+91-22-48913909

+91-22-48913909

Table of Contents

- એકસાથે મ્યુચ્યુઅલ ફંડ રોકાણ માટે ટિપ્સ

- શ્રેષ્ઠ મ્યુચ્યુઅલ ફંડમાં ઓનલાઈન કેવી રીતે રોકાણ કરવું?

- શ્રેષ્ઠ લમ્પસમ ઇક્વિટી મ્યુચ્યુઅલ ફંડ્સ 2022 - 2023

- શ્રેષ્ઠ લમ્પસમ ડેટ ફંડ્સ 2022 - 2023

- શ્રેષ્ઠ લમ્પસમ હાઇબ્રિડ ફંડ્સ 2022 - 2023

- ટોચના 5 લમ્પ સમ બેલેન્સ્ડ મ્યુચ્યુઅલ ફંડ્સ

- ટોચના 5 એકસાથે આક્રમક હાઇબ્રિડ ફંડ્સ

- ટોચના 5 એકસાથે કન્ઝર્વેટિવ હાઇબ્રિડ ફંડ્સ

- ટોચના 5 લમ્પ સમ આર્બિટ્રેજ ફંડ્સ

- ટોચના 5 એકસાથે ડાયનેમિક એલોકેશન ફંડ

- ટોચના 5 એકસાથે મલ્ટિ એસેટ ફાળવણી ફંડ

- ટોચના 5 લમ્પ સમ ઇક્વિટી સેવિંગ્સ ફંડ્સ

- ટોચની 5 લમ્પ સમ સોલ્યુશન ઓરિએન્ટેડ સ્કીમ્સ

- 1 મહિનાની કામગીરી પર શ્રેષ્ઠ એકસાથે મ્યુચ્યુઅલ ફંડ

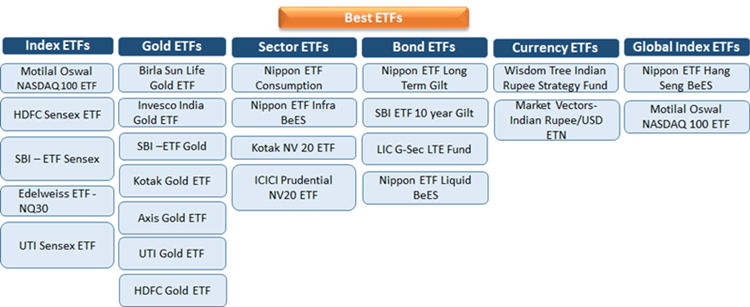

Top 4 Gold - Gold Funds

2022 - 2023 માટે 5 શ્રેષ્ઠ પર્ફોર્મિંગ એકમ રોકાણ

ભારતમાં મ્યુચ્યુઅલ ફંડ યોજનાઓ વર્ષોથી વિકસતી ગઈ છે. પરિણામે, ધશ્રેષ્ઠ પ્રદર્શન કરનાર મ્યુચ્યુઅલ ફંડ માંબજાર બદલતા રહો. ક્રિસિલ, મોર્નિંગ સ્ટાર, ICRA વગેરે જેવી મ્યુચ્યુઅલ ફંડ સ્કીમને નક્કી કરવા માટે વિવિધ રેટિંગ સિસ્ટમ્સ છે.

આ સિસ્ટમો ગુણાત્મક અને જથ્થાત્મક પરિબળો જેમ કે વળતર, પર આધારિત મ્યુચ્યુઅલ ફંડનું મૂલ્યાંકન કરે છે.પ્રમાણભૂત વિચલન, ફંડ વય, વગેરે. આ તમામ પરિબળોનો સરવાળો શ્રેષ્ઠ પ્રદર્શન કરનારનું રેટિંગ તરફ દોરી જાય છેમ્યુચ્યુઅલ ફંડ ભારતમાં.

એકસાથે મ્યુચ્યુઅલ ફંડ રોકાણ માટે ટિપ્સ

શ્રેષ્ઠ પ્રદર્શન કરતા મ્યુચ્યુઅલ ફંડ્સમાં રોકાણ કરવાની એક સંપૂર્ણ રીત છે તેના ગુણાત્મક અને માત્રાત્મક પગલાં, જેમ કે:

સ્કીમ એસેટ સાઈઝ

રોકાણકારોએ હંમેશા એવા ફંડ માટે જવું જોઈએ જે ન તો ખૂબ મોટું હોય અને ન તો ખૂબ નાનું હોય. જ્યારે ફંડના કદ વચ્ચે કોઈ સંપૂર્ણ વ્યાખ્યા અને સંબંધ નથી, એવું કહેવાય છે કે ખૂબ નાનું અને ખૂબ મોટું બંને, ફંડની કામગીરીને અવરોધી શકે છે. કોઈપણ સ્કીમમાં ઓછી એસેટ અંડર મેનેજમેન્ટ (AUM) ખૂબ જોખમી છે કારણ કે તમે જાણતા નથી કે રોકાણકારો કોણ છે અને કોઈ ચોક્કસ સ્કીમમાં તેઓનું કેટલું રોકાણ છે. આમ, ફંડ પસંદ કરતી વખતે, એ સલાહ આપવામાં આવે છે કે જેની AUM લગભગ શ્રેણી જેટલી જ હોય.

