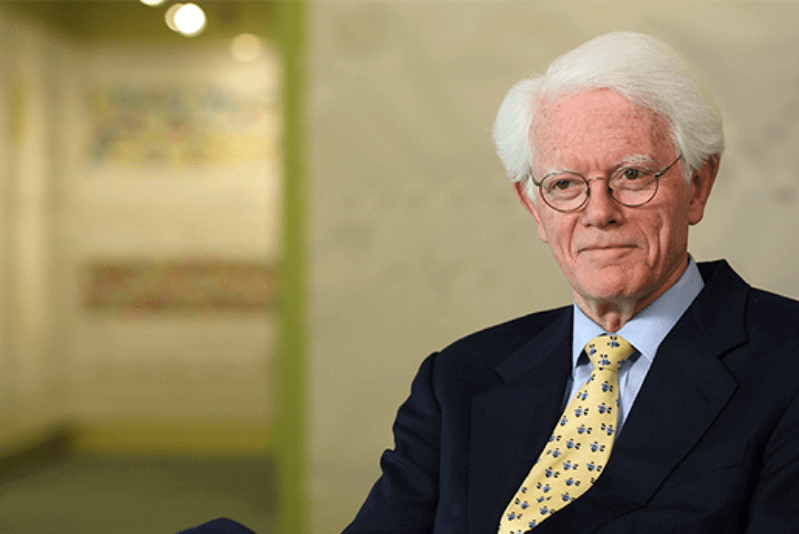

Best Rules of Investment from Peter Lynch to Tackle COVID-19 Uncertainty

With the Coronavirus Pandemic, the global markets have undergone some major changes with uncertainty hovering at the moment. A report mentioned that the data with regards to consumer confidence index has declined drastically over the past few months due to the lockdown, job losses, etc. The consumer confidence level is at a 6-year low.

However, with the major measure being implemented on the lockdown, the consumer sentiments are improving, which has pushed the S&P 500 over 40% higher than the March 2020 lows.

Peter Lynch has witnessed various difficult economic periods in his career and he has proved to stand strong through it all. This has definitely helped in the 29% compounded returns between 1977 and 1990.

According to Peter Lynch’s advice, investors should follow the following points to keep their heads high in the harsh Market phase.

1. Long-term Focus

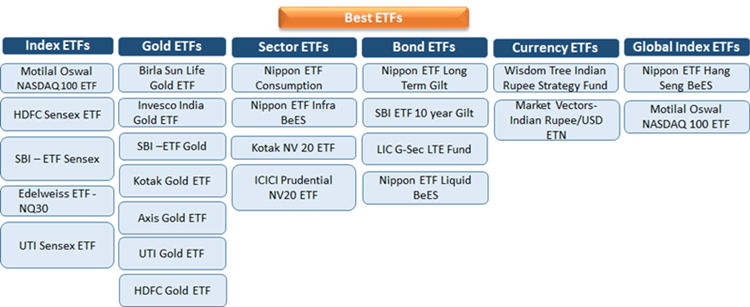

In times of uncertainty, Investing in equity and liquid assets is a great option. Peter Lynch once said that in the long run, a Portfolio of well-chosen stocks and/or Equity Mutual Funds will always outperform a portfolio of Bonds or a money-market account.

Though cash may pose as less risky than stocks, in the long run, holding quality companies for a long-term will yield higher returns.

Talk to our investment specialist

2. Research and Identify Stocks

During economic uncertainty, it becomes important to spend time identifying good stocks. This process may be difficult, especially when it is during a period of Economic Growth. This process may require you to spend more time assessing the fundamental strength of a large number of companies.

Peter Lynch once pointed out that a person who turns over the most rocks wins the game. Putting addition time searching for the best stocks and companies can pay off in times of uncertainty.

3. Thriving Businesses

Businesses that have a foothold in the market offer a better chance of survival in uncertain times. They may even extend their market share through weaker businesses. Peter Lynch once said that in business, competitions are never as healthy as total domination. He is basically saying in times of turmoil is better to invest in dominant businesses than the others since they offer a better safety margin than others. This is because when times are turbulent, a general investor only looks for a Safe Haven rather than much profit.

This point is specifically applicable to uncertain times when there is a global Recession with finance. Investing in growing companies, is one of the things to do when there is an economic boom and Peter Lynch has always advised investing only in those things an investor is well-aware about. He has always encouraged research and identification before investment.

Thriving businesses with wide margins of safety could exist in industries where the investor’s sentiment is weak.

4. Diversify

One of the major things to do when facing uncertain times is to diversify your portfolio. This can help in reducing the risk. However, make sure to not purchase an excessive number of stocks only for the purpose of diversification. Peter Lynch rightly said that owning stocks is like having children- don’t get involved with more than you can Handle.

Carefully identify assets during a period of economic turmoil. Being cautious is important because investors might be unaware of how a business is trading and its financial conditions during an economic recession.

Conclusion

The Coronavirus pandemic is definitely an issue of concern in both terms of survival and finance. One of the best ways to help your finances grow in this time is to be patient and not panic along with following Peter Lynch’s tips for uncertain times.

People across the globe have claimed to have gained benefits by following Mr Lynch’s advise and it would be advisable for every investor to keep this in mind and follow.

With the issue of financial insecurity prevailing today, why not invest for long-term to be able to fund your future? Start making a monthly investment in a Systematic Investment plan (SIP) and save for the future.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.