+91-22-48913909

+91-22-48913909

Table of Contents

- How to Invest in Gold ETFs?

- How to Invest in Gold Mutual Funds Online?

- Best Gold ETFs to Invest 2025

- How To Choose Best Gold ETFs?

- FAQs

- 1. How is the value of gold ETFs evaluated?

- 2. Who sells gold ETFs?

- 3. Can I purchase physical gold with the gold ETFs?

- 4. What do the gold ETFs invest in?

- 5. Why should I invest in gold ETFs?

- 6. Is there any exit load in this investment?

- 7. Are there any tax benefits on the investments?

- 8. Can I use gold ETFs as collateral for loans?

Top 5 Gold - Gold Funds

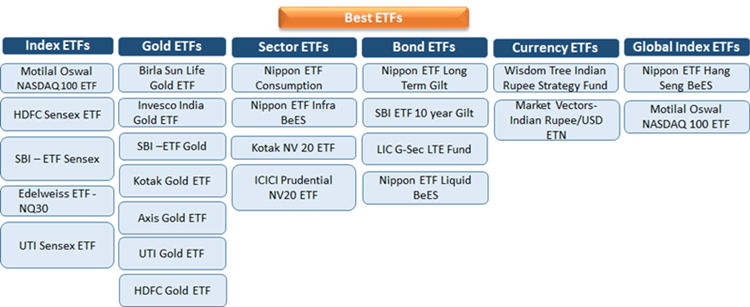

Best Gold ETFs to Invest in 2025

In recent years, the popularity of Gold ETFs (Exchange Traded Fund) amongst investors has surged high. Investors are more inclined towards Investing in Gold ETFs as they track gold prices and eliminate the need of storage. But, when it comes to Investing, often investors are confused over choosing the best Gold ETFs.

The ideal way to go for Gold ETFs is to focus on the fund with the lowest tracking error. It is advisable to go for a Gold ETF that has the largest margin and highest volume. To make it convenient for investors, we have listed down the best Gold ETFs to invest in India.

How to Invest in Gold ETFs?

To invest in gold ETF, you need to have a Demat account and an online Trading Account. To open an account, you would require a PAN Card, an address proof and an identity proof. After the account is ready, you can choose a Gold ETF and place an order. Once the trade is executed a confirmation is sent to you in your account. A small fee from the fund house and the broker is charged when one buys or sells these Gold ETFs.

How to Invest in Gold Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Talk to our investment specialist

Best Gold ETFs to Invest 2025

Some of the best performing Underlying gold ETFs having AUM/Net Assets > 25 Crore are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Aditya Birla Sun Life Gold Fund Growth ₹27.7639

↑ 0.47 ₹512 19.2 22.9 27.1 19.5 12.5 18.7 Invesco India Gold Fund Growth ₹27.0983

↑ 0.44 ₹127 20.1 23.1 26.4 19.7 13.5 18.8 SBI Gold Fund Growth ₹27.898

↑ 0.51 ₹3,225 18.7 22.6 27.6 19.9 11.2 19.6 Nippon India Gold Savings Fund Growth ₹36.6156

↑ 0.73 ₹2,623 18.9 22.7 27.6 19.7 12.5 19 ICICI Prudential Regular Gold Savings Fund Growth ₹29.5847

↑ 0.60 ₹1,741 18.8 22.8 27.9 19.8 12.1 19.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 25

An Open ended Fund of Funds Scheme with the investment objective to provide returns that tracks returns provided by Birla Sun Life Gold ETF (BSL Gold ETF). Aditya Birla Sun Life Gold Fund is a Gold - Gold fund was launched on 20 Mar 12. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Gold Fund Returns up to 1 year are on To provide returns that closely corresponds to returns provided by Invesco India Gold Exchange Traded Fund. Invesco India Gold Fund is a Gold - Gold fund was launched on 5 Dec 11. It is a fund with Moderately High risk and has given a Below is the key information for Invesco India Gold Fund Returns up to 1 year are on The scheme seeks to provide returns that closely correspond to returns provided by SBI - ETF Gold (Previously known as SBI GETS). SBI Gold Fund is a Gold - Gold fund was launched on 12 Sep 11. It is a fund with Moderately High risk and has given a Below is the key information for SBI Gold Fund Returns up to 1 year are on The investment objective of the Scheme is to seek to provide returns that closely correspond to returns provided by Reliance ETF Gold BeES. Nippon India Gold Savings Fund is a Gold - Gold fund was launched on 7 Mar 11. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Gold Savings Fund Returns up to 1 year are on ICICI Prudential Regular Gold Savings Fund (the Scheme) is a fund of funds scheme with the primary objective to generate returns by investing in units of ICICI Prudential Gold Exchange Traded Fund (IPru Gold ETF).

