Planning for Retirement: Smart Tips to Follow

Planning for retirement is the process to help you achieve your Financial goals, both during your working years and retired life. But, most people start their Retirement planning at their later stage of life i.e. around 40's. Well, it is important to understand that the earlier you start planning for your life post-retirement and start accumulating wealth, the sooner you will be able to live a worry-free life. Hence, here are the golden steps that one can follow to start planning for retirement.

Talk to our investment specialist

Benefits of Retirement Planning

Retirement planning helps you to provide financial security to your dependents (family members). This is done by making prudent investments during your working years. It helps you to maintain your desired lifestyle after you retire. Furthermore, it enables you to make the best use of your hard-earned money post-retirement. One of the key benefits of effective retirement planning is to cover for any emergencies arising from the uncertain events during the time to retirement or post-retirement.

Tips to Follow While Planning for Retirement

1. Retirement Savings- Save 10% of your Income

This is the first rule you need to religiously follow when planning for retirement. To initiate a retirement plan, working people can sign-up for the Employees’ Provident Fund (EPF). It is a retirement scheme wherein your employer deposits a certain amount monthly in an EPF account and this is deducted from your pay cheque. Those employees who are not covered by the EPF umbrella can opt for Mutual Funds. You can start exploring investment schemes under Mutual Funds, choosing the ones that suit your age profile and risk appetite.

2. Estimate Retirement Corpus by using Retirement Calculator

Retirement calculator is one of the ideal ways to estimate how much money one would need to save for their retired life. While using this calculator you would need to fill variables like current age, planned retirement age, regular expenses, Inflation rate and the expected long-term growth rate on investments (or equity markets etc). The sum of all these variable will help you to calculate the amount that you would need to save monthly. This amount will give you the money needed post-retirement given certain assumptions.

An illustration of retirement calculator is given below-

According to this, you can estimate your monthly investments and make a retirement plan accordingly.

3. Diversify Investment Plan

Having a diversified Portfolio reduces the rate of risk significantly. The portfolio typically should contain assets across classes, namely –fixed Income instruments, stocks, cash assets and commodities (gold). It is advisable to make a long-term Investment plan at an early age, with a mix of low-risk assets like cash, deposit schemes, etc., along with high-risk assets like equity.

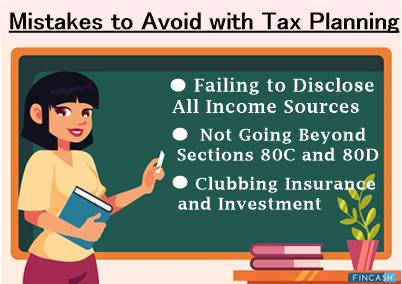

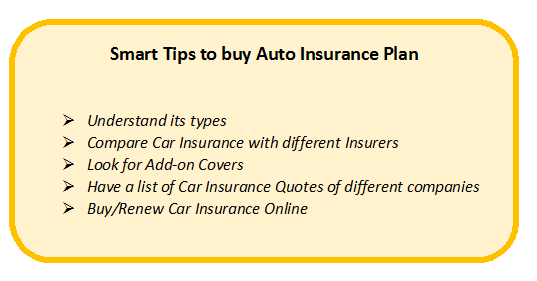

4. Opt for Insurance

While planning for Early retirement, one should consider Life Insurance and health insurance as an important element, as it gives you and your family income protection. Additionally, it provides financial support over uncertainties, both in business and personal life. There are various types of insurance policies if you want to explore like – Travel Insurance, Home insurance, liability insurance, etc. for relevant needs.

Insurance policies don't only support one during uncertainties or risks, but they are also a very efficient mode of investment when taken through certain policies (Endowment, etc). Insurance encourages savings through schemes that come with a maturity date.

5. Clear your Debt Early

This is an essential part of retirement planning. If you have some kind of loans or liabilities that need to be paid off, do it at the earliest. Most of the liabilities build up due to a use of credit cards. If you are using a credit card, make it a habit that you pay your monthly dues before the due date. Else, one can instruct the Bank to pay off the credit card outstanding on the due date, by debiting your bank account.