ફંડ ઉંમર

શ્રેષ્ઠ પ્રદર્શન કરતા મ્યુચ્યુઅલ ફંડમાં રોકાણ કરવા માટે, રોકાણકારોએ અમુક સમયગાળા માટે ફંડના પ્રદર્શનનું યોગ્ય મૂલ્યાંકન કરવું જોઈએ. ઉપરાંત, 4-5 વર્ષમાં સતત વળતર આપતી સ્કીમ પર જવાનું સૂચન કરવામાં આવે છે.

શ્રેષ્ઠ મ્યુચ્યુઅલ ફંડમાં ઓનલાઈન કેવી રીતે રોકાણ કરવું?

Fincash.com પર આજીવન માટે મફત રોકાણ ખાતું ખોલો.

તમારી નોંધણી અને KYC પ્રક્રિયા પૂર્ણ કરો

દસ્તાવેજો અપલોડ કરો (PAN, આધાર, વગેરે).અને, તમે રોકાણ કરવા તૈયાર છો!

શ્રેષ્ઠ લમ્પસમ ઇક્વિટી મ્યુચ્યુઅલ ફંડ્સ 2022 - 2023

નીચે ટોચના ક્રમાંકિત ફંડ્સ છેઇક્વિટી કેટેગરી જેવી કે લાર્જ-, મિડ-, સ્મોલ-, મલ્ટી-કેપ ફંડ્સ,ELSS અને ક્ષેત્રીય ભંડોળ.

ટોચના 5 લમ્પ સમ લાર્જ કેપ ઇક્વિટી મ્યુચ્યુઅલ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 5,000 9.2 12.5 15.4 21.9 12.6 Nippon India Large Cap Fund Growth ₹86.2827

↓ -0.10 ₹37,546 5,000 4.8 -1 8.5 20 27.6 18.2 DSP BlackRock TOP 100 Equity Growth ₹466.174

↓ -1.15 ₹5,070 1,000 7.4 1.6 17.2 19.4 23.1 20.5 ICICI Prudential Bluechip Fund Growth ₹106.09

↓ -0.26 ₹64,963 5,000 5.3 -0.8 10.1 17.8 25.6 16.9 HDFC Top 100 Fund Growth ₹1,110.04

↓ -3.03 ₹36,109 5,000 4.5 -1.9 7.4 16.7 24.9 11.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23

Talk to our investment specialist

ટોચના 5 લમ્પ સમ મિડ કેપ ઇક્વિટી મ્યુચ્યુઅલ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Motilal Oswal Midcap 30 Fund Growth ₹93.7774

↓ -0.75 ₹26,028 5,000 -3.4 -11 14.4 26.7 37.5 57.1 Edelweiss Mid Cap Fund Growth ₹93.831

↓ -0.29 ₹8,634 5,000 1.2 -3.8 17.4 23.2 34.2 38.9 SBI Magnum Mid Cap Fund Growth ₹229.041

↑ 0.70 ₹20,890 5,000 2 -3.6 9.7 17.8 32.4 20.3 ICICI Prudential MidCap Fund Growth ₹267.21

↓ -0.30 ₹5,796 5,000 1.1 -5.6 6.4 19.1 31.1 27 Invesco India Mid Cap Fund Growth ₹160.49

↓ -0.31 ₹5,779 5,000 3.2 -1.3 19.3 23.2 31.1 43.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 લમ્પ સમ સ્મોલ કેપ મ્યુચ્યુઅલ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) L&T Emerging Businesses Fund Growth ₹75.5889

↓ -0.36 ₹13,334 5,000 -3.6 -11.5 1.9 18.2 36 28.5 Franklin India Smaller Companies Fund Growth ₹161.691

↓ -0.05 ₹11,970 5,000 0.1 -7.9 2.5 21.5 35.2 23.2 HDFC Small Cap Fund Growth ₹126.507

↑ 0.29 ₹30,223 5,000 -1.2 -6.7 1.8 19.6 35.1 20.4 Kotak Small Cap Fund Growth ₹243.954

