Earnings Yield

What is the Earnings Yield?

The Earnings yield is known as the Earnings Per Share for the latest 12-month timeline, divided by the current price per share of the Market. This one is the opposite of the P/E ratio and displayed the percentage of the amount that a company earned per share.

This method is used by several investment managers to comprehend the optimal asset allocations. Other than that, investors use the yield to figure out overpriced and underpriced assets.

How Does it Work?

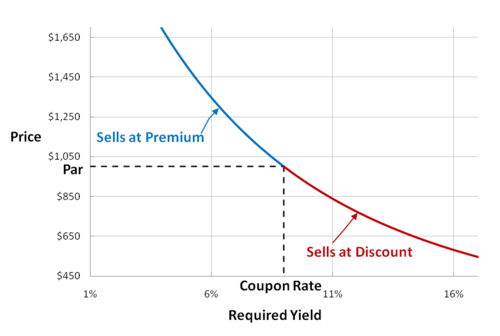

Often, money handlers compare the earnings yield of an extensive Market Index to dominant interest rates as the current 10-year treasury yield, and more. If the earnings yield is lesser than the prevailing rates, stocks would be regarded overvalued.

And, if the earnings yield is higher, stocks get regarded as undervalued in comparison to the Bonds. As per the economic theory, investors in equities must demand an extra risk premium of different percentage points above the dominant risk-free rates in earnings yield to compensate for the higher risk of handling stocks over bonds.

Example of Earnings Yield

Earnings yield is one metric that investors use to comprehend if they wish to sell or buy a stock. For instance, in 2019, Facebook traded almost Rs. 13,000 with 12-month earnings of Rs. 564. This gave the earnings yield of approximately 4.3%.

Talk to our investment specialist

Historically, this price was quite high as before 2018; the yield was always 2.5% or lesser than that. The increase in earnings yield may play a significant role in taking the stock higher, primarily because investors will anticipate earnings to increase in the future.

However, still, a higher earnings yield doesn’t avert the stock from experiencing a decline. Furthermore, earnings yield could also be effective in such a stock that is older and has experienced consistent earnings.

Since growth is anticipated to be on the lower side in the upcoming years; thus, earnings yield can be used to comprehend the appropriate time to purchase a certain stock, depending upon its cycle. If the earnings yield is higher than normal, it may signify that the stock could be oversold and may even go bounce. But, this assumption doesn’t lead to anything negative happening within the company.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.