Best Retirement Mutual Fund Options

Equity Mutual Funds

An equity fund is a type of Mutual Fund that invests mainly in stocks. Equity represents ownership in firms (publicly or privately traded) and the aim of the stock ownership is to participate in the growth of the business over a period of time. The wealth you invest in Equity Funds is regulated by SEBI and they frame policies & norms to ensure that the investor’s money is safe. As equities are ideal for long-term investments, it is a good early retirement investing option. Some of the Best equity funds to invest are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP US Flexible Equity Fund Growth ₹75.5738

↓ -0.30 ₹1,091 8.1 24.3 30 22.8 17 17.8 Franklin Asian Equity Fund Growth ₹35.0052

↓ -0.28 ₹297 7.5 16.2 20.1 11 2.8 14.4 ICICI Prudential Banking and Financial Services Fund Growth ₹138.3

↓ -0.32 ₹10,593 4.7 2.7 10.7 14.5 16.5 11.6 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹63.67

↓ -0.25 ₹3,606 6.6 3.3 9.7 14.8 15.8 8.7 Mirae Asset India Equity Fund Growth ₹116.017

↓ -0.50 ₹41,088 2.3 2.9 3.6 12.3 14.1 12.7 DSP Natural Resources and New Energy Fund Growth ₹94.225

↓ -0.23 ₹1,474 4.3 6 2.8 18.3 21.4 13.9 Kotak Standard Multicap Fund Growth ₹85.441

↓ -0.40 ₹56,040 1.2 -0.1 2.7 15 15.9 16.5 Bandhan Tax Advantage (ELSS) Fund Growth ₹156.398

↓ -0.24 ₹7,215 3.1 2.8 2.1 14.7 19.7 13.1 Invesco India Growth Opportunities Fund Growth ₹99.76

↓ -1.01 ₹9,034 -2.3 -0.3 1.7 22.2 20.3 37.5 DSP Equity Opportunities Fund Growth ₹630.779

↓ -1.68 ₹16,530 2.9 1.4 1 19.1 19.3 23.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Dec 25 Research Highlights & Commentary of 10 Funds showcased

Commentary DSP US Flexible Equity Fund Franklin Asian Equity Fund ICICI Prudential Banking and Financial Services Fund Aditya Birla Sun Life Banking And Financial Services Fund Mirae Asset India Equity Fund DSP Natural Resources and New Energy Fund Kotak Standard Multicap Fund Bandhan Tax Advantage (ELSS) Fund Invesco India Growth Opportunities Fund DSP Equity Opportunities Fund Point 1 Bottom quartile AUM (₹1,091 Cr). Bottom quartile AUM (₹297 Cr). Upper mid AUM (₹10,593 Cr). Lower mid AUM (₹3,606 Cr). Top quartile AUM (₹41,088 Cr). Bottom quartile AUM (₹1,474 Cr). Highest AUM (₹56,040 Cr). Lower mid AUM (₹7,215 Cr). Upper mid AUM (₹9,034 Cr). Upper mid AUM (₹16,530 Cr). Point 2 Established history (13+ yrs). Established history (17+ yrs). Established history (17+ yrs). Established history (12+ yrs). Established history (17+ yrs). Established history (17+ yrs). Established history (16+ yrs). Established history (16+ yrs). Established history (18+ yrs). Oldest track record among peers (25 yrs). Point 3 Top rated. Rating: 5★ (top quartile). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 16.96% (upper mid). 5Y return: 2.78% (bottom quartile). 5Y return: 16.54% (lower mid). 5Y return: 15.84% (bottom quartile). 5Y return: 14.09% (bottom quartile). 5Y return: 21.40% (top quartile). 5Y return: 15.93% (lower mid). 5Y return: 19.67% (upper mid). 5Y return: 20.33% (top quartile). 5Y return: 19.32% (upper mid). Point 6 3Y return: 22.82% (top quartile). 3Y return: 10.95% (bottom quartile). 3Y return: 14.45% (bottom quartile). 3Y return: 14.78% (lower mid). 3Y return: 12.26% (bottom quartile). 3Y return: 18.26% (upper mid). 3Y return: 15.04% (upper mid). 3Y return: 14.75% (lower mid). 3Y return: 22.24% (top quartile). 3Y return: 19.09% (upper mid). Point 7 1Y return: 30.04% (top quartile). 1Y return: 20.15% (top quartile). 1Y return: 10.71% (upper mid). 1Y return: 9.74% (upper mid). 1Y return: 3.64% (upper mid). 1Y return: 2.78% (lower mid). 1Y return: 2.67% (lower mid). 1Y return: 2.15% (bottom quartile). 1Y return: 1.67% (bottom quartile). 1Y return: 0.99% (bottom quartile). Point 8 Alpha: 3.17 (top quartile). Alpha: 0.00 (upper mid). Alpha: -2.18 (bottom quartile). Alpha: -3.75 (bottom quartile). Alpha: 0.62 (upper mid). Alpha: 0.00 (lower mid). Alpha: 3.08 (upper mid). Alpha: -1.66 (lower mid). Alpha: 5.34 (top quartile). Alpha: -3.17 (bottom quartile). Point 9 Sharpe: 1.31 (top quartile). Sharpe: 1.41 (top quartile). Sharpe: 0.44 (upper mid). Sharpe: 0.38 (upper mid). Sharpe: 0.12 (bottom quartile). Sharpe: 0.14 (lower mid). Sharpe: 0.23 (lower mid). Sharpe: -0.14 (bottom quartile). Sharpe: 0.37 (upper mid). Sharpe: -0.15 (bottom quartile). Point 10 Information ratio: -0.28 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.26 (top quartile). Information ratio: 0.26 (upper mid). Information ratio: -0.43 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.01 (upper mid). Information ratio: -0.27 (bottom quartile). Information ratio: 1.00 (top quartile). Information ratio: 0.21 (upper mid). DSP US Flexible Equity Fund

