Fincash Good and Service Tax » GST on Online Card Games in India

Table of Contents

GST on Online Card Games in India

The Goods and Services Tax (GST) has brought many changes in the selling and purchasing system of India. Taxation has covered almost all economic activities. GST is very much applicable to the supply in the country. This supply could include both tangible items and intangible virtual items.

Let’s take a look at the tax on online card games in light of GST laws.

Supply Under GST Law

Since we are discussing the taxation of online card games with regards to GST, let's discuss it in the context of the GST Act, 2016. The Central Goods and Service Tax Act (CGST) Section 7 describes supply in this manner as mentioned below:

The sale, transfer, barter, exchange, licence, rental, Lease or disposal made or is agreed upon to make by an individual for the sake of business growth is supply

Import of services

GST on Online Card Games

In online card games, players are asked to purchase tickets for a sum of money or are asked to deposit a fixed amount of money in the games. This is a platform where service is provided for an amount of money. This means supply has taken place and this event is taxable under the GST.

1. GST Liability

The supplier of goods and services will have the liability to pay GST. In the case of online games, the platform where the game is conducted will be considered as the supplier of the service. This makes the service taxable.

The online card gaming platform is liable to follow all the terms and conditions related to the supplier section under GST laws like the registration and filing of periodic returns.

Under GST laws, certain rules also indicate that the recipient of goods and services are also liable to be taxed, but in the case of online games, this is not applicable. It is the gaming platform that will be taxed.

Talk to our investment specialist

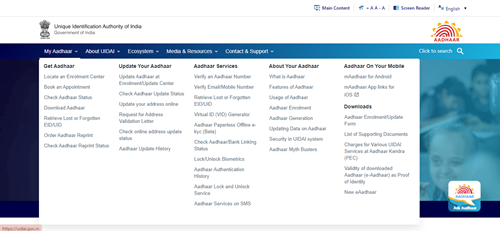

2. Registration

According to GST laws, suppliers with an aggregate turnover of over Rs. 20 lakhs at the end of the financial year are to be registered under the GST regime. If the online card gaming platform is earning more than Rs. 20 lakhs annually, it has to be registered.

However, remember that till date there is no such law that states this for online games, but these platforms should be following the common GST law for supply and threshold exemption to stay on the safe side.

3. Supply Value

According to the GST law under the CGST Act 15 (1), the supply value of goods or services will be as per the transaction value. This means that the price actually paid or payable for a specified supply of goods or services is transaction value.

However, in the case of online card games, the platform charges an amount from the players, which is also used in paying incentives, prizes or rewards.

For instance, an online card gaming platform gets Rs. 2 lakhs from the players’ deposit and other payments. The platform, in turn, uses Rs. 1 lakh of this amount to pay the incentives, rewards, etc. This means the platform has Rs. 1 lakh in hand.

So, what is the taxable amount now?

In section 15- it states that the supply value of goods or services will be the actual price paid or payable for a supply of goods or services. Note that the price paid or payable is the value of the supply. In the case of the example above, the amount actually paid to the platform is Rs. 1 lakh and this is what helps the game to run covering other incidental expenses. The amount not ‘actually paid’ to the platform should not be taxed.

However, there are no specific laws to date under GST for online games and it would be really helpful to see this take place in the near future.

Conclusion

GST on online card games is a necessity and the companies conducting such games should keep up with the present laws available for services and supply to help sustain the Indian Economy.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like