Table of Contents

Understanding Property Insurance in India

insurance is a necessary aspect of life. It not only protects you during hard times but also covers your losses. Though there are several types of insurance available, but perhaps the most common type is ‘Property Insurance’. When it comes to your house or your business, this insurance policy is something that you cannot neglect. So, what is property insurance?

Property Insurance

Property insurance offers coverage for individuals, firms and other related entities against man-made/natural calamities on their property. It provides a way for protecting and safeguarding assets like a home, shop, factory, business, machinery, stocks and personal belongings against risks like fire, burglary, implosion, riots, floods, earthquakes, etc.

Property insurance is a first-party cover, which means that it is a contract between the first party and the second party. Wherein the first party is the insured and the second party is the insurance company. If there is any loss incurred by the policyholder, the insured gets reimbursed.

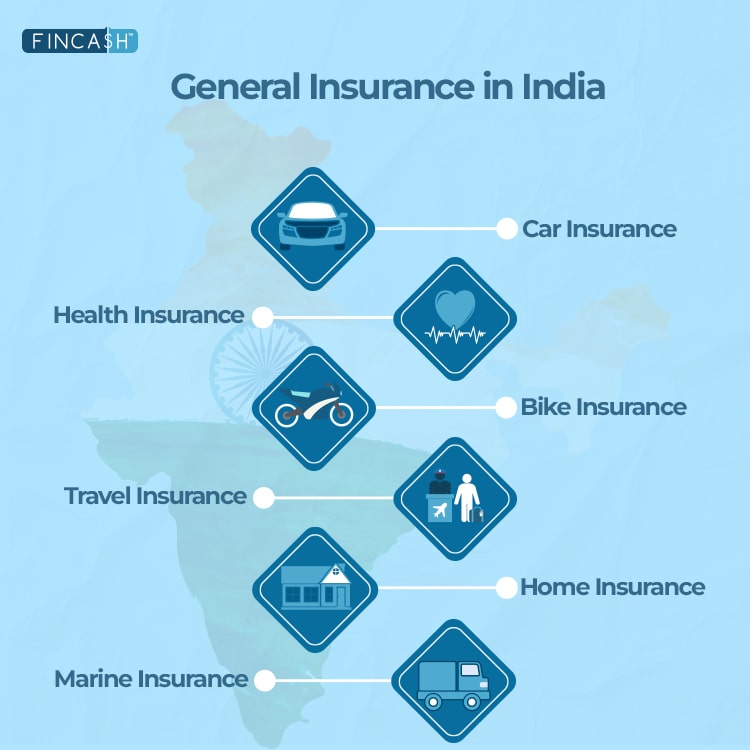

Property insurance is a broad category of general insurance and the type of cover that you need depends on the type of property you are seeking to cover.

To understand more, let us see the types covers provided by property insurance.

Types of Property Insurance

Fire Insurance

Fire insurance is considered to be a popular type of insurance in India. As the name indicates, it offers protection for buildings, shops, industrial establishments, hospitals. It also covers contents such as finished goods, Raw Materials, accessories, machinery, equipment’s, etc., against fire and allied perils. Moreover, apart from this, it also offers cover against storms, cyclones, floods, explosions, lightning, aircraft damage, riots, hurricanes, landslides, bursting and overflowing of water tanks, etc.

Fire insurance covers may not compensate for certain events such as war, nuclear perils, mechanical and electrical breakdown, pollution, etc.

Burglary Insurance

Burglary insurance policy may be offered for a house or for a business enterprise. This policy covers assets like important documents, cash and securities, which are kept inside the property. A burglary insurance policy can also cover damages caused due to thefts, riots and strikes.

Umbrella Insurance

Umbrella insurance provides coverage above the limits of other existing insurance policies. It is a Comprehensive Insurance policy that offers protection to businesses against different kinds of perils. It is a policy, which is suitable for large sized offices, as well as small and medium-sized offices. Also, Chartered Accountants, engineers, architects, or any other service providers can also acquire benefits from this policy.

Marine Cargo Insurance

Marine Cargo Insurance covers the risk of goods which are being transited through rail, road, air and, water. This insurance policy is useful for Import and export merchants, buyers/sellers, contractors, etc.

