+91-22-48913909

+91-22-48913909

Table of Contents

- Meaning of Dynamic Bond Fund

- Investment Bonds: Income Fund Vs Dynamic Bond Fund

- Mutual Funds India: Best Dynamic Bond Funds

- Dynamic Bond Fund Taxation

- Dynamic Bond Fund: How to Invest in Mutual Funds?

- Mutual Fund Investment: Why to Invest in Dynamic Bond Fund?

- Mutual Funds: Investment Plans in Dynamic Bond Funds

Dynamic Bond Fund: A Detailed Overview

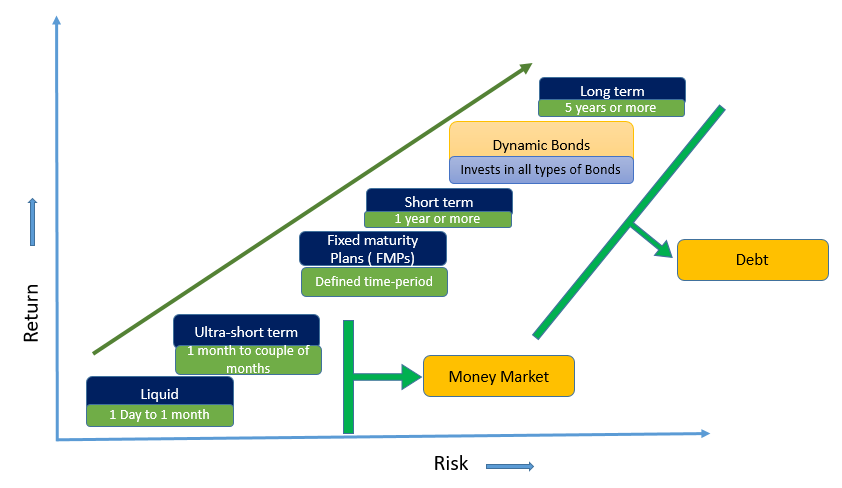

Dynamic bond funds can be considered as an investment option for medium or long-term. This mutual fund scheme invests its corpus in different Bonds with varying maturities. As the name suggests, the dynamic bond fund is dynamic in nature with respect to the maturity profile of its Underlying assets, in simple terms, it means that the fund manager can take papers of different maturities. Depending on the interest rate view the composition of the Portfolio changes. The fund invests in corporate debt, certificates of deposits and even government debt. So, let us have an in-depth understanding of the various aspects of dynamic bond funds that include the meaning of dynamic bond fund, best dynamic bond funds in 2025, how to invest in dynamic bond funds, mutual fund investment in dynamic bond funds, and so on.

Talk to our investment specialist

Meaning of Dynamic Bond Fund

As discussed in the previous paragraph, a dynamic bond fund is a mutual fund scheme that invests its funds in fixed Income securities consisting of varying maturity periods. It is a category of debt mutual fund. Here, the fund manager decides on which funds they need to invest based on their perception of the interest rate scenario and future interest rate movements. Based on this decision, they invest in funds across various maturity periods of debt instruments. This mutual fund scheme is suitable for individuals who feel puzzled about the interest rate scenario. Such individuals can rely on the view of the fund managers to earn money through dynamic bonds funds.

Investment Bonds: Income Fund Vs Dynamic Bond Fund

Income fund is a mutual fund scheme whose main concentration is to earn a steady income on a monthly or quarterly Basis instead of focusing on Capital appreciation. Such funds invest the money collected in government bonds, corporate bonds, and other Fixed Income instruments are known as income fund. Investors opting for income fund should be willing to take a higher level of risk and have an investment perspective for long-term. In these type of funds, the fund manager can invest in long term fixed income securities based on their stated objective.

Dynamic bond funds, on the contrary, are actively managed mutual fund schemes whose portfolio varies at a constant level based on the fund manager’s perception about interest rates. These funds invest their corpus across all classes of fixed income securities. The maturity profiles of the underlying securities forming part of the portfolio are also different. Income funds generate returns by following accrual strategy as well as capital gains made from interest rate movements. On the contrary, dynamic bond funds generate returns by following strategic and planned shifts between bonds of different maturities based on interest rate movements.

