Fincash » Investment Plan » Investing Tips from Raamdeo Agrawal

Table of Contents

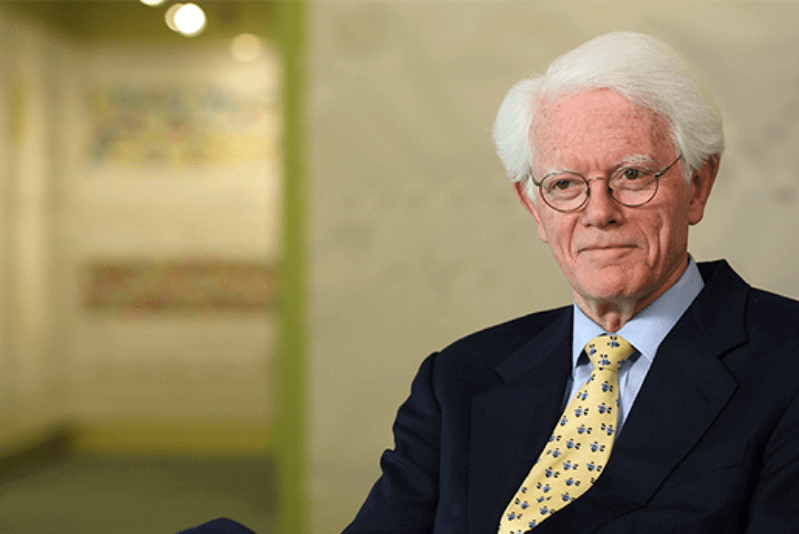

Top Investing Tips from Successful Investor Raamdeo Agrawal

Raamdeo Agrawal is an Indian businessman, stock trader and joint managing director of the Motilal Oswal Group. He co-founded the Motilal Oswal Financial Services with Motilal Oswal in 1987. The firm offers services like investment banking and Mutual Funds.

He began his career as a sub-broker on the Bombay Stock Exchange (BSE) in 1987. His partnership with Motilal Oswal Group led to the building of a $2.5 billion company whose shares have returned an average of 19% annually in 2017. The asset management arm of the Motilal Oswal Group focuses on Value investing with small and mid-cap stocks.

| Particular | Description |

|---|---|

| Name | Raamdeo Agrawal |

| Age | 64 years old |

| Birth Place | Chattisgarh, India |

| Net worth | US$1 billion (2018) |

| Profile | Businessman, Stock Trader, Joint Managing Director |

Motilal Oswal’s India Opportunity Portfolio Strategy Fund holds 15 to 20 companies. This includes companies from financial services and building material. The 24.6 billion mutual funds for the wealthy has returned about 19% p.a. since its inception in February 2010. This was beating its own annual benchmark at 15 p.a.

Raamdeo Agarwal’s company’s biggest holding is the Development Credit Bank Ltd. Its shares have doubled since 2016. He has also invested in Hero Honda, Infosys and Eicher Motors. According to Forbes, in 2018, Raamdeo Agrawal’s net worth is $1 billion.

Raamdeo Agrawal is from Raipur, Chhattisgarh. He is the son of a farmer and the Investing strategy he knew about was his father saving and investing in the kids. He moved to Mumbai to complete higher studies and Chartered Accountancy.

Top Investing Tips from Raamdeo Agrawal

1. Wait for Good Returns

Raamdeo Agrawal believes that the longer you wait, the better will be the result. He once said that he started in 1987 without nothing, but by 1990 he had earned a crore. Motilal Oswal was in a bad shape during the formative years. But soon after the Harshad Mehta scam, within 18 months they made 30 crores.

He encourages saying one cannot predict the Market and there is a huge need for patience and faith. Patience can help get more returns than desired.

Talk to our investment specialist

2. Believe in QGLP

Agrawal believes that QGLP (Quality, Growth, Longevity and Price) is what should be considered for purchasing a stock. Raamdeo Agrawal says that he always paid attention to the management. It is important to research first whether the management of the company Offering the stock has a good, honest and transparent management.

He also suggests looking at a stock in a growing company. Understanding the stock value in the present and future can help in taking better decisions about the same. You should focus on stocks that have a promising future and offer growth.

He also encourages investors to invest in companies that have been around for a long time now. This helps the investor gather all the necessary data to make an informed decision about the stock.

He says the price of the stock while purchase should be lower than its valuation.

3. Invest in Business You Understand

Before investing, it is always important to understand the business you are wishing to invest in. Do your research in order to feel convinced about the business. Understanding the various risks involved and identifying a strategy that works well with you is what makes the investment successful.

4. Long-term Investments

Raamdeo Agrawal says that always invest for the long-term. He says, you should always invest when there are surplus funds, and sell when you have a dire need for funds. Market Volatility can pose as an issue sometimes for the investor. That is why it becomes important to buy stocks at a reasonable price and sell when essential. Long-term investment can help the investor to withstand the short-term volatility and other irrational human reactions to the stock market.

The stock market is always affected by how investors react to a given situation.

Conclusion

Raamdeo Agrawal has been a big fan of Warren Buffet. Agrawal encourages investments and asks people to be smart with investing. If there is one thing to take away from his investing tips, it is to always make smart decisions. Have patience and do your research well before investing. Don’t let panic cause you to make irrational decisions regarding stock or a company. Always look for quality, growth, longevity and price. These are the essentials to invest well and earn big returns in the stock market.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.