Table of Contents

- Central KYC Registry

- How to get your Central KYC (cKYC) done?

- Central KYC or cKYC Status Check Online

- How to be cKYC or Central KYC compliant?

- Documents Required with cKYC Form

- How to fill cKYc Form

- How to Update Email ID?

- How to Update Mobile Number?

- How to Change Address in KYC?

- Types of cKYC Accounts

- Why was Central KYC(cKYC) brought into action?

- New Norms in the Central KYC (cKYC)

- Behind cKYC: CERSAI

- What is the difference between Normal KYC, eKYC and CKYC?

- A Change for a Better Future

What is cKYC and How to get Central KYC done?

cKYC stands for Central KYC which is a centralised repository which allows storage of personal information of the customer centrally. Earlier, when a customer went to a financial institution for buying any product, KYC(Know Your Customer) needed to be done at times for each product and with each institution (company) separately.

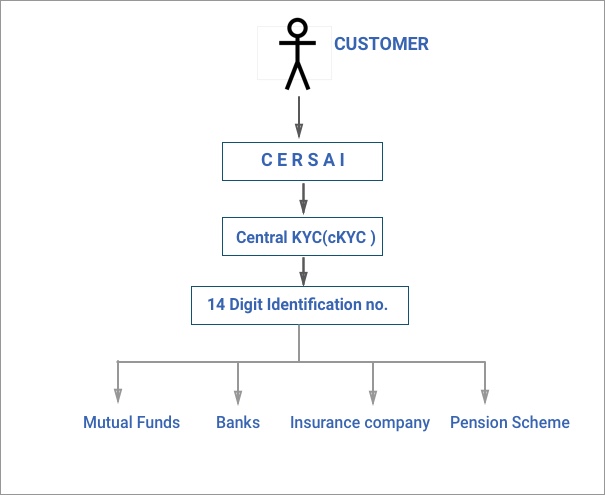

KYC is a regulated process requiring certain information, documents and subsequent verification. Ideally, if done once correctly, this KYC should suffice across all financial institutions in India. CKYC or central KYC can be used across financial institutions such as banks, Mutual Funds, Insurance companies, NBFCs etc.The cKYC programme was announced by the Government of India in the 2012-13 Union Budget and went live in July 2016. Central KYC (cKYC) is being managed by The Central Registry of Securitization and Asset Reconstruction and Security Interest in India (CERSAI). So, with cKYC, once your KYC is done, it does not need to be done again

Central KYC Registry

CKYC registry is the centralized repository of records for the customers in financial services. The registry for Central KYC or cKYC is CERSAI. This entity is responsible for keeping the data records for each KYC that is conducted. This centralized registry ensures that norms for KYC are standardized across the Financial Sector in India. It also ensures that inter-usability of KYC records and data making sure that the consumer does not have to do KYC each time when opening a financial relationship with an entity.

How to get your Central KYC (cKYC) done?

While central KYC or cKYC is rapidly getting adopted in India, one can approach financial institutions regulated by RBI, SEBI, IRDA or PFRDA to get the same done. One can do cKYC with a Bank, insurance company, Mutual Fund Company, a stock broker, an NBFC etc. To do your Central KYC process, you can approach any Mutual Fund distributor (provided they are regulated by SEBI), visit the office of a Mutual Fund house or can even approach a registrar. With a correctly filled cKYC form, photocopies of the required documents need to be attached. The form and documents then have to be physically verified and attested. For this, an in-person verification (IPV) needs to be carried out. For NRI (Non-Resident Indians) investors, they are authorised to attest the KYC documents and carry out an in-person verification (IPV) when they are in India. They need to confirm their NRI status while submitting their KYC Form.

Central KYC or cKYC Status Check Online

Currently, there is no available resource to check the KYC status online. Certain KRAs like Karvy KRA have introduced a column in the KYC status section, however, this is currently blank, we expect that this will start showing cKYC status in due course. If you are given the 14 digit KYC Identification Number (KIN) after submitting your documents, this means your cKYC application was successful and you are cKYC compliant. The KIN is allotted to an eligible application within 4-5 working days by CERSAI. An SMS is be sent to your registered mobile number along with an email as soon as the KYC Identification Number or KIN is generated for your KYC account. You must provide your email id and your mobile number on the cKYC form as CERSAI does not send out any physical confirmation of successful registration.

