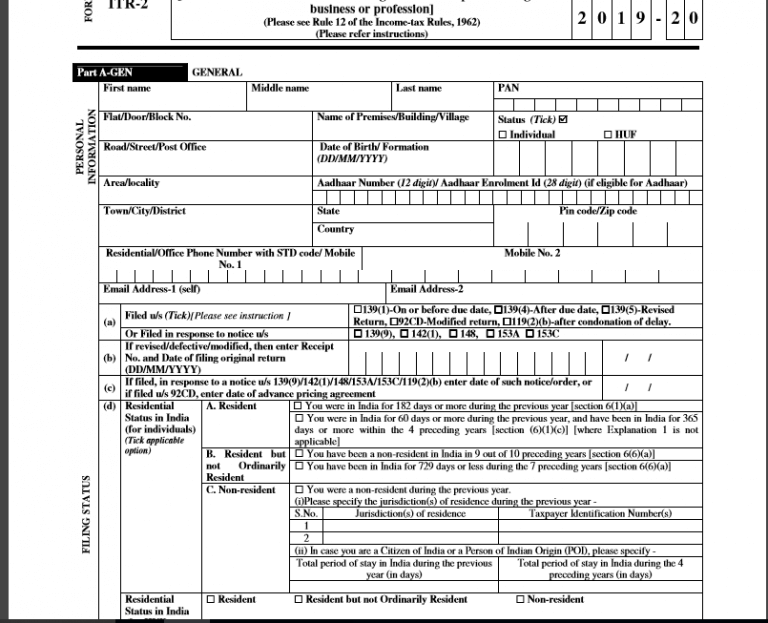

Table of Contents

Know Everything About C Forms

A C-certificate, or C form, is necessary for business transactions between states. To reduce the Tax Rate, the seller of the goods gives it to the buyer of the commodities. The "C" form must be used in cases involving interstate sales. To benefit from the central Sales Tax's reduced rate, any business that sells or purchases taxable goods to or from another state must either receive or issue this form, depending on the circumstance.

There are other types of form C, namely Form 10C, Form 12C, and Form 16C, that are used for employees' tax purposes. This article examines the C form and other variants of it in detail.

The Concept Behind C Form

A C form is a certification that the registered buyer of the goods from any state provides to the registered seller of another state. The customer declares the worth of their purchases on this form. The less expensive Central Sales Tax rate is applied to the central transaction if the buyer submits a "C" form.

10c Form

When requesting Employee Pension Scheme benefits, employees must complete and submit PF 10c Form, either online or offline (EPS). A portion of each employee's monthly salary is invested in the EPS retirement benefit system, and the company also contributes to the employee's EPS accounts. You can withdraw or transfer your pension amount when changing jobs by producing the EPS certificate. Furthermore, after 180 days of continuous service but before the end of the 10-year service tenure, you may submit Form 10C to request a withdrawal of funds if you cannot find a new position. You can take money out of the EPS scheme in times of need. However, your application will be turned down if you don't meet the requirements.

- If you left your employment before completing your ten years of service and became 58 years old before doing so, you may submit a Form 10C application

- A Form 10C application may be made by any member with at least ten years of service who has yet to turn 50 or by any member between 50 and 58 years of age who is dissatisfied with a decreased pension

- The member's nominee or family older than 58 at the time of death and who passed away before accumulating ten years of service may submit Form 10C

Talk to our investment specialist

Filling EPFO 10C Form

Both online and offline methods can be used to complete Form 10C. Details on the same are provided below.

The procedures for using Online Mode to fill form 10c in EPFO are as follows:

- Visit the Employees' Provident Fund's official website

- Use your Universal account number (UAN) and password to access the page

- Select the "Online Services" tab from the menu

- From the drop-down menu, select "Claim Form (Form-31, 19, 10C & 10D)"

- You'll be taken to a different page. The page will display your member, service, and KYC details

- Select "Continue Online Claim" from the menu now

- After that, you'll be directed to the claims section, where you can find details like your PAN, cellphone, account, and UAN numbers

- Choose the claim type you want to submit from the two choices "Withdraw PF Only" or "Withdraw Pension Only"

- Carefully fill out the claim form

- After completing the form, an OTP will be given to your registered mobile number

- To finish the submission, enter the OTP

- You will get a notification on your phone after the form has been successfully submitted

- After that, processing your request will take up to a few days

- The required amount will be transferred into your Bank account after the claim has been correctly processed

The procedures for using Offline Mode are as follows:

- Go to the Employees' Provident Fund website

- Get Form 10C. Additionally, you can pick it up at the EPFO office

- Carefully fill out all of the relevant fields on the form

- After the form has been filled out, deliver it to the EPFO office

- Once you submit it, it could take a few days to process your request

- Your bank account will get the money after your request is accepted

Form 12c

The income tax Department provided form 12C. A functioning document for the Income tax credit for mortgage loans was Form 12C. Under Section 192, it was regarded as an income tax exemption (2B).

