Fincash » Investment Plan » Investing Advice from Thomas Rowe Price Jr.

Table of Contents

5 Best Investing Advice from Thomas Rowe Price Jr.

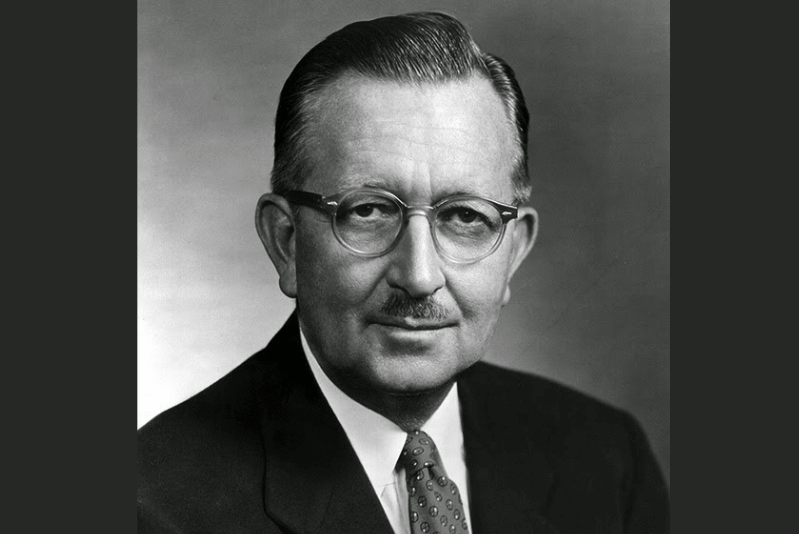

Thomas Rowe Price Jr., an investment banker, is popularly known for defining the concept of growth stocks. He is famously known as the ‘father of growth Investing’. Thomas founded the publicly traded American Investment Firm known as the T. Rowe Price in 1937, which is headquartered in Baltimore, Maryland.

His company deals with Mutual Fund services, account management for individuals and institutions and retirement plans. One of the most famous Thomas Rowe Price Jr books is the T. Rowe Price: The Man, The Company, and The Investment Philosophy.

| Details | Description |

|---|---|

| Name | Thomas Rowe Price Jr |

| Birthplace | Glyndon, Maryland |

| Birthdate | March 16, 1898 |

| Death Date | October 20, 1983 |

| Occupation | Investment Banker, Businessman |

| Education | Bachelors in Chemistry from Swarthmore College, U.S. |

Thomas Rowe Price Jr. Career

Thomas Rowe Price Jr. started his firm after spending a decade at three different companies and brokerages. Price always had the vision to start a company dealing with growth investment with a no-load fee system for clients. He personally believed that investors could earn great returns by investing in companies that are well-managed in fertile fields. Such companies’ Earnings and dividends could grow quicker than the Inflation and Economy as a whole.

While he was working with MacKubin, Legg and Co., he rose to prominence by becoming the head of investment. However, he was always different in his opinion and belief when it came to investing since his colleagues vouched for commission-based Value investing. Soon after, he set out to start his own fund firm, which deals with billions of dollars annually. Price would never charge commission as other firms did at his time. Instead, he charged a fee based on the assets under management, which is about collaborating the success of the investment firm with the success of the Portfolio of the stocks invested.

Price managed the firm single-handedly until he sold his shares in the company in 1966. He then retired in 1971. He passed away in 1983 and his family did not take part in the running of the firm. The company is now known as T. Rowe Price Associates. It went public in 1986 and became a part of the S&P 500 Index in 1999.

Even today, his firm runs on Price’s principles and his approach to guide investment selection and diversification. According to a report, in 2019 T. Rowe Group’s profit grew 17.5% in the second quarter of the year since an increase was recorded in the revenue and assets under management due to healthy returns in the money market.

Thomas Rowe Price Net Worth

According to the Baltimore-based money manager report, the Thomas Rowe Price Net worth Income of $527.5 million in 2019. The net revenue of the company rose from $1.34 billion in 2018 to $1.4 billion in 2019. As of June 30, 2019, the T. Rowe Price has $1.125 trillion in assets which was up from $1.04 trillion at the end of the quarter of the previous year.

