Table of Contents

અન્ય કર બચત રોકાણો પર ELSS શા માટે

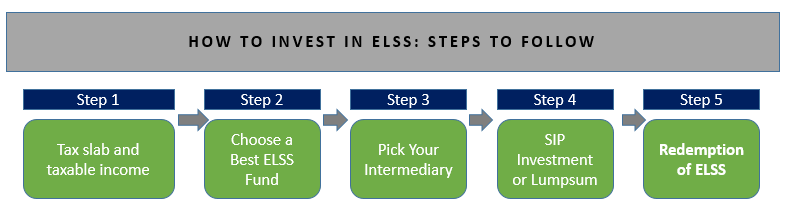

ELSS ઇક્વિટી લિંક્ડ સેવિંગ્સ સ્કીમ તરીકે પણ ઓળખાતા ફંડ્સ એ ઇક્વિટી-ડાઇવર્સિફાઇડ ટેક્સ સેવિંગ મ્યુચ્યુઅલ ફંડ છે જે મોટાભાગે તેની અસ્કયામતોમાં રોકાણ કરે છે.ઇક્વિટી અથવા શેર બજારો જેવા ઇક્વિટી-લિંક્ડ સાધનો. આ ELSSમ્યુચ્યુઅલ ફંડ ઓફરબજાર-લિંક્ડ વળતર, જે અસ્થિર છે અને બજારની સ્થિતિ પર આધારિત છે. જો કે,નાણાકીય સલાહકારો સૂચવે છેરોકાણ ELSS ફંડ્સમાં લાંબા ગાળા માટે, કારણ કે આ ELSS મ્યુચ્યુઅલ ફંડ્સ જ્યારે લાંબા ગાળા માટે રોકાણ કરવામાં આવે ત્યારે શ્રેષ્ઠ વળતર આપે છે. તાજેતરના અહેવાલોમાં, એવું જોવામાં આવ્યું હતું કે 3 વર્ષ માટે રોકાણ કરવામાં આવે ત્યારે ELSS ફંડે લગભગ 20%-30% વળતર જનરેટ કર્યું હતું, જે અન્ય મ્યુચ્યુઅલ ફંડ્સ દ્વારા જનરેટ કરાયેલા વળતર કરતાં ઘણું વધારે છે.

ELSS અને અન્ય કર બચત રોકાણ વિકલ્પોની સરખામણી

ELSS અને અન્ય કર બચતની સરખામણી કાર્યકાળ, વળતર, માટે પાત્રતા જેવા પરિમાણો પર આધારિત છેકપાત હેઠળ80c, વગેરે

ચાલો એક નજર કરીએ:

| પરિમાણ | પીપીએફ | એનએસસી | FD | ELSS |

|---|---|---|---|---|

| કાર્યકાળ | 15 વર્ષ | 6 વર્ષ | 5 વર્ષ | 3 વર્ષ |

| પરત કરે છે | 7.60 % (વાર્ષિક સંયોજન) | 7.60 % (વાર્ષિક સંયોજન) | 7.00 - 8.00 % (વાર્ષિક સંયોજન) | કોઈ ખાતરીપૂર્વકનું ડિવિડન્ડ / વળતર નહીં કારણ કે તે બજાર સાથે જોડાયેલું છે |

| મિનિ. રોકાણ | રૂ. 500 | રૂ. 100 | રૂ. 1000 | રૂ. 500 |

| મહત્તમ રોકાણ | રૂ. 1.5 લાખ | કોઈ ઉચ્ચ મર્યાદા નથી | કોઈ ઉચ્ચ મર્યાદા નથી | કોઈ ઉચ્ચ મર્યાદા નથી |

| 80c હેઠળ કપાત માટે પાત્ર રકમ | રૂ. 1.5 લાખ | રૂ. 1.5 લાખ | રૂ. 1.5 લાખ | રૂ. 1.5 લાખ |

| વ્યાજ/વળતર માટે કરવેરા | કરમુક્ત | વ્યાજ કરપાત્ર | વ્યાજ કરપાત્ર | 1 લાખ સુધીના લાભો કરમુક્ત છે. 1 લાખ રૂપિયાથી વધુના નફા પર 10% ટેક્સ લાગુ થાય છે |

| સલામતી/રેટિંગ્સ | સલામત | સલામત | સલામત | જોખમ |

2022 માં રોકાણ કરવા માટે ટોચના 5 ELSS ફંડ્સ

વચ્ચે નેટ એસેટ્સ/AUM ધરાવતા ફંડની સૂચિ નીચે છે100 - 200 કરોડ.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 1.2 15.4 35.5 20.6 17.4 JM Tax Gain Fund Growth ₹45.9445

