Table of Contents

How to File ITR 1? Know Everything About ITR 1 or Sahaj Form

As per the government, there are seven different types of income tax forms, mandatory for a varied type of taxpayers. Out of these forms, the one that stands at the top position is ITR 1, which is also known as Sahaj. So, this post comprises all of the aspects and more that you must know about Sahaj.

Who is Supposed to File ITR Form?

According to the current law, the ITR 1 form is mandatory for people who come under the following category:

If you have Income from salary

If you have income from pension

If you have income from one house property (excluded such cases where the previous year’s case is brought forward)

If you have income from other sources (excluding income from racehorses or winning a lottery)

Who is not Eligible for ITR 1 Filing?

Accordingly, the Sahaj ITR (also known as ITR-1) cannot be filled by those individuals who come under the following category:

- If your total gross income is more than Rs. 50 lakhs

- If you are either a director of a firm/company or have an unlisted equity share at any time during the last financial year

- If you are a non-resident of India (NRI), or a resident not ordinarily resident (RNOR)

- If you have Earned Income through racehorses, legal gambling, lottery, more than one house property, agricultural (more than Rs. 5000), professional, business, or taxable Capital gains (long term and short terms)

- If you are an Indian resident with assets and financial interest outside the country or signing authority in any foreign account

- If you want to claim a relief in foreign tax paid or a double taxation relief under the sections of 90/90A/91

