Table of Contents

What is ITR 4 or Sugam? How to File ITR 4 Form?

When it comes to paying Taxes, the payer requires to choose the right type of form. Out of the seven kinds, ITR 4 is one such form that is specific to a certain section of taxpayers. Comprising all the details, this post gives you the idea of who should and shouldn’t be filing this form. Scroll down to know more about it.

What ITR 4 Means?

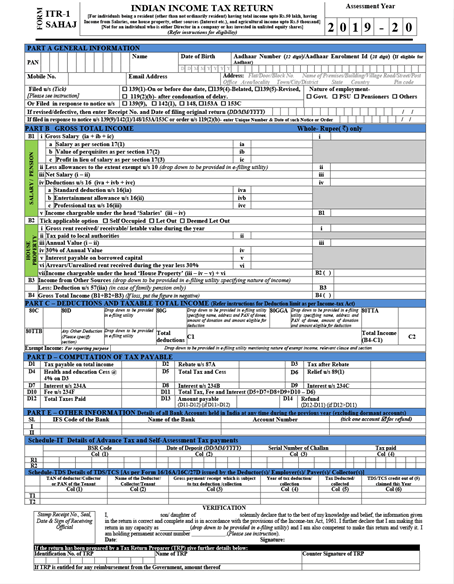

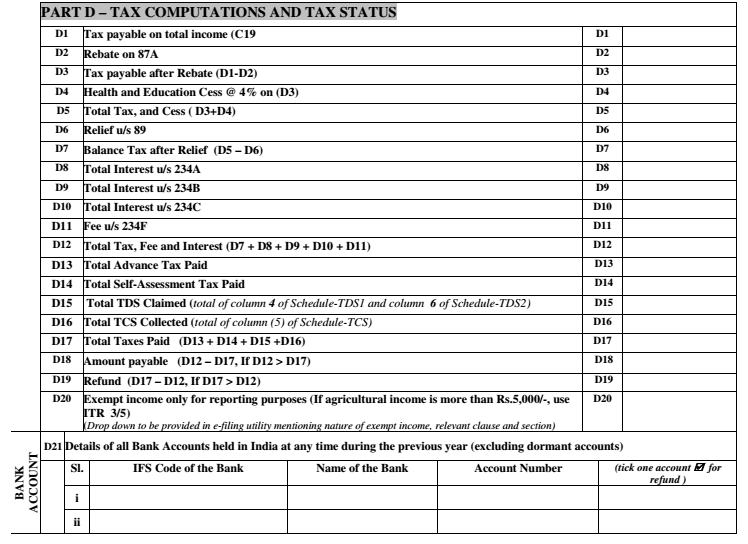

ITR 4, also known as Sugam is an Income Tax Return form used by those taxpayers who have chosen to opt for taxation under a presumptive Income scheme under the Section 44AD, 44ADA, and 44AE of the income tax Act.

Who is Allowed to File ITR 4 Sugam?

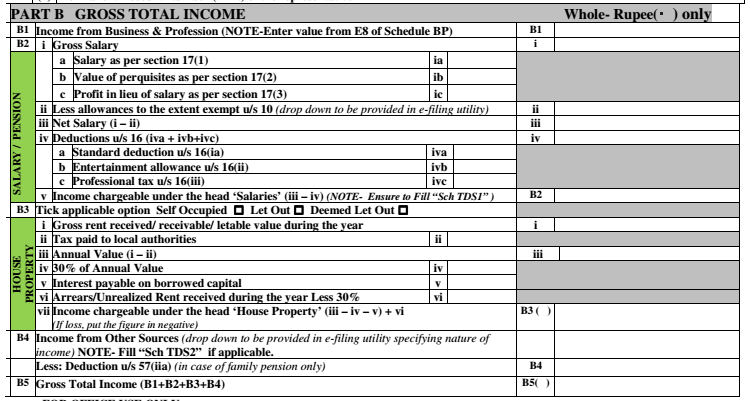

This firm is specifically for partnership firms, Hindu Undivided Funds (HUF), and those individuals whose income comprises:

Income from a business under the section 44ADA or 44AE

Income from a profession, calculated under the section 44ADA

Income from pension or salary

Income from a house property

Income from any additional sources

Freelancers with the gross income not more than Rs. 50 lakhs

Who Doesn’t Come Under ITR 4 Eligibility?