However, there can be no assurance that the investment objectives of the Scheme will be realized. ICICI Prudential Regular Gold Savings Fund is a Gold - Gold fund was launched on 11 Oct 11. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Regular Gold Savings Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Gold Fund

CAGR/Annualized return of 8.1% since its launch. Return for 2024 was 18.7% , 2023 was 14.5% and 2022 was 12.3% . Aditya Birla Sun Life Gold Fund

Growth Launch Date 20 Mar 12 NAV (16 Apr 25) ₹27.7639 ↑ 0.47 (1.71 %) Net Assets (Cr) ₹512 on 28 Feb 25 Category Gold - Gold AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.51 Sharpe Ratio 1.74 Information Ratio 0 Alpha Ratio 0 Min Investment 100 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹9,940 31 Mar 22 ₹11,371 31 Mar 23 ₹13,025 31 Mar 24 ₹14,416 31 Mar 25 ₹18,985 Returns for Aditya Birla Sun Life Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 8.9% 3 Month 19.2% 6 Month 22.9% 1 Year 27.1% 3 Year 19.5% 5 Year 12.5% 10 Year 15 Year Since launch 8.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 18.7% 2022 14.5% 2021 12.3% 2020 -5% 2019 26% 2018 21.3% 2017 6.8% 2016 1.6% 2015 11.5% 2014 -7.2% Fund Manager information for Aditya Birla Sun Life Gold Fund

Name Since Tenure Priya Sridhar 31 Dec 24 0.16 Yr. Data below for Aditya Birla Sun Life Gold Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 1.87% Other 98.13% Top Securities Holdings / Portfolio

Name Holding Value Quantity Aditya BSL Gold ETF

- | -100% ₹511 Cr 67,773,270

↑ 3,265,683 Clearing Corporation Of India Limited

CBLO/Reverse Repo | -1% ₹3 Cr Net Receivables / (Payables)

Net Current Assets | -0% -₹2 Cr 2. Invesco India Gold Fund

CAGR/Annualized return of 7.7% since its launch. Return for 2024 was 18.8% , 2023 was 14.5% and 2022 was 12.8% . Invesco India Gold Fund

Growth Launch Date 5 Dec 11 NAV (16 Apr 25) ₹27.0983 ↑ 0.44 (1.64 %) Net Assets (Cr) ₹127 on 28 Feb 25 Category Gold - Gold AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.45 Sharpe Ratio 1.71 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-6 Months (2%),6-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,219 31 Mar 22 ₹11,561 31 Mar 23 ₹13,495 31 Mar 24 ₹14,930 31 Mar 25 ₹19,501 Returns for Invesco India Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 8.5% 3 Month 20.1% 6 Month 23.1% 1 Year 26.4% 3 Year 19.7% 5 Year 13.5% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 18.8% 2022 14.5% 2021 12.8% 2020 -5.5% 2019 27.2% 2018 21.4% 2017 6.6% 2016 1.3% 2015 21.6% 2014 -15.1% Fund Manager information for Invesco India Gold Fund

Name Since Tenure Krishna Cheemalapati 1 Mar 25 0 Yr. Data below for Invesco India Gold Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 3.81% Other 96.19% Top Securities Holdings / Portfolio

Name Holding Value Quantity Invesco India Gold ETF

- | -98% ₹124 Cr 166,343

↑ 11,350 Triparty Repo

CBLO/Reverse Repo | -3% ₹4 Cr Net Receivables / (Payables)

Net Current Assets | -1% -₹1 Cr 3. SBI Gold Fund

CAGR/Annualized return of 7.8% since its launch. Return for 2024 was 19.6% , 2023 was 14.1% and 2022 was 12.6% . SBI Gold Fund

