KYC Status for Mutual Funds

KYC is an acronym for Know Your Customer. In the financial services industry, KYC term refers to a process of Customer Identification.The Securities and Exchange Board of India (SEBI) has set strict guidelines for all the financial institutions and intermediaries, including Mutual Funds to ‘know’ the customers.

The KYC process involves verification of personal identity, residence, financial status, occupation, In-Person Verification (IPV), and other personal information.KYC verification entails filling up a KYC Form and along with this one needs to submit KYC documents. Once this process is underway, you can check your kyc status on any of the KYC Registration Agencies' (KRAs) website.

Check KYC/CKYC Status Online

You can check your KYC status – PAN based or Aadhaar based – on any KRA website. If you have undergone Aadhaar based KYC registration then you can do a check on your KYC status by putting your UIDAI or Aadhaar number and check for the current KYC status. The same procedure can be done for PAN-based registration by putting PAN number instead of your Aadhaar number.

There are five KYC Registration Agencies (KRAs) in place to help investors:

Investors can also check their KYC status at Fincash.com by entering their mobile number and PAN details.

What Does the KYC Status Mean?

KYC Registered: Your records are successfully registered with the KRA.

KYC Under Process: Your KYC process is being accepted by the KRA and it is under process.

KYC On Hold: Your KYC process is on hold due to the discrepancy in the KYC documents. The documents that are incorrect need to be re-submitted.

KYC Rejected: Your KYC has been rejected by the KRA after verification of PAN with other KRAs. This means that your PAN is available with other KRA.

Not Available: Your KYC record is not available in any KRAs.

Aforementioned 5 KYC statuses can also reflect as Incomplete/Existing/Old KYC. Under such a status, you may need to submit fresh KYC documents to update your KYC records.

KYC Form

For investors who wish to invest in the market securities through the regular KYC process, they need to fill the KYC form and submit it to any of the SEBI registered intermediaries such as banks, Asset Management Companies, etc. In order to be KYC compliant, you need to submit the required KYC documents along with the correctly filled form. The KYC documents are of two types – proof of identity and proof of address. The KYC registration agencies (KRA) such as CAMSKRA, CVLKRA, etc., centrally maintain the information filled in the KYC form by the investors. If you are already KYC compliant then there is no need to fill a separate KYC form for different intermediaries. All your KYC details will be stored and can be accessed centrally with the help of a KRA and the intermediary you are interacting with. You can also check your KYC status on the KRA websites.

1. CAMS KRA Form

2. CVL KRA Form

3. NSE KRA Form

4. KARVY KRA Form

5. NSDL KRA Form

KYC Documents for KYC Verification

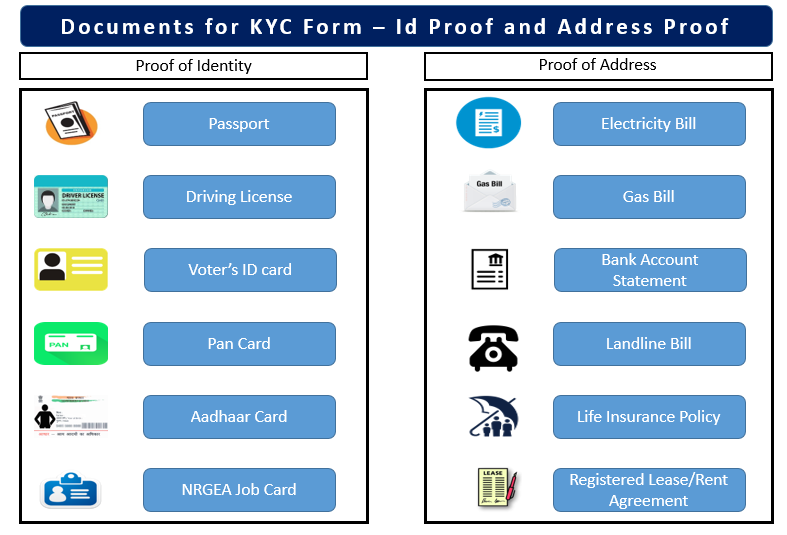

The Government of India has given out the list of six documents that are called as Officially Valid Documents (OVD) as the proof of identity. If these documents also have the proof of address, then those documents will be accepted for the same. In case the submitted document for the identity proof does not have the address proof then you need to provide a valid document which has the address details. These documents need to be attached with a correctly filled KYC form at the time of submission. Following is the list of KYC documents –

Documents for Identity Proof

- Passport

- Driving Licence

- Voter’s Identity Card

- PAN Card

- Aadhaar Card

- NRGEA Job Card

Documents for Address Proof

- Electricity Bill

- Gas Bill

- Bank Account statement

- Landline Bill

- Life Insurance Policy

- Registered Lease Agreement

Know Your Customer Process Steps

- Download and fill up the KYC form

- Produce the correct required documents during the time of KYC form submission

- Complete the in-person verification (IPV)

- Submit the KYC form to the nearest intermediaries of KRA

- Check your KYC status on any of the KRA by providing your PAN card number to see if any issue, else KYC status should show complete or registered.

