ARN (AMFI Registration Number) for Mutual Funds

1. What is ARN code?

Every agent, broker, or intermediary (distributor) has to clear the NISM Certification Test and agree to abide by the code of conduct as well as other undertaking mentioned in the application form. Senior citizens can attend Continuing Professional Education (CPE) to get the ARN. Corporate companies are also required to apply for the ARN and agree to adhere to the code of conduct.

Individual intermediaries receive a photo identity card which comprises an ARN code, address of the intermediary, and validity period of the ARN. The corporates receive a letter of registration with the ARN code, name of the corporate, and validity of the ARN code. Employees of the corporates are also issued EUIN card which contains similar details along with the EUIN.

2. Why is ARN code Required?

Everyone has heard the term, Mutual Fund investments are subject to Market risk. While it may be true at several levels, one can certainly reduce the risk by being more diligent. Not just the investors, but the intermediaries who are responsible for distributing Mutual Funds should strictly adhere to the guidelines. This will safeguard the interests of all the parties involved in the transaction.

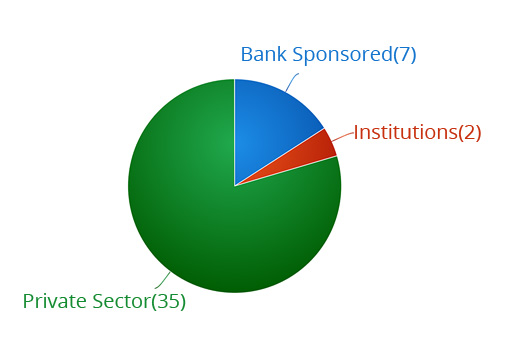

SEBI and AMFI take several measures to ensure the safety of investors. One such step includes the mandatory procurement of ARN code for the distributors. The Association of Mutual Funds in India (AMFI) has made it compulsory for all intermediaries involved in selling or marketing of mutual funds to clear a National Institute of Securities Markets (NISM) certification and register with AMFI to obtain AMFI Registration Number (ARN).

3. How to get ARN code?

The AMFI has entrusted M/s Computer Age Management Services Pvt. Ltd. (CAMS) with the responsibility to process the registration and issue ARN on its behalf.

- Intermediaries are required to apply in a prescribed form which is available online as well as at the offices of AMFI and CAMS. An online application can also be made from the CAMS online service.

- The application form needs to be submitted along with knowing your dealer (KYD) acknowledgment. If the application for KYD is made, then the individual should present KYD application form in person.

- The intermediary is required to submit NISM certificate copy, aadhaar card copy, PAN Card copy, Bank account proof, and two passport size photographs.

- The fee for individuals and senior citizens is 3,540 INR including the GST. The fees and the documents required will differ for corporates and other entities. You can check the details here.

4. Benefits of ARN Code?

ARN code is crucial for both the intermediary as well the investor. ARN number is an identity of the intermediary which is used to track the assets mobilized by the intermediary. It is then used to calculate the brokerage of the intermediary. Legally, an intermediary will become eligible to distribute mutual funds only after they have received the ARN number.

On the other hand, the investor is assured that the intermediary is a registered financial advisor and will adhere to the ethical code set by the AMFI. Investors can leverage the ARN by changing the distributor. If a distributor is changed, the investor is not charged trail commissions resulting in long-term financial benefits to the investor.

FINCASH ARN CODE IS : 112358

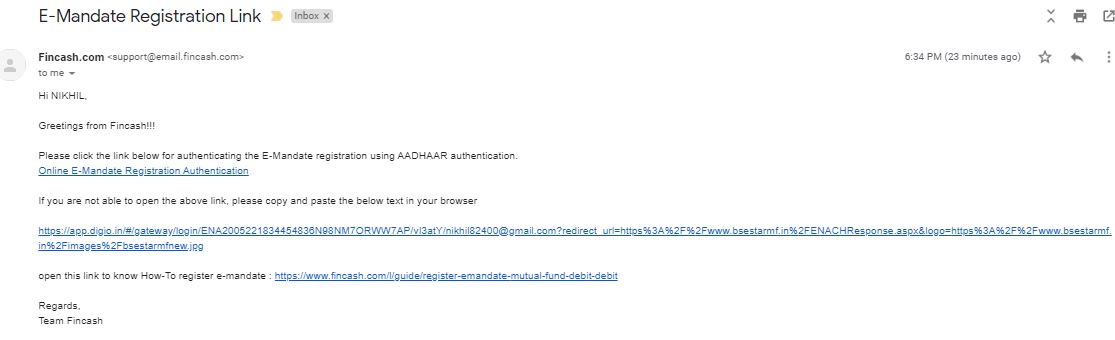

NA

Knowledgeable Article