Table of Contents

- What is GSTR-4?

- Who is a Composition Dealer?

- Who Shouldn’t File GSTR-4 Form?

- Due dates to File GSTR-4

- Details to File in the GSTR-4 Form

- 1. GSTIN

- 2. Name of the Taxable Person

- 3. Aggregate Turnover

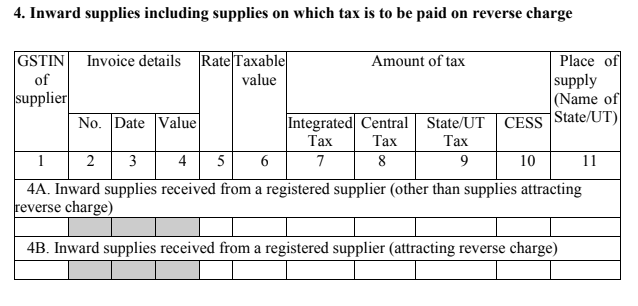

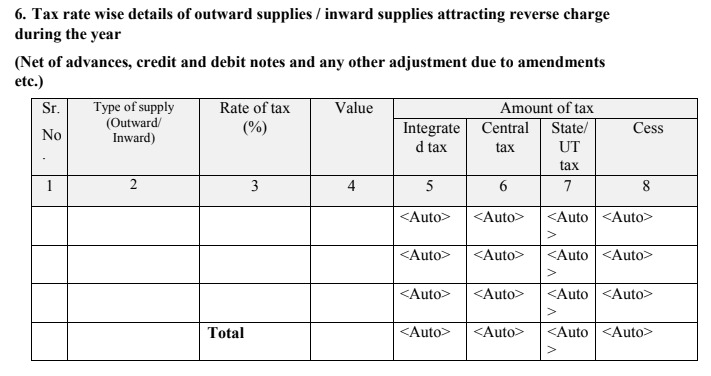

- 4. Inward supplies on which tax is to be paid on reverse charge

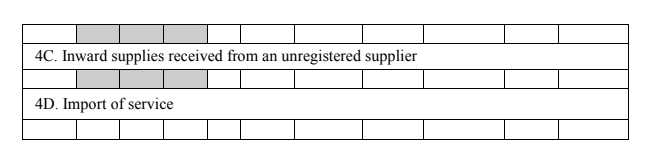

- 5. Summary of self-assessed liability as per FORM GST CMP-08 (Net of advances, credit and debit notes and any other adjustment due to amendments etc.)

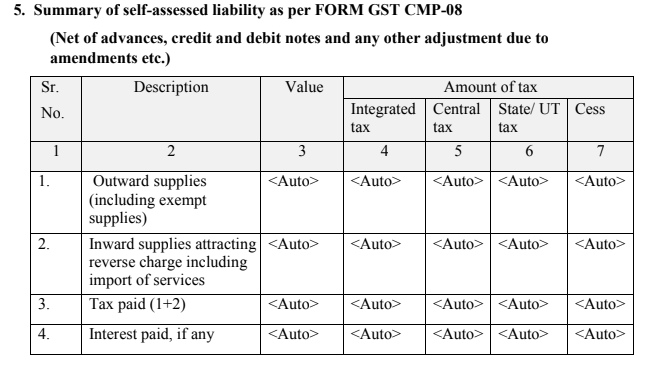

- 6.Tax rate wise details of outward supplies / inward supplies attracting reverse charge during the year (net of advances, credit and debit notes and any other adjustment due to amendments etc.)

- 7. TDS/TCS credit received

- 8. Tax Interest, Late Fee payable and paid

- 9. Refund claimed from Electronic cash ledger

- Penalty for Late Filing

- Conclusion

Know Everything About GSTR 4 Form

GSTR-4 is another important return to be filed under the GST regime. It has to be filed on a quarterly Basis. However, what makes this particular return different from other returns is that GSTR-4 is to be filed only by composition dealers.

What is GSTR-4?

GSTR-4 is a GST return that has to be filed by composition dealers under the GST regime. A normal taxpayer would have to file 3 monthly returns, but a composition dealer would have to file only GSTR-4 every quarter.

Be sure to remember that GSTR-4 can’t be revised. You can revise it only in the following quarterly return only. So it’s crucial that you check all your entries carefully before hitting the submit button.

