+91-22-48913909

+91-22-48913909

Table of Contents

Gold ETFs in India

Traditionally, Indians have always had an affinity towards gold. Investors looking to invest in gold can do so via ETFs or more specifically Gold ETFs. A Gold ETF (Exchange Traded Fund) is an instrument that is based on gold price or invests in gold bullion. It is traded on major stock exchanges and Gold ETFs track the gold bullion performance. When the gold price moves up, the value of the exchange-traded fund also rises and when the gold price goes down, the ETF loses its value.

Talk to our investment specialist

Gold ETFs

In India, Gold BeES ETF was the first listed exchange traded fund, thereafter other gold ETFs came into existence. There are Mutual Funds that also allow investors to take exposure to exchange-traded funds in gold.

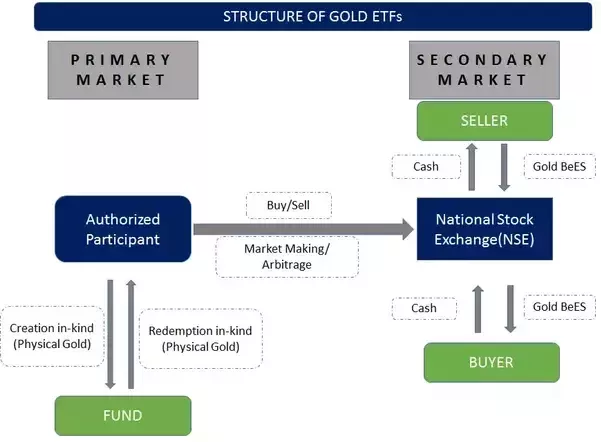

Investors can buy the gold ETFs online and keep it in their Demat account. An investor can purchase and sell gold ETFs on the stock exchange. Gold ETFs are units in lieu of physical gold, which may be in dematerialised form or paper form. One gold ETF unit is equal to one gram of gold and is backed by physical gold of very high purity.

Gold ETFs allow investors to participate in the gold Market at ease and also offer transparency, cost-Efficiency and a secure way to access the gold market. They also provide the benefit of liquidity as it can be traded at any time during the trading period. The first gold ETF in India was launched in 2007, and since then, their popularity amongst Indian investors has grown immensely.

Benefits of Investing in Gold ETFs

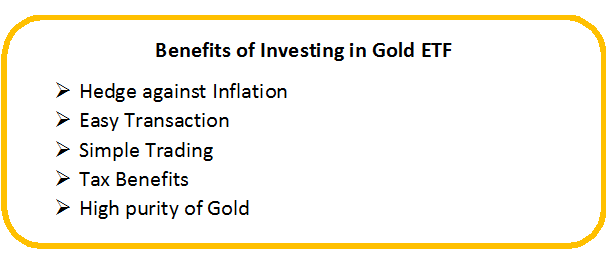

One of the major advantages of the gold ETFs is ‘safety’. As it’s bought and sold electronically, investors can track their movement anytime they want to, by just logging into their broking account. This also gives a high level of transparency.

In gold ETFs, an investor can invest even a small amount of money. With one share equal to one gram of gold, one can make purchases in small quantities. Small investors can buy and accumulate gold by making small investments over a period of time.

Gold ETFs are backed by gold of the highest purity.

Compared to physical gold, the gold ETF has a lower price, as there are no premium or making charges.

Gold ETFs are listed and traded on the stock exchange.

Drawbacks of Investing in Gold ETFs

Some of the disadvantages of Investing in Gold ETFs are:

- There are additional costs involved at the time of buying and selling in the form of brokerage/commission.

- An asset Management Fee is charged by the fund house.

How to Invest in Gold ETFs?

Investing in a gold ETF is fairly easy. All you need to have is a demat account and an online Trading Account. To open an account, you need to have a PAN Card, an Identity Proof and an Address Proof. After the account is ready, one has to choose a gold ETF and place an order. Once the trade is executed a confirmation is sent to the investor. Also, a small fee from the broker and the fund house is charged to the investor when one buys or sells these gold ETFs. You can also invest in Mutual Funds that have an Underlying gold ETF via brokers, distributors or IFAs.

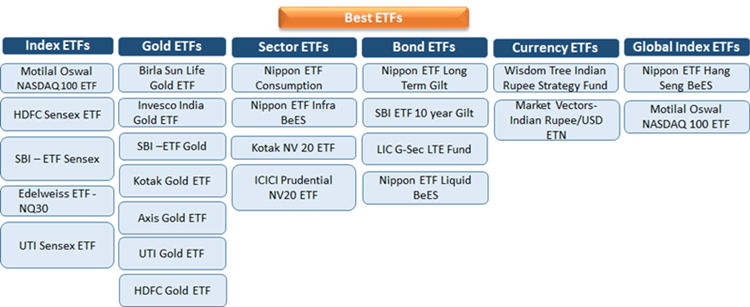

Best Gold ETFs in India

Investing in Gold via ETFs is considered to be one of the best ways to invest in gold. If you are planning to Invest, one should choose the underlying Best Gold ETFs to invest in by carefully looking at the performance of all the gold ETFs and then make a well-thought decision.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Aditya Birla Sun Life Gold Fund Growth ₹28.0046

↑ 0.24 ₹512 19.6 23.6 28.2 19.8 12.8 18.7 Invesco India Gold Fund Growth ₹27.0472

↓ -0.05 ₹127 18.9 22.2 26.2 19.6 13.5 18.8 SBI Gold Fund Growth ₹28.0449

↑ 0.15 ₹3,225 18.6 23.2 28.3 20.2 11.2 19.6 Nippon India Gold Savings Fund Growth ₹36.7536

↑ 0.14 ₹2,623 19.2 23.2 28 19.8 13 19 ICICI Prudential Regular Gold Savings Fund Growth ₹29.6926

↑ 0.11 ₹1,741 18.9 23.1 28.4 19.9 12.6 19.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

How to Invest in Gold Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Indians have traditionally had an affinity towards investing in gold. Households and housewives have always looked at gold as an asset, which accumulates wealth over time. With the advent of gold ETF, it has now become even easier; no premiums, no making charges and best of all no worries on purity make it the preferred route to Buy Gold as an investment!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.