Property and Casualty Insurance

Also known as P&C insurance, offers two types of coverage - liability insurance cover and property protection. It offers a wide Range of coverage, such as - protection against flood, fire, earthquake, machinery breakdown, office damage, electric equipments, money-in transit, public and professional liability, etc., you can buy depending on the property that needs to be insured.

A casualty insurance offers protection to business against risk or liabilities arising within their business environment.

Property Insurance Exclusions

Some of the typical exclusions are below:

- Damage/loss caused by nuclear activity.

- Damage/loss caused by war, etc.

- Damage/loss caused due to over-use of electric or electronic machines.

Talk to our investment specialist

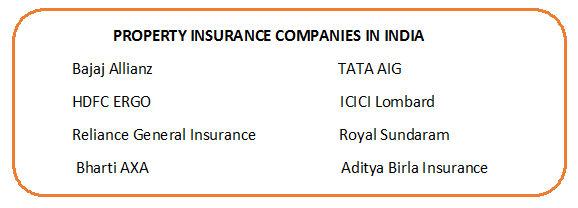

Property Insurance Companies 2025

1. Bajaj Allianz Property Insurance

The policy is specially designed to provide formidable coverage to your house, the contents inside it and other valuables. The plan is applicable for all home owners, landlords, and tenants of a rented house with its range of features, such as -

- Contents cover

- Portable equipment cover

- Jewellery and valuables cover

- Curios, works of art and paintings cover

- Burglary cover

- Building Cover

- Worldwide Cover

2. HDFC ERGO Property Insurance

Property insurance offers coverage to a house and its content from unforeseen circumstances such as damages caused by natural calamities and man-made activities. Some of the key benefits of this plan is it offers home protection as per your home structure along with affordable premiums.

Factors impacting premium for property insurance are:

- Location

- Age & structure of your building

- Home security

- Amount of belongings in contain

- Sum insured or total value of your home

3. Reliance Property Insurance

The property insurance by Reliance covers the risk related to loss in natural and manmade incidents. It offers full protection to the property and its content as well. This policy comes with low cost premiums and rebate. You also get cover on domestic, mechanical & electrical appliances, etc.

4. Bharti AXA Property Insurance (ICICI Lombard General Insurance)

Note: Bharti AXA General Insurance is now part of ICICI Lombard General Insurance.

ICICI Bharat Griha Raksha Policy protects your home and belongings during uncertain events. It gives the financial security and support, when you and your family need it the most. The highlight features of the ICICI Bharat Griha Raksha Policy are as follows:

- The property insurance covers damages due to fire, explosions, implosions and bush fires.

- Secures you against unexpected calamities, such as earthquakes, floods, cyclones, storms and lightning.

- Protects your possessions from theft

- The policy offers protection against bursting or overflowing of water tanks, apparatus and pipes.

- Secures your most treasured possessions such as jewellery, silverware and works of art under the Cover for Valuable Contents add-on.

- Covers death of the insured person and the spouse under the Personal Accident add-on.

5. TATA AIG Property Insurance

The property insurance plan by TATA AIG offers a host of coverage such as:

- Lightning Explosion / Implosion

- Fire

- Aircraft damage

- Storm, cyclone, typhoon, tempest hurricane, tornado, flood and inundation

- Riot strike and malicious damage

- Impact damage due to rail road vehicle or animal not belonging to insured, subsidence and landslide including rockslide

- Missile testing operations

- Bursting and/or overflowing of water tanks apparatus and pipes

- Leakage from automatic sprinkler installations

- Bush fire

7. Royal Sundaram Property Insurance

The Bharat GrihaRaksha Policy by Royal Sundaram is a comprehensive package of insurance benefits that safeguards your Building and Contents. There are three types of policy features you can consider - Home Building Insurance, Home Contents insurance and Home Building and Contents Insurance.

Conclusion

While buying property insurance, one has to remain wary of the key exclusions within the policy. So, to start with, look for a policy that aligns with the key risks that your house/business may be susceptible to and seek protection against allied perils and dangers!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like