one Factor.

Expense Ratio

The expense ratio refers to the cost of an investment, such as a Brokerage Fee or a commission imposed by a mutual fund company, compared to the profit gained. A reduced expense ratio translates to a higher return for investors. As a result, it's a good idea to double-check the charge structure, returns, NAV, and other costs.

Investment Horizon

If you are a moderate investor who wishes to build money over a lengthy period of time, you can go with flexi-cap mutual funds. On the contrary, large-cap mutual funds typically have 3- to 5-years of the investment horizon. As a result, investors searching for long-term investments should feel at ease investing in these funds during this time frame

Taxation

Both flexi-cap and large-cap mutual fund returns are taxed since they are considered capital gains. Short-Term Capital Gain (STCG) is taxed at 15%, while Long Term Capital Gain (LTCG) that exceeds Rs. 1 lakh will be taxed at 10%, just like any other equity asset classification.

Investment Needs

Personal needs and expectations from the investment are always the first things to evaluate. Before making a decision, evaluate your liquidity needs, Income demands, risk tolerance, and so on.

Fund Manager Performance

All buy-and-sell decisions are made after a thorough investigation and analysis. As a result, the fund manager's competency determines the scheme's performance to a great extent. As fund managers are in charge of your money, make sure to look into their experience in the industry. An experienced manager will be able to invest in the appropriate areas in order to get the desired return.

The Bottom Line

Market capitalisation is important when choosing companies to invest in through Mutual Fund Houses. It reflects a company's size and a variety of other factors that investors consider, such as the company's track record, growth potential, and risk. So be wise while choosing mutual funds as they are subject to market risk.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.