Table of Contents

CAMS KRA

CAMS KRA is a KYC registration agency (KRA) in India. CAMSKRA offers KYC services for all Mutual Funds, SEBI compliant stock brokers, etc. KYC – Know Your Customer – is a process to verify the customer’s identity and is mandatory for customers buying products of any financial institution.

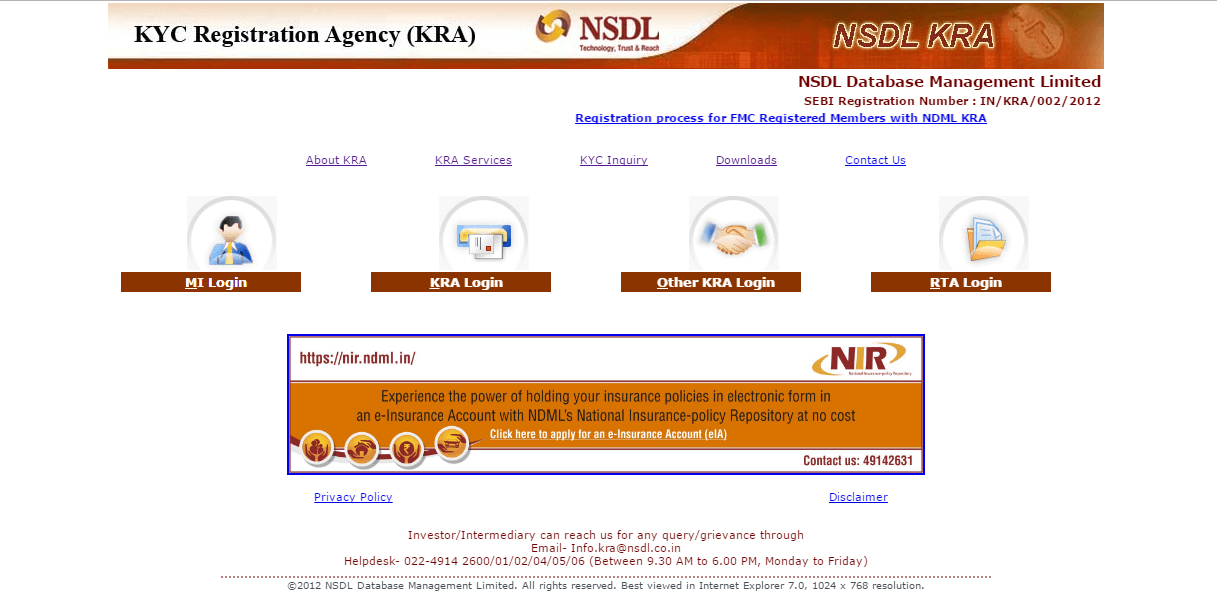

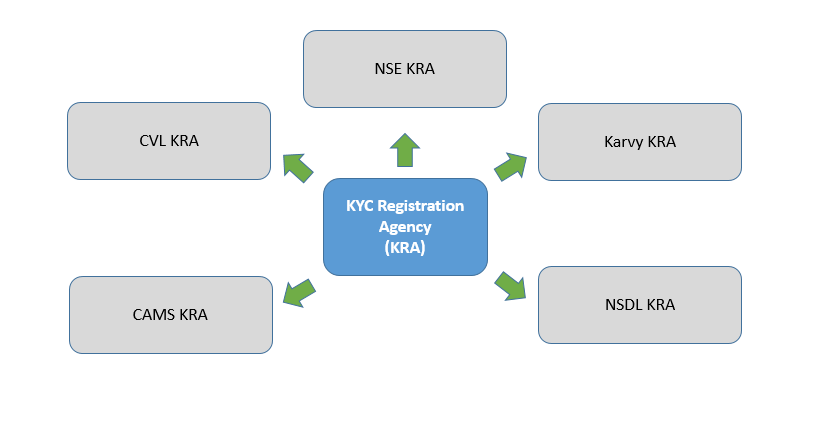

Earlier different financial institutions like AMCs, banks, etc., had different KYC verification processes. To bring uniformity in that process, SEBI introduced the KYC registration agency (KRA) regulations in 2011. As mentioned above, CAMSKRA is one such KRA (there are other KRAs in India that offer similar services). Here you can check your KYC Status, download the KYC Form and undergo KYC verification/modification. CVLKRA, NSDL KRA, NSE KRA and Karvy KRA are the other KRAs in the country.