↓ -0.74 ₹15,706 5,000 -1.8 -10.8 5.9 14 34.1 25.5 ICICI Prudential Smallcap Fund Growth ₹80.75

↑ 0.13 ₹7,392 5,000 -0.8 -7.8 2.9 16.3 34 15.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોપ 5 લમ્પ સમ ડાઇવર્સિફાઇડ/મલ્ટી કેપ ઇક્વિટી મ્યુચ્યુઅલ ફંડ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) JM Multicap Fund Growth ₹95.5574

↑ 0.03 ₹5,263 5,000 -0.6 -7.7 6.7 23.6 28.8 33.3 Nippon India Multi Cap Fund Growth ₹279.845

↓ -0.31 ₹38,637 5,000 4.5 -4.3 8.8 22.9 32.9 25.8 IDBI Diversified Equity Fund Growth ₹37.99

↑ 0.14 ₹382 5,000 10.2 13.2 13.5 22.7 12 HDFC Equity Fund Growth ₹1,919.86

↓ -6.21 ₹69,639 5,000 7.5 2 17.1 22.7 31.4 23.5 Motilal Oswal Multicap 35 Fund Growth ₹57.3974

↓ -0.71 ₹12,267 5,000 1.9 -6 15.4 21 23 45.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચની 5 લમ્પ સમ (ELSS) ઇક્વિટી લિંક્ડ સેવિંગ સ્કીમ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹419.168

↓ -0.45 ₹27,730 500 2.4 -3.4 9 24 29.8 27.7 Motilal Oswal Long Term Equity Fund Growth ₹47.4269

↓ -0.39 ₹3,817 500 -0.1 -10.3 8.4 23.3 27.5 47.7 HDFC Tax Saver Fund Growth ₹1,362.92

↓ -3.81 ₹15,556 500 7.3 1.1 14.8 22.6 28.9 21.3 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 500 9.7 15.1 16.9 20.8 10 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 500 1.2 15.4 35.5 20.6 17.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 લમ્પ સમ સેક્ટર ઇક્વિટી મ્યુચ્યુઅલ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI PSU Fund Growth ₹31.2291

↓ -0.03 ₹4,789 5,000 7.6 -1.1 2.8 30.5 32 23.5 Franklin India Opportunities Fund Growth ₹238.572

↓ -0.63 ₹6,047 5,000 2 -2.6 12.4 29.3 33 37.3 Invesco India PSU Equity Fund Growth ₹59.89

↓ -0.16 ₹1,217 5,000 6.2 -4 3.4 28.7 29.7 25.6 HDFC Infrastructure Fund Growth ₹45.116

↓ -0.08 ₹2,329 5,000 4.2 -4.2 3.6 28.5 35.8 23 ICICI Prudential Infrastructure Fund Growth ₹182.84

↑ 0.07 ₹7,214 5,000 3.9 -3.7 6.4 28.2 39.6 27.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

શ્રેષ્ઠ લમ્પસમ ડેટ ફંડ્સ 2022 - 2023

નીચે લિક્વિડ, અલ્ટ્રા શોર્ટ, શોર્ટ ટર્મ, ગિલ્ટ, ક્રેડિટ રિસ્ક અને કોર્પોરેટ જેવી ડેટ કેટેગરીના ટોચના ક્રમાંકિત ફંડ્સ છેડેટ ફંડ.

ટોચના 5 એકસાથે અલ્ટ્રા શોર્ટ ટર્મ ડેટ મ્યુચ્યુઅલ ફંડ્સ

અલ્ટ્રાટૂંકા ગાળાના ભંડોળ ઓછા જોખમી સ્થિર વળતર સાથે 6-12 મહિનાના સમયગાળા માટે સારું રોકાણ છે કારણ કે તેઓ 6-12 મહિનાની વચ્ચેની પરિપક્વતા સાથે ટૂંકા ગાળાના ડેટ સાધનોમાં કોર્પસનું રોકાણ કરે છે.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Savings Fund Growth ₹541.511

↑ 0.21 ₹13,294 1,000 2.3 4.1 8 7.1 7.9 7.75% 6M 25D 7M 28D SBI Magnum Ultra Short Duration Fund Growth ₹5,904.36

↑ 1.54 ₹12,470 5,000 2.1 3.8 7.6 6.7 7.4 7.28% 5M 8D 8M 16D ICICI Prudential Ultra Short Term Fund Growth ₹27.362

↑ 0.01 ₹12,674 5,000 2.1 3.9 7.5 6.8 7.5 7.53% 5M 8D 7M 28D Invesco India Ultra Short Term Fund Growth ₹2,665.84

