Endowment Plan

What is an Endowment Plan?

An endowment plan is a Life Insurance policy which gives life cover and also helps the policyholder to save regularly over a specified period of time so that upon maturity, they can receive a lump sum amount on surviving the term. Endowment insurance allows you to insure yourself till you wish to be insured(for a certain period) and upon maturity, you receive the sum assured along with the bonus for the term of the endowment policy. Thus, endowment plans can be seen as a variant of Term Insurance plans.

Jeevan Anand of LIC is one such endowment plan which offers life risk cover and maturity benefit.

Types of Endowment Policy

Endowment plans can be broadly classified into the following categories:

1. Endowment Insurance with Profit

In this type of insurance policy, in the case of the insured's death, the nominee receives the sum assured along with the bonus for the number of years the plan was active. Upon the survival of the term of the policy, the insured gets the sum assured plus the bonus for the term policy.

2. Endowment Insurance without Profit

In this type, the beneficiary gets only the sum assured upon the death of the insured.

3. Unit Linked Endowment Plan

It is a fixed term saving policy with life coverage. In this, you can invest your savings in the Capital Markets and the return you get depends on the performance of the investment.

4. Full Endowment Plan

In a full endowment plan, the initial death benefit would be the sum assured. However, as one gets into the policy tenure, the money being invested grows! So essentially, the premium you pay is pooled in the company’s investment and each year a bonus is added to your credit. Thus, the final amount paid(on policy survival) may be much higher than the original sum assured.

5. Low-Cost Endowment Plan

In this endowment policy, the projected future growth rate of the money will meet the target amount and has the guaranteed life insurance cover. In case of death, this target money will be paid as the minimum sum assured.

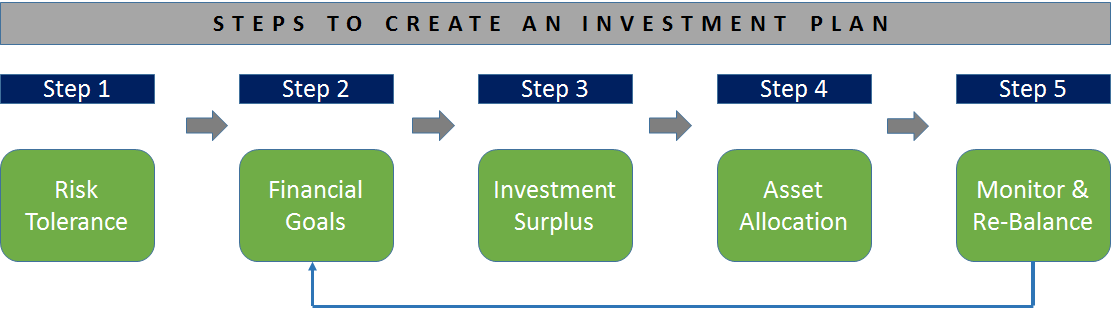

Best Endowment Plans in India 2026

There are many Insurance companies offering endowment plans. Listed below are some of the best endowment plans of the year.

Benefits of an Endowment Plan

- Endowment insurance plans guarantee that a certain amount of money will be given to the insured or the nominated beneficiary whether the insured survives the term or dies early.

- These policies are low-risk plans to invest in since the benefits after maturity period are fixed.

- Endowment policy insures financial cover for you in any case.

- Endowment plans give you tax benefits as well.

Bonus on an Endowment Insurance Policy

There are various bonuses offered by the insurance companies on an endowment policy. A bonus is an extra amount which adds to the promised amount. The insured must have an endowment policy with profit to avail these profits offered by the insurance company.

The bonuses are categorised as:

1. Reversionary Bonus

Additional money is added to the promised amount upon death or maturity with profits plan. Once the reversionary has been declared, it cannot be withdrawn if the insurance plan completes the maturity or the insured meets a premature death.

2. Terminal Bonus

A discretional sum of money added to the payments after maturity or on the death of the insured.

3. Rider Benefits

There are various rider benefits attached to the endowment plan. You can choose the rider benefit as per your requirement:

- Accidental death benefit

- Accidental disability benefit (total/permanent/partial)

- Family income benefit

- Premium benefit waiver

- Critical illness benefit

- Hospital expense benefit

Conclusion

If you are looking for an insurance policy that gives you a bit more than just a life cover, an endowment plan is the best possible option for you. It gives you a triple benefit of savings, gradual wealth creation, and insurance cover.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like