Table of Contents

- Understanding Retirement Calculator

- Retirement Calculator: Evaluation Process

- Top Funds for 2025

Top 2 Equity - Sectoral Funds

Retirement Calculator: Evaluate and Invest

retirement calculator is a tool for those who are eager to know about the corpus required post retirement to maintain a certain standard of living. Retirement calculator is considered as an essential element when Planning for retirement. It helps you to identify the estimated amount that you need to save for your retirement based on your current financial situations. Therefore, we take you through a very simple retirement calculator that will help you to evaluate the corpus needed when you retire.

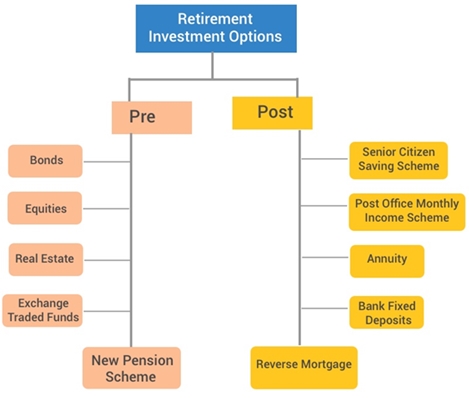

Understanding Retirement Calculator

While using a retirement calculator, you would need to enter certain variables, such as-

- Your current age

- Your current monthly expenses

- Expected Inflation rate (annual) for the years to come

- Long-term growth rate on investments

All these variables when fed into the calculator would end up giving the amount that you need to invest monthly for your retirement to maintain the standard of living. (i.e. your current monthly living expenses adjusted for inflation).

Retirement Calculator: Evaluation Process

1. Calculating your Current Monthly Expenses

The first thing that you need to do here is, calculate your monthly expenses like household expenses, utility expenses, transportation cost, and other lifestyle expenses. Other than this, you should have a rough idea about the minimum amount that you require monthly for miscellaneous expenses. The basic assumption here is that these expenses adjusted for inflation should suffice in the future to lead a comfortable post retired life.

*To illustrate- *

- Household expenses – INR 10,000

- Transportation expenses- INR 2,000

- Utility expenses-** INR 3,000**

- Other lifestyle expenses (movies, dining, etc.) - INR 3,000

- Miscellaneous expense- INR 2000

Total Monthly Expenses- INR 20,000

Know Your Monthly SIP Amount

2. Understand Inflation Rate for Coming Years

This is the average annual inflation rate that you expect in coming years till you retire. According to various Market sources, the average inflation can be taken to be around 4-5% p.a. in the coming years. However, one can enter their own assumption also.

3. Long Term Growth Rate of Investments

This is long-term growth rate that you expect on your investments. Though the long-term return from the equity market has been 8-15% historically, according to market sources, going forward one can expect around 8-15% p.a. in the long run. If you have sound knowledge about the markets, you can enter your own assumptions on the growth rate.

Talk to our investment specialist

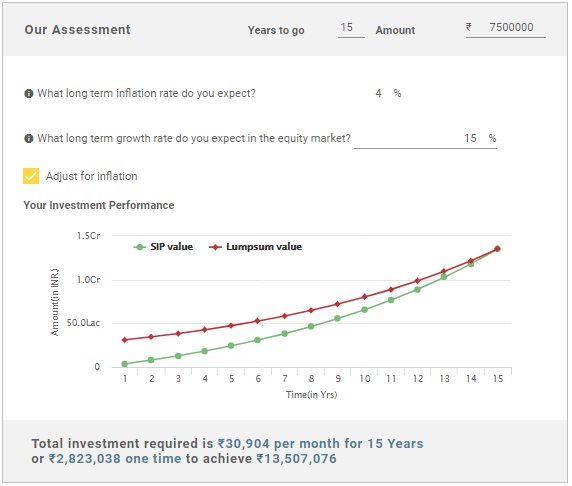

4. Investment Evaluation

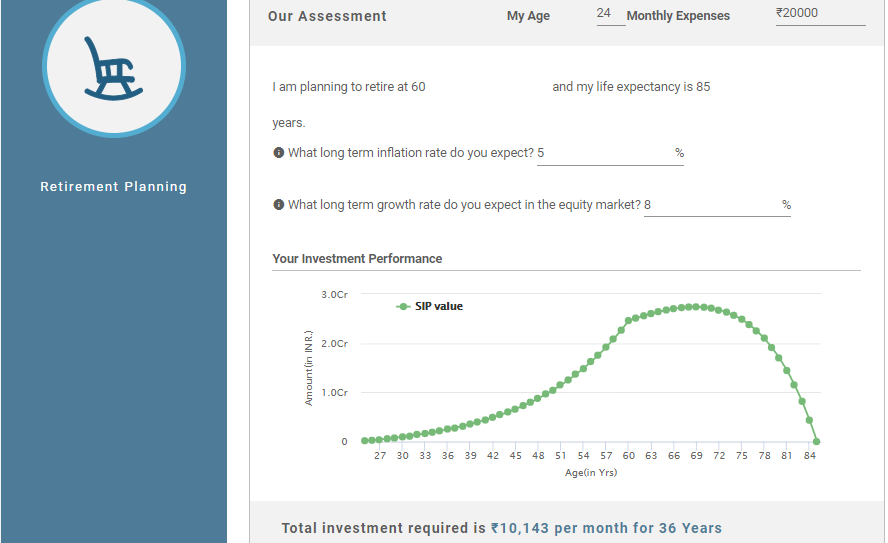

Now comes the interesting part where you get the desired amount that you need to invest monthly. Taking the above variables into consideration, you will get the desired corpus that you need to save monthly till you get retired. Here the estimated age for retirement is considered as 60 years (refer to the image below).

