What is Fire Insurance?

Fire insurance is a type of insurance that compensates the damage or loss caused by a fire to a property or house of insured. In other words, in this policy, a person pays a certain amount of money (premium) to the insurance company periodically, and in exchange, the company helps when that person suffers destruction of his property due to a fire.

Fire insurance is important for both house and business as it helps to protect from the damages/losses caused due to fire incidents, especially in industrial sectors like petrochemicals, etc., where fire hazards are very prone. This policy also provides the price of alternative properties and assets, which get damaged due to fire.

What's important about this policy is that the term ‘fire’ must satisfy the conditions like-

- The fire should be accidental but not incidental.

- There should be fire or ignition.

- The proximate cause of loss should be fire

Fire Insurance Policy: Types

There are various types of policies in fire insurance, one can choose as per their needs. Some of the notable fire insurance policies are mentioned below:

1. Valued Policy

In this policy, the insurer agrees to pay a fixed sum of money to the insured. The value of the subject matter is agreed beforehand between the insured and the insurer. Valued policies are usually issued on art, pictures, sculptures, and other such things whose value cannot be easily determined. However, the amount payable under a valued policy may be more or less than the actual property value.

2. Specific Policy

In this policy, any loss/damage suffered by the assured is covered only up to a specific amount, which is less than the actual value of the property. In a specific policy, a definite amount is insured on a property and during the time of loss, it will be remunerated if the loss falls within the specified amount.

3. Average Policy

In this policy, the amount of cover is determined with reference to the value of the property insured. For a clear view, an average policy is calculated under this formula-

Claim= (insured amount/value of property)* actual loss

For example- If a person insures his valuable, worth INR 20,000 for INR 10,000 only, and the loss is caused by the fire is INR 15,000 then the amount of the claim to be paid by the insurer will be (10,000/20,000*15,000) = INR 7,500.

4. Floating Policy

Floating policy covers the property lying at different location/places against loss of fire. Such a policy is usually preferred by a businessman whose goods are stored in warehouses or docks.

5. Comprehensive Policy

A comprehensive policy is known as all-in-one-policy because it covers losses arising from many kinds of risks such as fire, strike, war, theft, burglary, etc.

6. Replacement Policy

In this policy, the insurer undertakes to pay the cost of replacement of the property damaged or destroyed. The insurer may replace the property instead of paying in cash. However, the new asset should be similar to the one which has been lost.

Fire Insurance Coverage

Some of the common covers given by the insurers for fire insurance are given below-

- Loss/damage caused due to smoke or heat

- Items damaged due to water that is used to extinguish the fire

- Damages caused by throwing goods out of premises/house during the fire incident

- Wages paid to persons employed for extinguishing fire.

Losses that are not covered by the policy may include-

- Damage/loss caused due to the burning of property by public authorisation.

- Damage caused due to wars, rebellions, mutiny, enemy hostilities, etc.

- Loss/damage caused due to the underground fire.

Standard Fire and Special Perils Policy

Under Standard Fire and Special Perils policy, a wide Range of covers are included such as-

- Lightning, riot, strike and malicious damage.

- Explosion / implosion

- Aircraft damage

- Storm, cyclone, earthquake, typhoon, hurricane, tempest, tornado, flood, landslide, etc.

- Bursting/overflowing of water tanks.

- Forest fire

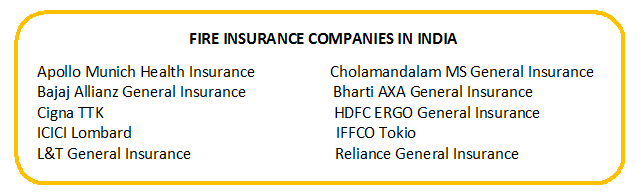

Fire Insurance Companies

Fire Insurance Quote

The premium paid on the fire insurance depends on many factors which include the environment and surroundings of the property, the assured money and the operational safety precautions available with the property. Even though most insurance firms provide cover against fire, but the policy of every insurance firm may differ. Hence, before buying a policy, read the terms & conditions carefully.

Talk to our investment specialist

Conclusion

Fire incidents are definitely unexpected. And when such incidents occur, they create extensive destruction. So, if you think your valuable assets are prone to fire, get fire insurance now!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like