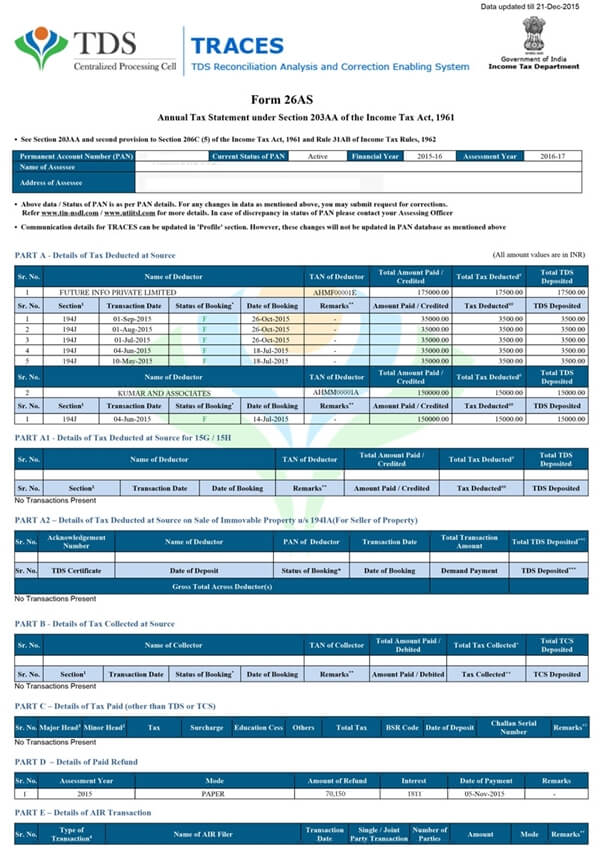

Table of Contents

KYC Form

KYC means Know Your Customer. Investors who want to invest in the Market securities need to complete the KYC process. They need to fill the KYC form and submit it to the SEBI registered intermediary such as Asset Management Companies, banks, etc. along with the required KYC documents in order to be KYC compliant.

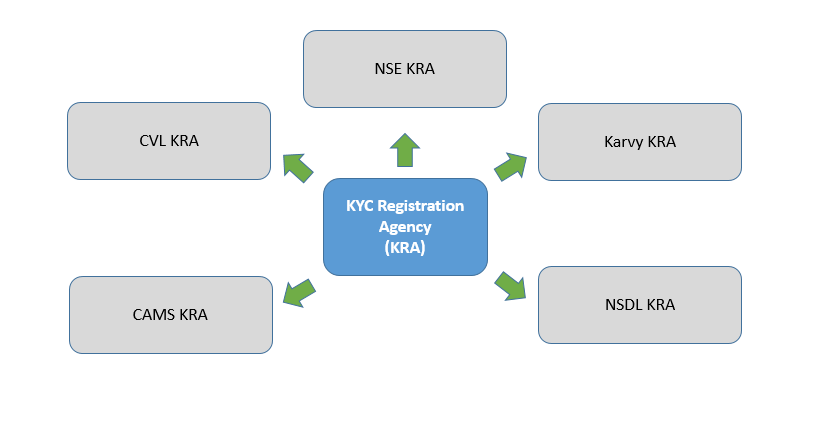

The KYC documents include 2 types of documents which are, proof of identity and proof of address. There are KYC registration agencies (KRA) such as CAMSKRA, CVLKRA which maintain the records filled in the KYC form by the investor centrally. If you are KYC compliant then you don't need to fill KYC form for different intermediaries separately. All your details will be stored and accessed centrally with the help of KRA and the intermediary you are interacting with can access them electronically. You can also check your KYC Status on the KRA websites.

KYC Form Download

There are five different KYC Registration Agencies (KRAs) in place in order to help investors to be KYC compliant. Each KRA provides you with a KYC form which you can download, fill up and submit along with the mentioned documents.

1. CAMS KRA Form

2. CVL KRA Form

3. NSE KRA Form

4. Karvy KRA Form

5. NSDL KRA Form

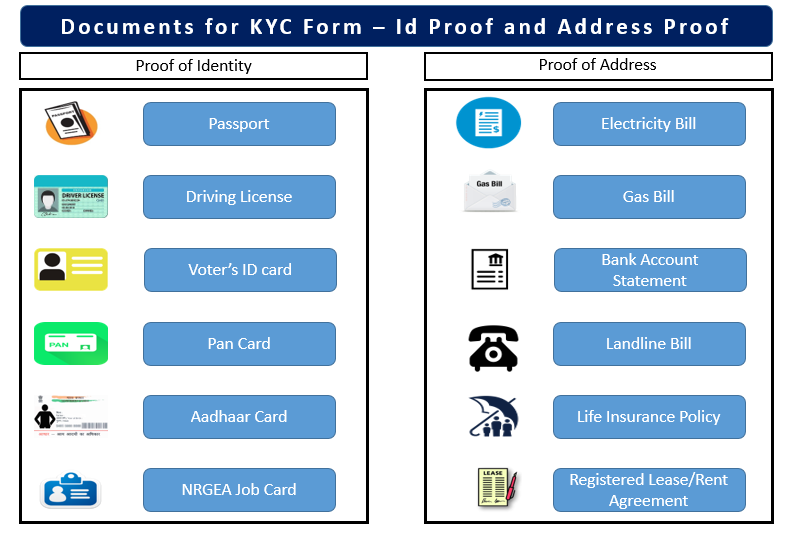

KYC Documents

The central government of India has given out the list of six documents that are termed as Officially Valid Documents for the proof of identity. If these documents contain the proof of address, then it will be accepted for the same. In case the document submitted as proof of identity does not contain the residential proof, you need to provide a valid document which has address details. These documents need to be attached with a correctly filled KYC form during the time of submission. Here is the list of the KYC documents-

