Table of Contents

Average Tax Rate

What is the Average Tax Rate?

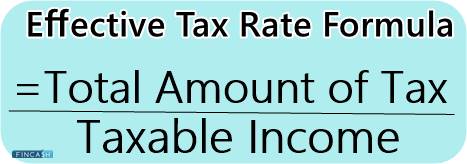

The average Tax Rate is the tax rate an individual pays when he/she adds all sources of Income that is taxable and divides into the amount of Taxes the individual actually owes. It is also known as the Effective Tax Rate. In simple words, an individual can calculate the average tax rate and divide the total tax Obligation by the total Taxable Income. The average tax rate will always be lower than the marginal tax rates.

Average tax rates apply to income taxes and don’t take into account the state a local income taxes, sales taxes, property taxes or the other taxes the individual might pay.

Basically, it is employed to understand the financial advantage or disadvantage.

Example of Average Tax Rate

For instance, Rajesh earned Rs. 1 lakh in 2019. Now, according to the tax bracket for the year Rajesh pays Rs. 15,000 as tax since his average tax rate is 15%. The average tax rate is a measure of an individual’s tax burden and also shows the individual’s ability of consumption in the present or through saving in the future.

Average tax rates are also calculated for companies -

For example, a company earned Rs. 2 lakhs and paid Rs. 50,000 in taxes. That means the average tax rate is equal to 50,000/200,000 would be 0.25. That means the company has paid an average tax rate of 25% in taxes on income.

Talk to our investment specialist

Importance of Average Tax Rate

The average tax rate is often considered as a profitability indicator that investors look for in a company. This amount is subject to fluctuation. It can be difficult to identify why the tax rate drops based on the circumstance. For example, the company would be engaging in activities to reduce the tax burden rather than in other improvements.

Companies pay two different financial statements. One is used for reporting, like income statements, and the other for tax purposes. The actual tax expenses are subject to variation in these two documents.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.