Table of Contents

- What are Low Risk Investment Funds?

- Best Low Risk Mutual Funds FY 25 - 26

- Frequently Asked Questions

- 1. How can I choose the best fund?

- 2. What is the appropriate investment type that has the lowest risk?

- 3. What is the use of a mutual fund calculator?

- 4. How much can I invest?

- 5. Is there a right time to invest?

- 6. Do I need a bank account to invest in mutual funds?

- 7. Is it necessary to contact a fund manager?

- 8. Can I withdraw my invested money?

- 9. Would I have to pay any penalty if I withdraw early?

Top 5 Debt - Ultrashort Bond Funds

Top 5 Best Low Risk Mutual Funds to Invest in 2025

Generally, a newbie to investment or a senior citizen who wants to secure their funds look for low-risk Mutual Funds. When an investor wants to invest in a low-risk mutual funds it's usually because he needs to secure his money or earn optimal returns in a short duration.

So, if you are one of those you can read more

What are Low Risk Investment Funds?

Many investors look forward to Investing in mutual funds as these offer higher returns and also are more tax efficient than other instruments like fixed deposits. But, when it comes to risk-averse investors, these are investors who are looking for secure returns and can’t tolerate risk in investments. Also, a risk-averse investor won’t prefer investing in equities, as they are highly risky funds.

Debt fund are suited for risk-averse or even a newbie investor who is willing to invest in Mutual Funds. As debt funds invest in government Bonds, Money market funds, etc., they are relatively safer. There are various types of debt funds like Liquid Funds, ultra-short term funds, short term funds, dynamic bonds, gilts funds, etc., that vary in risks. long term debt funds are risky funds, thus investors with a low-risk appetite should avoid investing in these funds.

Liquid funds and ultra-short term funds are the lowest risky funds that’s aims at generating optimal returns for a short duration. Thus a newbies investor who wants to earn good returns on their idle money within a shorter tenure can invest here.

Talk to our investment specialist

Best Low Risk Mutual Funds FY 25 - 26

Liquid Funds

Liquid funds invest in securities that have a low maturity period, usually less than 91 days. These funds provide easy liquidity and are least volatile than the other types of debt instruments. Also, liquids are a better option than traditional Bank Savings Account. In comparison to bank account, liquid funds provide 7-8% of annual interest. Investors who want risk-free investment can ideally prefer investing in these funds. Here are the top 5 Best Liquid Funds.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Indiabulls Liquid Fund Growth ₹2,493.17

↑ 0.37 ₹158 1.9 3.7 7.3 6.7 7.4 7.02% 1M 2D 1M 2D PGIM India Insta Cash Fund Growth ₹335.62

↑ 0.05 ₹391 1.9 3.7 7.3 6.8 7.3 7.17% 1M 21D 1M 24D Principal Cash Management Fund Growth ₹2,274.42

↑ 0.34 ₹6,619 1.9 3.6 7.3 6.8 7.3 7.22% 1M 17D 1M 17D JM Liquid Fund Growth ₹70.343

↑ 0.01 ₹3,341 1.8 3.6 7.2 6.7 7.2 7.13% 1M 10D 1M 13D Axis Liquid Fund Growth ₹2,870.28

↑ 0.46 ₹42,867 1.9 3.7 7.3 6.8 7.4 7.17% 1M 9D 1M 9D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 25

Ultra Short Term Funds

These funds invest in a combination of debt instruments like treasury bills, commercial papers, certificate of deposits, and corporate bonds. The funds have a lower residual maturity, ranging from 6 months to 1 year. Ultra Short Term fund offer good returns with very less Market Volatility. Newbie investors who are looking for better returns than Liquid Funds should prefer investing in these funds, as they provide better returns than liquid funds. Here are the top 5 best ultra-short term funds.