The above-mentioned process is the regular KYC process i.e. PAN-based KYC (PAN Card is necessary). There is another way of completing the KYC process with the help of Aadhaar card. This is called as the eKYC process.

eKYC – Aadhaar Based KYC Process

e-KYC is a paperless KYC service offered by the Unique Identification Authority of India (UIDAI). It makes you KYC compliant which allows you to start Investing in the Mutual Funds. For the ease of the investors, Securities and Exchange Board of India (SEBI) has allowed Aadhaar Card based KYC to be used in Mutual Fund investments.

The UIDAI has initiated the programme of integrating Aadhaar card number to allow the investor to disclose their personal information to the Mutual Fund distributors. Aadhaar e-KYC aims to eliminate the long and tiresome paperwork involved in the PAN based KYC process and give the investor a stress-free experience. Another motive behind the Aadhaar e-KYC is to simplify the process of buying and selling of the Mutual Fund products. The investor can now invest online even though they are non-complaint to the normal PAN-based KYC details. The Aadhhar based KYC process ensures that investments in mutual funds can be truly digital with the customer not requiring to fill even a single piece of paper!

Application Process of Aadhaar e-KYC

There are two ways to complete the Aadhaar based eKYC process. Either one can do a short process of completing KYC using an OTP (one-time-password) or a longer process with biometric verification. The latter does not have nay restrictions on investments. The process of carrying out the Aadhaar based eKYC is as below:

- Provide the Aadhaar card number to the KRA through which KYC is being carried out.

- The investor has to give their consent to the Mutual Fund company or distributor to access the personal data from UIDAI Central Data Repository if the eKYC is being carried out via a distributor or financial intermediary.

- UIDAI authorises the fund houses seeking the e-KYC service.

- Verification can be done by using biometric scanning devices or receiving OTP (One Time Password) on the registered mobile device.The biometric scanning devices are approved and registered by the UIDAI.

- The Aadhaar unique identification number then provides the AMCs with all the personal details of the investor which are then saved online.

Once the details are verified, the investor has access to their account instantly and their KYC is completed. If you have completed your KYC verification by using biometric verification, you are a regular KYC compliant investor with no restrictions on making an investment in Mutual Funds. In case of KYC verification by using OTP, you are restricted to investing INR 50,000 per Mutual Fund per year.

New KYC Norm (January 01, 2012)

Previously, there was no uniformity in the KYC processes between different SEBI registered intermediaries like Mutual Funds, Portfolio Mangers, Venture Capital Funds, and Collective Investment Schemes. In order to bring that uniformity in the KYC process, SEBI introduced KYC Registration Agency (KRA).

KYC Registration Agency (KRA)

KRA or KYC Registration Agency is a SEBI registered agency, that maintains the KYC records of the investors centrally, on behalf of capital market institutions complying with SEBI. KRA is registered with SEBI under the KYC Regulations Act of 2011. KRA allows the investors to invest in multiple Mutual Fund schemes of different Asset Management Companies (AMCs) without repeating the same KYC process for each AMC. The records of the completed KYC process are stored centrally by the KRA and can be accessed by other intermediaries in the market and KYC registration agencies. Also, any changes that might occur in the future are also updated on a central server. This can be initiated by giving a simple request to the KRA through any registered intermediary. All KRAs can provide you with your KYC status.

KYC Status for CKYC

cKYC stands for Central KYC which is a centralised repository that centrally stores the personal information of the customer. Previously, a customer had to complete a separate KYC process for each of the financial entities such as banks, Mutual Fund Houses, etc. cKYC has been brought in to eliminate the repetition of KYC process and bring uniformity in the overall process.

At present, there is no available option to check the KYC status online but is expected to start in the due course of time. If you are given the 14 digit KYC Identification Number (KIN) after submitting your form and documents, that means your cKYC application was successful and your KYC status is cKYC compliant. CERSAI provides the KIN to an eligible application within 4-5 working days. As soon as your KYC Identification Number or KIN is generated for your KYC account, an SMS is sent to your registered mobile number along with an email. CERSAI does not send out any physical confirmation of successful registration, thus making it necessary for you to provide your email id and mobile number on the cKYC form.

If there are any discrepancies found in your application, it might get rejected. CERSAI will not send out any physical intimation to you in such cases. The financial intermediary that is processing your cKYC application will be made aware of the rejection and for any queries & resolution, you should approach the intermediary.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.