Table of Contents

Real Rate of Return

What is a Real Rate of Return?

A Real return is what is earned on an investment after Accounting for Taxes and Inflation. A Real Rate of Return is the annual percentage return realized on an investment, which is adjusted for changes in prices due to inflation or other external effects. This method expresses the nominal rate of return in real terms, which keeps the purchasing power of a given level of Capital constant over time.

Adjusting the nominal return to compensate for factors such as inflation allows you to determine how much of your nominal return is real return.

The real rate of Return on Investment is very important before Investing your money. That’s because inflation can reduce the value as time goes on, even if taxes do chip away at it. Investors should also consider whether the risk involved with a certain investment is something they can tolerate given the real rate of return.

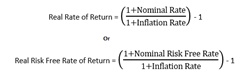

Real Return Formula

Real Return = Nominal Return - Inflation

Talk to our investment specialist

Strategies to Hedge against Inflation and Taxes

Economic theory proves that a moderate amount of inflation is ideal for a developing Economy. This is because rising prices provide an impetus to businesses for investing and thereby leading growth and overall development. Therefore, as a thumb-rule, one should be able to beat inflation by investing in these businesses - which means investing via equity and debt routes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.