↑ 0.64 ₹859 5,000 2.1 3.8 7.4 6.6 7.5 7.49% 6M 13D 7M 2D Kotak Savings Fund Growth ₹42.3815

↑ 0.01 ₹11,873 5,000 2.1 3.8 7.4 6.6 7.2 7.32% 6M 4D 6M 14D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 લમ્પ રકમ શોર્ટ ટર્મ ડેટ મ્યુચ્યુઅલ ફંડ્સ

ટૂંકા ગાળાના ફંડો ઓછા જોખમવાળા સ્થિર વળતર સાથે 1-2 વર્ષના સમયગાળા માટે સારું રોકાણ છે કારણ કે તેઓ 1 થી 3 વર્ષની વચ્ચેની પરિપક્વતાવાળા ડેટ સાધનોમાં કોર્પસનું રોકાણ કરે છે.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sundaram Short Term Debt Fund Growth ₹36.3802

↑ 0.01 ₹362 5,000 0.8 11.4 12.8 5.3 4.52% 1Y 2M 13D 1Y 7M 3D Axis Short Term Fund Growth ₹30.6127

↑ 0.01 ₹9,024 5,000 3.2 5 9.5 7.2 8 7.48% 2Y 9M 4D 3Y 7M 20D IDFC Bond Fund Short Term Plan Growth ₹56.624

↑ 0.01 ₹9,674 5,000 3.1 4.9 9.5 7 7.8 7.38% 2Y 10M 17D 3Y 8M 16D HDFC Short Term Debt Fund Growth ₹31.7102

↑ 0.01 ₹14,208 5,000 3.1 4.8 9.5 7.4 8.3 7.47% 2Y 9M 22D 4Y 2M 5D Nippon India Short Term Fund Growth ₹52.2745

↑ 0.00 ₹6,232 5,000 3.1 4.9 9.5 7 8 7.65% 2Y 9M 3Y 7M 13D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21

ટોચના 5 લમ્પ સમ લિક્વિડ મ્યુચ્યુઅલ ફંડ્સ

લિક્વિડ ફંડ્સ ઓછા જોખમી સ્થિર વળતર સાથે એક દિવસથી 90 દિવસના સમયગાળા માટે સારું રોકાણ છે કારણ કે તેઓ કોર્પસનું રોકાણ કરે છેમની માર્કેટ એક સપ્તાહથી 3 મહિનાની વચ્ચેની પાકતી મુદત સાથેના દેવાનાં સાધનો.

Fund NAV Net Assets (Cr) Min Investment 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹2,874.17

↑ 0.48 ₹32,609 500 0.7 1.9 3.7 7.3 7.4 7.08% 2M 4D 2M 4D DSP BlackRock Liquidity Fund Growth ₹3,685.15

↑ 0.60 ₹15,829 1,000 0.7 1.8 3.6 7.3 7.4 6.95% 1M 20D 1M 28D Invesco India Liquid Fund Growth ₹3,547.97

↑ 0.60 ₹10,945 5,000 0.7 1.9 3.6 7.3 7.4 7.01% 2M 5D 2M 5D Aditya Birla Sun Life Liquid Fund Growth ₹415.972

↑ 0.07 ₹41,051 5,000 0.7 1.9 3.6 7.3 7.3 7.2% 2M 8D 2M 8D UTI Liquid Cash Plan Growth ₹4,234.93

↑ 0.68 ₹23,383 500 0.7 1.9 3.6 7.3 7.3 7% 2M 2D 2M 2D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 લમ્પ સમ GILT મ્યુચ્યુઅલ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Magnum Gilt Fund Growth ₹66.8857

↓ 0.00 ₹11,489 5,000 4.7 6.1 12.3 8.8 8.9 6.97% 10Y 2M 1D 24Y 14D DSP BlackRock Government Securities Fund Growth ₹97.284

↓ -0.03 ₹1,566 1,000 4.8 5.9 12.9 8.6 10.1 7.04% 11Y 6M 29Y 2M 26D ICICI Prudential Gilt Fund Growth ₹102.797

↑ 0.06 ₹7,133 5,000 4.2 6 11.2 8.5 8.2 6.94% 7Y 22D 15Y 9M 14D Axis Gilt Fund Growth ₹25.8793

↓ 0.00 ₹868 5,000 4.7 6.3 13 8.4 10 7% 10Y 2M 16D 25Y 1M 17D Invesco India Gilt Fund Growth ₹2,880.04

↓ -0.31 ₹953 5,000 4.6 5.8 12.5 8.2 10 6.96% 11Y 11D 26Y 10M 2D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 એકસાથે કોર્પોરેટ બોન્ડ મ્યુચ્યુઅલ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity ICICI Prudential Corporate Bond Fund Growth ₹29.5531