Growth Launch Date 12 Sep 11 NAV (16 Apr 25) ₹27.898 ↑ 0.51 (1.86 %) Net Assets (Cr) ₹3,225 on 28 Feb 25 Category Gold - Gold AMC SBI Funds Management Private Limited Rating ☆☆ Risk Moderately High Expense Ratio 0.29 Sharpe Ratio 1.72 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹9,722 31 Mar 22 ₹11,159 31 Mar 23 ₹12,913 31 Mar 24 ₹14,265 31 Mar 25 ₹18,680 Returns for SBI Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 8.6% 3 Month 18.7% 6 Month 22.6% 1 Year 27.6% 3 Year 19.9% 5 Year 11.2% 10 Year 15 Year Since launch 7.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.6% 2022 14.1% 2021 12.6% 2020 -5.7% 2019 27.4% 2018 22.8% 2017 6.4% 2016 3.5% 2015 10% 2014 -8.1% Fund Manager information for SBI Gold Fund

Name Since Tenure Raj gandhi 1 Jan 13 12.17 Yr. Data below for SBI Gold Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 1.34% Other 98.66% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Gold ETF

- | -100% ₹3,232 Cr 439,902,410

↑ 29,358,199 Net Receivable / Payable

CBLO | -1% -₹27 Cr Treps

CBLO/Reverse Repo | -1% ₹20 Cr 4. Nippon India Gold Savings Fund

CAGR/Annualized return of 9.6% since its launch. Return for 2024 was 19% , 2023 was 14.3% and 2022 was 12.3% . Nippon India Gold Savings Fund

Growth Launch Date 7 Mar 11 NAV (16 Apr 25) ₹36.6156 ↑ 0.73 (2.02 %) Net Assets (Cr) ₹2,623 on 28 Feb 25 Category Gold - Gold AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 0.34 Sharpe Ratio 1.68 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (2%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹9,956 31 Mar 22 ₹11,456 31 Mar 23 ₹13,213 31 Mar 24 ₹14,599 31 Mar 25 ₹19,055 Returns for Nippon India Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 8.8% 3 Month 18.9% 6 Month 22.7% 1 Year 27.6% 3 Year 19.7% 5 Year 12.5% 10 Year 15 Year Since launch 9.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 19% 2022 14.3% 2021 12.3% 2020 -5.5% 2019 26.6% 2018 22.5% 2017 6% 2016 1.7% 2015 11.6% 2014 -8.1% Fund Manager information for Nippon India Gold Savings Fund

Name Since Tenure Himanshu Mange 23 Dec 23 1.19 Yr. Data below for Nippon India Gold Savings Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 3.07% Other 96.93% Top Securities Holdings / Portfolio

Name Holding Value Quantity Nippon India ETF Gold BeES

- | -98% ₹2,580 Cr 362,884,792

↑ 9,655,000 Net Current Assets

Net Current Assets | -1% ₹31 Cr Triparty Repo

CBLO/Reverse Repo | -0% ₹12 Cr Cash Margin - Ccil

CBLO | -0% ₹0 Cr 5. ICICI Prudential Regular Gold Savings Fund

CAGR/Annualized return of 8.4% since its launch. Return for 2024 was 19.5% , 2023 was 13.5% and 2022 was 12.7% . ICICI Prudential Regular Gold Savings Fund

Growth Launch Date 11 Oct 11 NAV (16 Apr 25) ₹29.5847 ↑ 0.60 (2.08 %) Net Assets (Cr) ₹1,741 on 28 Feb 25 Category Gold - Gold AMC ICICI Prudential Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.4 Sharpe Ratio 1.71 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-15 Months (2%),15 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,050 31 Mar 22 ₹11,473 31 Mar 23 ₹13,247 31 Mar 24 ₹14,669 31 Mar 25 ₹19,133 Returns for ICICI Prudential Regular Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 8.8% 3 Month 18.8% 6 Month 22.8% 1 Year 27.9% 3 Year 19.8% 5 Year 12.1% 10 Year 15 Year Since launch 8.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.5% 2022 13.5% 2021 12.7% 2020 -5.4% 2019 26.6% 2018 22.7% 2017 7.4% 2016 0.8% 2015 8.9% 2014 -5.1% Fund Manager information for ICICI Prudential Regular Gold Savings Fund