↑ 0.16 ₹184 0.4 -7.1 9.4 18.7 26.8 29 Baroda Pioneer ELSS 96 Growth ₹68.6676

↑ 0.33 ₹210 -6.1 -3.5 17.6 16.7 11.6 BNP Paribas Long Term Equity Fund (ELSS) Growth ₹91.1972

↑ 0.31 ₹866 2.3 -2.7 10.8 16.6 21.8 23.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23

Talk to our investment specialist

The Scheme will seek to invest predominantly in a diversified portfolio of equity and equity related instruments with the objective to provide investors with opportunities for capital appreciation and income along with the benefit of income-tax deduction(under section 80C of the Income-tax Act, 1961) on their investments. Investments in this scheme would be subject to a statutory lock-in of 3 years from the date of allotment to be eligible for income-tax benefits under Section 80C. There can be no assurance that the investment objective under the scheme will be realized. IDBI Equity Advantage Fund is a Equity - ELSS fund was launched on 10 Sep 13. It is a fund with Moderately High risk and has given a Below is the key information for IDBI Equity Advantage Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments HDFC Long Term Advantage Fund is a Equity - ELSS fund was launched on 2 Jan 01. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on The investment objective is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities and to enable investors a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. JM Tax Gain Fund is a Equity - ELSS fund was launched on 31 Mar 08. It is a fund with Moderately High risk and has given a Below is the key information for JM Tax Gain Fund Returns up to 1 year are on The main objective of the scheme is to provide the investor long term capital growth as also tax benefit under section 80C of the Income Tax Act, 1961. Baroda Pioneer ELSS 96 is a Equity - ELSS fund was launched on 2 Mar 15. It is a fund with Moderately High risk and has given a Below is the key information for Baroda Pioneer ELSS 96 Returns up to 1 year are on The investment objective of the Scheme is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities along with income tax rebate, as may be prevalent fromtime to time. However, there can be no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. BNP Paribas Long Term Equity Fund (ELSS) is a Equity - ELSS fund was launched on 5 Jan 06. It is a fund with Moderately High risk and has given a Below is the key information for BNP Paribas Long Term Equity Fund (ELSS) Returns up to 1 year are on 1. IDBI Equity Advantage Fund

CAGR/Annualized return of 16% since its launch. Ranked 21 in ELSS category. . IDBI Equity Advantage Fund

Growth Launch Date 10 Sep 13 NAV (28 Jul 23) ₹43.39 ↑ 0.04 (0.09 %) Net Assets (Cr) ₹485 on 30 Jun 23 Category Equity - ELSS AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.39 Sharpe Ratio 1.21 Information Ratio -1.13 Alpha Ratio 1.78 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,407 31 Mar 22 ₹17,362 31 Mar 23 ₹17,326 Returns for IDBI Equity Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3.1% 3 Month 9.7% 6 Month 15.1% 1 Year 16.9% 3 Year 20.8% 5 Year 10% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for IDBI Equity Advantage Fund

Name Since Tenure Data below for IDBI Equity Advantage Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. HDFC Long Term Advantage Fund

CAGR/Annualized return of 21.4% since its launch. Ranked 23 in ELSS category. . HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,787

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. JM Tax Gain Fund

CAGR/Annualized return of 9.3% since its launch. Ranked 18 in ELSS category. Return for 2024 was 29% , 2023 was 30.9% and 2022 was 0.5% . JM Tax Gain Fund

Growth Launch Date 31 Mar 08 NAV (23 Apr 25) ₹45.9445 ↑ 0.16 (0.35 %) Net Assets (Cr) ₹184 on 31 Mar 25 Category Equity - ELSS AMC JM Financial Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.4 Sharpe Ratio 0.26 Information Ratio 0.48 Alpha Ratio 4.69 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,396 31 Mar 22 ₹21,099 31 Mar 23 ₹20,935 31 Mar 24 ₹30,269 31 Mar 25 ₹33,442 Returns for JM Tax Gain Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 2.2% 3 Month 0.4% 6 Month -7.1% 1 Year 9.4% 3 Year 18.7% 5 Year 26.8% 10 Year 15 Year Since launch 9.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 29% 2022 30.9% 2021 0.5% 2020 32.2% 2019 18.3% 2018 14.9% 2017 -4.6% 2016 42.6% 2015 5.2% 2014 -0.6% Fund Manager information for JM Tax Gain Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 0.41 Yr. Asit Bhandarkar 31 Dec 21 3.17 Yr. Chaitanya Choksi 18 Jul 14 10.63 Yr. Ruchi Fozdar 4 Oct 24 0.41 Yr. Data below for JM Tax Gain Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 24.93% Consumer Cyclical 16.94% Basic Materials 12.3% Technology 11.78% Industrials 9.75% Health Care 9.45% Consumer Defensive 4.67% Communication Services 2.88% Utility 1.21% Asset Allocation