↑ 0.01 ₹29,929 5,000 3.1 4.9 9.3 7.7 8 7.37% 2Y 11M 5D 4Y 11M 26D Nippon India Prime Debt Fund Growth ₹59.5549

↑ 0.01 ₹6,738 1,000 3.5 5.2 10.1 7.7 8.4 7.44% 3Y 10M 6D 5Y 2M 26D Aditya Birla Sun Life Corporate Bond Fund Growth ₹112.22

↑ 0.02 ₹24,570 1,000 3.4 5.1 10.2 7.7 8.5 7.31% 3Y 5M 16D 4Y 9M 14D HDFC Corporate Bond Fund Growth ₹32.3282

↓ 0.00 ₹32,527 5,000 3.3 5 9.9 7.5 8.6 7.31% 3Y 9M 5Y 10M 2D Kotak Corporate Bond Fund Standard Growth ₹3,742.06

↑ 0.81 ₹14,639 5,000 3.3 5 9.8 7.3 8.3 7.31% 3Y 2M 8D 4Y 5M 8D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 લમ્પ સમ ક્રેડિટ રિસ્ક મ્યુચ્યુઅલ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity DSP BlackRock Credit Risk Fund Growth ₹48.7643

↑ 0.02 ₹207 1,000 15.6 17.7 22.5 14 7.8 7.81% 2Y 2M 8D 2Y 11M 12D Franklin India Credit Risk Fund Growth ₹25.3348

↑ 0.04 ₹104 5,000 2.9 5 7.5 11 0% Aditya Birla Sun Life Credit Risk Fund Growth ₹21.9718

↑ 0.01 ₹970 1,000 6.4 8.2 17.2 10.7 11.9 8.29% 2Y 5M 16D 3Y 9M 29D Invesco India Credit Risk Fund Growth ₹1,915.88

↑ 0.62 ₹144 5,000 5 6.7 10.9 8.8 7.3 7.24% 3Y 1M 10D 4Y 3M 25D SBI Credit Risk Fund Growth ₹45.1066

↑ 0.01 ₹2,255 5,000 2.8 4.8 9.3 7.7 8.1 8.51% 2Y 2M 12D 3Y 14D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

શ્રેષ્ઠ લમ્પસમ હાઇબ્રિડ ફંડ્સ 2022 - 2023

નીચે વિવિધ શ્રેણીઓમાંથી ટોચના ક્રમાંકિત ફંડ્સ છે જેમ કે. આક્રમક, રૂઢિચુસ્ત, આર્બિટ્રેજ, ગતિશીલ ફાળવણી, મલ્ટી એસેટ, ઇક્વિટી બચત અને ઉકેલ લક્ષી

વર્ણસંકરયોજનાઓ

ટોચના 5 લમ્પ સમ બેલેન્સ્ડ મ્યુચ્યુઅલ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) JM Equity Hybrid Fund Growth ₹117.656

↓ -0.02 ₹768 5,000 2.2 -5.9 6 20.9 28.2 27 HDFC Balanced Advantage Fund Growth ₹503.309

↓ -0.55 ₹90,375 5,000 3.8 0.2 9.3 19.5 26.2 16.7 ICICI Prudential Equity and Debt Fund Growth ₹380.97

↓ -0.91 ₹40,962 5,000 6.8 1.9 11.6 18.6 27.6 17.2 UTI Multi Asset Fund Growth ₹72.3016

↓ -0.10 ₹5,285 5,000 3.4 0.4 10 18.4 18.5 20.7 ICICI Prudential Multi-Asset Fund Growth ₹737.218

↑ 2.62 ₹55,360 5,000 5.5 3.8 13.5 18.4 26.1 16.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 એકસાથે આક્રમક હાઇબ્રિડ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) JM Equity Hybrid Fund Growth ₹117.656

↓ -0.02 ₹768 5,000 2.2 -5.9 6 20.9 28.2 27 ICICI Prudential Equity and Debt Fund Growth ₹380.97

↓ -0.91 ₹40,962 5,000 6.8 1.9 11.6 18.6 27.6 17.2 UTI Hybrid Equity Fund Growth ₹393.676

↓ -0.35 ₹5,910 1,000 3.1 -0.6 12.6 17.1 23.6 19.7 DSP BlackRock Equity and Bond Fund Growth ₹353.331

↓ -0.55 ₹10,425 1,000 6.5 2.7 18.4 16.1 20.5 17.7 Sundaram Equity Hybrid Fund Growth ₹135.137

↑ 0.78 ₹1,954 5,000 0.5 10.5 27.1 16 14.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 એકસાથે કન્ઝર્વેટિવ હાઇબ્રિડ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) JM Equity Hybrid Fund Growth ₹117.656