Franklin Asian Equity Fund

ICICI Prudential Banking and Financial Services Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Mirae Asset India Equity Fund

DSP Natural Resources and New Energy Fund

Kotak Standard Multicap Fund

Bandhan Tax Advantage (ELSS) Fund

Invesco India Growth Opportunities Fund

DSP Equity Opportunities Fund

Retirement Schemes-Solution Oriented Mutual Fund Schemes

These are the retirement solution oriented schemes that will have a lock-in of five years or till the age of retirement.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata Retirement Savings Fund-Moderate Growth ₹63.978

↓ -0.38 ₹2,180 -0.5 -2.6 -2.6 13.5 12.6 19.5 Tata Retirement Savings Fund - Progressive Growth ₹64.3908

↓ -0.40 ₹2,117 -1 -4.2 -5.4 14.3 13.2 21.7 Tata Retirement Savings Fund - Conservative Growth ₹31.7666

↓ -0.08 ₹175 0.3 -0.2 1.8 8 6.6 9.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Dec 25 Research Highlights & Commentary of 3 Funds showcased

Commentary Tata Retirement Savings Fund-Moderate Tata Retirement Savings Fund - Progressive Tata Retirement Savings Fund - Conservative Point 1 Highest AUM (₹2,180 Cr). Lower mid AUM (₹2,117 Cr). Bottom quartile AUM (₹175 Cr). Point 2 Oldest track record among peers (14 yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 12.58% (lower mid). 5Y return: 13.21% (upper mid). 5Y return: 6.63% (bottom quartile). Point 6 3Y return: 13.53% (lower mid). 3Y return: 14.26% (upper mid). 3Y return: 7.98% (bottom quartile). Point 7 1Y return: -2.60% (lower mid). 1Y return: -5.43% (bottom quartile). 1Y return: 1.84% (upper mid). Point 8 1M return: -0.94% (lower mid). 1M return: -0.99% (bottom quartile). 1M return: -0.34% (upper mid). Point 9 Alpha: 0.00 (upper mid). Alpha: -4.72 (bottom quartile). Alpha: 0.00 (lower mid). Point 10 Sharpe: -0.20 (upper mid). Sharpe: -0.26 (lower mid). Sharpe: -0.40 (bottom quartile). Tata Retirement Savings Fund-Moderate

Tata Retirement Savings Fund - Progressive

Tata Retirement Savings Fund - Conservative

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.