Home Insurance: House Insurance in India

It is a dream for most of us to have a beautiful house. We often renovate it, hire an interior designer to make it look pleasant and attractive. Moreover, we feel comfortable and safer at home than any other place! But, is our home secured and protected? Confused? No worries! Let us tell you about 'Home insurance', as it is one of the best ways to protect your house against all the losses and damages.

Home Insurance

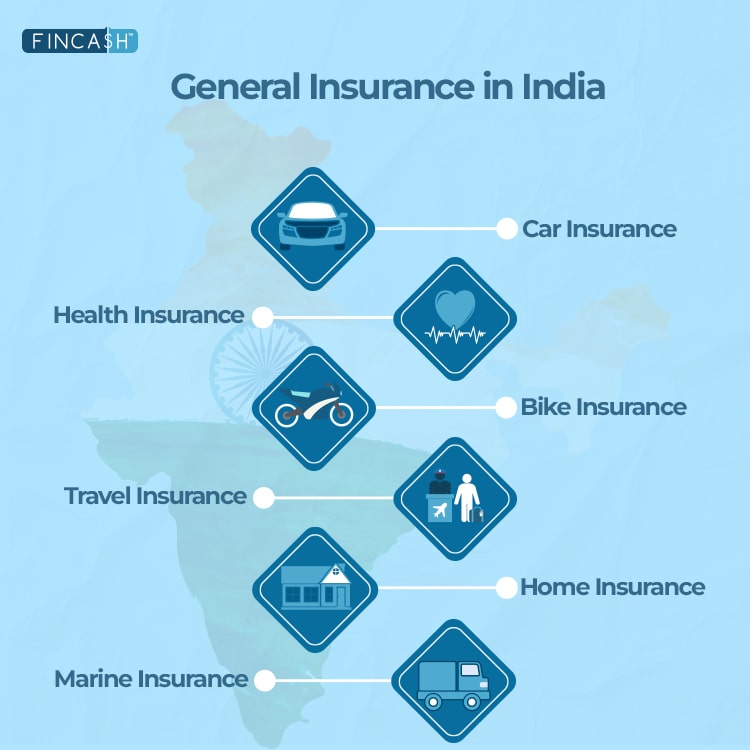

Since a home is one of our most prized assets, one should always make sure that they insure their house. Home insurance provides financial protection against disasters and natural calamities. It is a policy that combines various insurance covers, such as its contents (burglary), loss of its use, liability against accidents/loss occurrence at home, etc. Home insurance policies cover losses occurred due to both natural and man-made disasters.

House insurance is an agreement between the house owner and an insurance firm. The insured promises to pay a fixed premium to cover his property against unforeseen losses (if any). If the property suffers any loss because of man-made or natural disasters, the respective insurance firm helps by covering those losses.

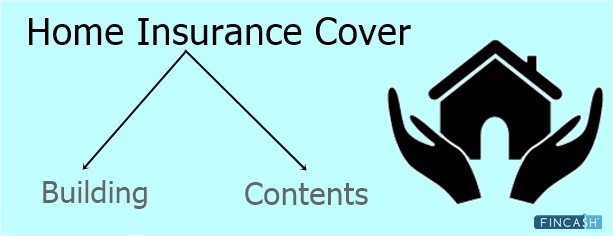

Types of House Insurance - Building & Contents

There are two types of home insurance policies, i.e. a basic building policy and a comprehensive policy (also called as the householder’s package policy). Let’s understand what each of the types covers.

A Basic Building Policy

This policy provides cover for home/building against loss or damage caused by man-made or natural calamities, such as fire, lightning, storms, flood, strike, landslide, cyclone, aircraft damage, riot, etc.

A Comprehensive Policy

This policy provides cover for home/building structure and its contents. The structure insurance covers loss/damage against the structure of the home caused due to natural or man-made calamities, such as an earthquake, fire, floods, air crash damage, explosions, etc. Contents insurance covers damage/loss caused due to burglary, etc. It may include precious assets like jewellery, paintings, important documents, etc.

Benefits of Home Insurance Policy

- Secure asset from any loss/damage

- Comprehensive coverage of both structure and content of your house

- Financial back-up against any unforeseen circumstances

- You can always be stress-free as your house is secured and protected

Home Insurance Quotes

When it comes to Property Insurance, the sum insured and the premium is calculated on the Basis of property area, the location of the property and the rate of construction (per sq.ft). Mainly the cost depends on the location, for instance, the cost of construction is relatively higher in metros. Also, insurance firms usually have a fixed rate of construction for different localities.

Talk to our investment specialist

Property Insurance Claim

Getting claims are perhaps the most important part of insurance. One should get a clear understanding of the clauses mentioned in the claim process. At the time of claim, the insurer thoroughly inspects the damage or loss that has incurred. Therefore, one should have all the required documents and proofs.

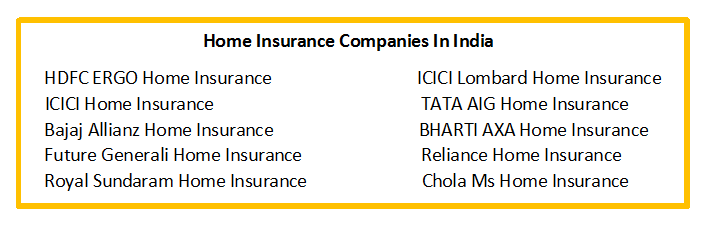

Home Insurance Companies

These are some of the companies which provide home insurance in India-

Conclusion

Our home is probably the most precious assets in our lives. Since we understand the value of our house, it is important for us to ensure that our house is protected against any damage/loss. So, take a step today of buying a home insurance and keep your house protected at all times of life!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.