Who is a Composition Dealer?

A composition dealer is anyone who opts for the composition scheme. However, they should have an annual turnover of less than Rs.1.5 crore.

Composition scheme is a hassle-free GST filing scheme. This is why various registered dealers opt for the composition scheme.

Here are two reasons:

Reason 1: Small business owners can avail the benefit of easy compliance of data.

Reason 2: Quarterly filing is a benefit for composition dealers.

Who Shouldn’t File GSTR-4 Form?

GSTR-4 is exclusively for composition dealers. Therefore, the following are exempted from filing GSTR-4.

- Non-resident taxable person

- Input Service distributor

- Casual Taxable person

- Persons liable to collect TCS

- Persons liable to deduct TDS

- Suppliers of Online Information and Database Access or Retrieval (OIDAR) services

Due dates to File GSTR-4

Since GSTR-4 is to be filed every quarter, the third and the fourth quarter for 2019-2020 will be the time you need to file the form.

Here are the due dates for the period of 2019-2020:

| Period (Quarterly) | Due Dates |

|---|---|

| 1st Quarter – April to June 2019 | 31st August 2019 (due date was extended in the 36th GST Council Meeting) |

| 2nd Quarter – July to September 2019 | 22nd October 2019 |

| 3rd Quarter – October to December 2019 | 18th January 2020 |

| 4th Quarter – January to March 2020 | 18th April 2020 |

Talk to our investment specialist

Details to File in the GSTR-4 Form

The government has prescribed 9 headings for the GSTR-4 format.

If you are a composition dealer, you have to enter the following details while filling the GSTR-4.

- Purchases attracting Reverse charges

- Supplies from unregistered suppliers

- Sales net turnover

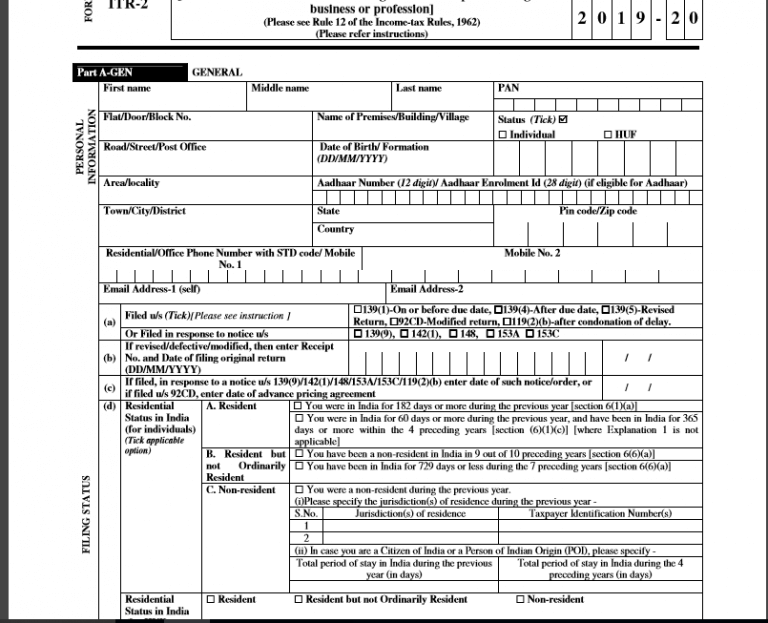

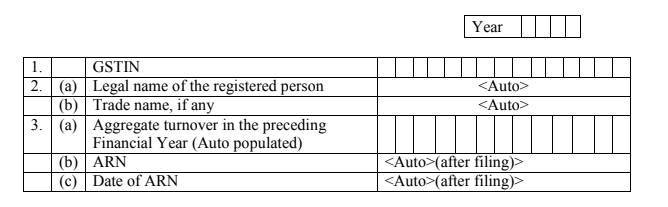

1. GSTIN

Each registered taxpayer will be allotted a 15-digit GST identification number. It will be auto-populated at the time of the GST return filing.

2. Name of the Taxable Person

It is auto-populated.

3. Aggregate Turnover

Every taxpayer has to enter details of the previous year’s aggregate turnover.

4. Inward supplies on which tax is to be paid on reverse charge

4A. Registered Supplier (other than reverse charge)

In this section, you need to enter the details of purchases from a registered supplier whether inter-state or intra-state. However, only purchases on which reverse charge is not applicable has to be reported here.

