+91-22-48913909

+91-22-48913909

Fincash » Retirement Planning » Retirement Investment Options

Table of Contents

Retirement Investment Options

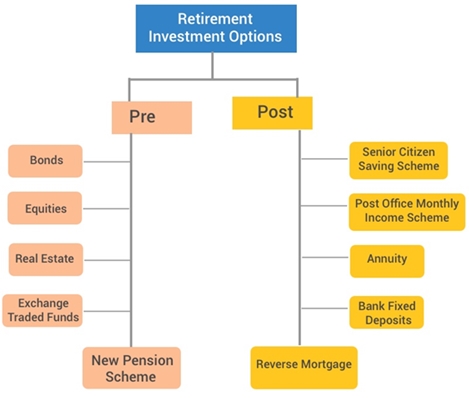

The most important part of Retirement planning is ‘Investing’. Investing for retirement has to be very effective. There are several investment avenues that you can opt for retirement planning. Let us have a look at some of the most preferred pre- retirement investment options and the post- retirement investment options.

Talk to our investment specialist

Pre-Retirement Investment Options

1. New Pension Scheme (NPS)

New Pension Scheme is gaining popularity in India as one of the best retirement investment options. NPS is open to all but, is mandatory for all government employees. An investor can deposit a minimum of INR 500 per month or INR 6000 yearly, making it as the most convenient for Indian citizens. Investors can consider NPS as a good idea for their retirement planning because there is no direct tax exemption during the time of withdrawal as the amount is tax-free as per Tax Act, 1961. This scheme is a risk-free investment as it's backed by the Government of India.

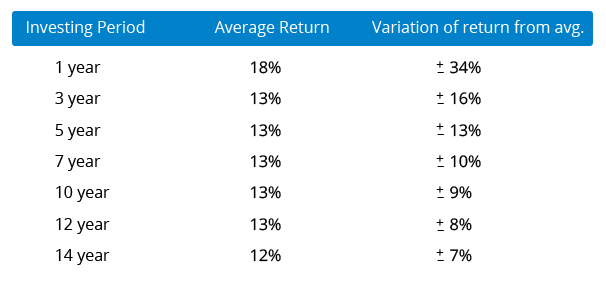

2. Equity Funds

An equity fund is a type of Mutual Fund that invests mainly in stocks. Equity represents ownership in firms (publicly or privately traded) and the aim of the stock ownership is to participate in the growth of the business over a period of time. The wealth you invest in Equity Funds is regulated by SEBI and they frame policies & norms to ensure that the investor’s money is safe. As equities are ideal for long-term investments, it is one of the best retirement investment options. Some of the Best Equity Mutual Funds to invest are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Principal Emerging Bluechip Fund Growth ₹183.316

↑ 2.03 ₹3,124 2.9 13.6 38.9 21.9 19.2 ICICI Prudential Banking and Financial Services Fund Growth ₹128.07

↑ 2.49 ₹8,843 9.5 4.1 18.3 15 23.5 11.6 Invesco India Growth Opportunities Fund Growth ₹89.58

↑ 0.87 ₹5,930 -1.1 -6.7 17.5 20.3 25.3 37.5 Motilal Oswal Multicap 35 Fund Growth ₹56.3349

↑ 0.62 ₹11,172 -3.7 -9.9 15.6 19.6 21.8 45.7 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹58.51

↑ 1.20 ₹3,011 10.9 3.3 15 15.3 24 8.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21

3. Real Estate

It's the most preferred retirement investment options amongst investors. It is an investment made in the Real Estate, i.e. house/shop/site, etc. It's considered to give good stable returns. To make an investment in real estate, one should consider good location as the key point.