Talk to our investment specialist

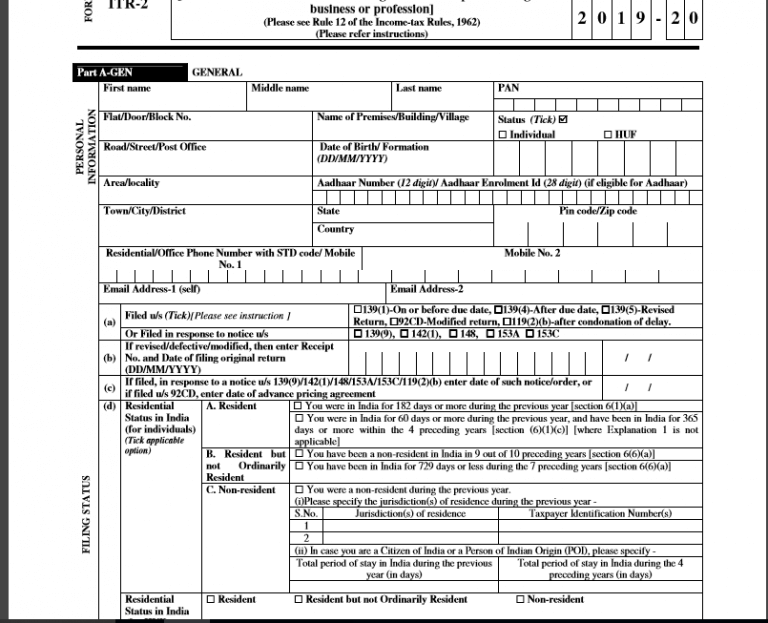

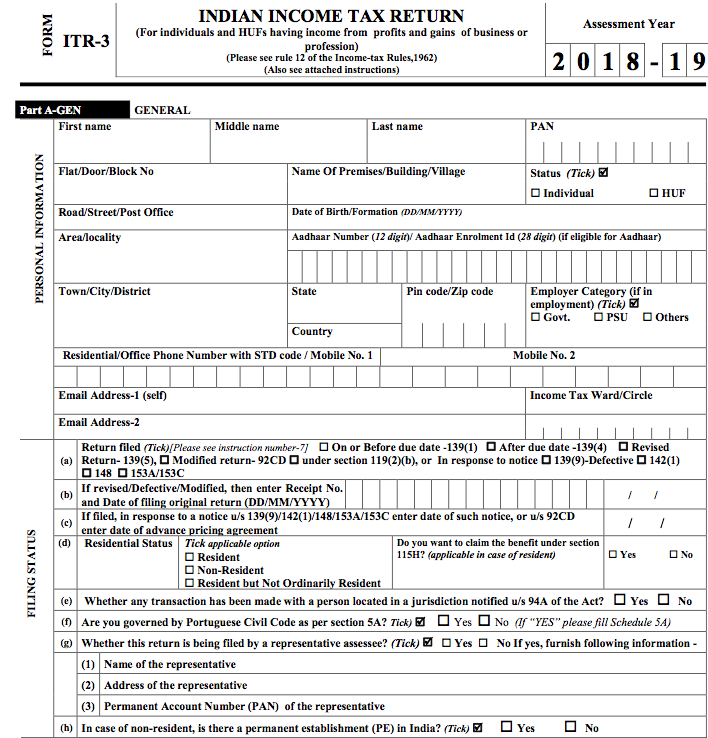

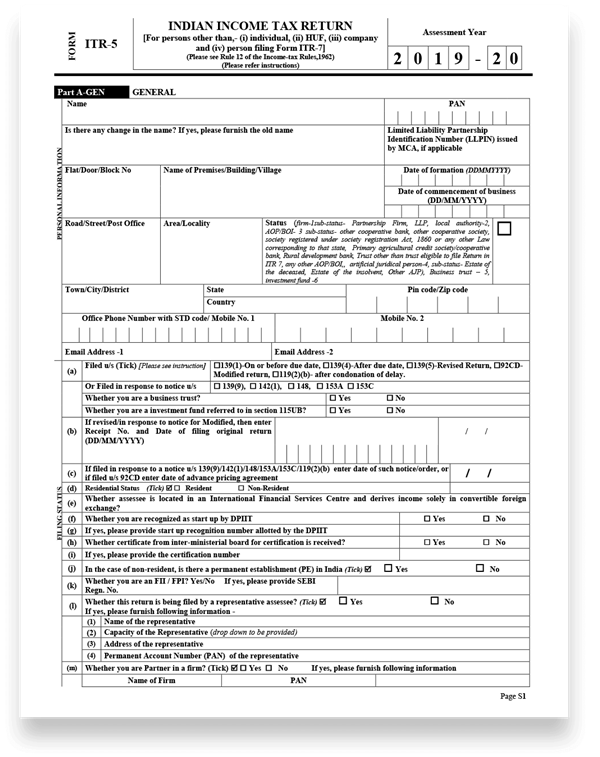

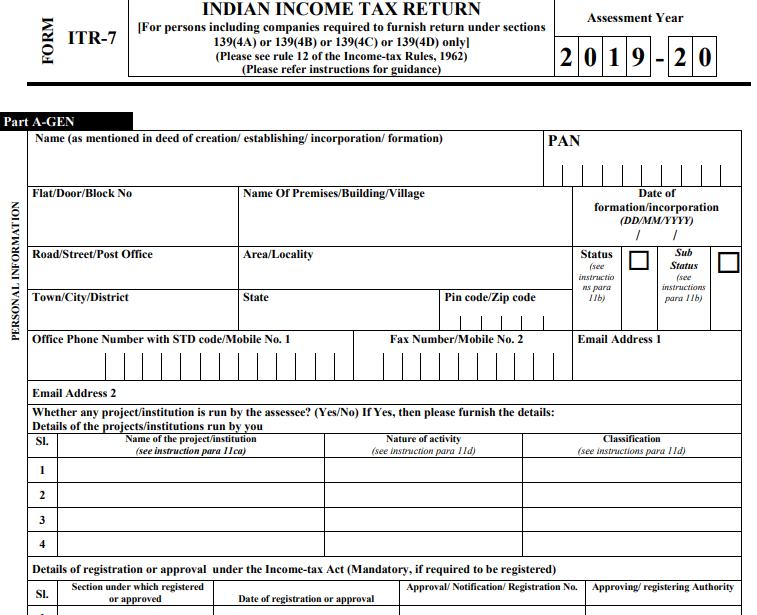

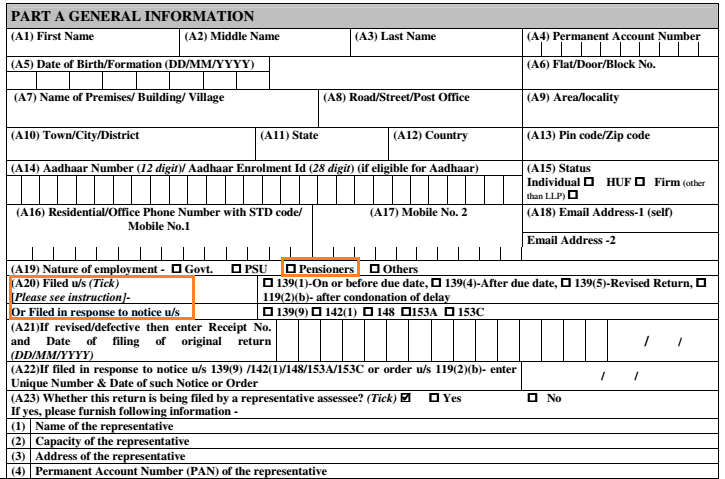

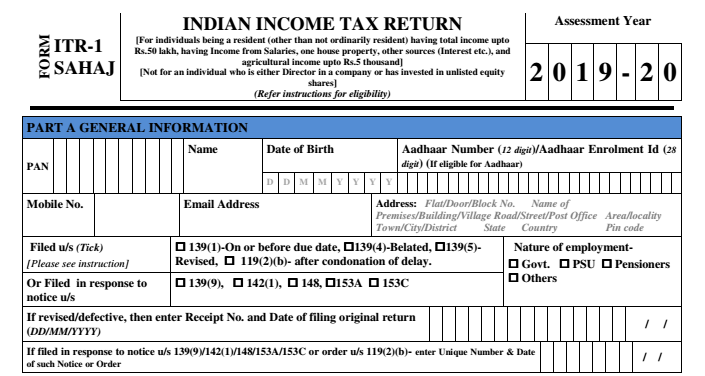

Structure of the Sahaj Form

Below-mentioned is how the ITR 1 Sahaj form looks like –

General Information

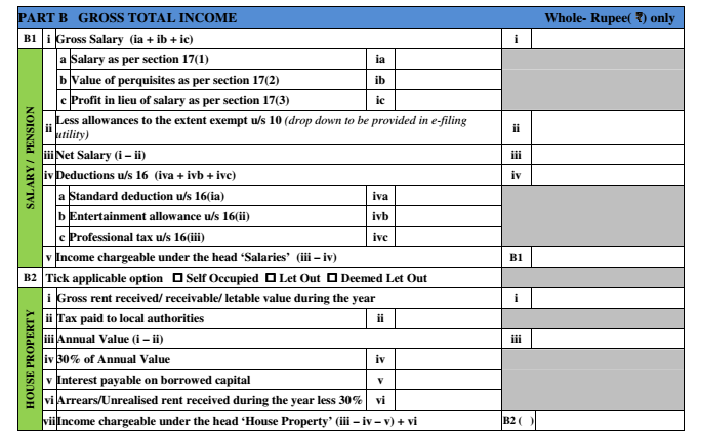

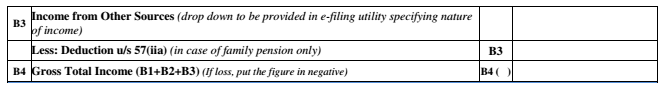

Gross Total Income

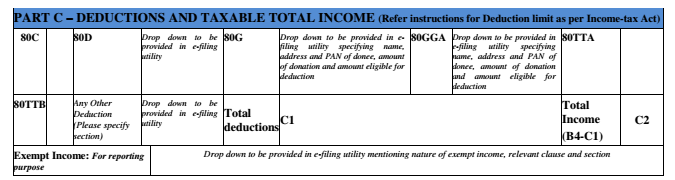

Deductions and Taxable Total Income

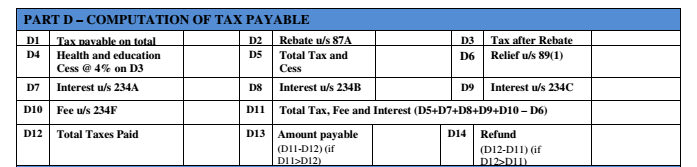

Computation of Tax Payable

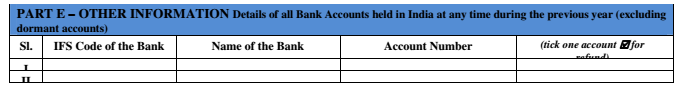

Other Information

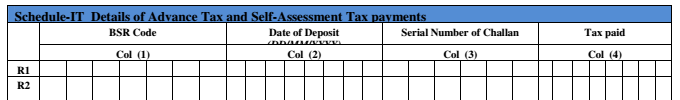

Details of Advance Tax and Self-Assessment Tax Payments

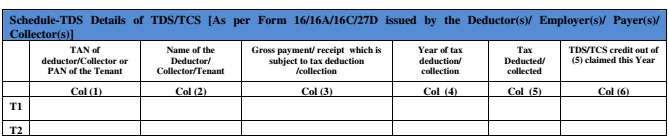

Schedule TDS – Detail of TDS/TCS

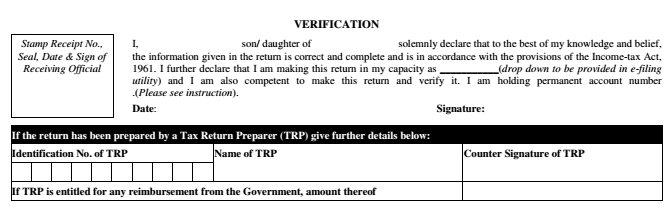

Verification

How Can You File Income Tax ITR-1?

There are two different methods of filing ITR Sahaj – online and offline.

Offline

In case you are thinking to submit the form online, then you must be either more than 80 years of age, be a HUF/Individual with an income of not more than Rs. Lakhs, or would not want to claim any refund.

For the online method, the return is submitted in a physical form. You will be issued an acknowledgement by the Income Tax Department during the submission.

Online

The ITR1 efiling is another method to fill up this form.

- Visit the government website for the same

- Click Prepare and submit ITR form once you have logged into your dashboard

- Now, choose ITR-Form 1

- Fill up your details and click the Submit button

- If applicable, upload your digital signature certificate (DSC)

- Click submit

The Significant Changes Made in ITR 1 Sahaj Form AY 2019-20:

ITR 1 form for the financial year 2018-19 is not applied to those individuals who are either director in a company or have invested funds in unlisted equity shares

In Part A, “Pensioners”, checkboxes have been given under the section of “Nature of employment”

For senior citizens, section 80TTB has been added

Under section return filed is segregated between filed in response to notices and normal filing

Under Income from house property, a new option – Deemed to be let out property – has been added

Deductions under salary is going to be divided into entertainment allowances, standard Deduction, and professional tax

Under Income from other sources, a separate column is added for deduction under section 57(IIA) – if the family pension is the income

Under the section of Income from other sources, taxpayers would have to provide income-wise detailed information

Conclusion

Now that you are aware of everything regarding ITR 1, find out if you are allowed to fill up this form. If yes, go ahead with the selection. Or, if not, then find your match today.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.