In the case of any discrepancies found in your application, it might get rejected. CERSAI will not send any intimation to you in such cases. The financial entity that is processing your Central KYC application will be made aware of the situation and for any queries & resolution, you should approach the entity.

CKYC Number

14 digit unique KYC Identification Number (KIN) recieved after submitting your documents. The KIN is allotted to an eligible application within 4-5 working days by CERSAI. An SMS is be sent to your registered mobile number along with an email as soon as the KYC Identification Number or KIN is generated for your KYC account.

How to be cKYC or Central KYC compliant?

Central KYC (cKYC) was brought in to make the life easier for customers. by completing cKYC process with any bank, Mutual Fund, or any insurance company, one will be KYC compliant, and subsequently, one does not have to do this process again anywhere. Central KYC (cKYC) will store all the customer information at one central server that is accessible to all the financial institutions. Before the Central KYC (cKYC) process was in place, there were separate KYC processes for different financial institutions like Mutual Funds, Banks etc. The introduction of Central KYC (cKYC) aims to eliminate this dissimilarity across various platforms.

To be cKYC compliant you need to fill the Central KYC(cKYC) form. Along with the correctly filled form, the customer has to submit a self-attested copy of proof of identity (PAN Card, etc) and proof of address, along with this a scanned photo & signature also needs to be submitted. There are some new fields in the KYC form such as the name of the applicant’s mother which were not there in earlier KYC forms. With a correctly filled cKYC form, one will open a KYC account. After opening a KYC account or completing cKYC, you will get a 14-digit KYC identification number (KIN) which is unique to every individual. So, you just have to show this number every time for a new investment or opening a new account in any financial entity. The number will have all your details saved centrally and will save you & the company or bank from completing the tedious process of KYC all over again.

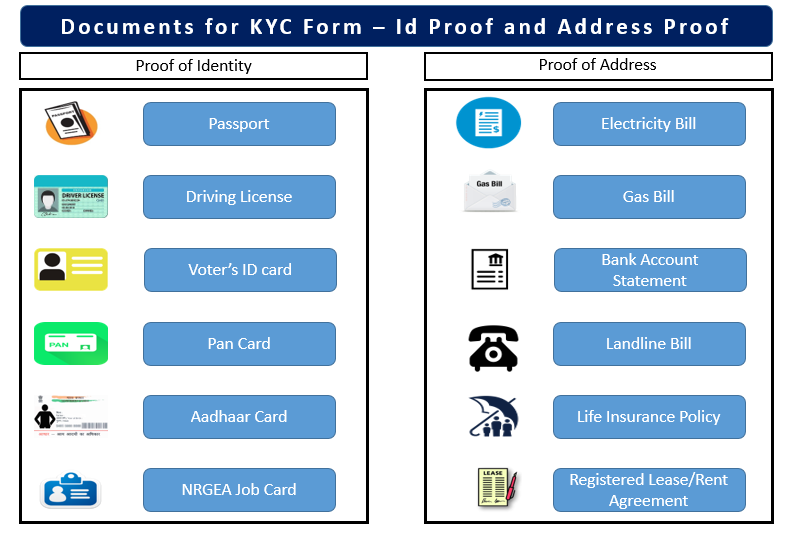

Documents Required with cKYC Form

One needs to submit following set of documents while submitting a Central KYC form:

- Correctly filled and signed cKYC form

- A self-attested copy of Proof of Identity

- A self-attested copy of Proof of Residence

- One photograph

How to fill cKYc Form

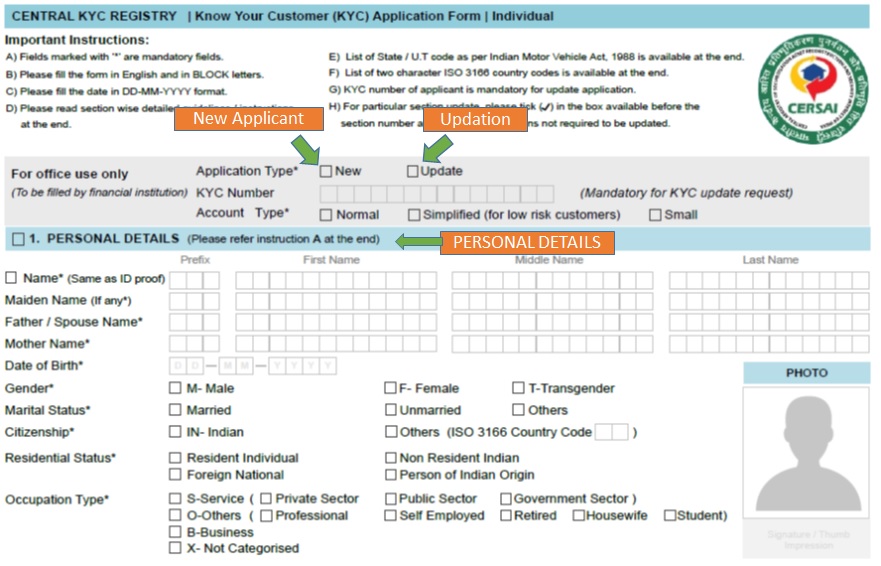

The cKYC or central KYC form has many sections that need to be filled in. There are various sections in the form pertaining to personal details, tax jurisdiction, documents submitted for proof of identity and proof of address, contact details, related persons, declarations and signature.

The same form can be used for filling in a new application or even updating details of an existing record.

The form looks like the below:

There are various instructions given at the back of the form for filling in all the sections.

There are various instructions given at the back of the form for filling in all the sections.

How to Update Email ID?

The Central KYC has made it easier to update your contact details online. To update email ID online, you will have to first log in to the website, where you want to update your KYC details. Then, click on 'Update KYC'. Type your email ID in the requisite area. However, before the database can be updated, a one-time password or OTP will be sent to your registered mobile number. Submit the OTP so that the verification process is completed following with updation of your email ID.

How to Update Mobile Number?

You can update your KYC details through official portals like CAMS, Karvy, CSDL, NSDL, etc. But to do so, you must have done eKYC previously. Log-on to one such platform and click on update KYC. You will have to update your mobile number and an OTP will be sent, thereafter click on submit. The verification will be completed, and your mobile number will be updated.

How to Change Address in KYC?

Log onto your bank or the financial institution's website. Also, you can update your KYC details on the centralized eKYC platforms. Once you have logged into one such platform, you will have to select update KYC details and choose the address change option. Usually, the updating process is completed submitting the OTP sent to your registered mobile number. However, to ensure that the process is completed with ease, provide no discrepancy in the personal details, you can file in any KYC forms across platforms.

Types of cKYC Accounts

There are three types of accounts in the cKYC form:

1. Normal KYC account

For normal KYC account, you can submit any of the six official documents as proof of identity. Those documents are PAN card, Aadhaar card, Driving licence, Voter ID, Passport, and NREGA Job Card.

2. Simplified or Low-Risk KYC Account

This type of account holders are the ones who cannot submit any of the above mentioned six officially valid documents (OVD) and are classified as “low risk” by banks. Such customers often face problems in submitting the identity proof or residence proof while doing a KYC process. Such customers can do cKYC by submitting any one of the following:

A proof of identity with photo issued by state/central government departments, public sector undertakings (PSUs), statutory/regulatory authority, public financial institutions and scheduled commercial banks.

Letter with a duly attested photo of the person issued by a gazetted officer.Such type of accounts will have a prefix ‘L’ to it.

3. Small account

Individuals who do not possess any kind of officially valid documents can open a small account with banks. These accounts can be opened by submitting a self-attested photograph along with a signed application. These accounts are initially valid for 12 months and can be extended for another 12 months if the customer produces a document that shows that they have applied for any one of the officially valid document. These types of KYC accounts come with a prefix of ‘S’. There are certain restrictions in these kinds of accounts such as:

- Total credits to not exceed INR 1,00,000 in a year.

- Total withdrawals to not exceed INR 10,000 in a month.

- account balance to not exceed INR 50,000 at any time.

Why was Central KYC(cKYC) brought into action?

Central KYC or cKYC process has been brought into action in order to get all the customers of financial products on a single and uniform KYC platform. Earlier, customers needed to complete the KYC formality separately for each financial institution such as Bank, Mutual Fund company, Insurance company etc. With Central KYC or cKYC once “Know Your Customer” (KYC) norms are completed centrally, all financial institutions can access them and use them.

The Central KYC (cKYC) process allows all the records of customers to be stored digitally which will, in turn, help financial entities to avoid re-doing KYC for each customer. By accessing data available with CERSAI each financial institution can find out whether the customer is KYC compliant or not, retrieve their KYC data, and by doing so make their internal process seamless by taking this KYC data and not asking the customer for the same. This ensures that the customer is not bothered each time by asking the same set of information or documents repeatedly. Financial institutions that are regulated by RBI, SEBI, IRDA & PFRDA can tie-up with CERSAI to perform cKYC.