Asset Class Value Cash 4.75% Equity 95.25% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | ICICIBANK6% ₹9 Cr 77,975

↑ 20,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 11 | HDFCBANK6% ₹9 Cr 54,131 Infosys Ltd (Technology)

Equity, Since 31 Aug 18 | INFY5% ₹8 Cr 45,965

↓ -2,500 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5329784% ₹7 Cr 35,500

↑ 3,000 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | MARUTI3% ₹6 Cr 4,706 Bajaj Auto Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | 5329773% ₹5 Cr 6,550 State Bank of India (Financial Services)

Equity, Since 31 Aug 20 | SBIN3% ₹5 Cr 72,900 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 24 | BHARTIARTL3% ₹5 Cr 30,700 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 10 | LT3% ₹5 Cr 14,447 CreditAccess Grameen Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 24 | CREDITACC2% ₹4 Cr 43,600 4. Baroda Pioneer ELSS 96

CAGR/Annualized return of 8.4% since its launch. . Baroda Pioneer ELSS 96

Growth Launch Date 2 Mar 15 NAV (11 Mar 22) ₹68.6676 ↑ 0.33 (0.48 %) Net Assets (Cr) ₹210 on 31 Jan 22 Category Equity - ELSS AMC Baroda Pioneer Asset Management Co. Ltd. Rating Risk Moderately High Expense Ratio 2.55 Sharpe Ratio 2.51 Information Ratio -0.09 Alpha Ratio 5.69 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,937 Returns for Baroda Pioneer ELSS 96

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -3.9% 3 Month -6.1% 6 Month -3.5% 1 Year 17.6% 3 Year 16.7% 5 Year 11.6% 10 Year 15 Year Since launch 8.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Baroda Pioneer ELSS 96

Name Since Tenure Data below for Baroda Pioneer ELSS 96 as on 31 Jan 22

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. BNP Paribas Long Term Equity Fund (ELSS)

CAGR/Annualized return of 12.1% since its launch. Ranked 22 in ELSS category. Return for 2024 was 23.6% , 2023 was 31.3% and 2022 was -2.1% . BNP Paribas Long Term Equity Fund (ELSS)

Growth Launch Date 5 Jan 06 NAV (23 Apr 25) ₹91.1972 ↑ 0.31 (0.34 %) Net Assets (Cr) ₹866 on 31 Mar 25 Category Equity - ELSS AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.29 Sharpe Ratio 0.22 Information Ratio 0.11 Alpha Ratio 3.06 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,840 31 Mar 22 ₹18,175 31 Mar 23 ₹17,467 31 Mar 24 ₹24,819 31 Mar 25 ₹27,184 Returns for BNP Paribas Long Term Equity Fund (ELSS)

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3.2% 3 Month 2.3% 6 Month -2.7% 1 Year 10.8% 3 Year 16.6% 5 Year 21.8% 10 Year 15 Year Since launch 12.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.6% 2022 31.3% 2021 -2.1% 2020 23.6% 2019 17.8% 2018 14.3% 2017 -9.3% 2016 42.3% 2015 -6.6% 2014 7.7% Fund Manager information for BNP Paribas Long Term Equity Fund (ELSS)

Name Since Tenure Sanjay Chawla 14 Mar 22 2.97 Yr. Pratish Krishnan 14 Mar 22 2.97 Yr. Data below for BNP Paribas Long Term Equity Fund (ELSS) as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 27.76% Industrials 11.82% Consumer Cyclical 11.61% Technology 10.27% Health Care 8.44% Consumer Defensive 7.81% Basic Materials 6.73% Energy 4.19% Utility 3.21% Communication Services 3.1% Asset Allocation

Asset Class Value Cash 4.62% Equity 95.38% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK7% ₹57 Cr 328,160 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | ICICIBANK6% ₹49 Cr 411,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 18 | RELIANCE4% ₹34 Cr 284,200 Infosys Ltd (Technology)

Equity, Since 29 Feb 24 | INFY3% ₹27 Cr 161,100

↓ -43,900 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 19 | BHARTIARTL3% ₹25 Cr 160,566 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Jul 23 | 5433203% ₹20 Cr 920,813 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 20 | LT2% ₹20 Cr 64,020 Sagility India Ltd (Healthcare)

Equity, Since 30 Nov 24 | SAGILITY2% ₹20 Cr 4,616,000 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 30 Sep 23 | CHOLAFIN2% ₹17 Cr 120,500 State Bank of India (Financial Services)

Equity, Since 31 Mar 22 | SBIN2% ₹17 Cr 243,000

અન્ય કર બચત રોકાણો કરતાં ELSS કેટલું સારું છે?

