Table of Contents

What is Folio Number in Mutual Funds?

A folio number is a unique number allotted by the Mutual Fund Company to the investor. It is just like a Bank account number with a particular bank. The unique number differs from the fund house to fund house. Once an investor purchases a fund, folio number is automatically assigned to by the fund house. An investor can make multiple purchases by using the same folio number within the same mutual fund.

With the folio number, one can easily obtain a mutual fund statement or update personal information from the fund house or broker itself. So, it is important for an investor to keep the folio number safe.

The folio number is essential for both investor and for a mutual fund company. It helps the fund house to maintain/update records and information about the mutual fund investor from time to time.

Benefits of Folio Number

Some of the major benefits of the folio number are:

A folio number ensures the accuracy of the investor

A folio number is advantageous to the mutual fund company as it helps them maintain a credible record system for every investor

The folio number uniquely identifies fund investors and keep records of information such as contact details, how much money an investor has placed with the fund and transaction history

With the same folio number, investors can make multiple purchases across Asset Class and funds within the same fund house. So, one can easily track the Portfolio on a regular Basis.

Talk to our investment specialist

How to get Folio Number?

The folio no can be accessed via various means, such as-

Mutual Fund Statement

Whenever an investor purchases a MF scheme form a mutual fund house, you receive a set of documents via the registered email id and SMS on the phone number. The statement contains details about the entire scheme along with the folio number, etc.

Consolidated Account Statements (CAS)

A consolidated mutual fund Account Statement means that an investor can see all his MF holdings across fund houses in one statement. Whether, if one has an old mutual fund investment through a distributor, or have invested directly in various schemes and are finding it cumbersome to get their details. Such investors can get their consolidated account statement of all their mutual fund investments at one place from specific websites- Computer Age Management Services (CAMS) Pvt. Ltd.

CAS gives an investor all the details of his mutual fund transactions. It mainly shows the MF investments so far under a single PAN. Investors can request for a hard copy as well as a soft copy of CAS once a month for free. The mutual fund statement is an important document as it carries every information regarding sales, purchases and other transactions in a mutual fund. The statement gives a proper insight to the investors about how to track mutual fund performance.

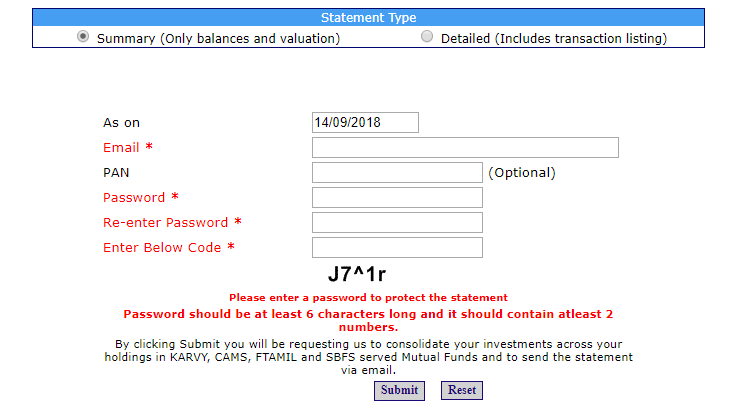

How to Generate Consolidate Account Statement (CAS)

Step 1. Go to camsonline.com

Step 2. Select the period for which you need the mutual fund statement

Step 3. Enter your registered e-mail ID

Step 4. Enter your PAN no (Optional)

Step 5. Enter the password

Step 6. Re-enter the password

Step 7. You need to enter the code that is shown below

Click on submit button to get your statement by e-mail

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.