Fincash » Investment Plan » Investing Rules from Jess Livermore

Table of Contents

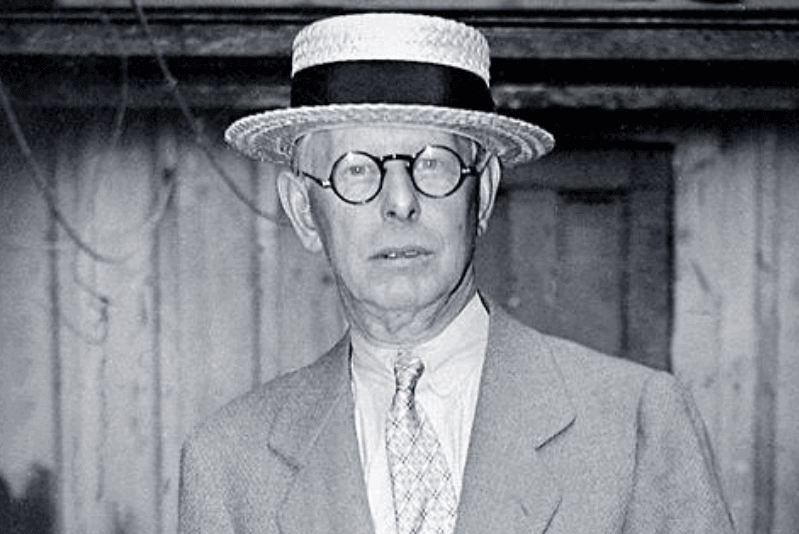

Top Investing Rules from Wolf of Wall Street Jesse Livermore

Jesse Lauriston Livermore was an American stock trader. Born in 1877, he is one of the greatest traders in the history of the world. He is the pioneer of modern-day stock trading. He was one of the richest people in the world during his time. Jesse is considered to be one of the greatest traders to have ever lived.

In 1923, Edwin Lefèvre wrote a book on Livermore’s life called the Reminiscence of a Stock Operator. This book is highly recommended for traders even today. In 1929, Jesse Livermore’s Net worth was $100 million, which equates to $1.5 billion today.

| Particulars | Description |

|---|---|

| Name | Jesse Lauriston Livermore |

| Birth Date | July 26, 1877 |

| Birth Place | Shrewsbury, Massachusetts, U.S. |

| Died | November 28, 1940 (aged 63) |

| Cause of death | Suicide by gunshot |

| Other names | The Wolf of Wall Street, The Great Bear of Wall Street |

| Occupation | Stock trader |

What makes him a pioneer and special when it comes to trading is that he traded on his own. Yes, he used his own funds and his own system. Even if the Market system has undergone many changes since then, his rules for Investing are still true today.

Jesse Livermore’s Top 5 Tips for Investing

1. Buy Rising Stocks

Jesse Livermore once said that buy rising stocks and sell falling stocks. When the market moves in a certain direction, the majority of the traders are sensing an idea as to where the stock will go. If the majority of them think that the stock is going to fare well and go higher, they will decide to buy it. This automatically creates a rise in price.

Livermore suggests picking stocks that are trading higher. It is important to recognise whether the stock is truly profitable and get in the line early. You can make more profit from this move.

Talk to our investment specialist

2. Plan beforehand

Jesse Livermore said that only enter a trade after the action of the market confirms your opinion. Before entering the market, it is important to have a plan ready. You should have a list of reasons why to enter the market and also exit it.

This needs a good amount of research and organisational skill. This also has to fit with your goal for investing. Don’t rush into the market for investing because it’s the trend. Observe the trend in the market and confirm your understanding. Always wait for the market to expose itself.

3. Follow Profit

Jesse Livermore always believed that it is important to end anything that shows a loss. He once said that continue with traders that show you a profit, end trades that show a loss.

He suggests that it is always important to stick with the winner when it comes to markets. One of the biggest mistakes to commit is to keep something that clearly shows a loss. If an investment is showing loss, sell it and the ones that show a profit- keep it. Hope is not a strategy for the financial market. Research and validated opinion are.

There is no guarantee that investment tips work for 100% success in the stock market. It is all about the profit and as an investor, you have to follow that. A winning percentage of less than 50% can also bring you huge success.

4. Don’t Buy Fallen Stocks to Average Out Loss

If any of your investment is showing a loss, pay attention to it. Livermore once said never average losses by, for example, buying more of a stock that has fallen. You may think that the price will go higher, but this will only end in loss.

Don’t buy more fallen stocks thinking the trend will change in the near future. There is no reason to hold or buy more stocks that have fallen in the market.

5. Stay Away from Emotions

Jesse Livermore talks about how human emotions play a role in stock markets. He once rightly pointed out that the human emotional side of every person is the greatest enemy of the average investor or speculator.

During times of panic, humans are bound to feel panic. But this can lead to a downfall when it comes to investments. In a panic, we are often led to make irrational decisions and we may buy a bad stock or sell a profitable one. It is important to always hold onto the most-profitable stock and not let emotions get in the way of your investing decisions.

Conclusion

Jesse Livermore lived a life that has set a course for the trading Industry today. His knowledge and skills with investment were amazing and continue to amaze audiences and investors even today. One of the things to take back from Livermore’s investment tips is to never make emotional decisions and sell profitable stocks. Always sell the ones that are falling or have fallen in value.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.