Table of Contents

- Importance of Mobile Insurance

- What Does Mobile Insurance Not Cover?

- How to Claim your Insurance?

- Best Mobile Insurance in India

- Things to Consider before Buying a Mobile Insurance Plan

- How is Mobile Insurance Different from Manufacturer's Warranty?

- Frequently Asked Questions (FAQs) About Mobile Insurance

Best Mobile Insurance to Buy 2025

Planning to buy a new phone? Don't forget to safeguard your device by getting mobile phone insurance. Today, mobile phones have become less of a necessity and more of a status symbol that can cost up to lakhs. And no doubt, expensive smartphones are an easy target for theft, making it all more important for the owners to protect them.

Mobile insurance policies offer protection against theft or any other damages that are solely not covered under the manufacturer's warranty. To know more, here's a brief guide to help you understand things better.

Importance of Mobile Insurance

Although buying mobile insurance is not compulsory, it can be the best decision to save you from financial losses that come with repairing a damaged phone or Investing in a new phone. Here are some reasons why getting mobile insurance is important and how it can benefit you in tackling different situations.

Provide Coverage Against Water or Liquid Damage

Mobile insurance can come to your rescue if your phone gets damaged due to water or any other liquid. Any damage to the phone due to moisture or humidity is covered under mobile insurance.

Protection Against Theft or Loss of Phone

If you've had a history of losing phones, ensure investing in a mobile insurance plan to avoid dealing with the same affair in the future. Know that in case of theft, you lose not only your phone but also all the important data stored in it as well. A mobile insurance plan can compensate you for your lost phone.

Coverage Against Accidental Breakage

Mobile phones like iPhone, Samsung, and OnePlus are quite expensive, and any breakage can lead to hefty repair costs. Getting mobile phone insurance will provide you coverage against accidental internal or external damages affecting the working of the phone, screen cracks and breakage.

Saves you from High Repair Costs

Mobile insurance covers high repairing costs that often come along with fixing malfunctionings, like issues with the charging port, speaker, or touch screens. No overhead expenses!

Talk to our investment specialist

What Does Mobile Insurance Not Cover?

While purchasing mobile insurance, understand that certain issues are usually not covered under a mobile insurance policy. These are known as exclusions which may vary from company to company. Jotted down below are some common exclusions:

- Loss or damage of phone when it was being used by someone other than the owner

- Mysterious loss of the device reason for which cannot be explained by the policyholder

- Damage due to change in climatic conditions, routine wear and tear, or gradual deterioration

- Damages caused due to overloading or experimenting with the mobile phone under abnormal conditions

- Pre-existing defects or issues before the commencement of the mobile insurance plan

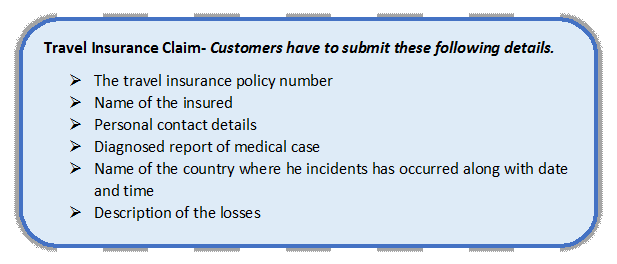

How to Claim your Insurance?

Got an idea of how getting mobile insurance helps you? But how to claim your insurance in case of any damage or loss of your phone? Following are some steps that can help you with the process:

- Report to the insurance company about the loss or damage to your phone as soon as possible on any provided customer support channels

- Share photographs and other details of the damaged phone

- Attach the required documents such as the original invoice, serial number, and policy number of the phone. In case of robbery, make sure to file a First Information Report (FIR) at the police station and attach its copy along with your claim form

- Next, you'll need to submit the claim form. You can submit it online or at the nearest branch of your insurance company

- Once your claim is approved by the insurance company, your device will be collected from your doorstep for repairs (in case of a damaged phone)

- Next, your handset will be passed through a thorough assessment by the authorised service centre to check for Beyond Economical Repair (BER)

- Once the repairs are done, your device will be delivered to you

Best Mobile Insurance in India

With countless offers and insurance plans, buying the best mobile insurance may often seem like a task. Hence, to ease down the process for you, here's a list of some best mobile insurance policies:

Syska Gadget Secure Mobile Insurance

Syska Gadget Secure offers insurance services with accidental damage covers, protection against antivirus, and theft or loss of device coverage. You can purchase the syska mobile insurance online either from their official web portal or from Amazon. While at it, make sure to purchase the Syska Gadget Insurance kit and register it on the web portal within 48 hours of your smartphone purchase. The insurance will activate within 24 hours of the purchase and will be valid for 12 months.

