Table of Contents

What is Real Rate of Return?

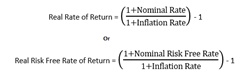

Real Rate of Return is known as the annual profit percentage earned on a certain investment, that is adjusted for Inflation. Thus, the real rate of return precisely signifies the real purchasing power of an amount over the time period.

Adjusting the nominal return to recompense for inflation enables an investor to comprehend how much a nominal return will be the real return. Along with adjusting for inflation, an investor must also regard the effect of additional factors, such as investment fees and Taxes in calculating real returns on the money or to select from several Investing options.

Real Rate of Return Formula

Real rate of return is equal to:

Real rate of return = [(1 + Nominal Rate)/ (1 + Inflation Rate)] – 1

Inflation is known to reduce the overall value of money. The calculation of real rate of return in its real value instead of the nominal value –especially for the period involving high inflation, helps in providing a proper picture of the success of the investment.

Real Rate of Return Examples

Let us assume that a bond is paying interest rate of 5 percent every year. If the inflation rate tends to be 3 percent every year, then the real rate of return is going to be just 2 percent on your overall savings.

In another way, it can be said that even when the nominal rate of return on the savings turns out to be 5 percent, the real rate of return is just going to be 2 percent. This implies that the real value of the savings tends to increase by just 2 percent every year.

If you would like to consider the same in another way –let us assume that you made a saving of INR 10,000 for buying something. However, you decide that you are going to invest it for a year to for purchasing some other desired item.

If you are going to earn 5 percent rate of interest on the same, you will end up having INR 10,500 at the end of the year. However, as prices are going to increase by 3 percent along the same period because of inflation, the same item would now be costing INR 10,300.

Eventually, the amount of cash or money that is going to remain once you purchase the item, for representing your overall increase in the purchasing power, is going to be INR 200 or 2 percent of the initial investment. This is going to serve as the real rate of return. This is because it helps in representing the amount that you would have gained after considering the effects of inflation.

Talk to our investment specialist

Real Return Vs. Nominal Return

Interest rates are known to be expressed either in the form of real return rates or nominal return rates. The difference of real return vs. nominal return is the fact that nominal returns need not be adjusted for inflation. On the other hand, real returns are expected to be adjusted accordingly. Due to this, nominal rates always tend to be higher –except during rare instances like negative inflation or deflation.

Real rates of return are helpful in providing accurate historical picture of how the investment is being carried out. However, it is the nominal rates that you are going to observe getting advertised on some investment product.

Strategies to Hedge against Inflation and Taxes

Economic theory proves that a moderate amount of inflation is ideal for a developing Economy. This is because rising prices provide an impetus to businesses for investing and thereby leading growth and overall development. Therefore, as a thumb-rule, one should be able to beat inflation by investing in these businesses - which means investing via equity and debt routes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.