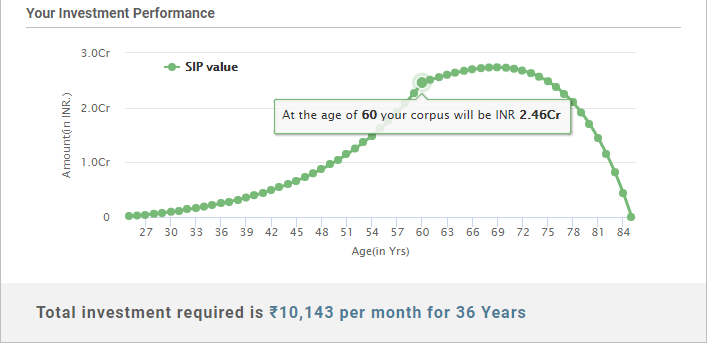

5. Total Corpus

By this, we mean how much corpus will be accumulated when you invest for 36 years, meaning if you start Investing at the age of 24 till 60 years of age. To reach the desired corpus, you need to make a monthly investment. According to the aforementioned figures, the total investment required every month is INR 10,143 for 36 years. As indicated, the estimated total corpus will depend on your current age, current monthly expenses, inflation and the growth rate on investment expected over the years.

Conclusion- People who are planning for their retirement can use this calculator, through which you can easily estimate your retirement corpus. It will help you calculate approximately the amount needed for retirement and hence, you can plan your investment accordingly!

Top Funds for 2025

*Best funds based on 5 year performance.

The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. HDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 10 Mar 08. It is a fund with High risk and has given a Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on 1. IDFC Infrastructure Fund

CAGR/Annualized return of 11.8% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (23 Apr 25) ₹48.045 ↑ 0.19 (0.41 %) Net Assets (Cr) ₹1,563 on 31 Mar 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio 0.11 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,153 31 Mar 22 ₹24,848 31 Mar 23 ₹27,324 31 Mar 24 ₹47,064 31 Mar 25 ₹50,038 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 4.9% 3 Month 0.9% 6 Month -6.6% 1 Year 5.3% 3 Year 25.9% 5 Year 36.1% 10 Year 15 Year Since launch 11.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.3% 2023 50.3% 2022 1.7% 2021 64.8% 2020 6.3% 2019 -5.3% 2018 -25.9% 2017 58.7% 2016 10.7% 2015 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.1 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Infrastructure Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 54.7% Utility 13.22% Basic Materials 10.84% Communication Services 4.49% Energy 3.88% Consumer Cyclical 3.46% Financial Services 2.99% Technology 2.07% Health Care 1.9% Asset Allocation

Asset Class Value Cash 2.43% Equity 97.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹71 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹58 Cr 183,173

↑ 11,726 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE4% ₹54 Cr 452,706 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL4% ₹52 Cr 330,018

↑ 40,855 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325384% ₹51 Cr 50,452

↑ 3,476 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA3% ₹45 Cr 4,797,143 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹39 Cr 365,137

↓ -69,842 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹39 Cr 12,400,122 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹35 Cr 1,431,700 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹35 Cr 512,915 2. HDFC Infrastructure Fund

CAGR/Annualized return of since its launch. Ranked 26 in Sectoral category. Return for 2024 was 23% , 2023 was 55.4% and 2022 was 19.3% . HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (23 Apr 25) ₹45.192 ↑ 0.06 (0.13 %) Net Assets (Cr) ₹2,329 on 31 Mar 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.31 Sharpe Ratio -0.01 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,356 31 Mar 22 ₹21,727 31 Mar 23 ₹25,279 31 Mar 24 ₹45,346 31 Mar 25 ₹47,548 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 5% 3 Month 3% 6 Month -4.2% 1 Year 4.3% 3 Year 28.5% 5 Year 35.2% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 23% 2023 55.4% 2022 19.3% 2021 43.2% 2020 -7.5% 2019 -3.4% 2018 -29% 2017 43.3% 2016 -1.9% 2015 -2.5% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Srinivasan Ramamurthy 12 Jan 24 1.13 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Infrastructure Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 38.42% Financial Services 20.62% Basic Materials 10.93% Utility 7.4% Energy 6.96% Communication Services 3.76% Health Care 1.73% Technology 0.98% Real Estate 0.94% Consumer Cyclical 0.58% Asset Allocation

Asset Class Value Cash 6.48% Equity 92.31% Debt 1.21% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹157 Cr 1,300,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK6% ₹121 Cr 700,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT6% ₹120 Cr 380,000

↑ 30,000 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL5% ₹98 Cr 1,450,000

↓ -50,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹69 Cr 2,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹67 Cr 150,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL3% ₹67 Cr 758,285 Coal India Ltd (Energy)

Equity, Since 31 Oct 18 | COALINDIA3% ₹63 Cr 1,700,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹60 Cr 500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹55 Cr 350,000

↓ -50,000

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.