The following people cannot use Sugam ITR:

- The ones who get income from more than one house property or if the losses are brought forward or have to be carried forward under this specific head

- People who have income from horse races or winning lottery

- Individuals with income under Capital gains

- People whose income is taxable under the section 115BBDA

- The ones who have income under the section 115BBE

- People with agricultural income, which is more than Rs. 5000

- Those who have income from speculative business

- The ones with income from brokerage, commission or agency business

- People who want to claim relief of foreign tax under section 90, 90A, or 91

- Residents who have assets or any signing authority outside India

- Residents with income from sources outside India

Talk to our investment specialist

How Can You File ITR 4 Form?

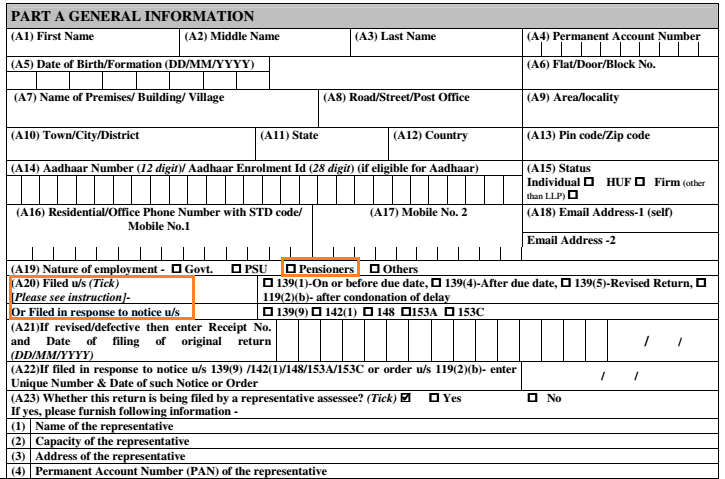

There are two different methods of filing ITR 4 income tax, such as:

Offline Method:

To fill up this form offline, the taxpayer’s age should be at least 80 years or above, and the income should be less than Rs. 5 lakhs.

Further, you can either visit the Income Tax Department Portal or can download ITR 4 form from the official portal of the department, fill in the details and send it to the Centralized Processing Centre (CPC) Bangalore.

Another method is to furnish the bar-coded return that simply means that you will have to log into the Income Tax Department website, fill-up the form download and send it to the CPC, Bangalore. Once you have filed the return, you will then receive ITR Verification form at the registered address.

You will have to sign the form and send it back to CPC Bangalore. You will be then issued an acknowledgement once the verification has been submitted.

Online Method:

The next and easiest method is online. Follow the below-mentioned steps for the same:

Visit the official e-filing portal

File your return with ITR 4 along with a digital signature

You will then receive ITR-V on the registered email ID, which you can submit through Demat account, Bank ATM, Aadhaar OTP and more

You will then receive acknowledgement on the registered ID

Final Words

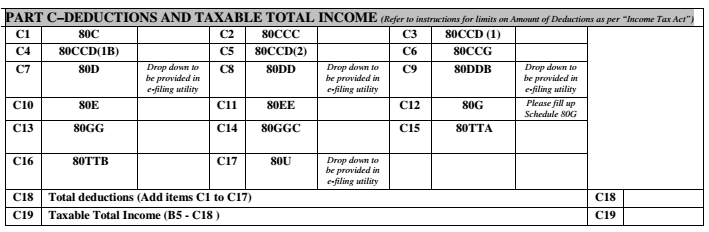

Of course, tax filing can turn out to be an arduous process; however, once it is done, all you can have is several advantages in your basket. So, that was all about ITR 4. If you belong to the category of ITR 4 taxpayers, you would not have to attach documents while filing this form as it is annexure-less form.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.