Mutual Funds India: Best Dynamic Bond Funds

Some of the best dynamic bond fund schemes to invest are listed below as follows.

Top and Best Dynamic Bond Funds

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity ICICI Prudential Long Term Plan Growth ₹36.5109

↑ 0.04 ₹14,049 3.2 4.8 9.6 7.9 8.2 7.82% 4Y 4M 2D 8Y 11M 5D UTI Dynamic Bond Fund Growth ₹30.6734

↑ 0.02 ₹626 3.2 4.3 9.4 9.6 8.6 7.09% 6Y 5M 5D 14Y 7M 13D L&T Flexi Bond Fund Growth ₹29.4561

↑ 0.03 ₹158 3.7 4.8 10.2 7.3 8.7 7.1% 8Y 3M 4D 16Y 11M 26D JM Dynamic Debt Fund Growth ₹41.2566

↑ 0.02 ₹44 3.9 5.1 10.1 7.2 8 6.87% 6Y 10M 22D 10Y 5M 7D SBI Dynamic Bond Fund Growth ₹35.5205

↑ 0.04 ₹3,324 3.5 4.2 9.8 7.9 8.6 7.29% 8Y 4M 24D 18Y 6M 18D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

Dynamic Bond Fund Taxation

The taxation rules for dynamic bond fund is similar to those of other mutual fund schemes. If individuals redeem the mutual fund's units within three years from the date of purchase then, profit will be liable for short-term Capital Gain. However, if the mutual fund units are sold after a period of three years then, long-term capital gain tax is applicable wherein indexation benefit can be claimed.

Dynamic Bond Fund: How to Invest in Mutual Funds?

Individuals always are in a catch 22 situation while deciding on How to Invest in Mutual Funds. Individuals can invest in dynamic bond funds either by visiting the mutual fund company’s or broker’s office in person. Here, they need to fill the form and attach related documents and pay the amount. Another mode of investment is through online by visiting an independent portal dealing in Mutual Funds or fund house’s website. By opting for online mode individuals can invest and redeem their money from mutual funds at any time and from any place.

Mutual Fund Investment: Why to Invest in Dynamic Bond Fund?

Investors who feel perplexed about the interest rate scenario or future interest rate movements can consider dynamic bond funds as a better investment option. This mutual fund scheme provides regular income as well as capital appreciation. This can be explained with an example. The interest rate and price of a bond share an inversely proportional relationship. In other words, when the interest rate falls, the price of a bond moves up and vice versa. In case of a falling interest scenario, the fund manager will increase the holding in long-term fixed income securities especially gilts (government securities), along with diversifying with some medium and short-term corporate bonds. Such a strategy is known as a duration strategy.

As the interest rate falls, the prices of the Gilt Funds tend to increase. Also, the prices of the corporate bonds also increase when interest rates fall. In addition, these bonds also earn steady interest income. If the interest rate takes a U-turn from low to high, the fund manager decreases the holding in gilt funds and starts to increase the holdings in medium and short-term corporate bonds. This shift from gilt funds to corporate bonds ensures lower Volatility in the fund prices, and increasing the proportion of corporate bonds in the portfolio ensures higher interest income from gilts.

Mutual Funds: Investment Plans in Dynamic Bond Funds

Individuals Investing in dynamic bond funds mutual fund scheme should have a minimum investment time frame of around 2-3 years. They should also have a risk appetite who are willing to make the most out of interest rate changes by investing in a dynamic bond fund.

Individuals should be aware of their objectives while investing in dynamic bond funds, a category of debt funds. In addition, they should assess whether the bond funds will help them to reach their objectives or not. To conclude, it can be said that individuals looking to harness the maximum advantages by investing in a Debt fund but are not aware of the interest rate scenarios can invest in dynamic bond fund.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.