Table of Contents

Definition of Effective Tax Rate

The effective Tax Rate is the proportion of taxable Income from an individual's or company’s income. There are two types of effective rate: Individual effective rate and Statutory tax rate. The individual effective rate is the rate of tax levied on Earned Income of an individual, which can be either salary or wages and unearned income such as stock dividends, royalty.

In contrast to the statutory tax rate, the effective tax rate is the average rate at which a corporation's pre-tax profits are taxed by the government.

Effective Tax Rate: An Overview

The effective tax rate usually relates exclusively to individual or company income Taxes. There are a variety of taxes like Sales Tax, property tax, entertainment tax and so on that an individual owes, but the effective tax rate doesn’t take them into consideration. Individuals can determine their overall effective tax rate by multiplying their entire tax burden by their Taxable Income.

It is possible to compare the effective tax rates of two or more people or what a single individual may pay in taxes if they lived in a high-tax vs low-tax state.

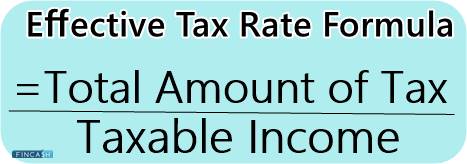

The calculation of the effective tax rate can be done as follow:

Effective Tax Rate = Total Amount of Tax/ Taxable Income

For instance, if your taxable income is 6,00,000 INR and you paid taxes of 17500 INR, then dividing 17500 by 600000 will give an effective tax rate of 0.029%.

Distinction Between Effective Tax Rate and Marginal Tax Rate

Many taxpayers are perplexed by the distinction between effective and marginal tax rates. The tax rate levied on the final amount of a taxpayer's income is known as the marginal tax rate, whereas the taxes levied on all the taxable incomes is termed as the effective tax rate.

There are three major reasons for the disparity between marginal and effective tax rates.

- Progressive nature of tax system

- Nature of income

- An enormous number of deductions and rebates to taxpayers

Tax Planning reduces the amount of tax you pay not just this year but over the course of your life. When determining how much tax you owe, it is a common misconception that what you must pay is based on the marginal tax rate that corresponds with your tax bracket and your total income. In the first place, you should realise that the effective tax rate depends on your net income after standard deductions or itemised tax deductions.

Along with the above-the-line adjustments to income and the qualifying business income Deduction have been subtracted.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.