Thomas Rowe Price Jr. Family and Early Life

Price was born in Glyndon, Maryland to Thomas Rowe Price Sr. and Ella Stewart Black on March 16, 1898. His father Thomas Sr. worked as a surgeon for the Western Maryland Railroad for decades. He was also the physician for the birth of his own kids.

He received his bachelor’s degree in chemistry from Swarthmore College. Price married Eleanor Baily Gherky and they had two children Richard Baily Price and Thomas Rowe Price III.

Talk to our investment specialist

Top Investing Advice from Thomas Rowe Price Jr.

1. Buy and Hold Investing

Price believed in Buy and Hold investing as a must-do for investors. He once said that even the amateur investor who lacks training and time to devote to manage his investments can be reasonably successful by selecting the best-managed companies in fertile fields of growth, buying their shares and retaining them until it becomes obvious that they no longer meet the definition of a growth stock.

Price tried and tested this method and made it popular. He believed that when the individual investor finds that there is less time for research and education in stock valuation, one can still hope for the best. Price said that even a beginner can overcome such obstacles by holding onto the stocks of a company they truly believe in for longer periods of time.

You can benefit from buying and holding the stock. You can enjoy lower tax rates as compared to intraday traders, potential to get high returns, lower overhead stock expenses, etc. All you have to do is purchase the stock of your choice and hold it until you are convinced to sell it based on profit.

If you wish to buy stocks and investment in view of being a growth investor, make sure to consider your investments well before buying them for years and decades.

2. Step Away from Competition

One of the major pieces of advice Price had for investors is to stay away from the competition. Since his major focus was on growth investing, Price helped his company drive the efforts in that direction. He was always focused on succeeding by helping his clients achieve their Financial goals. His intention was never on the acquisition and personal wealth increment.

Price once said that if you treat your customer right, you will be rewarded in the longer term by the customer. The most important asset to have is goodwill which is so difficult to build up and so easy to lose.

This is an important piece of advice to follow for companies looking for investors. The downfall for any company occurs when it enters into a fierce competition with their rival. This often sabotages the good it might want to establish. Focus will be shifted toward defeating the competition rather than satisfying the client. This will cause the reputation and goodwill of the company to fall and in turn affect investment.

3. Aim to be Best

Being the best in investment performance was the ultimate goal of Price. In fact, this spirit drove him to achieve his legendary status.. Price once said that he makes more mistakes than anyone else, but he learned long ago to admit his mistakes and try to correct them.

If you are a firm or an individual, you should always aim to be the best to build goodwill and success for yourself in investment.

While you should stay away from competition, do not forget to achieve your goals. Always aim to be the best. This aim will help you defeat the barriers that may arise for your company in your pathway to success. Aiming to be the best is also important advice for individual investors. Do not follow the majority just for the sake of it. Always let your determination drive you to be well-informed to make a decision.

4. Trust Your Idea

Price had a focused mind. He trusted his ideas and worked hard until they worked for him. . He believed that his investment philosophy would bring superior results and working for someone else would only be frustrating in the end.

As an investment lesson, one should always have immense faith in their investing ideas. But, ensure these ideas and strategies come from hardcore research and experiences.

5. Keep Adding Success to Your List

Success is a continuous process. And, this is what Price footprints talk about. His continuous success led him to launch his first mutual fund — the T. Rowe Price Growth Stock Fund. One of the initial investments of the fund was IBM.

This growth stock fund produced the best performance record through its first 10 years of any U.S. equity mutual fund aiming for growth, according to a report. Price had a great work ethic and also set a very high standard for everyone in his company. He always encouraged people to express their opinion. He once said that he always loved a good investment fight. He believed that success also involved having others participate in it. In 1960, Price started the New Horizons Fund and it invested in Xerox as its first investment. According to a report, the fund had the best performance for its first 10 years compared to other U.S. Equity Mutual Funds.

This entire illustration was for you to understand that never stop just because you have achieved what you worked for. Keep trading, investing, researching and take the long way. Don’t ever let your desire for success dim down. If you own a company, let it be your ethic to be the best and invest in everything that might seem profitable to you. If you are an individual investor, make sure to not stop investing and trading just because you have seen some good days.

Conclusion

One of the best lessons from Price’s advice is to always believe in yourself and never stop succeeding.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.