ત્યાં વિવિધ છેકર બચત રોકાણ ભારતમાં વિકલ્પો કે જેમાં ELSS શ્રેષ્ઠ વિકલ્પોમાંથી એક છે. કેવી રીતે? અહીં કેટલાક કારણોનો ઉલ્લેખ કર્યો છે.

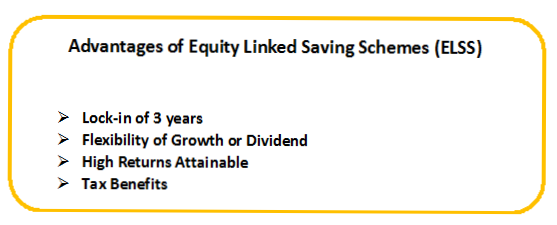

લાંબા ગાળા માટે ઉચ્ચ વળતર

ELSS ફંડ્સ શેરબજારમાં અન્ય કર બચત રોકાણોમાં સૌથી વધુ અસ્કયામતોની ફાળવણી કરે છે. તેથી, આ ભંડોળ શ્રેષ્ઠ કમાણી કરે છેફુગાવો-બધાની વચ્ચે મારપીટ પરત આવે છે. જો લાંબા ગાળા માટે રોકાણ કરવામાં આવે તો, ELSS ના વળતરનો દર અન્ય પરંપરાગત દેવું-લક્ષી રોકાણોના વળતરને સરળતાથી હરાવી શકે છે. તેથી, ELSS મ્યુચ્યુઅલ ફંડ્સ રોકાણકારોને બંને વિશ્વમાં શ્રેષ્ઠ - ઉચ્ચ વળતર અને કર લાભો પ્રદાન કરે છે.

સૌથી ટૂંકો લોક-ઇન સમયગાળો

પરંપરાગત કર બચત રોકાણ વિકલ્પોની તુલનામાં ELSS મ્યુચ્યુઅલ ફંડ્સમાં ટૂંકા લોક-ઇન સમયગાળો હોય છે. ELSS ફંડનો લોક-ઇન સમયગાળો 3 વર્ષનો છે જ્યારે PPFનો સમયગાળો 15 વર્ષ છે અનેએનપીએસ સુધી છેનિવૃત્તિ. તેથી, ELSS માં રોકાણ કરવાથી તમારા પૈસા લાંબા સમય સુધી લૉક થતા નથી અને તમે લૉક-ઇન સમાપ્ત થયા પછી તરત જ રોકાણ કરવાનું બંધ કરી શકો છો.

અત્યંત લવચીક રોકાણ

ELSS મ્યુચ્યુઅલ ફંડ્સની લવચીકતા અન્ય તમામ કર બચત રોકાણો કરતાં ઘણી વધારે છે. પરંપરાગત રોકાણોથી વિપરીત, માત્ર એક પ્રકારના વિકલ્પમાં રોકાણ કરવાની જરૂર નથી. ELSS ફંડ્સ તમને તમારા પોર્ટફોલિયોમાં વિવિધ પ્રકારના રોકાણો સાથે વૈવિધ્યીકરણ કરવામાં સક્ષમ બનાવે છે. ઉપરાંત, રોકાણકારો લોક-ઇન અવધિ પૂર્ણ થયા પછી પણ આ ભંડોળમાં રોકાણ કરી શકે છે. તેથી, એકવાર લૉક-ઇન સમાપ્ત થઈ જાય, પછી તમે સરળતાથી રોકાણ કરવાનું અથવા તમારી અનુકૂળતા મુજબ રિડીમ કરવાનું પસંદ કરી શકો છો.

નિષ્કર્ષ

નિષ્કર્ષમાં, ELSS ફંડ્સમાં રોકાણ કરનારા રોકાણકારો માટે અહીં કેટલીક ટીપ્સ આપી છે.

- ELSS માં વહેલું રોકાણ કરવાનું શરૂ કરો

- તમારી મર્યાદામાં રોકાણ કરો

- ડિવિડન્ડ રિઇન્વેસ્ટમેન્ટ પસંદ કરશો નહીં

- ધીમે ધીમે અને ધીમે ધીમે રિડીમ કરો

- એ દ્વારા રોકાણ કરોSIP

અહીં આપેલી માહિતી સચોટ છે તેની ખાતરી કરવા માટેના તમામ પ્રયાસો કરવામાં આવ્યા છે. જો કે, ડેટાની શુદ્ધતા અંગે કોઈ ગેરંટી આપવામાં આવતી નથી. કોઈપણ રોકાણ કરતા પહેલા કૃપા કરીને સ્કીમ માહિતી દસ્તાવેજ સાથે ચકાસો.