SEBI Guidelines of KRA

Earlier, investors could complete the KYC process as and when they opened an account with any of the SEBI intermediaries by submitting relevant documents. This process led to a high duplication of KYC records since a customer had to undergo the process of KYC with each entity separately. In order to eliminate such duplications and bring uniformity in the KYC process, SEBI introduced the concept of KYC Registration Agency (KRA). There are 5 such KYC Registration Agencies in India, as below:

- CAMS KRA

- CVL KRA

- Karvy KRA

- NSDL KRA

- NSE KRA

Investors who want to invest in Mutual Funds and become KYC complaint can register with any one of the above-mentioned agencies. Once registered or KYC complaint, customers can start Investing in Mutual Funds.

What is CAMS KRA?

CAMS stands for Computer Age Management Services Pvt Ltd and was established in the year 1988 to focus on software development. However, in the 1990s, when the Mutual Funds Industry opened up, it focused towards the Mutual Fund industry and became an R&T agent (Registrar & transfer agent) for Mutual Funds. An R & T agent handles all the operations for processing investor forms, redemptions, etc., for Mutual Funds.

CAMS has set up a subsidiary called CAMS Investor Services Pvt. Ltd. (CISPL) to do KYC processing. CISPL was given the licence in June 2012 to act as a KRA. In July 2012, CISPL launched CAMS KRA to implement the common KYC verification process across all the financial intermediaries regulated by SEBI. CAMS KRA also provides a paperless Aadhaar-based verification process to complete the KYC requirements to start investing in the Mutual Funds. Along with that, it also conducts the traditional PAN-based KYC process as well.

CAMS KRA KYC for Mutual Fund

The KRA for Mutual Funds by SEBI is setup in order to eliminate the duplication in the KYC process and to bring a uniformity in the KYC process across SEBI registered intermediaries. This will also enable a client to invest or trade through various intermediaries, after undergoing the KYC process only once through any intermediary. The KYC for a Mutual Fund is a one-time process and once an investor successfully gets registered under the KYC norms, he can invest through various intermediaries. Additionally, if there are any changes or modifications in investor’s static or demographic information, it can be made under a single request to the KRA through one of the registered intermediaries. The customer needs not go the initial KRA only where initial KYC was carried out, but for modification, one can go to any KRA.

How does CAMS KRA work?

CAMSKRA boasts of using top-end technology in processing, storing and retrieving the documents required for KYC. It implements constant regulatory changes and takes care of all the other compliance while functioning as a KRA. The registration under CAMS KRA are carried out in the following ways:

1. PAN based Registration

To register with CAMS KRA with PAN Card you need to submit the following documents-

- A correctly filled KYC form with your signature

- Documents for personal identification and an address proof

Under this process, subsequently, an In-Person Verification (IPV) carried out to verify the documents submitted with the originals. Once this verification is completed and everything is found to be in order, the KYC status changes to "KYC Registered".

2. Aadhaar based Registration

This process is very simple with one needing to fill their Aadhaar number and then confirming the OTP (One-Time Password) which comes on the registered mobile number. When it comes to Aadhaar based KYC, also known as eKYC, it allows you to invest up to INR 50,000 per Mutual Fund per year. If one wants to invest more than INR 50,000 in an AMC, then you need to complete the PAN-based KYC verification in order to invest more or one needs to complete the biometric based aadhaar process.

Talk to our investment specialist

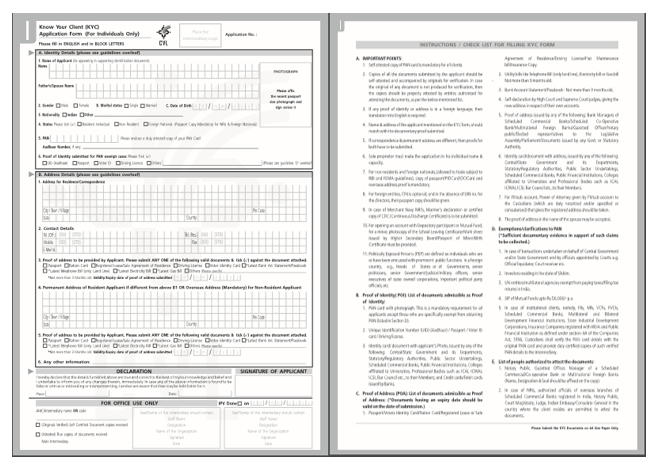

CAMS KRA KYC Form Download

Investors can download the KYC form from the CAM KRA website. There are different KYC forms available for download such as:

- KYC application form (normal KYC)

- cKYC application form (for completing Central KYC)

- Intermediary registration form (for entities who want to conduct KYC through CAMS KRA)

- KYC details change form (KRA complied individuals who want to change their details like- address, etc.)

1.Individuals can download the KYC Form here- Download Now!

- Non-Individual can download the KYC Form here- Download Now!

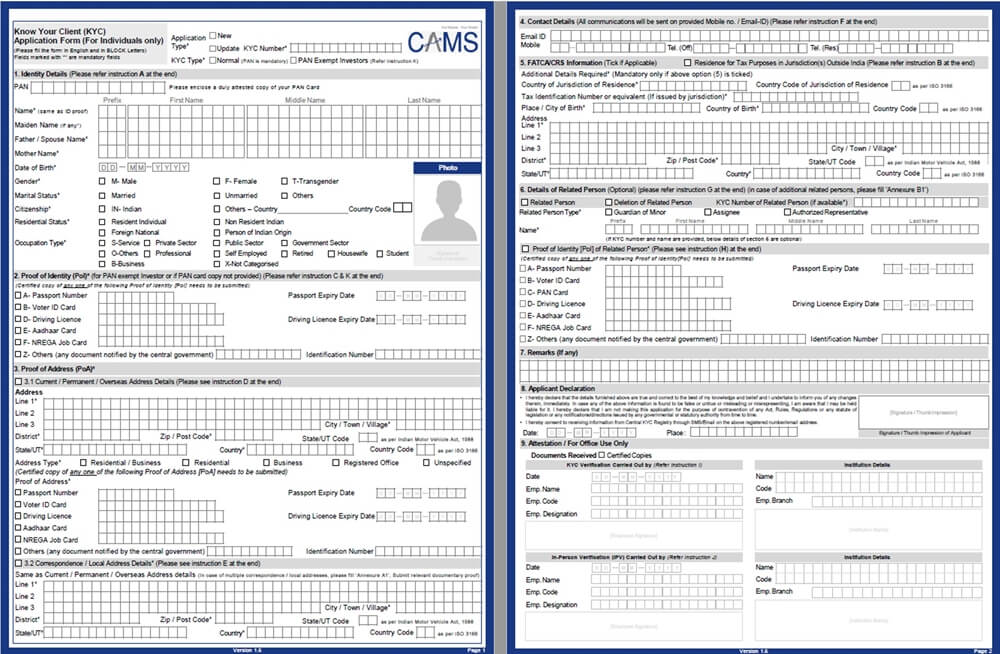

Overview of Individual KYC Form

Overview of Individual KYC Form

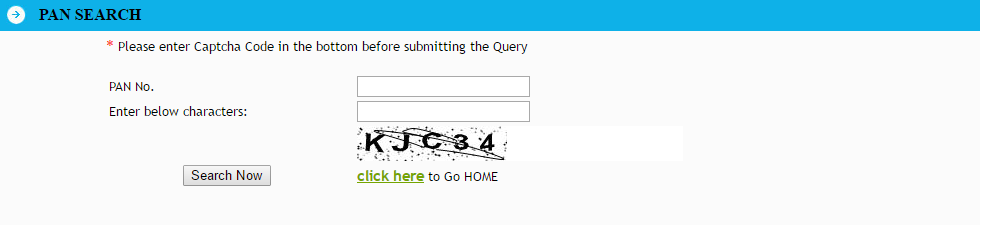

KYC Status

Investors can check their KYC status – PAN based or Aadhaar based – on CAMS KRA website. If you have opted for Aadhaar based KYC registration, then you can do a KYC check (called eKYC) by putting your UIDAI or Aadhaar number and check for the current status. The same procedure can be done for PAN-based registration by putting PAN number instead of Aadhaar or UIDAI number.