"The primary investment objective of the Scheme is to seek to generate reasonable returns commensurate with low risk and a high degree of liquidity, from a portfolio constituted of money market securities and high quality debt securities. However, there can be no assurance that the investment objective of the Scheme will be realized." DSP BlackRock Money Manager Fund is a Debt - Ultrashort Bond fund was launched on 31 Jul 06. It is a fund with Moderately Low risk and has given a Below is the key information for DSP BlackRock Money Manager Fund Returns up to 1 year are on The primary objective of the schemes is to generate regular income through investments in debt and money market instruments. Income maybe generated through the receipt of coupon payments or the purchase and sale of securities in the underlying portfolio. The schemes will under normal market conditions, invest its net assets in fixed income securities, money market instruments, cash and cash equivalents. Aditya Birla Sun Life Savings Fund is a Debt - Ultrashort Bond fund was launched on 16 Apr 03. It is a fund with Moderately Low risk and has given a Below is the key information for Aditya Birla Sun Life Savings Fund Returns up to 1 year are on (Erstwhile Invesco India Medium Term Bond Fund) The objective is to generate regular income and capital appreciation by investing in a portfolio of medium term debt and money market instruments. Invesco India Ultra Short Term Fund is a Debt - Ultrashort Bond fund was launched on 30 Dec 10. It is a fund with Moderate risk and has given a Below is the key information for Invesco India Ultra Short Term Fund Returns up to 1 year are on (Erstwhile SBI Magnum InstaCash Fund) To provide the investors an opportunity to earn returns through investment in

debt & money market securities, while having the benefit of a very high degree of liquidity. SBI Magnum Ultra Short Duration Fund is a Debt - Ultrashort Bond fund was launched on 21 May 99. It is a fund with Low risk and has given a Below is the key information for SBI Magnum Ultra Short Duration Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Regular Income Fund) The fund’s objective is to generate regular income through investments primarily in debt and money market instruments. As a secondary objective, the Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the Scheme. ICICI Prudential Ultra Short Term Fund is a Debt - Ultrashort Bond fund was launched on 3 May 11. It is a fund with Moderate risk and has given a Below is the key information for ICICI Prudential Ultra Short Term Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Savings Fund Growth ₹540.054

↑ 0.15 ₹14,988 2.1 4 7.8 7 7.9 7.84% 5M 19D 7M 20D UTI Ultra Short Term Fund Growth ₹4,183.42

↑ 0.65 ₹3,385 2 3.7 7.3 6.5 7.2 7.58% 4M 14D 4M 22D BOI AXA Ultra Short Duration Fund Growth ₹3,121.55

↑ 0.35 ₹157 2 3.5 6.9 6.2 6.7 7.46% 5M 19D 5M 23D Indiabulls Ultra Short Term Fund Growth ₹2,021.64

↑ 0.84 ₹18 0.8 1.5 4.2 6.2 3.23% 1D 1D SBI Magnum Ultra Short Duration Fund Growth ₹5,893.76

↑ 1.24 ₹11,987 2.1 3.8 7.5 6.7 7.4 7.53% 5M 5D 8M 8D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 25 1. DSP BlackRock Money Manager Fund

CAGR/Annualized return of 6.7% since its launch. Ranked 75 in Ultrashort Bond category. Return for 2024 was 6.9% , 2023 was 6.7% and 2022 was 4.1% . DSP BlackRock Money Manager Fund

Growth Launch Date 31 Jul 06 NAV (16 Apr 25) ₹3,362.58 ↑ 0.53 (0.02 %) Net Assets (Cr) ₹2,902 on 28 Feb 25 Category Debt - Ultrashort Bond AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆ Risk Moderately Low Expense Ratio 1.02 Sharpe Ratio -0.17 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 7.64% Effective Maturity 5 Months 23 Days Modified Duration 5 Months 8 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,414 31 Mar 22 ₹10,733 31 Mar 23 ₹11,251 31 Mar 24 ₹12,023 31 Mar 25 ₹12,882 Returns for DSP BlackRock Money Manager Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 1% 3 Month 2.2% 6 Month 3.8% 1 Year 7.2% 3 Year 6.4% 5 Year 5.3% 10 Year 15 Year Since launch 6.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.9% 2023 6.7% 2022 4.1% 2021 2.9% 2020 4.7% 2019 7.3% 2018 5% 2017 6% 2016 7.5% 2015 7.9% Fund Manager information for DSP BlackRock Money Manager Fund