↓ -0.02 ₹768 5,000 2.2 -5.9 6 20.9 28.2 27 HDFC Balanced Advantage Fund Growth ₹503.309

↓ -0.55 ₹90,375 5,000 3.8 0.2 9.3 19.5 26.2 16.7 ICICI Prudential Equity and Debt Fund Growth ₹380.97

↓ -0.91 ₹40,962 5,000 6.8 1.9 11.6 18.6 27.6 17.2 UTI Multi Asset Fund Growth ₹72.3016

↓ -0.10 ₹5,285 5,000 3.4 0.4 10 18.4 18.5 20.7 ICICI Prudential Multi-Asset Fund Growth ₹737.218

↑ 2.62 ₹55,360 5,000 5.5 3.8 13.5 18.4 26.1 16.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 લમ્પ સમ આર્બિટ્રેજ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Equity Arbitrage Fund Growth ₹37.0782

↑ 0.01 ₹60,373 5,000 1.8 3.7 7.4 6.9 5.7 7.8 UTI Arbitrage Fund Growth ₹34.6633

↑ 0.00 ₹6,614 5,000 1.8 3.7 7.4 6.7 5.5 7.7 ICICI Prudential Equity Arbitrage Fund Growth ₹33.9386

↑ 0.00 ₹25,727 5,000 1.8 3.7 7.3 6.7 5.5 7.6 HDFC Arbitrage Fund Growth ₹30.318

↑ 0.00 ₹18,350 100,000 1.7 3.6 7.3 6.7 5.4 7.7 Invesco India Arbitrage Fund Growth ₹31.5579

↑ 0.00 ₹19,675 5,000 1.7 3.6 7.3 6.9 5.6 7.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 એકસાથે ડાયનેમિક એલોકેશન ફંડ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Balanced Advantage Fund Growth ₹503.309

↓ -0.55 ₹90,375 5,000 3.8 0.2 9.3 19.5 26.2 16.7 Axis Dynamic Equity Fund Growth ₹20.56

↓ -0.05 ₹2,808 5,000 3.6 1.6 13.7 14.1 14.5 17.5 ICICI Prudential Balanced Advantage Fund Growth ₹71.5

↓ -0.18 ₹60,591 5,000 4.6 2.6 10.4 12.8 17.4 12.3 Aditya Birla Sun Life Balanced Advantage Fund Growth ₹103.31

↓ -0.18 ₹7,321 1,000 4.9 2.3 11.8 12.7 16.7 13 Nippon India Balanced Advantage Fund Growth ₹172.389

↓ -0.37 ₹8,808 5,000 3.8 1.6 9.3 12.6 16.1 13 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 એકસાથે મલ્ટિ એસેટ ફાળવણી ફંડ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹72.3016

↓ -0.10 ₹5,285 5,000 3.4 0.4 10 18.4 18.5 20.7 ICICI Prudential Multi-Asset Fund Growth ₹737.218

↑ 2.62 ₹55,360 5,000 5.5 3.8 13.5 18.4 26.1 16.1 Edelweiss Multi Asset Allocation Fund Growth ₹61.21

↓ -0.16 ₹2,487 5,000 3.8 -0.1 11.7 16.7 22.3 20.2 SBI Multi Asset Allocation Fund Growth ₹56.8204

↑ 0.09 ₹7,674 5,000 4 1.4 9.4 14.3 15.4 12.8 HDFC Multi-Asset Fund Growth ₹69.504

↓ -0.05 ₹3,837 5,000 5 2.7 11.4 13.5 18.8 13.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચના 5 લમ્પ સમ ઇક્વિટી સેવિંગ્સ ફંડ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) L&T Equity Savings Fund Growth ₹31.7502

↓ -0.06 ₹624 5,000 -1.2 -2.1 6.8 11.1 14.8 24 Kotak Equity Savings Fund Growth ₹25.5059

↓ -0.02 ₹8,043 5,000 2.4 1.9 8 11 13 11.7 Principal Equity Savings Fund Growth ₹68.6905

↓ -0.07 ₹976 5,000 2.7 1.7 8.8 10.9 14.9 12.6 DSP BlackRock Equity Savings Fund Growth ₹21.618

↓ -0.01 ₹2,517 1,000 3.7 3.1 11.8 10.4 13.2 12.1 Edelweiss Equity Savings Fund Growth ₹24.5177

↓ -0.03 ₹577 5,000 2.6 3 10.3 10.2 11.7 13.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

ટોચની 5 લમ્પ સમ સોલ્યુશન ઓરિએન્ટેડ સ્કીમ્સ

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Retirement Savings Fund - Equity Plan Growth ₹48.913