4. Bonds

Bonds are one of the most popular retirement investment options. A bond is a debt security where the buyer/holder initially pays the principal amount for buying the bond from the issuer. The issuer of the bond then pays the holder an interest at regular intervals and also pays the principal amount at the maturity date. Some of the bonds provide good 10-20% p.a.-rate of interest. Also, there is no tax applicable on bonds at the time of investment. Some of the Best Bond Funds to invest are (as per category rank):

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Corporate Bond Fund Growth ₹111.856

↑ 0.13 ₹25,293 3.3 4.8 9.9 7.6 8.5 7.48% 3Y 9M 14D 5Y 8M 19D HDFC Corporate Bond Fund Growth ₹32.2227

↑ 0.04 ₹32,191 3.2 4.7 9.7 7.5 8.6 4.03% 3Y 9M 19D 5Y 11M 12D ICICI Prudential Corporate Bond Fund Growth ₹29.4756

↑ 0.03 ₹29,290 3 4.7 9.2 7.7 8 7.63% 2Y 7M 28D 4Y 8M 8D Kotak Corporate Bond Fund Standard Growth ₹3,731.28

↑ 4.52 ₹14,449 3.2 4.7 9.7 7.3 8.3 7.41% 2Y 9M 29D 4Y 2M 8D Sundaram Corporate Bond Fund Growth ₹39.7244

↑ 0.05 ₹705 3.2 4.6 9.5 6.9 8 7.37% 3Y 9M 25D 5Y 10M 5D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

5. Exchange Traded Funds (ETFs)

Exchange traded funds are considered to be one of the popular securities amongst investors. An Exchange Traded Fund (ETF) is a type of investment that is bought and sold on stock exchanges. It holds assets like commodities, bonds, or stocks. An exchange traded fund is like a mutual fund, but unlike a Mutual Fund, ETFs can be sold at any time during the trading period. Moreover, ETFs helps you to build a diverse Portfolio.

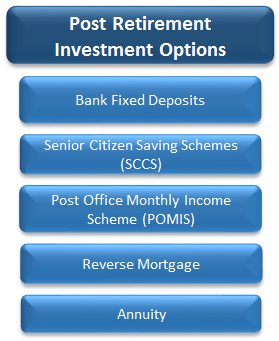

Post Retirement Investment Options

1. Senior Citizen Saving Schemes (SCSS)

As part of the post- retirement investment options, an SCSS is designed for retired people who are above 60 years old. SCSS is available through certified banks as well as the network post offices spread across India. This scheme (or SCSS account) is up to five years, but, upon the maturity, it can be subsequently extended for an additional three years. With this investment, tax exemption is eligible under Section 80C.

2. Post Office Monthly Income Scheme (POMIS)

As the name denotes, this is the monthly Income scheme from the Post Office of India. If an investor is looking at a guaranteed regular monthly income, then it's good-to-go with it. The minimum investment for POMIS is Rs 1,000 and the maximum investment goes up to 4.5 lakh for a single account and for a joint account the investment options limit is up to nine lakh. The tenure for POMIS is five years.

3. Annuity

An annuity is an agreement aimed at generating steady income during retirement. Where a lump sum payment is made by an investor to obtain a certain amount instantly or in future. The minimum age entry for any investor in this scheme is 40 years and the maximum is up to 100 years.

4. Reverse Mortgage

As a part of the post- retirement investment options, a reverse mortgage is a good option for senior citizens who need a steady flow of income. In a reverse mortgage, stable money is generated from the lender in lieu of the mortgage on their homes. Any house owner who is 60 years of age (and above) is eligible for this. Retired people can live in their property and receive regular payments, until the death. The money receivable from the Bank will depend on the valuation of property, its current price and well as the condition of the property.

5. Bank Fixed Deposits

Most people consider the Fixed Deposit investment as a part of their retirement investment options because it enables money to be deposited with banks for a fixed maturity period, ranging from 15 days to five years (& above) and it allows to earn a higher rate of interest than other conventional Savings Account. During the time of maturity, the investor receives a return which is equal to the principal and also the interest earned over the duration of the fixed deposit

With this diverse retirement investment options, one would definitely find instruments matching their goals and objectives. Make sure you choose right investment options by knowing in-depth details about it.

As Dwight L. Moody rightly says— “Preparation for old age should begin not later than one's teens. A life which is empty of purpose until 65 will not suddenly become filled on retirement.”

So, for a healthy, wealthy and peaceful retired life, start investing now!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.