Name Since Tenure Karan Mundhra 31 May 21 3.75 Yr. Shalini Vasanta 1 Jan 25 0.16 Yr. Data below for DSP BlackRock Money Manager Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 68.21% Debt 31.37% Other 0.43% Debt Sector Allocation

Sector Value Corporate 52.3% Cash Equivalent 37.82% Government 9.44% Credit Quality

Rating Value AA 5.7% AAA 94.3% Top Securities Holdings / Portfolio

Name Holding Value Quantity LIC Housing Finance Ltd

Debentures | -5% ₹156 Cr 1,500 91 DTB 10042025

Sovereign Bonds | -3% ₹100 Cr 10,000,000 Small Industries Development Bank Of India

Debentures | -2% ₹79 Cr 750 Small Industries Development Bank Of India

Debentures | -2% ₹78 Cr 750 182 Days Tbill (Md 01/05/2025)

Sovereign Bonds | -2% ₹74 Cr 7,500,000 National Bank for Agriculture and Rural Development

Domestic Bonds | -2% ₹70 Cr 1,500

↑ 1,500 182 DTB 31072025

Sovereign Bonds | -2% ₹63 Cr 6,500,000 Cholamandalam Investment And Finance Company Limited

Debentures | -2% ₹61 Cr 500 National Housing Bank

Debentures | -2% ₹54 Cr 5,000 Tata Capital Limited

Debentures | -2% ₹53 Cr 500 2. Aditya Birla Sun Life Savings Fund

CAGR/Annualized return of 7.4% since its launch. Ranked 6 in Ultrashort Bond category. Return for 2024 was 7.9% , 2023 was 7.2% and 2022 was 4.8% . Aditya Birla Sun Life Savings Fund

Growth Launch Date 16 Apr 03 NAV (16 Apr 25) ₹540.054 ↑ 0.15 (0.03 %) Net Assets (Cr) ₹14,988 on 28 Feb 25 Category Debt - Ultrashort Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately Low Expense Ratio 0.54 Sharpe Ratio 3.52 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.84% Effective Maturity 7 Months 20 Days Modified Duration 5 Months 19 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,634 31 Mar 22 ₹11,077 31 Mar 23 ₹11,676 31 Mar 24 ₹12,543 31 Mar 25 ₹13,517 Returns for Aditya Birla Sun Life Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 1.1% 3 Month 2.1% 6 Month 4% 1 Year 7.8% 3 Year 7% 5 Year 6.3% 10 Year 15 Year Since launch 7.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.9% 2023 7.2% 2022 4.8% 2021 3.9% 2020 7% 2019 8.5% 2018 7.6% 2017 7.2% 2016 9.2% 2015 8.9% Fund Manager information for Aditya Birla Sun Life Savings Fund

Name Since Tenure Sunaina Cunha 20 Jun 14 10.7 Yr. Kaustubh Gupta 15 Jul 11 13.64 Yr. Monika Gandhi 22 Mar 21 3.95 Yr. Data below for Aditya Birla Sun Life Savings Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 40.5% Debt 59.18% Other 0.32% Debt Sector Allocation

Sector Value Corporate 69.04% Cash Equivalent 24.5% Government 6.14% Credit Quality

Rating Value AA 33.14% AAA 66.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity Shriram Finance Company Limited

Debentures | -4% ₹603 Cr 60,000 Nirma Limited

Debentures | -3% ₹485 Cr 48,500 364 DTB

Sovereign Bonds | -3% ₹471 Cr 47,500,000 National Housing Bank

Debentures | -3% ₹400 Cr 40,000 182 DTB 29082025

Sovereign Bonds | -2% ₹340 Cr 35,000,000 Mankind Pharma Ltd

Debentures | -2% ₹305 Cr 30,500 Avanse Financial Services Ltd 9.40%

Debentures | -2% ₹299 Cr 30,000 Axis Bank Ltd.