It is a document that the worker gives to the employer explaining their additional revenue sources. When determining how much to withhold from wages for Taxes, the employer may consider any income sources other than salary if the employee completes form No. 12C with the relevant information. The employer may take into account the employee's additional sources of income when deducting taxes from the salary if the employee provides the required information on form No. 12C.

The Income Tax Department is no longer using the form. Form 12C is no longer in use. Thus you are not needed to complete it or give it to your employer.

Form 16c

The Indian government introduced a new TDS certificate, Form 16C, that shows the amount of TDS that the person/HUF withheld from the rent under Section 194IB at a rate of 5%. It is like Form 16 or Form 16A, which are used to report salaries or other payments. Within 15 days of the due date for supplying the challan cum statement in Form 26QC, the person deducting the TDS from the rent must provide Form 16C to the payee.

C Form Sections as per the CST

Section 8(1): This section lists the articles approved according to CST Act Section 2(d) of 1956. These items (which are only important for interstate sale) may be sold after the CST has been assessed at a rate of 2% if the following conditions in section 8(3) are satisfied

According to articles 8(3)(b) and 8(3)(c), the following is applicable:

A: The commodities must fit within the class or classes specified on the dealer's (registered) registration certificate to be purchased

B: Items which are:

- Intended for resale by the dealer

- Employed in the creation or perhaps the preparation of goods for sale

- Specifically concerning network communications

- When mining

- The production or distribution of power

- The production or delivery of electricity

- Used for the packaging of merchandise for sale

C Form PDF Contents

C forms can only be issued for the products listed in the Registration Certificate. It is necessary to engage in commerce and use the purchased goods as Raw Materials for production. The form can typically be used to buy Capital goods, with a few exceptions.

On a C form, the appropriate column should have the following details:

- Names of the buyer and seller

- The country where the license was granted

- The signature of the issuing body

- The place where the certificate was issued

- Date of issuance of the certificate

- Validity of the Declaration

- The addresses of the buyer and the seller

- Registration numbers for the buyer and the seller

- Details on how to contact the buyer and seller

- The specific serial number of the form

- Information about the items you purchased

- Name and signature of the authorised signatory

Importance of 'C' Form

The form is utilised when there is interstate trading. The buying dealer from another state files a "C Form" to demonstrate compliance with the "CST Rules" of the state of the selling dealer. The interstate sale offers the buyer the chance to purchase goods at a discount in exchange for a form.

A "C Form" can only be given to another registered dealer by registered dealer. The commodities covered by the issuing dealer's certificate of registration and raw materials, packing materials, and other commodities can typically be covered by it.

C Form Example

The following example will help you understand the effect:

Suppose Mr B, a registered dealer in Mumbai, wants to buy items from Mr A, a registered dealer in Hyderabad (AP). If Mr A issues him a "C" Form, Mr B should charge him CST at 2%, saving Mr A tax. Mr B, selling the items, will charge VAT at 4% or 12.5% on the goods. If the seller obtains a D.D. for the tax amount of the products sold to the buyer, he will be in a secure position. This D.D. that is gathered will be very helpful to the seller because, occasionally, the buyer will Fail to give form - C to the seller for unforeseen reasons.

Timeline to Issue Form C

The buyer must submit the form to the seller every quarter for the goods purchased during the quarter. A single bill can be issued in a particular quarter without financial restrictions; however, the total number of bills issued is capped at Rs. 1 crore.

Effects of not Issuing Form C Timely

If the form is not issued and approved timely, the buyer will not be eligible for discounts and will be forced to pay all taxes at regular rates. In addition to the taxes, the buyer must pay the applicable interest and penalties; however, they can be passed along to the customers.

How to get a C Form?

Here's how you can find a C form:

- C form can be found by visiting the TINXSYS website

- You can search by entering details such as the form type, state name, series number, and serial number

- And you will get the form to be downloaded

Conclusion

To receive all CST benefits, Form C must be given by the buying dealer to the selling dealer (Concessional rates). Offering these Form C benefits is primarily done to protect client interests and to lessen the impact of increasing tax rates.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.