+91-22-48913909

+91-22-48913909

Table of Contents

সেরা আর্থিক মিউচুয়াল ফান্ড 2022

একটি আর্থিকযৌথ পুঁজি সেক্টরের একটি অংশইক্যুইটি ফান্ড. এই তহবিলগুলি 'ব্যাংকিং এবং আর্থিক পরিষেবা তহবিল' নামেও পরিচিত। এই তহবিল উদ্দেশ্য উৎপন্ন হয়আয় দ্বারাবিনিয়োগ কোম্পানির স্টক/শেয়ারে যা ব্যাংকিং সেক্টর এবং আর্থিক শিল্পকে পূরণ করে। সুতরাং, আসুন বিনিয়োগের জন্য সেরা আর্থিক মিউচুয়াল ফান্ডগুলির সাথে আর্থিক তহবিলের ভবিষ্যত সম্ভাব্যতা বুঝতে পারি।

Talk to our investment specialist

ভারতে আর্থিক মিউচুয়াল ফান্ড

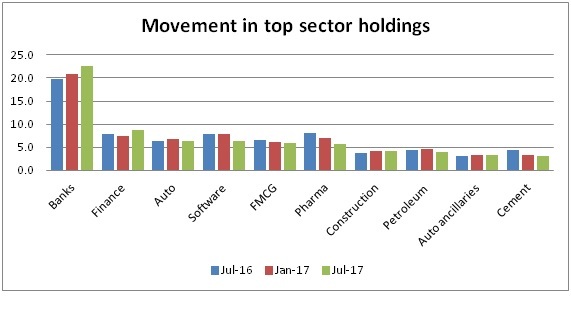

আমরা যদি জুলাই 2017 এর প্রকাশিত তথ্য দেখিসেবি, ব্যাংকিং এবংসেক্টর তহবিল সবচেয়ে পছন্দের বেশী ছিল. তথ্য তা দেখায়ব্যাংক এবং ফাইন্যান্স- দুটি নেতৃস্থানীয় সেক্টর শেয়ার AUM একটি ধারালো ঢেউ দেখিয়েছে.

জুলাই 17 সালের পরিসংখ্যান অনুযায়ী, ব্যাংকিং সেক্টরের AUM, যা শীর্ষস্থানীয় খাত, মাত্র ছয় মাসে 20.9 শতাংশ থেকে 22.6 শতাংশে চলে গেছে।

অনলাইনে ফাইন্যান্সিয়াল মিউচুয়াল ফান্ডে কীভাবে বিনিয়োগ করবেন?

Fincash.com এ আজীবনের জন্য বিনামূল্যে বিনিয়োগ অ্যাকাউন্ট খুলুন।

আপনার রেজিস্ট্রেশন এবং KYC প্রক্রিয়া সম্পূর্ণ করুন

নথি আপলোড করুন (প্যান, আধার, ইত্যাদি)।এবং, আপনি বিনিয়োগ করতে প্রস্তুত!

সেরা পারফর্মিং সেরা আর্থিক মিউচুয়াল ফান্ড FY 22 - 23৷

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Banking and Financial Services Fund Growth ₹129.8

↓ -0.36 ₹9,008 12 5.9 18.9 16.9 24.9 11.6 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹59.75

↓ -0.02 ₹3,248 14.3 6.5 15.5 17.4 25.8 8.7 Invesco India Financial Services Fund Growth ₹131.97

↓ -0.05 ₹1,208 10.3 4.6 18.7 20.7 25.3 19.8 UTI Banking and Financial Services Fund Growth ₹186.607

↓ -0.50 ₹1,211 15.6 8.2 19.3 18.8 24.8 11.1 Sundaram Financial Services Opportunities Fund Growth ₹103.612

↓ -0.25 ₹1,415 14.1 7.3 15.8 21.9 26.4 7.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

