Fincash » Investment Plan » Investing Advice from Rakesh Jhunjhunwala

Table of Contents

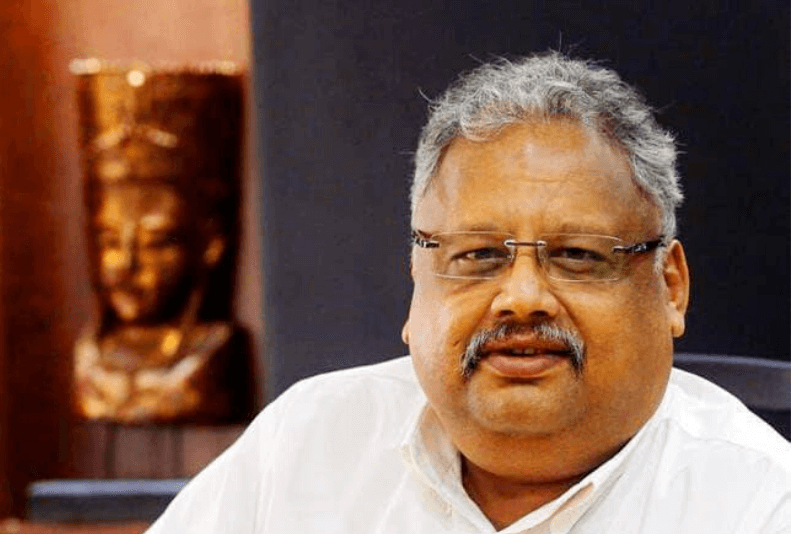

Top Investing Advice from Dalal Street Mogul Rakesh Jhunjhunwala

Rakesh Jhunjhunwala is an Indian chartered Accountant, investor and trader. He is the 48th richest person in India and is the founder of the company Rare Enterprises, an asset management firm. He is also the chairman of Hungama Media and Aptech. Furthermore, he is also one of the board of directors for Viceroy Hotels, Concord Biotech, Provogue India and Geojit Financial Services.

As of May 2021, Rakesh Jhunjhunwala has a Net worth of $4.3 billion. He is often referred to as India’s Warren Buffet and the Dalal Street Mogul. He is involved in philanthropy and also contributes to various social activities and social causes.

| Details | Description |

|---|---|

| Name | Rakesh Jhunjhunwala |

| Birthdate | 5 July 1960 |

| Age | 59 |

| Birthplace | Hyderabad, Andhra Pradesh (now in Telangana), India |

| Nationality | Indian |

| Education | Chartered Accountant |

| Alma mater | Sydenham College of Commerce and Economics, Mumbai, The Institute of Chartered Accountants of India |

| Occupation | Owner of Rare Enterprises, investor, trader & film producer |

| Net worth | $4.3 billion (May 2021) |

Rakesh Jhunjhunwala’s Inspiring Story

Rakesh Jhunjhunwala’s story is quite interesting. He started trading in the stock Market while he was still in college. After graduation, he enrolled at the Institute of Chartered Accountant and soon headed into Dalal Street Investing. In 1985, Mr Jhunjhunwala invested Rs. 5000 as Capital and by September 2018, it grew massively to Rs. 11 crore.

In 1986, he bought 500 shares of Tata Tea at Rs. 43 and the same stock went up to Rs. 143 within a period of three months. He earned Rs. 20-25 lakhs within three years, almost triple returns on his investment. The billionaire owns six apartment houses in Malabar Hill. In 2017, he bought the remaining six flats in the building and reportedly invested a whopping Rs. 125 crore in them.

His stock prices fell by 30% after the 2008 global Recession, but he was able to recover by 2012.

Mr Jhunjhunwala has invested in Titan, CRISIL, Aurobindo Pharma, Praj Industries, NCC, Aptech Limited, Ion Exchange, MCX, Fortis Healthcare, Lupin, VIP Industries, Geojit Financial Services, Rallis India, Jubilant Life Sciences, etc.

Talk to our investment specialist

Rakesh Jhunjhunwala Portfolio

Rakesh Jhunjhunwala’s Portfolio has been very interesting. This investing mogul, and the risk-taker, has a way of investing unlike others in the investing world.