↓ -0.07 ₹5,983 5,000 4.3 -2 9.3 18.8 29.4 18 ICICI Prudential Child Care Plan (Gift) Growth ₹308.55

↓ -0.36 ₹1,273 5,000 4 -0.6 6.8 17.5 21.3 16.9 HDFC Retirement Savings Fund - Hybrid - Equity Plan Growth ₹37.366

↓ -0.05 ₹1,567 5,000 3.4 -1.3 8.1 15 21 14 Tata Retirement Savings Fund - Progressive Growth ₹62.3074

↓ -0.11 ₹1,914 5,000 1.1 -4.1 9.5 14.7 19.6 21.7 Tata Retirement Savings Fund-Moderate Growth ₹61.6721

↓ -0.17 ₹2,008 5,000 1.6 -2.3 10.5 14 18.1 19.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 25

1 મહિનાની કામગીરી પર શ્રેષ્ઠ એકસાથે મ્યુચ્યુઅલ ફંડ

The investment objective of the Scheme is to seek to provide returns that closely correspond to returns provided by Reliance ETF Gold BeES. Nippon India Gold Savings Fund is a Gold - Gold fund was launched on 7 Mar 11. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Gold Savings Fund Returns up to 1 year are on To provide returns that closely corresponds to returns provided by Invesco India Gold Exchange Traded Fund. Invesco India Gold Fund is a Gold - Gold fund was launched on 5 Dec 11. It is a fund with Moderately High risk and has given a Below is the key information for Invesco India Gold Fund Returns up to 1 year are on ICICI Prudential Regular Gold Savings Fund (the Scheme) is a fund of funds scheme with the primary objective to generate returns by investing in units of ICICI Prudential Gold Exchange Traded Fund (IPru Gold ETF).

However, there can be no assurance that the investment objectives of the Scheme will be realized. ICICI Prudential Regular Gold Savings Fund is a Gold - Gold fund was launched on 11 Oct 11. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Regular Gold Savings Fund Returns up to 1 year are on To generate returns that closely correspond to returns generated by Axis Gold ETF. Axis Gold Fund is a Gold - Gold fund was launched on 20 Oct 11. It is a fund with Moderately High risk and has given a Below is the key information for Axis Gold Fund Returns up to 1 year are on 1. Nippon India Gold Savings Fund

CAGR/Annualized return of 9.7% since its launch. Return for 2024 was 19% , 2023 was 14.3% and 2022 was 12.3% . Nippon India Gold Savings Fund

Growth Launch Date 7 Mar 11 NAV (24 Apr 25) ₹37.2056 ↑ 0.06 (0.15 %) Net Assets (Cr) ₹2,744 on 31 Mar 25 Category Gold - Gold AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 0.34 Sharpe Ratio 1.55 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (2%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹9,956 31 Mar 22 ₹11,456 31 Mar 23 ₹13,213 31 Mar 24 ₹14,599 31 Mar 25 ₹19,055 Returns for Nippon India Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 10.3% 3 Month 18.7% 6 Month 22.2% 1 Year 32.1% 3 Year 20.7% 5 Year 13.1% 10 Year 15 Year Since launch 9.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 19% 2023 14.3% 2022 12.3% 2021 -5.5% 2020 26.6% 2019 22.5% 2018 6% 2017 1.7% 2016 11.6% 2015 -8.1% Fund Manager information for Nippon India Gold Savings Fund

Name Since Tenure Himanshu Mange 23 Dec 23 1.19 Yr. Data below for Nippon India Gold Savings Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.07% Other 96.93% Top Securities Holdings / Portfolio

Name Holding Value Quantity Nippon India ETF Gold BeES

- | -98% ₹2,580 Cr 362,884,792

↑ 9,655,000 Net Current Assets

Net Current Assets | -1% ₹31 Cr Triparty Repo

CBLO/Reverse Repo | -0% ₹12 Cr Cash Margin - Ccil

CBLO | -0% ₹0 Cr 2. Invesco India Gold Fund

CAGR/Annualized return of 7.9% since its launch. Return for 2024 was 18.8% , 2023 was 14.5% and 2022 was 12.8% . Invesco India Gold Fund

Growth Launch Date 5 Dec 11 NAV (24 Apr 25) ₹27.5392 ↑ 0.13 (0.49 %) Net Assets (Cr) ₹142 on 31 Mar 25 Category Gold - Gold AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.45 Sharpe Ratio 1.6 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-6 Months (2%),6-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,219 31 Mar 22 ₹11,561 31 Mar 23 ₹13,495 31 Mar 24 ₹14,930 31 Mar 25 ₹19,501 Returns for Invesco India Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 10.3% 3 Month 18.2% 6 Month 22.4% 1 Year 31.8% 3 Year 20.9% 5 Year 13.9% 10 Year 15 Year Since launch 7.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.8% 2023 14.5% 2022 12.8% 2021 -5.5% 2020 27.2% 2019 21.4% 2018 6.6% 2017 1.3% 2016 21.6% 2015 -15.1% Fund Manager information for Invesco India Gold Fund