যখন আমরা ভারতের ব্যাঙ্কিং এবং ফিনান্স সেক্টরের কথা বলি, তখন আমাদের অনেক বড় খেলোয়াড় আছেআইসিআইসিআই ব্যাঙ্ক লিমিটেড, এইচডিএফসি ব্যাঙ্ক লিমিটেড, স্টেট ব্যাঙ্ক অফ ইন্ডিয়া, ইয়েস ব্যাঙ্ক লিমিটেড, অ্যাক্সিস ব্যাঙ্ক লিমিটেড ইত্যাদি। ভারতীয় ব্যাঙ্কিং ব্যবস্থায় 26টি বেসরকারি ব্যাঙ্ক, 27টি সরকারি ব্যাঙ্ক, 1,574টি শহুরে সমবায় ব্যাঙ্ক, 56টি আঞ্চলিক গ্রামীণ ব্যাঙ্ক, 46টি বিদেশী ব্যাঙ্ক রয়েছে। এবং সমবায় ঋণ প্রতিষ্ঠান ছাড়াও 93,913টি গ্রামীণ সমবায় ব্যাংক।

ব্যাংকিং এবং আর্থিক শিল্পের মধ্যে কাজ করে এমন কোম্পানিগুলি অত্যন্ত নিয়ন্ত্রিত। অনেক ভাল কোম্পানি বছরের পর বছর ধরে ধারাবাহিক কর্মক্ষমতা এবং রিটার্ন প্রদানের লক্ষ্য রাখে, ফলস্বরূপ, এটি বিনিয়োগকারীদের জন্য আস্থা আনে যারা সেক্টর ফান্ডে বিনিয়োগ করার পরিকল্পনা করছেন। যাইহোক, এই ধরনের তহবিলের ঝুঁকির কারণগুলিকে সর্বদা মনে রাখা উচিত। এই তহবিলগুলি, কখনও কখনও, দুটি চরমে হতে পারে, তারা ভাল রিটার্ন প্রদান করতে পারে এবং কখনও কখনও খারাপভাবেও পারফর্ম করতে পারে। অতএব, এটা যুক্তিযুক্ত যে বিনিয়োগকারীরা যারা এই ধরনের সেক্টর ফান্ডে বিনিয়োগ করার পরিকল্পনা করছেন তাদের উচ্চ-ঝুকিপুন্ন ক্ষুধা এবং দীর্ঘ সময়ের জন্য বিনিয়োগ করা উচিত। আদর্শভাবে, বৈচিত্র্যের উদ্দেশ্যে এই ধরনের তহবিলে বিনিয়োগ করা উচিত।

ICICI Prudential Banking and Financial Services Fund is an Open-ended equity scheme that seeks to generate long-term capital appreciation to unitholders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. However, there can be no assurance that the investment objective of the Scheme will be realized. ICICI Prudential Banking and Financial Services Fund is a Equity - Sectoral fund was launched on 22 Aug 08. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Banking and Financial Services Fund Returns up to 1 year are on The primary investment objective of the Scheme is to generate long-term capital appreciation to unit holders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. Aditya Birla Sun Life Banking And Financial Services Fund is a Equity - Sectoral fund was launched on 14 Dec 13. It is a fund with High risk and has given a Below is the key information for Aditya Birla Sun Life Banking And Financial Services Fund Returns up to 1 year are on (Erstwhile Invesco India Banking Fund) The investment objective of the Scheme is to generate long-term capital growth from a portfolio of equity and equity-related securities of companies engaged in the business of banking and financial services. Invesco India Financial Services Fund is a Equity - Sectoral fund was launched on 14 Jul 08. It is a fund with High risk and has given a Below is the key information for Invesco India Financial Services Fund Returns up to 1 year are on (Erstwhile UTI Banking Sector Fund) Investment objective is "capital appreciation" through investments in the stocks of the companies/institutions engaged in the banking and financial services activities. UTI Banking and Financial Services Fund is a Equity - Sectoral fund was launched on 7 Apr 04. It is a fund with High risk and has given a Below is the key information for UTI Banking and Financial Services Fund Returns up to 1 year are on Seek capital appreciation by investing predominantly in equity and equity related securities of indian companies engaged in banking and financial Services. Sundaram Financial Services Opportunities Fund is a Equity - Sectoral fund was launched on 10 Jun 08. It is a fund with High risk and has given a Below is the key information for Sundaram Financial Services Opportunities Fund Returns up to 1 year are on 1. ICICI Prudential Banking and Financial Services Fund

CAGR/Annualized return of 16.6% since its launch. Return for 2024 was 11.6% , 2023 was 17.9% and 2022 was 11.9% . ICICI Prudential Banking and Financial Services Fund