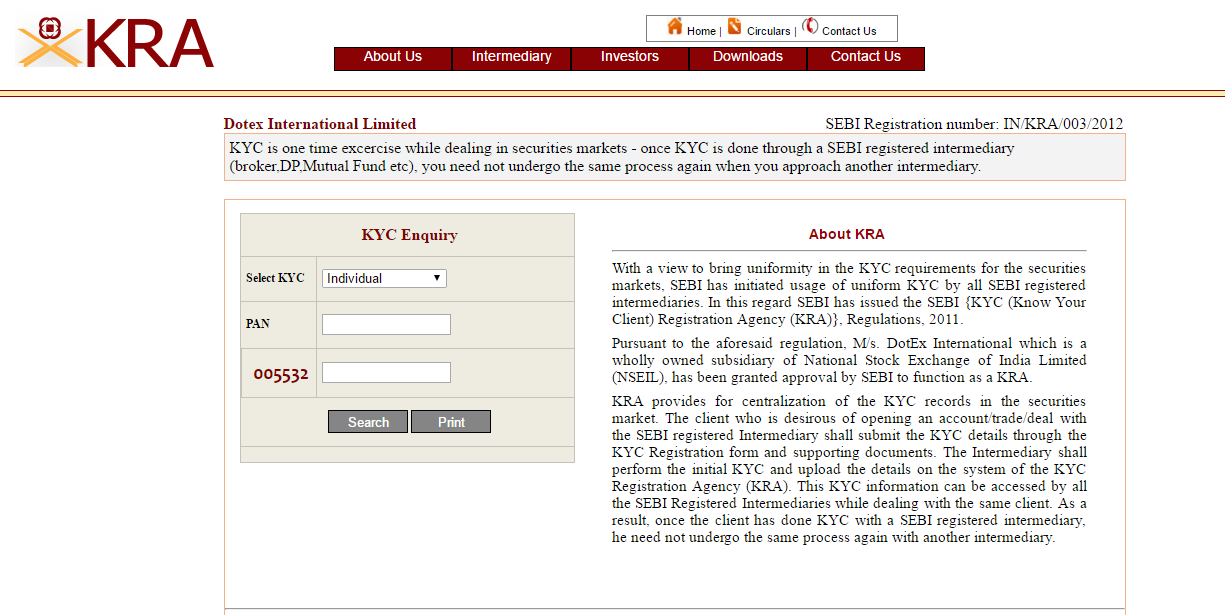

Investors can also check their KYC status by visiting the below mentioned KRA’s website by submitting your PAN number.

- CDSL KRA

- KARVY KRA

- NDML KRA

- NSE KRA

Investors can also check their KYC status at Fincash.com

What does the KYC Status Mean?

KYC Registered: Your records are verified and is successfully registered with the KRA.

KYC Under Process: Your KYC documents are being accepted by the KRA and it is under process.

KYC On Hold: Your KYC process is on hold due to the discrepancy in the KYC documents. The documents/details that are incorrect need to be re-submitted.

KYC Rejected: Your KYC has been rejected by the KRA after verification of PAN details and other KYC documents. This means that you need to submit a fresh KYC form with relevant documents.

Not Available: Your KYC record is not available in any KRAs.

Aforementioned 5 KYC statuses can also reflect as Incomplete/Existing/Old KYC. Under such a status, you may need to submit fresh KYC documents to update your KYC records.