Name Since Tenure Krishna Cheemalapati 1 Mar 25 0 Yr. Data below for Invesco India Gold Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.81% Other 96.19% Top Securities Holdings / Portfolio

Name Holding Value Quantity Invesco India Gold ETF

- | -98% ₹124 Cr 166,343

↑ 11,350 Triparty Repo

CBLO/Reverse Repo | -3% ₹4 Cr Net Receivables / (Payables)

Net Current Assets | -1% -₹1 Cr 3. ICICI Prudential Regular Gold Savings Fund

CAGR/Annualized return of 8.5% since its launch. Return for 2024 was 19.5% , 2023 was 13.5% and 2022 was 12.7% . ICICI Prudential Regular Gold Savings Fund

Growth Launch Date 11 Oct 11 NAV (24 Apr 25) ₹30.0776 ↑ 0.04 (0.14 %) Net Assets (Cr) ₹1,909 on 31 Mar 25 Category Gold - Gold AMC ICICI Prudential Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.4 Sharpe Ratio 1.56 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-15 Months (2%),15 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,050 31 Mar 22 ₹11,473 31 Mar 23 ₹13,247 31 Mar 24 ₹14,669 31 Mar 25 ₹19,133 Returns for ICICI Prudential Regular Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 10.2% 3 Month 18.9% 6 Month 22.2% 1 Year 32.7% 3 Year 20.8% 5 Year 13.3% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 19.5% 2023 13.5% 2022 12.7% 2021 -5.4% 2020 26.6% 2019 22.7% 2018 7.4% 2017 0.8% 2016 8.9% 2015 -5.1% Fund Manager information for ICICI Prudential Regular Gold Savings Fund

Name Since Tenure Manish Banthia 27 Sep 12 12.43 Yr. Nishit Patel 29 Dec 20 4.17 Yr. Data below for ICICI Prudential Regular Gold Savings Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 1.73% Other 98.27% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -100% ₹1,740 Cr 236,566,280

↑ 16,326,224 Treps

CBLO/Reverse Repo | -1% ₹16 Cr Net Current Assets

Net Current Assets | -1% -₹15 Cr 4. Axis Gold Fund

CAGR/Annualized return of 8% since its launch. Return for 2024 was 19.2% , 2023 was 14.7% and 2022 was 12.5% . Axis Gold Fund

Growth Launch Date 20 Oct 11 NAV (24 Apr 25) ₹28.3201 ↑ 0.06 (0.20 %) Net Assets (Cr) ₹944 on 31 Mar 25 Category Gold - Gold AMC Axis Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.24 Sharpe Ratio 1.58 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,025 31 Mar 22 ₹11,437 31 Mar 23 ₹13,264 31 Mar 24 ₹14,661 31 Mar 25 ₹19,150 Returns for Axis Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 9.9% 3 Month 18.1% 6 Month 22% 1 Year 32% 3 Year 20.7% 5 Year 13.6% 10 Year 15 Year Since launch 8% Historical performance (Yearly) on absolute basis

Year Returns 2024 19.2% 2023 14.7% 2022 12.5% 2021 -4.7% 2020 26.9% 2019 23.1% 2018 8.3% 2017 0.7% 2016 10.7% 2015 -11.9% Fund Manager information for Axis Gold Fund

Name Since Tenure Aditya Pagaria 9 Nov 21 3.31 Yr. Pratik Tibrewal 1 Feb 25 0.08 Yr. Data below for Axis Gold Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 2.87% Other 97.13% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Gold ETF

- | -99% ₹857 Cr 119,827,570

↑ 8,979,678 Clearing Corporation Of India Ltd

CBLO/Reverse Repo | -2% ₹16 Cr Net Receivables / (Payables)

Net Current Assets | -0% -₹4 Cr

અહીં આપેલી માહિતી સચોટ છે તેની ખાતરી કરવા માટેના તમામ પ્રયાસો કરવામાં આવ્યા છે. જો કે, ડેટાની શુદ્ધતા અંગે કોઈ ગેરંટી આપવામાં આવતી નથી. કોઈપણ રોકાણ કરતા પહેલા કૃપા કરીને સ્કીમ માહિતી દસ્તાવેજ સાથે ચકાસો.

Best kumaun sun

Comprehensive list of funds from all categories.