Table of Contents

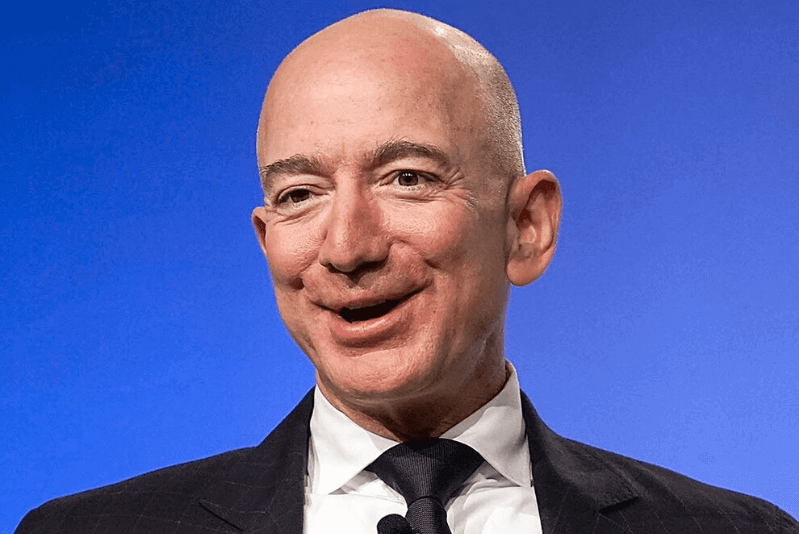

Top Investing Tips from World’s Richest Man Jeff Bezos

Jeffery Preston Bezos or Jeff Bezos is an American industrialist, media proprietor, internet entrepreneur and investor. He is the founder, CEO and the President of one of the biggest tech companies, Amazon. Jeff Bezos also owns Blue Origin, an aerospace company and Washington Post.

According to the Forbes wealth index, Jeff Bezos is the first centi-billionaire. He has been the richest man on the planet since 2017 and has also been named as the ‘richest man in modern history.’ On June 30, 2020, Jeff Bezos’ Net worth was $160.4 Billion according to Forbes. He still tops the list of Forbes Billionaires 2020. In July 2018, Jeff Bezos’ net worth increased to $150 billion. In September 2018, Amazon became the second company in the history of the world to reach a Market cap of $1 trillion. This mega profit added $1.8 billion to Bezos’ net worth. Forbes described him as ‘richer than anyone else on the planet’.

| Details | Description |

|---|---|

| Name | Jeffrey Preston Jorgensen |

| Date of Birth | January 12, 1964 (age 56) |

| Birth Place | Albuquerque, New Mexico, U.S. |

| Education | Princeton University (BSE) |

| Occupation | Businessman, Media proprietor, Investor, Computer Engineer |

| Years active | 1986–present |

| Known for | Founder of Amazon and Blue Origin |

| Net worth | US$160 billion (June 2020) |

| Title | CEO and President of Amazon |

Amazing Facts About Jeff Bezos

Jeff Bezos’ mega empire wasn’t created in a day. Jeff Bezos founded Amazon in 1994 at his garage in Seattle. His investments and strategies landed him where he is today. His major investments come through Amazon, Nash Holdings and Bezos Expeditions. Uber Technologies (UBER), Airbnb, Twitter and the Washing Post are some his successful investments.

According to a recent report, Jeff Bezos annual salary is only $81,840. However, his major wealth comes from his shares in Amazon, which contributes to making him the world’s richest person by $2489 per second. The report also stated that the Amazon CEO is nearly 38% richer than the British Monarchy and his net worth is greater than the GDP of Iceland, Afghanistan and Costa Rica combined.

Jeff Bezos was born in Albuquerque and raised in Houston and later Miami. He graduated from Princeton University in 1986 with a degree in electrical engineering and computer science.

Talk to our investment specialist

About Amazon

Amazon hired 175,000 workers between March and April 2020 amid a pandemic, thus helping the unemployed. Amazon spent more than $800 million within the first of 2020 on safety measures including hand sanitizer and additional hand-washing station at warehouses.

Best Investing Tips from Jeff Bezos

1. Find Opportunity in Crisis

Jeff Bezos is the man the world looks up to when it comes to financial success. His empire has withstood the storm of the Coronavirus pandemic. While various multi-national companies were seen firing their employees, Jeff Bezos hired new ones. This led to an increase in sales and workflow that attracted investments all the more. While the pandemic caused an economic Recession, Jeff Bezos used it as an opportunity to gain more profit while also helping the masses at large. It was a win-win situation for the masses and Amazon.

2. See What the Crowd Thinks

Jeff Bezos believes in - it is important to know what the crowd thinks. Only when you know this, you will know when the crowd is off. Don’t think against the crowd just because that seems right. Conduct relevant research and analysis of what the prevalent thinking is and then come to a conclusion. You will be able to identify whether what the majority is thinking is right or wrong. You can then make a choice and invest to gain more profits.

3. Have Clarity and Focus

Jeff Bezos affirms that one should approach Investing with much clarity and focus. They are the main ingredients to help you be a successful investor in the competitive market. Clarity and focus will help you conduct successful research and analysis while also keeping up with the trend in the market. It is important to never think the work invested behind research and analysis will ever go in vain.

Jeff Bezos’ aim for Amazon was always to have a large customer base with low margin rather than a low customer base with high margins. This helps him in gaining the recognition he has today, while also giving him high returns in the shares he holds in the company.

4. Stick to your Investment Philosophy

Jeff Bezos once said to be a successful investor it is important to have a clear philosophy and stick to it. Every investor is different from the other. While many are comfortable with active trading in the market, others are comfortable with a personal pace. It is important to understand one’s pace before investing so that irrational decisions don’t come in play.

Emotions play a vital role in distracting an investor from his personal vision, goals and risk management. Market panic can snowball a direction into chaos. To avoid that, sticking to one’s personal philosophy with regards to investing is a must.

5. Long-Term Investment

Jeff Bezos surely does believe in holding long-term investments. This is a common trait among the world’s top investors. Long-term investment produces gain with higher profit that usually cannot be gained in a short period. But the work philosophy behind long-term investments is the same- conduct thorough research and analysis of the companies you wish to invest in. Do your homework well and reap the benefits in the long-run. Don’t give into market conditions and withdraw your long-term investments. This will backfire and cause unprecedented losses.

Conclusion

Jeff Bezos is definitely an inspiration to many when it comes to investing and financial success. One major life lesson from Jeff Bezos is to never give up and turn crisis into opportunities.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.