Name Since Tenure Manish Banthia 27 Sep 12 12.43 Yr. Nishit Patel 29 Dec 20 4.17 Yr. Data below for ICICI Prudential Regular Gold Savings Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 1.73% Other 98.27% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -100% ₹1,740 Cr 236,566,280

↑ 16,326,224 Treps

CBLO/Reverse Repo | -1% ₹16 Cr Net Current Assets

Net Current Assets | -1% -₹15 Cr

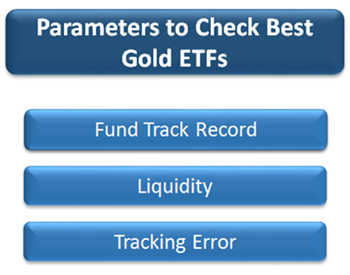

How To Choose Best Gold ETFs?

The parameters to choose the best Gold ETFs in India are as follows-

Fund Track Record

It is important to know the past performance of the fund house in Exchange Traded Funds. Investors looking for the best Gold ETFs, it is advisable to choose a fund which has a track record of at least three years.

Liquidity

Exchange Traded Funds need to be checked based on the trading activity. Most of the ETFs trade heavily based on the changes in the benchmark, but some ETFs trade barely. The trading activity actually confirms the liquidity of an ETF. The higher the trading activity, the higher is the liquidity.

Tracking Error

The ETFs are expected to track the underlying index closely, but some ETF do not track it closely. An investor should prefer an ETF with minimum tracking error.

FAQs

1. How is the value of gold ETFs evaluated?

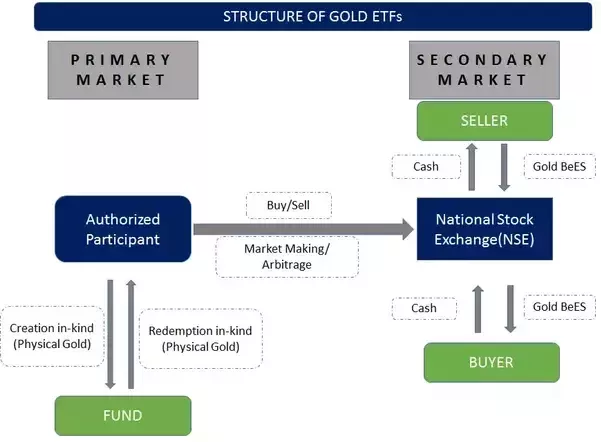

A: The value of gold ETFs is tracked based on the Market value of physical gold. It represent the price of gold bars that have a purity of 99.5%. You can track the price of gold by logging into the NSE website or the BSE, and it will be reflected in the ongoing price of gold ETFs.

2. Who sells gold ETFs?

A: Mutual Fund companies and financial institutes sell gold ETFs. Some of the well-performing gold ETFs are mentioned above.

3. Can I purchase physical gold with the gold ETFs?

A: No, once the investment period is completed, you can close the account and withdraw the money. You cannot en-cash the gold ETFs for physical gold.

4. What do the gold ETFs invest in?

A: Gold ETFs have diversified investments in gold mining, Manufacturing, transportation, and other similar sectors. Usually, the assets are made in industries known to produce good returns, ensuring that the investments are safe and secure.

5. Why should I invest in gold ETFs?

A: Gold ETFs are suitable investments, especially if you are looking to diversify your investment Portfolio. Gold, as experts mention, is one of the safest investments as its value does not go down extensively. The same is applicable for gold ETFs.

6. Is there any exit load in this investment?

A: Given the nature of the investment, most companies do not levy an exit load in gold ETFs. Hence, if you want to withdraw from the investment before its maturity, you do not have to pay any exit load. However, most financial institutes levy a brokerage charge you will have to discuss with your fund manager.

7. Are there any tax benefits on the investments?

A: You would not have to pay any VAT in the case of gold ETFs, which would be the case if you had purchased physical gold of similar value. Moreover, depending on the income tax slab that you fall under, you can enjoy tax benefits from the investment you make. With gold ETFs, you will not have to pay any wealth tax, long-term Capital gains tax, or Sales Tax.

8. Can I use gold ETFs as collateral for loans?

A: Yes, gold ETFs are similar to gold, and hence, you can use them as Collateral for loans. You can it to secure the loan that you require from a Bank or a financial institute.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.