Identity Proof Documents

- Passport

- Driving Licence

- Voter's Identity Card

- PAN Card

- Aadhaar Card

- NRGEA Job Card

Address Proof Documents

- Electricity Bill

- Gas Bill

- Bank Account statement

- Landline Bill

- Life Insurance Policy

- Registered Lease Agreement

Documents required for KYC Form

Documents required for KYC Form

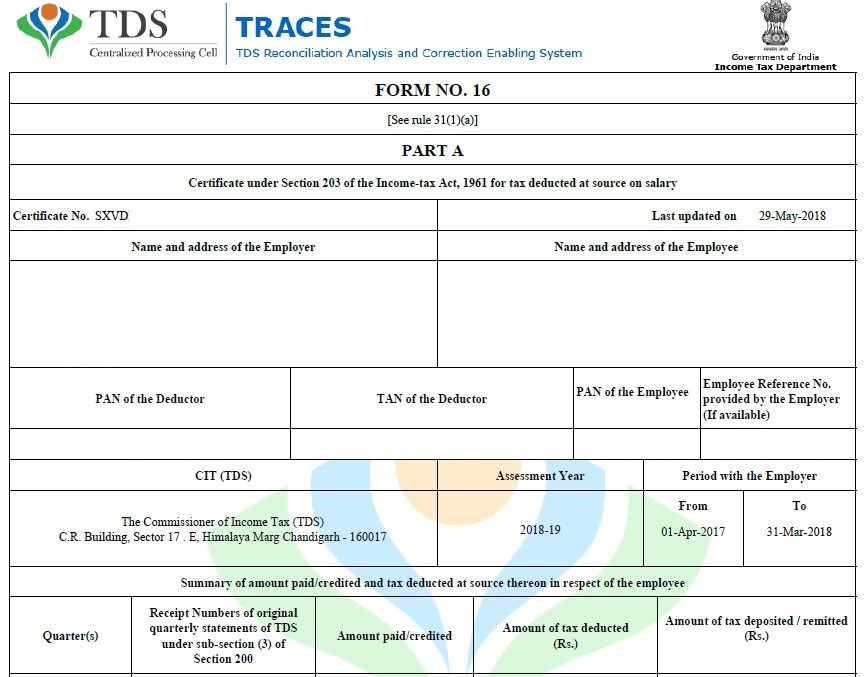

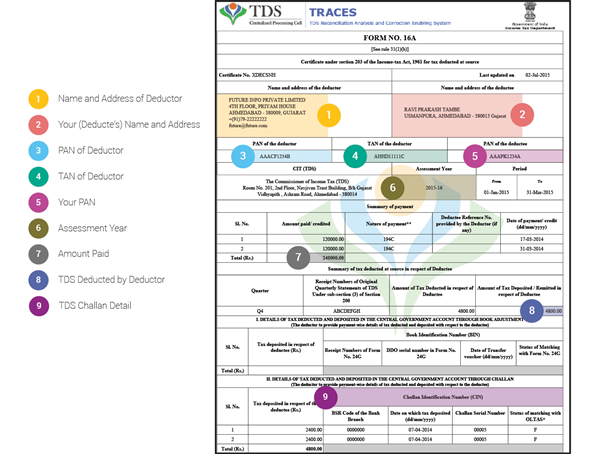

PAN-Based KYC Process for Mutual Fund Investment

- Download and fill up the KYC form

- Produce the correct required documents during the time of KYC form submission

- Complete the in-person verification (IPV)

- Submit the KYC form to the nearest intermediaries of KRA

- Check your KYC status on any of the KRA by providing your PAN card number

Aadhaar based KYC (eKYC) Process

- Visit any KRA website and provide the Aadhaar card number

- You will receive an OTP (One Time Password) on the registered mobile number.

- The OTP will internally link and fill up your details in the online KYC form.

- On successful verification, you will be e-KYC compliant

e-KYC allows an investor to invest up to INR 50,000 per asset management company per year. Biometric verification, if done, allows investors to transact without any limits.

Central KYC Form(c-KYC)

c-KYC or Central KYC is a process of storing and accessing the KYC records of a customer centrally. c-KYC is managed by The Central Registry of Securitization Asset Reconstruction and Security Interest in India (CERSAI). Central KYC (cKYC) will store all the investor information at one central server that is accessible to all the financial institutions such as Mutual Fund companies, Insurance companies, banks etc. After filling the central KYC form, you will open a c-KYC account. Then you will be provided with a 14-digit identification number. You just need to provide this number at the time of any new investment or purchasing any financial product with the registered entity. The unique identification number will lead to the record that will have all your KYC information saved centrally. This process will save you and the entity you are interacting with from repeating the tedious process of KYC.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

The forms are good for customers use. Where does a person send the filled out form.. I live in Chennai and the package is in Bangalore. Thanks for any information. Ranjit

Good Article. Explaining all types of forms.