4B. Registered supplier (attracting reverse charge) (B2B)

Enter the details of purchases from a registered supplier whether inter-state or intra-state. However, only purchases on which reverse charge is applicable has to be reported here.

Tax payable on purchases against reverse charge will be calculated based on these details.

4C. Unregistered supplier (B2B UR)

In this section, you need to enter the details of purchases from an unregistered supplier whether interstate or intrastate.

4D. Import of Services subject to reverse charge (IMPS)

This section includes the entry of details of the tax you have attracted due to reverse charges on Import of services.

5. Summary of self-assessed liability as per FORM GST CMP-08 (Net of advances, credit and debit notes and any other adjustment due to amendments etc.)

5A. Outward supplies (including exempt supplies)

You have to enter the total value and segregate it into the different Taxes payable.

5B. Inward supplies attracting reverse charge including import of services

Enter the total value and segregate it according to the category mentioned.

6.Tax rate wise details of outward supplies / inward supplies attracting reverse charge during the year (net of advances, credit and debit notes and any other adjustment due to amendments etc.)

Enter your net turnover and select the applicable rate of tax. The tax amount will be auto- computed.

If you wish to make any change to details of sales provided in previous returns, you have to state it in this section along with original details.

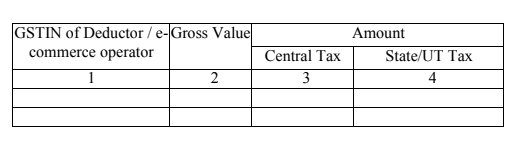

7. TDS/TCS credit received

If suppliers have deducted any TDS while making payment to the composition dealer, they have to enter it in this table.

Deductor’s GSTIN, gross invoice value and the TDS amount should be mentioned here.

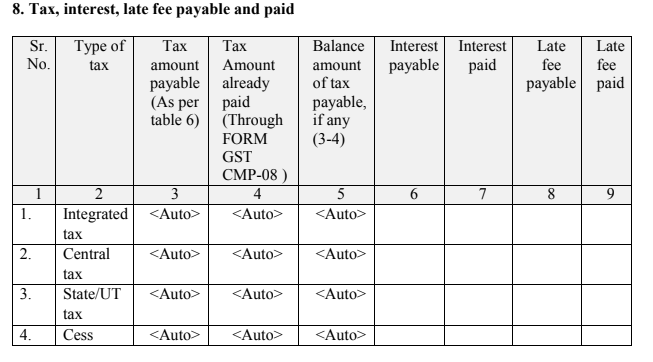

8. Tax Interest, Late Fee payable and paid

Mention the total Tax Liability and the tax paid here. Remember to mention IGST, CGST, SGST/UTGST and Cess separately.

If you have attracted interest and late fees for late filing or late payment of GST, mention the details in the section. It is mandatory that you mention the interest or late fees payable and the payment actually made in this table.

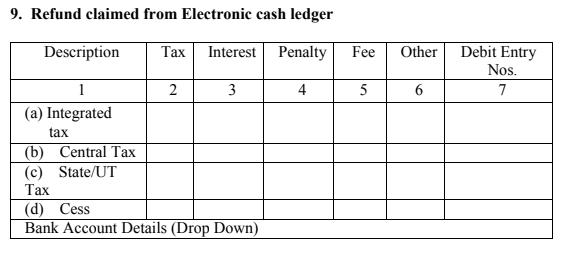

9. Refund claimed from Electronic cash ledger

You can claim any refund of excess taxes paid here.

Penalty for Late Filing

If you haven’t filed GSTR-4 on time, a fee of Rs.200 is levied per day. You will be charged a maximum penalty of Rs. 5000. Do remember that if you Fail to file GSTR-4 for a particular quarter, you will not be allowed to file it the next quarter either.

According to the latest notification No. 73/2017 – Central Tax late fees for GSTR-4 has been reduced to Rs. 50 per day. The late fees for 'NIL' return in GSTR-4 have also been reduced to Rs. 20 per day of delay.

Conclusion

GSTR-4 is definitely a relief from all the tedious monthly filings that non-composition dealers have. However, a composition dealer should keep himself updated with the changes occurring with the tax payment and file GSTR-4 on-time every quarter.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.