Table of Contents

How to Choose Best SIP to Invest?

SIP or Systematic Investment plan is an investment mode in Mutual Funds where people invest in small amounts at regular intervals. SIP is considered to be one of the beauties of Mutual Fund as people can attain their objectives through small investment amounts. Although SIP is one of the convenient methods, however; a questions that mostly puzzles people is;

how to choose the best SIP for investment? Individuals in many situations are confused whether their SIP investment is the best or not. So, let us see through this article how to select the Top SIP, how to use SIP return calculator, the top and Best Performing Mutual Funds for a SIP, and much more.

Why do a SIP?

Any investment is always done with the purpose of attaining an objective.

SIP is also known as goal-based investment. people try to attain various objectives like purchasing a house, purchasing a vehicle, planning for higher education, Retirement planning, through SIP investment. Moreover, for each objective, the approach adopted would be different. Consequently, while defining your investment objective, you need to answer certain questions related to:

- What is the objective to be achieved?

- What would be the tenure of the investment?

- What is your risk-appetite?

Defining the tenure and risk-appetite helps people to define the type of scheme to be chosen. For defining the risk-appetite, people can do a Risk assessment or risk profiling. For example, people whose tenure is short-term can choose to invest in debt funds. Similarly, people who have a high-risk profile can choose to invest in Equity Funds. Therefore, defining objectives is crucial for any investment to be successful and efficient.

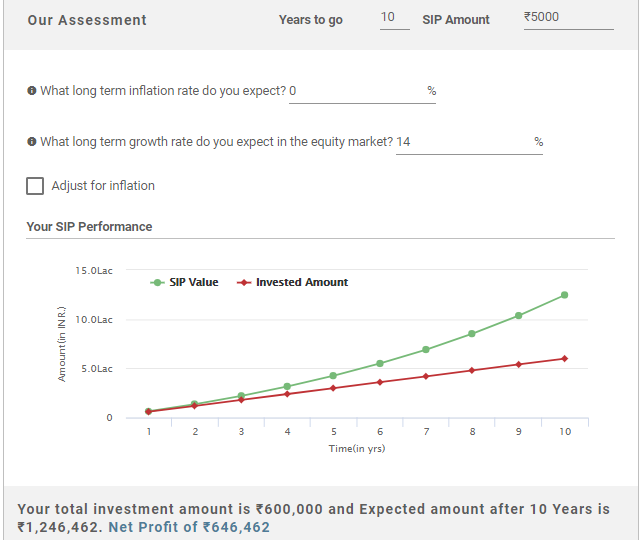

Mutual Fund Calculator or SIP Return Calculator

Once you define your objective, the next step is to determine the money required to accomplish the objective. This can be done using a mutual fund calculator that helps you to assess the amount required to be invested today to attain your future objectives. In addition, people can also verify how their SIP grows over a period of time. Some of the input data that people need to enter into Mutual Fund calculator includes monthly income, monthly savings amount, expected returns on investment, expected Inflation rate, and much more.

Know Your Monthly SIP Amount

Choose the Required Scheme

After defining the objectives and deciding on the SIP amount, the next area to be focused is to choose the best scheme for SIP investment. Mutual Fund schemes are divided into various categories to cater the diverse requirements of the individuals. On a broad note, with respect to the underlying asset composition of the portfolios, Mutual Fund schemes are classified into three broad categories. They are:

1. Equity-Based Funds

Equity funds invest their corpus in equity and equity-related instruments. These schemes do not provide guaranteed returns as their performance depends on the performance of the underlying equity shares. However, these schemes can be a good option for long-term tenure. Equity funds are classified into Large cap funds, mid cap funds, Small cap funds, sectoral funds, Multicap funds, and much more.

2. Debt Based Funds

These schemes invest their corpus in fixed income instruments depending on varying maturity periods. These schemes can be considered as a good option for short-term investments. These schemes are classified on the Basis of maturity profiles of the underlying assets into Liquid Funds, ultra short-term funds, dynamic bond funds, and much more.

3. Balanced Funds

Also known as Hybrid Fund, these schemes invest their corpus in both equity and debt instruments. These schemes are good for investors looking for regular income along with Capital appreciation.

SIP in general is referred to in context of equity funds. This is because SIP is done generally for a long-tenure where people can extract maximum benefits.

Talk to our investment specialist

Best Performing SIP to Invest

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Principal Emerging Bluechip Fund Growth ₹183.316

↑ 2.03 ₹3,124 100 2.9 13.6 38.9 21.9 19.2 ICICI Prudential Banking and Financial Services Fund Growth ₹128.72

↓ -0.74 ₹9,008 100 11.3 5.4 17 16.8 25.2 11.6 Invesco India Growth Opportunities Fund Growth ₹89.96

↓ -2.28 ₹6,432 100 2.8 -1.4 14.8 21.6 25.8 37.5 Motilal Oswal Multicap 35 Fund Growth ₹57.0416

↓ -0.36 ₹12,267 500 1.3 -5.4 14.4 21.2 22.9 45.7 DSP BlackRock Equity Opportunities Fund Growth ₹591.642

↓ -8.64 ₹13,784 500 4.1 -1.6 12.2 20.5 26.6 23.9 Sundaram Rural and Consumption Fund Growth ₹93.4881

↓ -1.36 ₹1,445 100 1.5 -3.4 11.6 18.4 22.5 20.1 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹58.8

↓ -0.73 ₹3,248 1,000 13 6 11.6 17 26 8.7 Mirae Asset India Equity Fund Growth ₹106.786

↓ -1.24 ₹37,778 1,000 3.6 -0.9 8.4 12 20.7 12.7 Kotak Standard Multicap Fund Growth ₹79.005

↓ -1.22 ₹49,130 500 3.9 -0.5 6.7 15.7 22.6 16.5 Tata India Tax Savings Fund Growth ₹41.5908

↓ -0.65 ₹4,335 500 0.6 -4.6 6.7 15 23.1 19.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21

Parameters for How to Choose Best SIP?