New Norms in the Central KYC (cKYC)

This new KYC platform is promoted by the Government, PSU Banks and other financial institutions. Infact, cKYC is being adopted as the mother KYC process by all institutions regulated by RBI, SEBI, IRDA & PFRDA. As per the SEBI circular, all the Market intermediaries regulated by it will now have to register the KYC details of the new customer on CERSAI’s online platform compared to the past practice of registering through SEBI registered KRAs. Thus, all the intermediaries in the market first have to register with CERSAI – an ongoing process. Banks, insurance companies, Asset Management Companies (AMCs) are now required to hand over their KYC records to CERSAI. CERSAI has appointed DotEx International as its only managed service provider.

There is a certain apprehension in investors’ mind as KYC based on Aadhaar Card and PAN card now won’t be enough for investing in Mutual Funds and the Stock Market. Central KYC (cKYC) asks about other details of the customer like maiden name, the name of mother, in the case of minors details of related persons, proof of permanent address where the local or corresponding address is not same.

Behind cKYC: CERSAI

Central Registry of Securitization Asset Reconstruction and Security Interest (CERSAI) is an online security interest registry of the country. It is authorized by the Central Government of India to act as a governing body and perform the duties of the Central KYC Records Registry under the PMLA (Prevention of Money-Laundering) rules, 2005. This includes receiving, storing, guarding, and retrieving the KYC records of an investor in the digital form.

What is the difference between Normal KYC, eKYC and CKYC?

KYC

KYC means Know Your Customer. This is the normal and regular process carried out in Mutual Fund Industry or infact, with any financial institution to authenticate the identity of an investor/customer. The verification is done on the Basis of submission of a correctly filled KYC form along with required documents. It is then followed by an In-Person Verification(IPV), a process which verifies the documents and identity of the person for which KYC is being done. Once the process is successful, the data is entered into a KYC Registration Agency (KRA).

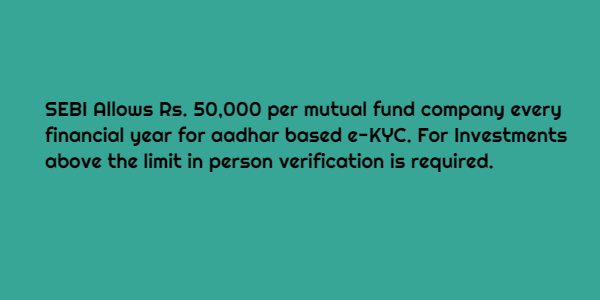

EKYC or Electronic KYC

eKYC is a KYC process done with the help of the Aadhaar Card of the customer. During the eKYC process, the verification of the identity of the customer can be done by either of the following two methods –

1. One Time Password (OTP)

The investor will receive an OTP on their registered mobile number. On successful verification, the investor is entitled to invest up to INR 50,000 per year per Mutual Fund House.

2. Biometric verification

With the help of biometric verification (thumb or retina scan), an investor can invest without any limitations.

CKYC OR Central KYC

cKYC is the new single platform KYC for all financial products. It is a one-time process that one needs to undergo.

A Change for a Better Future

There are some issues with the introduction of Central KYC (cKYC) like technical glitches in registration, the slow handover of data to CERSAI etc. Moreover, this process seems to replace both Aadhaar and PAN identification. Also, with the requirement of disclosure of information such as mother’s name, maiden name etc. investors need to go through the whole KYC process again. But to look on the brighter side, the Central KYC (cKYC) registry has been set up to spread the culture of saving and transparent investments. The earlier process which required KYC to be completed for each product or with every institution now needs to be done only once. This eliminates waste of time, resources, money and manpower, making the system more efficient. While there may be some early teething issues, with time all this will get sorted out making cKYC or central KYC a norm for the industry. In the long run, this will benefit the industry and yes, the consumer most importantly!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good and correct information. At the moment CKYC is nothing but a big propaganda by Govt. My SBI branch manager is not aware of CKYC! I could not find any correct way to register cKYC online. Even the www.ckycindia.in website is totally blank.

Very good kyc

Exellent service

* * * * * EXCELLENT * * * * *