Growth Launch Date 22 Aug 08 NAV (23 Apr 25) ₹129.8 ↓ -0.36 (-0.28 %) Net Assets (Cr) ₹9,008 on 31 Mar 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 1.98 Sharpe Ratio 0.59 Information Ratio 0.07 Alpha Ratio -4.45 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,701 31 Mar 22 ₹19,901 31 Mar 23 ₹21,205 31 Mar 24 ₹26,444 31 Mar 25 ₹30,205 Returns for ICICI Prudential Banking and Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 7.6% 3 Month 12% 6 Month 5.9% 1 Year 18.9% 3 Year 16.9% 5 Year 24.9% 10 Year 15 Year Since launch 16.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.6% 2023 17.9% 2022 11.9% 2021 23.5% 2020 -5.5% 2019 14.5% 2018 -0.4% 2017 45.1% 2016 21.1% 2015 -7.2% Fund Manager information for ICICI Prudential Banking and Financial Services Fund

Name Since Tenure Roshan Chutkey 29 Jan 18 7.09 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Banking and Financial Services Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 92.1% Industrials 0.18% Technology 0.07% Asset Allocation

Asset Class Value Cash 7.65% Equity 92.35% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK21% ₹1,887 Cr 10,891,127 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | ICICIBANK18% ₹1,619 Cr 13,445,003 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 19 | 5322158% ₹730 Cr 7,188,596

↑ 173,125 State Bank of India (Financial Services)

Equity, Since 31 Oct 08 | SBIN6% ₹568 Cr 8,244,914

↑ 1,706,850 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 17 | SBILIFE5% ₹477 Cr 3,332,802

↑ 255,647 IndusInd Bank Ltd (Financial Services)

Equity, Since 30 Apr 24 | INDUSINDBK5% ₹433 Cr 4,371,007 HDFC Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 23 | HDFCLIFE4% ₹330 Cr 5,423,546

↑ 984,400 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 23 | KOTAKBANK3% ₹284 Cr 1,491,184

↓ -480,000 ICICI Lombard General Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIGI3% ₹236 Cr 1,396,761

↑ 311,863 Max Financial Services Ltd (Financial Services)

Equity, Since 31 Aug 19 | 5002712% ₹169 Cr 1,697,397

↑ 34,116 2. Aditya Birla Sun Life Banking And Financial Services Fund

CAGR/Annualized return of 17.1% since its launch. Ranked 3 in Sectoral category. Return for 2024 was 8.7% , 2023 was 21.7% and 2022 was 11.5% . Aditya Birla Sun Life Banking And Financial Services Fund

Growth Launch Date 14 Dec 13 NAV (23 Apr 25) ₹59.75 ↓ -0.02 (-0.03 %) Net Assets (Cr) ₹3,248 on 31 Mar 25 Category Equity - Sectoral AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.99 Sharpe Ratio 0.33 Information Ratio 0.03 Alpha Ratio -9.7 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,760 31 Mar 22 ₹19,860 31 Mar 23 ₹20,711 31 Mar 24 ₹27,001 31 Mar 25 ₹30,038 Returns for Aditya Birla Sun Life Banking And Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 8.5% 3 Month 14.3% 6 Month 6.5% 1 Year 15.5% 3 Year 17.4% 5 Year 25.8% 10 Year 15 Year Since launch 17.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.7% 2023 21.7% 2022 11.5% 2021 16.8% 2020 1.1% 2019 14.9% 2018 -2.4% 2017 47.6% 2016 15.7% 2015 -0.5% Fund Manager information for Aditya Birla Sun Life Banking And Financial Services Fund

Name Since Tenure Dhaval Gala 26 Aug 15 9.52 Yr. Dhaval Joshi 21 Nov 22 2.28 Yr. Data below for Aditya Birla Sun Life Banking And Financial Services Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 97.02% Technology 1.09% Asset Allocation

Asset Class Value Cash 1.89% Equity 98.11% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | ICICIBANK20% ₹601 Cr 4,993,129 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | HDFCBANK19% ₹578 Cr 3,336,948 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Sep 16 | 5000347% ₹199 Cr 233,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | 5322157% ₹196 Cr 1,927,100 State Bank of India (Financial Services)

Equity, Since 31 Oct 17 | SBIN5% ₹162 Cr 2,351,492 Cholamandalam Financial Holdings Ltd (Financial Services)

Equity, Since 31 Jan 20 | CHOLAHLDNG4% ₹110 Cr 667,972 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN3% ₹97 Cr 1,577,700 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 19 | KOTAKBANK3% ₹89 Cr 469,972 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 30 Nov 23 | 5406112% ₹74 Cr 1,308,861 Repco Home Finance Ltd (Financial Services)

