Table of Contents

Defining Tax Rate

In a tax system, the tax rate meaning is quite a simple and understandable one. It is referred to as a ratio, which is expressed in the percentage form, at which an individual or a company is taxed.

To put forth a tax rate, there is a variety of methods that a system uses. These are listed below.

Tax Rate Types

1. Statutory Tax Rate

This tax rate is legally imposed one. An income tax can have several statutory rates for varying Income levels. Expressed in percentage, a statutory tax rate is higher than the Effective Tax Rate.

2. Average Tax Rate

An Average Tax Rate is the total amount of paid Taxes to the total Tax Base, which is the taxable spending or income. The ratio between these two is expressed in the form of a percentage.

3. Marginal Tax Rate

A marginal tax rate is referred to the tax rate that is applied on income that is above the designated bracket.

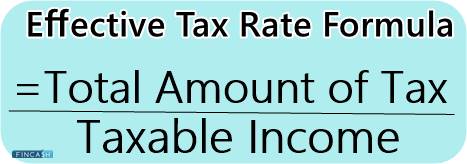

4. Effective Tax Rate

The effective tax rate is known as the percent of the income that a company or an individual pays in the form of taxes.

Talk to our investment specialist

Reasons to Levy Taxes

As obvious as it could be, countries tax residents to maintain the infrastructure and to develop their countries further. This collected tax is used for the betterment of living, society and that of the nation.

In several countries across the globe, a tax rate gets applied to certain types of money that taxpayers receive. This money could be anything, from income earned through salary or wages to income from investment, Capital gains, profits made, and more.

A percentage of the salary is taken by the government in the form of taxes. The taxes are levied according to the slab system in India.

What is the Income Tax Slab?

Income tax slab consists of a variety of tax rates that increase with an upsurge in the taxpayer’s income and vice versa. This taxation system allows a fair and progressive methodology in the country. Also, with every budget, these income tax slabs are changed and altered accordingly. Furthermore, these rates are different for different categories of taxpayers that are:

- Non-residents and residents with less than 60 years of age

- Resident senior citizens with 60 to 80 years of age

- Resident super senior citizens with more than 80 years of age

Income Tax Slab Rates for Financial Year 2020-2021 (AY 2021-2022)

The new tax regime for FY 2020-2021 is optional, which means that taxpayers can go with either of the options:

- To pay income tax at the lower rates only if they forgo a few deductions and exemptions available; or

- To pay taxes under the existing tax rates while availing exemptions and deductions

| Income Tax Slab Rate (FY 2020 – 2021) | For all individuals and HUF |

|---|---|

| ₹0.0 - ₹2.5 lakhs | Nil |

| ₹2.5 lakhs - ₹5 lakhs | 5% |

| ₹5 lakhs - ₹7.5 lakhs | 10% |

| ₹7.5 lakhs - ₹10 lakhs | 15% |

| ₹10 lakhs - ₹12.50 lakhs | 20% |

| ₹12.5 lakhs - ₹15 lakhs | 25% |

| >₹15 lakhs | 30% |

Note: This new tax regime is similar for all of the categories.

Income Tax Slab Rate for Old Tax Regime

| Income Tax Slab Rate (FY 2020 – 2021) | For individuals with age lesser than 60 years |

|---|---|

| ₹0.0 - ₹2.5 lakhs | Nil |

| ₹2.5 lakhs - ₹5 lakhs | 5% |

| ₹5 lakhs - ₹10 lakhs | 20% |

| >₹10 lakhs | 30% |

| Income Tax Slab Rate (FY 2020 – 2021) | For 60-80 years of age |

|---|---|

| ₹0.0 - ₹3 lakhs | Nil |

| ₹3 lakhs - ₹5 lakhs | 5% |

| ₹5 lakhs - ₹10 lakhs | 20% |

| >₹10 lakhs | 30% |

| Income Tax Slab Rate (FY 2020 – 2021) | For above 80 years of age |

|---|---|

| ₹0.0 - ₹5 lakhs | Nil |

| ₹5 lakhs - ₹10 lakhs | 20% |

| >₹10 lakhs | 30% |

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.