The parameters about how to choose the best SIP to invest are classified into Quantitative Parameters and Qualitative Parameters. Both the parameters along with the points forming their part are explained as follows.

Quantitative Parameters

1. Mutual Fund Ratings

mutual fund ratings is an important parameter to understand about a scheme in detail. Individuals need to check the ratings of the scheme given by various credit rating agencies such as CRISIL, ICRA, and much more. These agencies evaluate a scheme on the basis of their predetermined parameters. This will help you to narrow down your preferences while selecting the best Mutual Fund.

2. Historical Returns

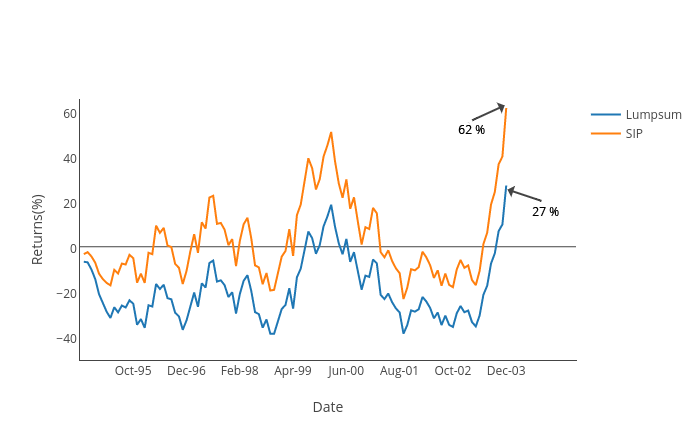

After sorting the schemes with respect to the ratings, the next parameter is to check for the scheme’s historical returns. Though historical returns are not a benchmark for future performance still, people can use it for forecasting future returns.

3. Fund Age & AUM

Fund age and AUM are also key parameters that need to be looked while investing in Mutual Fund. People need to check for how many years has the fund been existing in the market. The older the fund, the better it is for investors. People should try to invest in schemes that have a minimum of 3 years of existence. Along with the fund age, people should also consider the AUM of the scheme. AUM or Assets Under Management refers to the total value of the assets of the investment company in the scheme. This will help you understand how many people have invested their money in the scheme.

4. Expense Ratio & Exit Load

Along with the performance, people should also look for expense ratio and exit load of the scheme. The expense ratio of a scheme is related to the management fee and administrative fee of a fund. People should understand that a lower expense ratio will result in higher profits and vice versa. Along with the expense ratio, people need to consider the exit load of the scheme. Exit load refers to the charges that need to be paid to the fund house while exiting from the schemes before a certain predefined period. People need to have a detailed understanding about the expense ratio and exit load as they can eat away a pie’s share of the profit.

5. Interest Rate Scenario & Average Maturity

These parameters are essential with respect to debt funds. In case of debt funds, the interest rate scenario is crucial as their prices are affected by interest rate movements. For example, in case of falling interest rates, long-term fixed income instruments would be a good choice and the vice versa happens in case of increasing interest rates. Along with the interest rate, average maturity also plays an important role. People need to always look at the average maturity of the Debt fund, before Investing, to aim for optimum risk returns in debt funds.

6. Analysing Ratios

This is with respect to equity funds where people need to analyse ratios such as Sharpe Ratio and Alpha. These ratios help to check whether the fund manager has generated more or less returns in comparison to their set benchmark.

Qualitative Parameters

1. Fund House

Fund House is an integral part of any Mutual Fund scheme. A good AMC which is well-reputed in the market gives you with good investment options. It also helps individuals to invest smartly and make more money. While looking at the fund house, people need to check the AMC’s age, its overall AUM, a number of schemes offered, and much more.

2. Fund Manager

Along with the fund house, people should also check for the credentials of the fund manager. People can check the past records of the fund managers and assess whether their investment style fits in-line with your objectives. People should check for how many schemes they are managing, their track record, and much more.

3. Investment Process

Along with other factors people should also focus on the investment process instead of on relying only on the fund manager. If there is a well-designed investment process, then one can ensure that the scheme is well managed.

Review & Rebalance

This is an important step in every investment where the investment needs to be monitored and rebalanced timely. This will ensure that people can make the maximum out of their investments. People can also rebalance their schemes based on the performance of their underlying portfolio.

Thus, it can be said that people need to be careful while doing their SIP. They need to understand a scheme’s modalities completely before investing in it. Also, they can consult a financial advisor to ensure that the funds are safe and fetch good returns for their investors.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.