Equity, Since 31 Dec 13 | 5353222% ₹58 Cr 1,751,838

↓ -180,986 3. Invesco India Financial Services Fund

CAGR/Annualized return of 16.6% since its launch. Ranked 5 in Sectoral category. Return for 2024 was 19.8% , 2023 was 26% and 2022 was 12.8% . Invesco India Financial Services Fund

Growth Launch Date 14 Jul 08 NAV (23 Apr 25) ₹131.97 ↓ -0.05 (-0.04 %) Net Assets (Cr) ₹1,208 on 31 Mar 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆☆ Risk High Expense Ratio 2.39 Sharpe Ratio 0.48 Information Ratio 0.48 Alpha Ratio -5.98 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,232 31 Mar 22 ₹18,053 31 Mar 23 ₹19,068 31 Mar 24 ₹26,174 31 Mar 25 ₹29,776 Returns for Invesco India Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 7.9% 3 Month 10.3% 6 Month 4.6% 1 Year 18.7% 3 Year 20.7% 5 Year 25.3% 10 Year 15 Year Since launch 16.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 19.8% 2023 26% 2022 12.8% 2021 14% 2020 2.4% 2019 21.2% 2018 -0.3% 2017 45.2% 2016 10.4% 2015 -2.1% Fund Manager information for Invesco India Financial Services Fund

Name Since Tenure Dhimant Kothari 1 Jun 18 6.75 Yr. Hiten Jain 19 May 20 4.79 Yr. Data below for Invesco India Financial Services Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 94.38% Health Care 1.22% Technology 0.93% Asset Allocation

Asset Class Value Cash 3.47% Equity 96.53% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK21% ₹232 Cr 1,927,995 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK20% ₹217 Cr 1,251,578

↑ 131,127 Axis Bank Ltd (Financial Services)

Equity, Since 31 May 18 | 5322156% ₹66 Cr 645,964 State Bank of India (Financial Services)

Equity, Since 31 Aug 20 | SBIN5% ₹58 Cr 838,841 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Jul 17 | CHOLAFIN3% ₹35 Cr 248,287

↑ 21,739 Shriram Finance Ltd (Financial Services)

Equity, Since 28 Feb 25 | SHRIRAMFIN3% ₹32 Cr 518,214

↑ 518,214 PB Fintech Ltd (Financial Services)

Equity, Since 30 Nov 21 | 5433903% ₹30 Cr 202,712 HDFC Asset Management Co Ltd (Financial Services)

Equity, Since 31 Jul 24 | HDFCAMC3% ₹29 Cr 78,652

↓ -30,996 Muthoot Finance Ltd (Financial Services)

Equity, Since 31 Jul 24 | 5333983% ₹28 Cr 129,828

↑ 14,519 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 30 Sep 22 | 5900032% ₹27 Cr 1,332,287 4. UTI Banking and Financial Services Fund

CAGR/Annualized return of 14.9% since its launch. Ranked 20 in Sectoral category. Return for 2024 was 11.1% , 2023 was 19.5% and 2022 was 15.1% . UTI Banking and Financial Services Fund

Growth Launch Date 7 Apr 04 NAV (23 Apr 25) ₹186.607 ↓ -0.50 (-0.27 %) Net Assets (Cr) ₹1,211 on 31 Mar 25 Category Equity - Sectoral AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk High Expense Ratio 2.28 Sharpe Ratio 0.55 Information Ratio 0.29 Alpha Ratio -6.11 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,413 31 Mar 22 ₹18,931 31 Mar 23 ₹20,398 31 Mar 24 ₹25,837 31 Mar 25 ₹29,643 Returns for UTI Banking and Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 7.9% 3 Month 15.6% 6 Month 8.2% 1 Year 19.3% 3 Year 18.8% 5 Year 24.8% 10 Year 15 Year Since launch 14.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.1% 2023 19.5% 2022 15.1% 2021 14.3% 2020 -5.3% 2019 11.6% 2018 -6.8% 2017 43.5% 2016 13% 2015 -11.3% Fund Manager information for UTI Banking and Financial Services Fund

Name Since Tenure Preethi S 2 May 22 2.83 Yr. Data below for UTI Banking and Financial Services Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 95.39% Technology 0.08% Asset Allocation