Debentures | -2% ₹279 Cr 6,000

↑ 6,000 ICICI Home Finance Company Limited

Debentures | -2% ₹270 Cr 27,000 Bajaj Housing Finance Ltd. 8%

Debentures | -2% ₹250 Cr 25,000

↓ -5,000 3. Invesco India Ultra Short Term Fund

CAGR/Annualized return of 7.1% since its launch. Ranked 40 in Ultrashort Bond category. Return for 2024 was 7.5% , 2023 was 6.6% and 2022 was 4.1% . Invesco India Ultra Short Term Fund

Growth Launch Date 30 Dec 10 NAV (16 Apr 25) ₹2,661.32 ↑ 0.43 (0.02 %) Net Assets (Cr) ₹1,337 on 28 Feb 25 Category Debt - Ultrashort Bond AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderate Expense Ratio 0.74 Sharpe Ratio 1.38 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.5% Effective Maturity 5 Months 29 Days Modified Duration 5 Months 13 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,449 31 Mar 22 ₹10,784 31 Mar 23 ₹11,305 31 Mar 24 ₹12,113 31 Mar 25 ₹12,995 Returns for Invesco India Ultra Short Term Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 1% 3 Month 2.1% 6 Month 3.8% 1 Year 7.4% 3 Year 6.6% 5 Year 5.4% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.5% 2023 6.6% 2022 4.1% 2021 3% 2020 5.1% 2019 7.6% 2018 7.3% 2017 7.1% 2016 9.1% 2015 8.3% Fund Manager information for Invesco India Ultra Short Term Fund

Name Since Tenure Krishna Cheemalapati 4 Jan 20 5.24 Yr. Vikas Garg 27 Jul 21 3.68 Yr. Data below for Invesco India Ultra Short Term Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 42.85% Debt 56.81% Other 0.34% Debt Sector Allocation

Sector Value Corporate 52.93% Cash Equivalent 30.8% Government 15.92% Credit Quality

Rating Value AA 26.25% AAA 73.75% Top Securities Holdings / Portfolio

Name Holding Value Quantity 182 DTB 15052025

Sovereign Bonds | -4% ₹49 Cr 5,000,000

↑ 5,000,000 Cholamandalam Investment And Finance Company Limited

Debentures | -4% ₹40 Cr 4,000,000 Export Import Bank Of India

Debentures | -4% ₹40 Cr 4,000,000 Small Industries Development Bank Of India

Debentures | -3% ₹35 Cr 3,500,000 Ongc Petro Additions Limited

Debentures | -3% ₹30 Cr 3,000,000 Export Import Bank Of India

Debentures | -3% ₹30 Cr 3,000,000 Bharti Telecom Limited

Debentures | -2% ₹25 Cr 2,500,000 Godrej Industries Limited

Debentures | -2% ₹25 Cr 2,500,000 Bharti Telecom Limited

Debentures | -2% ₹25 Cr 2,500,000 Torrent Power Limited

Debentures | -2% ₹25 Cr 2,500,000 4. SBI Magnum Ultra Short Duration Fund

CAGR/Annualized return of 7.1% since its launch. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.5% . SBI Magnum Ultra Short Duration Fund

Growth Launch Date 21 May 99 NAV (16 Apr 25) ₹5,893.76 ↑ 1.24 (0.02 %) Net Assets (Cr) ₹11,987 on 28 Feb 25 Category Debt - Ultrashort Bond AMC SBI Funds Management Private Limited Rating ☆☆☆ Risk Low Expense Ratio 0.54 Sharpe Ratio 2.38 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 7.53% Effective Maturity 8 Months 8 Days Modified Duration 5 Months 5 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,516 31 Mar 22 ₹10,893 31 Mar 23 ₹11,453 31 Mar 24 ₹12,277 31 Mar 25 ₹13,186 Returns for SBI Magnum Ultra Short Duration Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 1% 3 Month 2.1% 6 Month 3.8% 1 Year 7.5% 3 Year 6.7% 5 Year 5.8% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.5% 2021 3.4% 2020 5.9% 2019 8% 2018 7.9% 2017 6.6% 2016 7.7% 2015 8.3% Fund Manager information for SBI Magnum Ultra Short Duration Fund

