Table of Contents

Top Investing Tips from Venture-Capitalist Peter Thiel

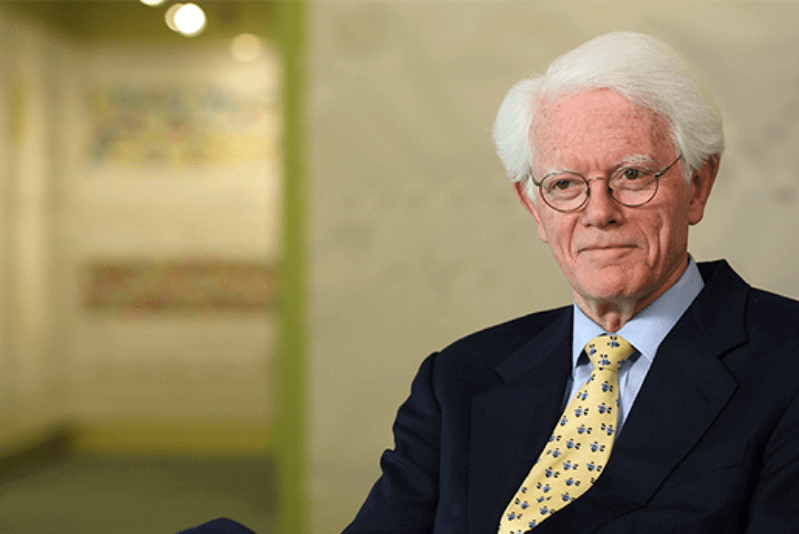

Peter Thiel is a German-American entrepreneur and venture capitalist. This billionaire is the co-founder of PayPal, Palantir Technologies and Founders Fund. In 2014, he was ranked #4 on the Forbes Midas List. His Net worth then was $2.2 billion. In 2018, he was #348 on the Forbes 400 with a net worth of $2.5 billion.

He also founded the Thiel Capital Management in 1996 and co-found PayPal in 1999. He served as PayPal’s CEO until its sale to eBay in 2002 for $1.5 billion. He went on to start a Global Macro hedge fund after selling PayPal. In 2004, he launched Palantir Technologies and served as chairman till 2019. In 2005, he launched founders fund with PayPal partners Ken Howery and Luke Nosek.

In 2004, he also became Facebook’s first investor from outside the circle when he acquired a 10.2% stake for $500,000. He then sold the majority of his shares in Facebook for over$1 billion in 2012 but continues to remain on Facebook’s board of directors.

In 2010, he co-founded Valar Ventures and also co-found Mithril Capital. He also served as a partner at Y Combinator from 2015 to 2017.

| Details | Description |

|---|---|

| Name | Peter Andreas Thiel |

| Birthdate | 11 October 1967 |

| Age | 52 |

| Birthplace | Frankfurt, West Germany |

| Citizenship | Germany (1967–1978), United States (1978–present), New Zealand (2011–present) |

| Education | Stanford University (BA, JD) |

| Occupation | Entrepreneur, venture capitalist, businessman, hedge fund, manager, investor |

| Organization | Thiel Foundation |

| Net worth | US$2.3 billion (2019) |

| Title | President of Clarium Capital, Chairman of Palantir, Partner in Founders Fund, Chairman of Valar Ventures, Chair of Mithril Capital |

| Board member of |

Peter Thiel Awards

In 2005, Thiel received a co-producer credit for the feature film based on Christopher Buckley’s 1994. In 2006, Thiel received won the Herman Lay Award for Entreprenuership. In 2007, he was lauded as a Young Global Leader by the World Economic Forum as one of the most amazing leaders under 40. He was awarded the honorary degree from Universidad Franscisco Marroquin in 2009. In 2013, he received TechCrunch Crunchie Award for Venture Capitalist of the year.

Talk to our investment specialist

About Peter Thiel

Peter Thiel was born in Frankfurt am Main, West Germany in 1967. Peter;s family moved to America in 1968. Thiel was great at mathematics and ranked #1 in a California-wide mathematics competiotion attending Bowditch Middle School in Foster City.

He studied Philosophy at Stanford University and also served as the edition-in-chief at the Standford Review. He remained as the editor till he completed his Bachelor in Arts in 1989. He then enrolled in Stanford Law School and earned his Doctor of Jurisprudence degree in 1992.

Top Tips from Peter Thiel for Investing

1. Look for Principles in Companies

Peter Thiel once said that the single most powerful pattern he noticed is that successful people find value in unexpected places and they do this by thinking about business from first principles instead of formulas. This is great advice for investors who believe that companies should be judged solely on their results.

It is important to look for the principles a company has before looking at anything else. Companies with strong and ethical principles is a good place to invest.

2. Invest in Quality

Thiel believes that it is important to research the company first. Look for its principles but more importantly, look at the quality of the company. How will you know the quality of the company?

Some of the key points to look for in a quality company is the strength of the Balance Sheet, sound dividend policy and returns. Companies with a strong balance sheet can stand strong amid adverse situations. If the company has a history of growing dividends, you can consider it as a quality company.

3. Love what you do

Investment is not an activity to do on the side of your life cycle. It should be one of the most important tasks you are focussed on. The culture today does encourage us to do things we love but sometimes it could be unprofitable. But the investment is an activity that can bring huge profit if done with passion and dedication. It does not matter what you do as long as you do it well.

4. Understand the Power of Venture Capital

One of the major mistakes to commit as an investor is to have a casual approach toward Investing. Don’t make the mistake on underestimating the power of diverse portfolios in growing companies. It is important to pay attention to growing companies and invest in them. Venture-backed firms have created 11% of the jobs in the United State of America with the revenues amounting for 21% of its GDP. Thiel says that dozen largest tech firms are all venture-backed.

Conclusion

Peter Thiel is one of the best investors today. One aspect to learn from his tips is to never underestimate investing. Invest well in quality companies with passion and research well-done. Seek to invest in venture-backed firms.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.