OneAssist Mobile

OneAssist mobile insures your handset against damages, breakages, and thefts; plus, it also offers an extended warranty. You can activate your protection plan by entering the activation voucher details and submitting the request at the OneAssist app or the online web portal. The OneAssist insurance plans start at only Rs.67 per month.

Acko Mobile Insurance

Acko protection plan covers liquid and accidental physical damages, including cracked screens, plus in-warranty repairs. However, the plan is only for smartphones purchased on Amazon and is invalid on refurbished devices. You can buy the Acko mobile insurance plan along with your mobile phone purchase or register for it later by logging into the Acko portal.

Things to Consider before Buying a Mobile Insurance Plan

Now that you've come this far learning about mobile insurance, next are some tips to help you with your insurance purchase. Make sure to ponder upon the following aspects before getting ahead with any measure:

1. Do you Actually Need Mobile Phone Insurance?

If you are someone who's quite clumsy and glued to the phone 24x7, there is no doubt that you are at a higher risk of losing or dropping and breaking your phone. Hence, investing in a phone protection plan can be the best deal for you in the long run. However, before buying a traditional mobile insurance policy, make sure to check if your phone is covered under your Home insurance plan or premium Bank account. Also, don't forget to check what is actually covered!

2. Compare Price, Covers and Exclusions

No insurance policies are created equal. Yes, that's a fact! Therefore, while looking to purchase mobile insurance, consider comparing the services and cover you are paying for. While it's important to understand what an insurance plan covers, it's equally important to understand what it doesn't cover. Hence, make sure to learn about the exclusions too.

3. Browse Through All the Accessible Options

While buying mobile insurance online, browse through a handful of options to get the best deal. Check out their prices, reviews and offered services, as this will help you make an informed decision. Here, make sure to look beyond price tags. Be mindful of the fact that slightly expensive policies with better coverage can be more valuable than cheap policies that Fail to provide better phone protection plans. Therefore, invest in a plan that helps to put you back on your feet.

How is Mobile Insurance Different from Manufacturer's Warranty?

Many smartphone owners mistake manufacturers' warranties for mobile insurance. But they are completely different forms of phone protection plans.

| Manufacturer's Warranty | Mobile Insurance |

|---|---|

| A manufacturer's warranty is a written promise by the company stating that they'll take the responsibility to fix or repair any defect found in their sold products. | Mobile insurance is an additional layer of protection Offering coverage against different kinds of damages to your handset. |

| It does not provide coverage against theft, burglary, liquid, and accidental damages. | Provide coverage against theft, burglary, liquid, and accidental damages. |

| It is provided by the product manufacturer. | It can be bought from any insurance company. |

| The manufacturer's warranty is included in the cost price of the mobile phone. | Mobile insurance is an extra protection cover that can be availed from different Insurance companies. |

Frequently Asked Questions (FAQs) About Mobile Insurance

1. I've found my lost phone. Can I cancel my insurance claim?

A. Most mobile phone insurance plans allow you to cancel claims, but only within a specific time period. Hence, the best option is to first report the incident to your insurance provider and ask for further assistance in the process.

2. How can I check my insurance claim status?

A. To check your Insurance Claim status, visit your insurer's website. Here, click on the 'Under Claim Status' options and fill in the required details to check the current status of your claim.

3. Does mobile phone insurance provides coverage against cracked screens?

A. Yes. If your phone screen is accidentally damaged, you can file an insurance claim. The insurer may repair your phone screen or offer an instant replacement if it's beyond repair.

4. How many times can I make an insurance claim?

A. Most insurance companies limit your claims to 2 in a 12 months validity. However, this may vary from one insurance company to another.

5. How can I cancel my mobile insurance?

A. Cancelling your mobile insurance is relatively easier than buying it. You can cancel your insurance plan anytime by directly speaking to your insurer via contact number or email. While at it, make sure to keep your policy number handy.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.