Table of Contents

How to Update PAN Card Online?

The Permanent Account Number or PAN Card holds a significant value in today’s digital age. Whether you want to make an investment in the Real Estate Market or apply for a passport, you will be asked to submit PAN card to verify your identity.

Ideally, your aadhaar card and Bank account should match the details in your PAN card, and any wrong information or a mismatch could get you into trouble. However, the details mentioned in your PAN can be corrected or updated both offline and online. Whether you need to correct the spelling of your name or update the address, etc., any correction can be done online.

Changing Name in PAN Card

To change the name on your PAN card, fill out the PAN correction form on the NSDL E-governance portal. Here are the detailed steps for making the changes:

Step 1: Visit the official website of NSDL E-Governance - www.tin-nsdl.com/

Step 2: You will be redirected to the page featuring the application form for correction in the PAN card

Step 3: Click on the “Application Type” option and select “Pan correction” from the drop-down menu.

Step 4: Once you have selected the PAN correction option, you will be given a token number via email (for future references).

Step 5: Select the option “submit scanned images” and type the PAN card number you would like to update under this section. You will be asked to fill in your personal details, along with the corrections required.

Step 6: You need to fill all the fields marked with “*” and check the boxes on the left side of the screen (only the ones that need correction).

Note: The boxes on the left margin are for correction purposes only. No need to select these boxes if you need to re-issue your PAN card. Just fill in the required details and submit the form.

Talk to our investment specialist

Step 7: Once you are done submitting the personal information, enter the address details. The address will be added to the income tax Department database.

Step 8: Right at the bottom, you will find the option for mentioning the additional PAN cards you have acquired accidentally. Leave it blank.

Step 9: Double-check all the information you have entered in the personal details and address sections and select “Next”. Once done, you will be redirected to a new page where you have to submit your residency details, proof of age, and identity.

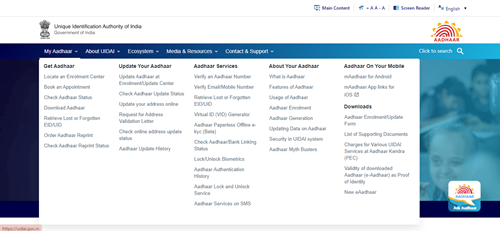

Note: If you have given the Aadhaar number in the application form, you must give proof of the same with additional supporting documents. Similarly, if you have selected a copy of your Aadhar card or any document for proof of the current address, name, date of birth, and other details, then mention the Aadhar number in the application form.

Step 10: Once you have submitted the required documents and information, you will get a preview of the submitted form. Check the information and make changes if there’s anything wrong.

PAN Card Updating Fees

The payment can be processed online, and it may vary depending on the communication address. If it’s in India, a total of INR 110 will be charged for corrections. If you are sending the form to an international address, then INR 1,020 is charged. Choose a suitable banking option from credit/Debit Card, Demand Draft, and net banking.

Once you have made the payment, you will get a downloadable acknowledgment. You can get a print of this letter and submit it to the NSDL e-gov. The letter features two blank spaces where the photographs of the applicant must be affixed. Sign the form in such a way that the portion of your signature is on the photograph and the rest of the sign is on the letter.

PAN Card Address Change or Update Mobile Number in PAN card Offline

Whether you need PAN card address change services or update mobile number in PAN card, the process can be executed online and offline. If you want to change details on PAN card offline, visit the nearest NSDL center and submit a form for changes in pan card. You must also send a letter to the jurisdictional assessing officer for making changes in the card.

The form is similar to the online and it can be downloaded online. Save the form on your mobile and get a print.

Tips for Making Corrections in PAN Card

The acknowledgment letter along with the required documents must be sent to the NSDL in a span of 15 days following the date you filled the online form.

The PAN card application form could be filled for many purposes. You can change the name, address, surrendering additional PAN cards (those you have created inadvertently), and reissuing the same card.

For every field, there is a checkbox on the corresponding left side of the screen, which is used for making the necessary corrections. These boxes must be checked carefully. For instance, you don’t have to check any box if you are applying for a PAN card surrendering or re-issuance.

PAN Card Linked Aadhaar Card - How to Link?

- Check the Income Tax e-filling website and select “Link Aadhaar” from the options.

- Submit your Aadhaar and PAN number

- Type your name as given on your Aadhaar Card

- Validate the details

- Submit the CAPTCHA code

- Select Link Aadhaar button

Time taken for PAN Card Correction Online?

There is no specified limit for how long it takes for the information in the PAN to update. Generally, it takes anywhere between 15 and 30 days for updating. To check the status of your PAN card, use the acknowledgment number you get after the payment.

The time also varies depending on the type of correction you need in the PAN card. For example, if there is a major update required, you may have to wait for longer to get the PAN card rectified.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like