Name Since Tenure Rajeev Radhakrishnan 27 Dec 24 0.26 Yr. Ardhendu Bhattacharya 1 Dec 23 1.33 Yr. Data below for SBI Magnum Ultra Short Duration Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 61.18% Debt 38.53% Other 0.29% Debt Sector Allocation

Sector Value Cash Equivalent 46.36% Corporate 33.97% Government 19.38% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 182 DTB 31072025

Sovereign Bonds | -4% ₹454 Cr 46,500,000

↓ -3,500,000 National Bank For Agriculture And Rural Development

Debentures | -4% ₹421 Cr 4,250 7.3% Govt Stock 2028

Sovereign Bonds | -4% ₹417 Cr 41,500,000

↓ -16,500,000 Power Finance Corporation Limited

Debentures | -3% ₹384 Cr 3,850 Hdb Financial Services Limited

Debentures | -3% ₹345 Cr 34,500 INDIA UNIVERSAL TRUST AL2

Unlisted bonds | -3% ₹340 Cr 400 Citicorp Finance (India) Limited

Debentures | -2% ₹250 Cr 25,000 Rec Limited

Debentures | -2% ₹241 Cr 2,450 Tata Capital Housing Finance Limited

Debentures | -2% ₹220 Cr 2,200 08.18 HR UDAY 2025

Domestic Bonds | -2% ₹211 Cr 21,000,000 5. ICICI Prudential Ultra Short Term Fund

CAGR/Annualized return of 7.5% since its launch. Ranked 27 in Ultrashort Bond category. Return for 2024 was 7.5% , 2023 was 6.9% and 2022 was 4.5% . ICICI Prudential Ultra Short Term Fund

Growth Launch Date 3 May 11 NAV (16 Apr 25) ₹27.308 ↑ 0.01 (0.02 %) Net Assets (Cr) ₹13,017 on 15 Mar 25 Category Debt - Ultrashort Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderate Expense Ratio 0.86 Sharpe Ratio 1.8 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Months (0.5%),1 Months and above(NIL) Yield to Maturity 7.74% Effective Maturity 7 Months 6 Days Modified Duration 5 Months 1 Day Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,589 31 Mar 22 ₹11,009 31 Mar 23 ₹11,594 31 Mar 24 ₹12,428 31 Mar 25 ₹13,344 Returns for ICICI Prudential Ultra Short Term Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 16 Apr 25 Duration Returns 1 Month 1.1% 3 Month 2.1% 6 Month 3.8% 1 Year 7.5% 3 Year 6.8% 5 Year 6% 10 Year 15 Year Since launch 7.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.5% 2023 6.9% 2022 4.5% 2021 4% 2020 6.5% 2019 8.4% 2018 7.5% 2017 6.9% 2016 9.8% 2015 9.1% Fund Manager information for ICICI Prudential Ultra Short Term Fund

Name Since Tenure Manish Banthia 15 Nov 16 8.3 Yr. Ritesh Lunawat 15 Jun 17 7.72 Yr. Data below for ICICI Prudential Ultra Short Term Fund as on 15 Mar 25

Asset Allocation

Asset Class Value Cash 45.31% Debt 54.4% Other 0.29% Debt Sector Allocation

Sector Value Corporate 56.83% Cash Equivalent 24.3% Government 18.59% Credit Quality

Rating Value AA 20.39% AAA 79.61% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.3% Govt Stock 2028

Sovereign Bonds | -4% ₹583 Cr 58,000,000

↑ 10,000,000 India (Republic of)

- | -4% ₹484 Cr 50,000,000

↑ 50,000,000 LIC Housing Finance Limited

Debentures | -3% ₹434 Cr 4,350 Bharti Telecom Limited

Debentures | -3% ₹351 Cr 35,000

↑ 2,500 National Bank For Agriculture And Rural Development

Debentures | -2% ₹304 Cr 30,500 L&T Metro Rail (Hyderabad) Limited

Debentures | -2% ₹299 Cr 3,000 Small Industries Development Bank Of India

Debentures | -2% ₹299 Cr 3,000 National Bank For Agriculture And Rural Development

Debentures | -2% ₹249 Cr 2,500 LIC Housing Finance Limited

Debentures | -2% ₹225 Cr 2,250

↓ -500 Oberoi Realty Ltd.

