Table of Contents

Corporate Insurance

What is Corporate Insurance?

Corporate insurance, business insurance or commercial insurance is a type of insurance cover that is generally bought by businesses to cover themselves against certain risks like financial losses, employee health care benefits, accidents, theft, etc. As these are large companies, liabilities arising due to such risks could be high, hence such an insurance becomes a big necessity for them. There are many sub-categories that fall under corporate insurance policies such as public liability insurance, Property Insurance, director insurance, corporate health insurance, etc. All these types of insurance policies cover different types of liabilities or risks undertaken by the corporate.

Types of Commercial Insurance

Public Liability Insurance

A public liability insurance protects the organisation from the paying the damages caused by their business to their clients or the general public. The liability insurance can pay for the cost of consequent legal costs and other expenses. It is one of the basic corporate insurance covers for the business companies which regularly interact and deal with customers.

Business Property Insurance

Property insurance majorly covers for the damages occurred to the company's property because of certain events like fire, vandalism, civil unrest, etc.

Director and officers Liability Insurance

It is a special type of corporate insurance policy which covers the high ranking company officials such as directors and other officials. It is a liability insurance payable to these officers as a reimbursement for the losses or advancement of defence expenses because of some legal action against them. Sometimes the cover is used by the company itself to indemnify itself from the financial losses that occur during the lengthy legal processes. It covers the expenses for the defence against the criminal or regulatory investigation charges. Intentional illegal activities are not covered by this type of insurance.

Corporate Health Insurance

Some companies opt for corporate health insurance cover. This corporate insurance covers the health and medical needs of the employees till the time they are associated with the company. The cover expires after the employee is no longer associated with the company.

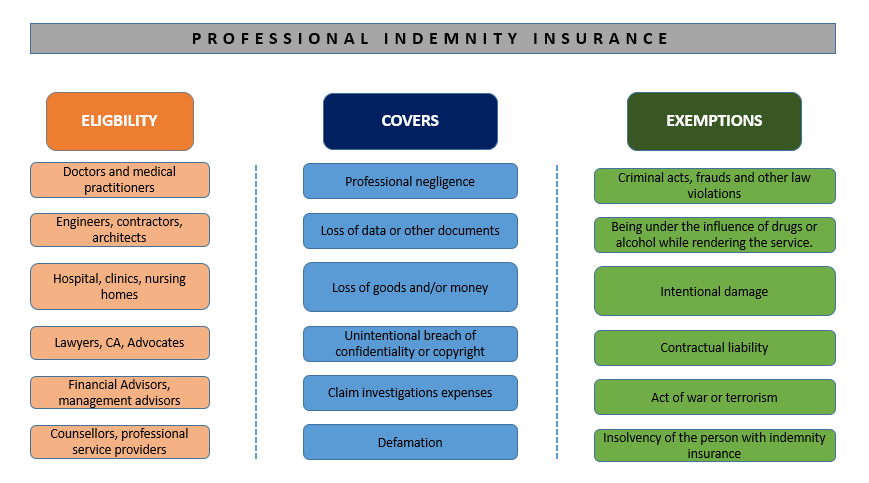

Professional Indemnity Insurance

Professional Indemnity insurance covers an employee of the company from bearing the full cost of defending themselves against the claim of negligence or error made by the client and also the damages that might occur due to a subsequent civil lawsuit.

Workers Compensation Insurance

This corporate insurance covers the employee of the company from any kind of injury, accident or any misconduct during their time of working. It also covers the medical and legal bills of the worker if they stage any such incident.

Talk to our investment specialist

Why do you Need a Business Insurance?

It is important for every organisation to have a corporate insurance because of the high-risk environment that they work in and the liabilities that may arise. A disaster can hit the working of the company at any point of time and thus it is important to take precautions. Insurance against these various business interruptions will be handled by the insurance cover which will allow the company to run its functioning normally.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.