Have a look at his portfolio as of Feb 2021-

| Company | %Holding | No of Shares (in Lakhs) | Rs. Crore |

|---|---|---|---|

| The Mandhana Retail Ventures | 12.74 | 28.13 | 3 |

| Rallis India | 9.41 | 183.06 | 481 |

| Escorts | 8.16 | 100.00 | 1,391 |

| Geojit Financial Services | 7.57 | 180.38 | 100 |

| Bilcare | 7.37 | 17.35 | 9 |

| Autoline Industries | 4.86 | 10.20 | 3 |

| Ion Exchange (India) | 3.94 | 5.78 | 69 |

| Multi Commodity Exchange of India | 3.92 | 20.00 | 300 |

| CRISIL | 3.77 | 27.17 | 534 |

| VIP Industries | 3.69 | 52.15 | 197 |

| Sterling Holiday Financial Services | 3.48 | 31.30 | 1 |

| Autoline Industries | 3.48 | 7.31 | 2 |

| Agro Tech Foods | 3.40 | 8.29 | 72 |

| Anant Raj | 3.22 | 95.00 | 40 |

| Dewan Housing Finance Corporation | 3.19 | 100.00 | 18 |

| Firstsource Solutions | 2.90 | 200.00 | 190 |

| Karur Vysya Bank | 2.53 | 201.84 | 118 |

| Prozone Intu Properties | 2.06 | 31.50 | 6 |

| DB Realty | 2.06 | 50.00 | 11 |

| Agro Tech Foods | 2.05 | 5.00 | 44 |

| NCC | 1.93 | 116.00 | 105 |

| Lupin | 1.79 | 80.99 | 857 |

| CRISIL | 1.73 | 12.48 | 245 |

| Agro Tech Foods | 1.64 | 4.00 | 35 |

| Jubilant Pharmova | 1.57 | 25.00 | 209 |

| Prakash Industries | 1.53 | 25.00 | 13 |

| Ion Exchange (India) | 1.52 | 2.23 | 27 |

| SpiceJet | 1.25 | 75.00 | 66 |

| Man Infraconstruction | 1.21 | 30.00 | 11 |

| Jaiprakash Associates | 1.13 | 275.00 | 20 |

| Bilcare | 1.11 | 2.63 | 1 |

| Edelweiss Financial Services | 1.07 | 100.00 | 65 |

| Geometric | 0.00 | 82.61 | 217 |

| Geometric | 0.00 | 9.90 | 26 |

| Geometric | 0.00 | 30.00 | 79 |

Source- MoneyControl

Rakesh Jhunjhunwala Tips

1. Long-term Investments

A firm believer of long-term investments, Mr Rakesh once said that it is important to give investments time to mature. Picking good funds or stocks will not be sufficient or good enough - if you don’t hold them for a long time.

He says that holding Equity Mutual Funds is a good investment to make. This will allow an average of 13-14% average returns for over seven years’ time.

2. Avoid Emotional Investments

He rightly says that emotional investments are a sure way to make a loss in the stock markets. Emotional investments include panic-buying during a recession or buying too much when the market is doing well. He says that selling during a recession will only cost loss and letting greed drive you to buy more when the markets are doing well can cause you to buy too much. This can also cause a loss since the stocks could be expensive.

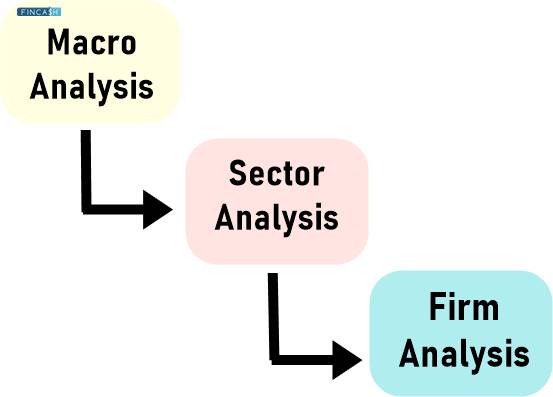

3. Conduct Research

Mr Jhunjhunwala advises that conducting market research is very important before investing in Mutual Funds or stocks. You should never put your hard-earned money without proper research. Stock markets cannot be treated as a place to make quick money. It is not a gamble. One needs to conduct thorough research before investing. Even friendly tips from people should not be applied blindly.

He further advises to never take stock tips from any source. One should depend on research and analysis. If you are not able to conduct an analysis of the stock market before investment, you should look for Mutual Funds.

4. Never depend on Historical Data

Mr Jhunjhunwala says that you should never depend on data from the past to make choices about the present. It is important to understand the market completely and make a choice. When one depends on historical data, it is possible emotions and irrational thinking may play a role. One should not expect the past to repeat itself since the stock markets are very sensitive to various areas like the Economy, buying methods, etc.

One of the ways historical data about a particular stock can affect your behaviour is to make you optimistic about the same. You can be led to stick to non-performing investments which will keep you hoping that the best is yet to come. This will lead you to invest more in the scheme and you will be going around the clock for no reason.

Conclusion

Rakes Jhunjhuwala’s tips are widely recognised by investors worldwide. One of the main things you can take back from his advice is the importance of long-term investments and the need to avoid emotional investments. Investing for a long time will definitely help you gain better returns. Investing without allowing emotions to play a part is crucial for investment success. Conducting market research and investing in equity mutual funds can always prove to be beneficial in the long-run.

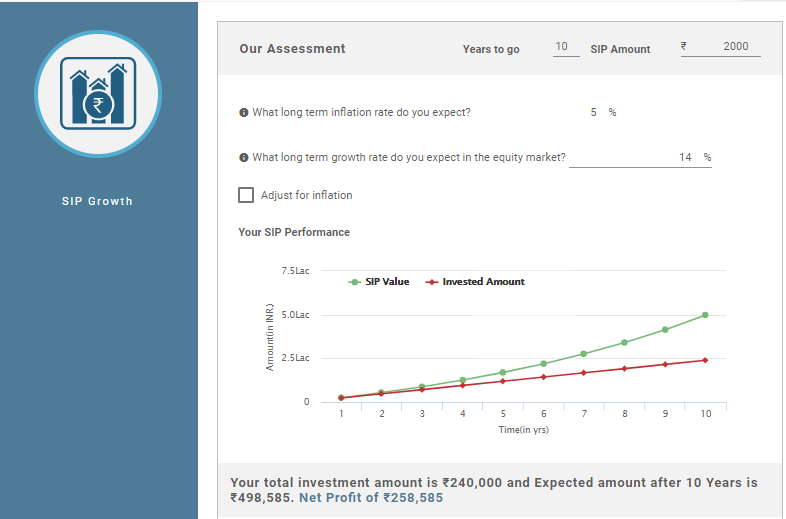

One of the many ways you can start investing today with minimum money in hand is a Systematic Investment plan (SIP). SIPs are a great way to make long-term investments with security. It offers great returns in the long-run.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.