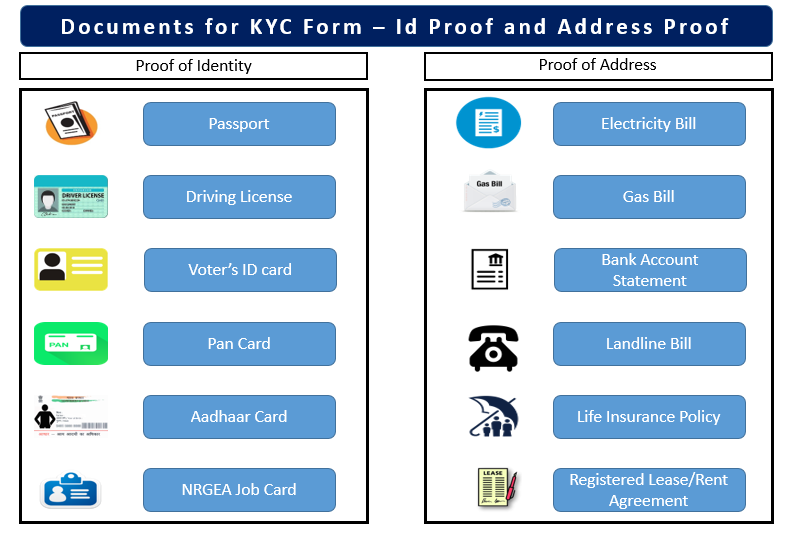

Documents Applicable for KYC Verification

There are certain validation processes in KYC where investors (individuals) need to submit the following proofs (mentioned below), following with the IPV verification.

- PAN Card

- Address Proof

- Voter’s Identity Card

- Driving License

- Telephone Bill

- Electricity Bill

- Bank Account statement

In-Personal Verification (IPV)

IPV is a one-time process and is mandatory to become a KYC compliant. Under this process, all the above-submitted documents will be verified in person. As per SEBI guidance, without IPV, the KYC process shall not proceed ahead and KYC will not be complete.

Benefits of KRA for Investors

- One time process, registering KYC with KRA saves duplication.

- An investor, if once registered as a KYC complaint with any KRA, can easily open an account with any SEBI registered intermediary.

- As per the latest KYC regulations by SEBI, KYC for Mutual Funds includes completion of In-person verification (IPV)- a transparency in verification of the KYC process.

- Investors can walk into any of the CAMS service centers to complete the KYC process, including IPV along with their transactions forms.

- CAMS KRA also enables investors to update any changes in their KYC records.

- Image based technology, real-time connectivity of its pan-India presence brings speed and Efficiency to the CAMS KRA services.

CAMS KRA Online Service

CAMS provides following online services to its customers:

- Track KYC status

- Form downloads

- Frequently Asked Questions (FAQ)

- You can get it all on its website at www. camskra.com

CAMS KRA Address

CAMS has its headquarters in Chennai. But for the convenience of investors and intermediaries, CAMS KRA has its service centres located all over the country. All these centres are connected to the main branch in real-time. These service centres are capable of processing and retrieving documents just like the main branch. CAMS KRA's Headquarters Address: New No.10, Old No.178, MGR Salai, Opp.Hotel Palmgrove, Nungambakkam, Chennai, Tamil Nadu-600034.

FAQS

1. What is KYC? Why is it Required?

KYC means ‘Know Your Customer’, which is commonly used for Client Identification Process. SEBI who has initiated the KRA KYC process has prescribed certain requirements relating to the KYC norms for intermediaries. Through the KYC process intermediaries would verify investors’ identity, address, personal information, etc. Any investor investing in Mutual Funds must be KYC compliant.

2. What are KYC Requirements for Mutual Fund Investors?

For an individual, identity proof (such as Voter ID, PAN Card, Passport, Driver’s Licence), an address proof and a photo is required. Non-individual investors will have to produce entity's registration certificate, company's PAN card, a list of directors, etc., along with authorized signatories.

3. What is a KYC Applicant Form?

A KYC applicant form is a mandatory document, which an investor needs to fill before investing in a Mutual Fund. The form is required for processing the KYC for an individual or any entity, and this form needs to be submitted along with certain documents.The form is designed for individuals and non-individuals investors separately. These forms are available on the website of AMCs and Mutual Funds. Before filling the form, one must read all the important instructions mentioned on the form.

4. To whom is a KYC Applicable? Is there any Exemption?

All investors who wish to invest in Mutual Funds needs to complete the KYC process. There is no exemption for an individual (Minors/Joint account holders/PoA holders) or non-individuals.

5. Whom do I inform about changes in Name/Sign/Address Status?

Any changes in name/signature/address/status, one should intimate to the authorized PoS. The desired changes in the KYC records will be done within 10-15 days. The specified form can be obtained from the Mutual Fund and AMFI.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good service

Its a good information but i din't get information that wether it is also for IPO.

NICE TEAM WORK

meri kyc process hold par hai to ab kya process karni hai.