Asset Class Value Cash 4.54% Equity 95.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 04 | ICICIBANK18% ₹202 Cr 1,675,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 09 | HDFCBANK16% ₹174 Cr 1,005,927 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 18 | 5322156% ₹68 Cr 670,000 Shriram Finance Ltd (Financial Services)

Equity, Since 31 Jan 24 | SHRIRAMFIN5% ₹61 Cr 983,680 India Shelter Finance Corporation Ltd (Financial Services)

Equity, Since 31 Dec 23 | INDIASHLTR5% ₹52 Cr 714,617 State Bank of India (Financial Services)

Equity, Since 28 Feb 18 | SBIN5% ₹52 Cr 750,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Nov 19 | 5000344% ₹49 Cr 57,257

↑ 15,000 HDFC Life Insurance Co Ltd (Financial Services)

Equity, Since 31 Jul 24 | HDFCLIFE4% ₹42 Cr 697,890 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Dec 18 | 5900033% ₹38 Cr 1,876,541 Max Financial Services Ltd (Financial Services)

Equity, Since 30 Sep 22 | 5002713% ₹31 Cr 314,018 5. Sundaram Financial Services Opportunities Fund

CAGR/Annualized return of 14.9% since its launch. Ranked 23 in Sectoral category. Return for 2024 was 7.1% , 2023 was 31.1% and 2022 was 16.8% . Sundaram Financial Services Opportunities Fund

Growth Launch Date 10 Jun 08 NAV (23 Apr 25) ₹103.612 ↓ -0.25 (-0.24 %) Net Assets (Cr) ₹1,415 on 31 Mar 25 Category Equity - Sectoral AMC Sundaram Asset Management Company Ltd Rating ☆☆☆ Risk High Expense Ratio 2.24 Sharpe Ratio 0.15 Information Ratio 0.62 Alpha Ratio -10.88 Min Investment 100,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,095 31 Mar 22 ₹18,755 31 Mar 23 ₹20,630 31 Mar 24 ₹28,468 31 Mar 25 ₹30,814 Returns for Sundaram Financial Services Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 10.3% 3 Month 14.1% 6 Month 7.3% 1 Year 15.8% 3 Year 21.9% 5 Year 26.4% 10 Year 15 Year Since launch 14.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.1% 2023 31.1% 2022 16.8% 2021 15.3% 2020 2.7% 2019 26.4% 2018 -3.7% 2017 33.3% 2016 12.8% 2015 -9% Fund Manager information for Sundaram Financial Services Opportunities Fund

Name Since Tenure Rohit Seksaria 30 Dec 17 7.17 Yr. Ashish Aggarwal 1 Jan 22 3.16 Yr. Data below for Sundaram Financial Services Opportunities Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 94.17% Asset Allocation

Asset Class Value Cash 3.84% Equity 95.06% Debt 1.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 08 | HDFCBANK18% ₹241 Cr 1,390,056

↑ 7,660 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 10 | ICICIBANK12% ₹161 Cr 1,339,673

↑ 10,584 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 10 | 53221510% ₹128 Cr 1,259,449 State Bank of India (Financial Services)

Equity, Since 31 Dec 08 | SBIN5% ₹65 Cr 949,469

↑ 64,175 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Sep 23 | SHRIRAMFIN5% ₹64 Cr 1,036,445 IndusInd Bank Ltd (Financial Services)

Equity, Since 30 Jun 20 | INDUSINDBK4% ₹60 Cr 601,270 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jul 18 | 5000344% ₹58 Cr 68,102

↓ -5,238 Ujjivan Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 May 24 | UJJIVANSFB4% ₹49 Cr 15,383,384

↑ 412,458 CSB Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Jun 20 | CSBBANK4% ₹48 Cr 1,697,765

↑ 3,396 PNB Housing Finance Ltd (Financial Services)

Equity, Since 31 Jul 24 | PNBHOUSING4% ₹47 Cr 616,144

↑ 39,470

এখানে প্রদত্ত তথ্য সঠিক কিনা তা নিশ্চিত করার জন্য সমস্ত প্রচেষ্টা করা হয়েছে। যাইহোক, তথ্যের সঠিকতা সম্পর্কে কোন গ্যারান্টি দেওয়া হয় না। কোনো বিনিয়োগ করার আগে স্কিমের তথ্য নথির সাথে যাচাই করুন।