Debentures | -2% ₹200 Cr 20,000

Frequently Asked Questions

1. How can I choose the best fund?

A. The investment choice is based upon a variety of factors, like the fund managers, historical returns, fees and loads, investment style, investment objective, investment horizon and more. Thus, to pick the best fund, make sure you analyze every important Factor cautiously before moving ahead.

2. What is the appropriate investment type that has the lowest risk?

A. Because of the unpredictable situation of the Economy and the availability of varying investment options, it is quite difficult to evaluate a safe option. However, some of the options that you can consider include bank fixed deposits, municipal bonds, certificate of deposits, and more.

3. What is the use of a mutual fund calculator?

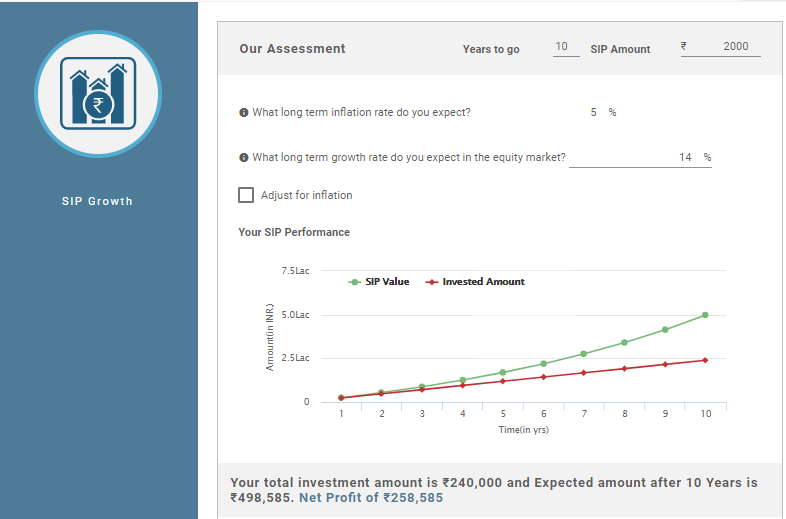

A. The mutual fund calculator offers an investment value at maturity by evaluating the returns according to the investment horizon. You can set different variables of the calculator, like duration, anticipated return rate, frequency, investment amount and more to figure out your benefits.

4. How much can I invest?

A. The amount mainly depends upon your requirements, budget and objectives of the investment. However, keep in mind that you only invest the surplus money, irrespective of the amount.

5. Is there a right time to invest?

A. There is no right time to invest. For better and best returns, it is recommended that you should start investing right away.

6. Do I need a bank account to invest in mutual funds?

A. Yes, it is necessary to have a bank account with KYC/cKYC, aadhaar card and PAN Card to invest in mutual funds.

7. Is it necessary to contact a fund manager?

A. Yes! When investing in mutual funds, experience plays a major role so as to generate good performance. The more the experience, the better will be the possibility of gaining the best returns. Thus, make sure that you get in touch with an experienced fund manager.

8. Can I withdraw my invested money?

A. Most of the schemes in a mutual fund are open-end schemes. This allows you to withdraw the entire invested amount at any point in time. However, there could be a few situations where you may experience restrictions.

9. Would I have to pay any penalty if I withdraw early?

A. If you have invested in open-end schemes, you may not have to pay the penalty. However, some schemes might not be as liquid as the others. So, you will have to re-check this factor before investing.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very Good

good information on funds. appreciated!!!